What is crypto spoofing?

Crypto spoofing is a market manipulation tactic in crypto where traders try to mislead others by placing fake buy or sell orders to influence a cryptocurrency’s price.

Picture this: A trader places a massive buy order for Bitcoin (BTC), creating the illusion of strong demand. This move might entice other traders or trading bots to jump on board, anticipating a price surge.

But here’s the twist: Once the price starts climbing, the trader pulls the rug out from under everyone by canceling that fake order and cashing in on their own Bitcoin at the inflated price.

Instead of genuinely wanting to trade, spoofers aim to create a false sense of market sentiment, either bullish or bearish, to trick others into making moves that benefit them. Spoofing in cryptocurrency trading is often hard to detect in real time and can confuse both human traders and algorithms relying on order book data. While illegal in traditional finance, crypto markets still struggle with this deceptive practice.

How spoofing works in crypto

Crypto spoofing takes advantage of the digital asset market’s emotional nature and fast-paced price changes.

Since cryptocurrencies are known for extreme volatility, even small market signals can influence prices within seconds. Spoofers exploit this sensitivity by placing large fake buy or sell orders to create the illusion of strong demand or selling pressure, without any intention of letting those orders go through.

When traders or bots see these orders, they may assume a price shift is coming. For example, a wall of buy orders might convince others that the price is about to rise, prompting them to buy in early. Once the price increases as planned, the spoofer cancels the fake buy orders and sells at a higher price. The reverse works, too, as fake sell orders can cause panic and push prices down, allowing the spoofer to buy cheap.

This strategy works particularly well when markets fluctuate and investor behavior is driven by emotions, such as fear of missing out (FOMO) or fear, uncertainty and doubt (FUD).

Automated trading bots that depend on order book signals are especially susceptible to spoofing since they can respond to big orders right away without doubting their validity. It also fuels unnecessary volatility, especially when spoofed liquidity affects decisions on large trades.

Spoofing is sometimes confused with maximal extractable value (MEV). However, MEV is a different phenomenon occurring when miners or validators reorder or insert blockchain transactions to extract extra profit, often by frontrunning or sandwiching users’ trades. Spoofing, in contrast, tricks trading bots with fake orders on an exchange’s order book. Both can hurt traders, but spoofing distorts market prices directly, while MEV leverages how transactions are sequenced onchain.

Spoofing has the potential to generate a vicious cycle of fraudulent activity, attracting more bots and individual investors while intensifying price fluctuations. Although some exchanges are acting to identify and stop spoofing, it is still a difficult problem in non-regulated or closely watched cryptocurrency marketplaces.

Did you know? Sometimes, the goal of spoofing is just chaos rather than financial gain. In certain instances, spoofers employed manipulation to start liquidation cascades, advance a narrative or sway public opinion about a coin or exchange rather than directly attempting to make money.

Is crypto spoofing legal?

Crypto spoofing is illegal in most jurisdictions, as it creates a false impression of market activity.

According to the Dodd-Frank Act of 2010, crypto spoofing is considered a federal crime in the United States. Spoofing and other illegal crypto trading tactics are activities monitored by the Commodity Futures Trading Commission (CFTC), which can enforce harsh sanctions, such as up to 10 years in prison for each violation. As a type of market manipulation, spoofing is also strictly enforced by the US Securities and Exchange Commission.

Similar rules are applied against spoofing by the UK’s Financial Conduct Authority (FCA), which upholds them to preserve market integrity. Major exchanges are responding by implementing real-time detection techniques that are intended to stop spoofing before it affects prices.

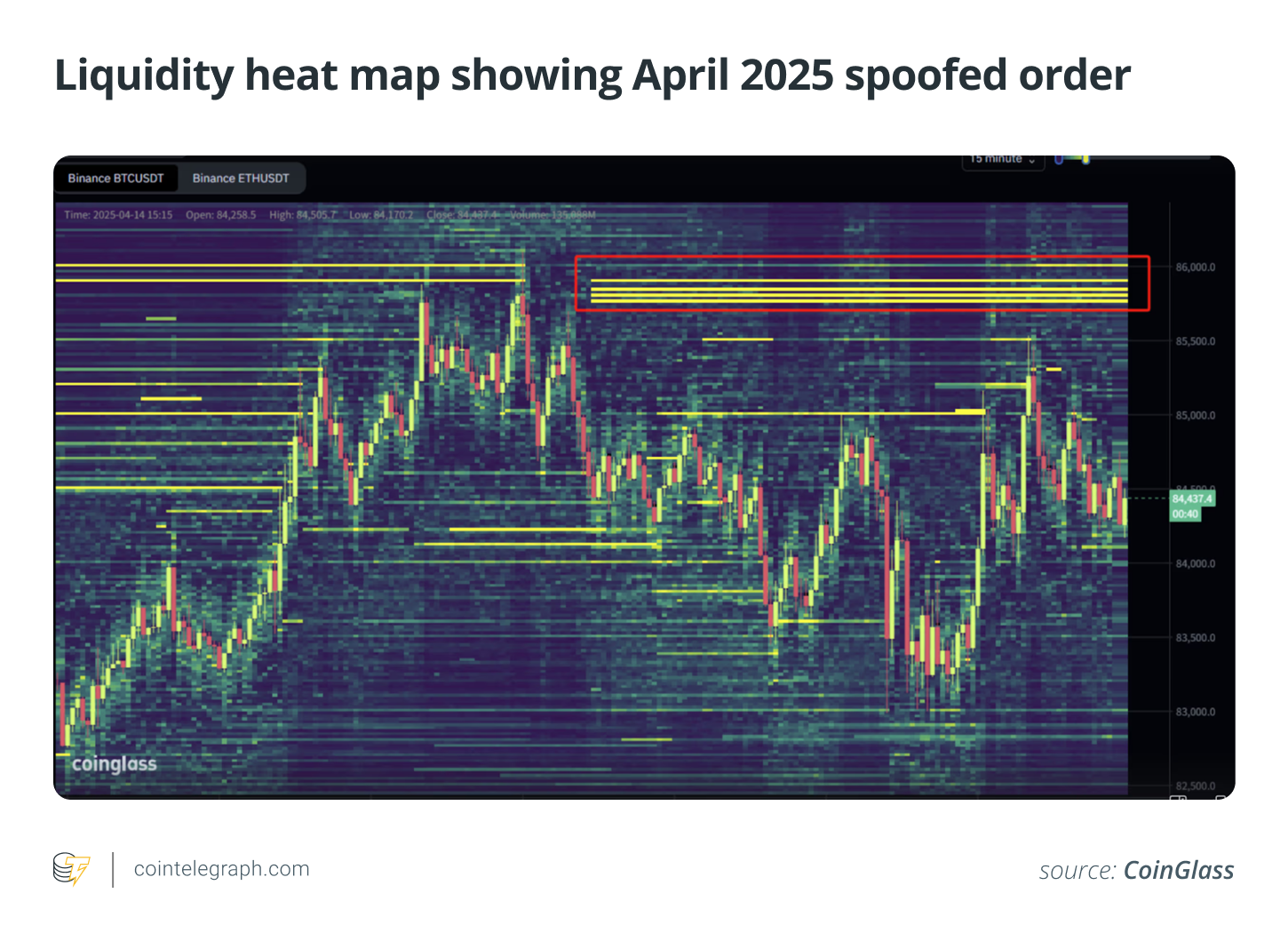

Despite increased regulatory oversight, spoofing is still a significant problem in the cryptocurrency market. In April 2025, a massive $212-million Bitcoin sell order appeared on Binance at $85,600, which was well above the market rate, only to vanish moments later. This sudden disappearance rattled traders and triggered short-term volatility as the fake order distorted market sentiment and liquidity.

While such behavior is illegal in traditional finance, crypto markets still operate in regulatory gray zones, especially on offshore platforms. Q1 2025 showed that manipulation persists on popular exchange platforms, such as Binance, MEXC and Hyperliquid, even as institutional involvement grows.

How to detect crypto spoofing in crypto markets

Detecting spoofing in crypto markets isn’t straightforward, as it requires detailed analysis of order books, trading patterns and unusual cancellation behavior.ёWhile there’s no guaranteed way to catch spoofers in real-time, here are some signs and tools that can help:

- Sudden order book changes: Watch for large orders appearing at key levels and then vanishing before execution. These can create false demand or supply signals meant to influence trader behavior.

- High frequency of order cancellations: Repeated placement and quick cancellation of sizable orders, especially without execution, can indicate spoofing. Experienced spoofers may engage in trading operations that follow particular market patterns or routines.

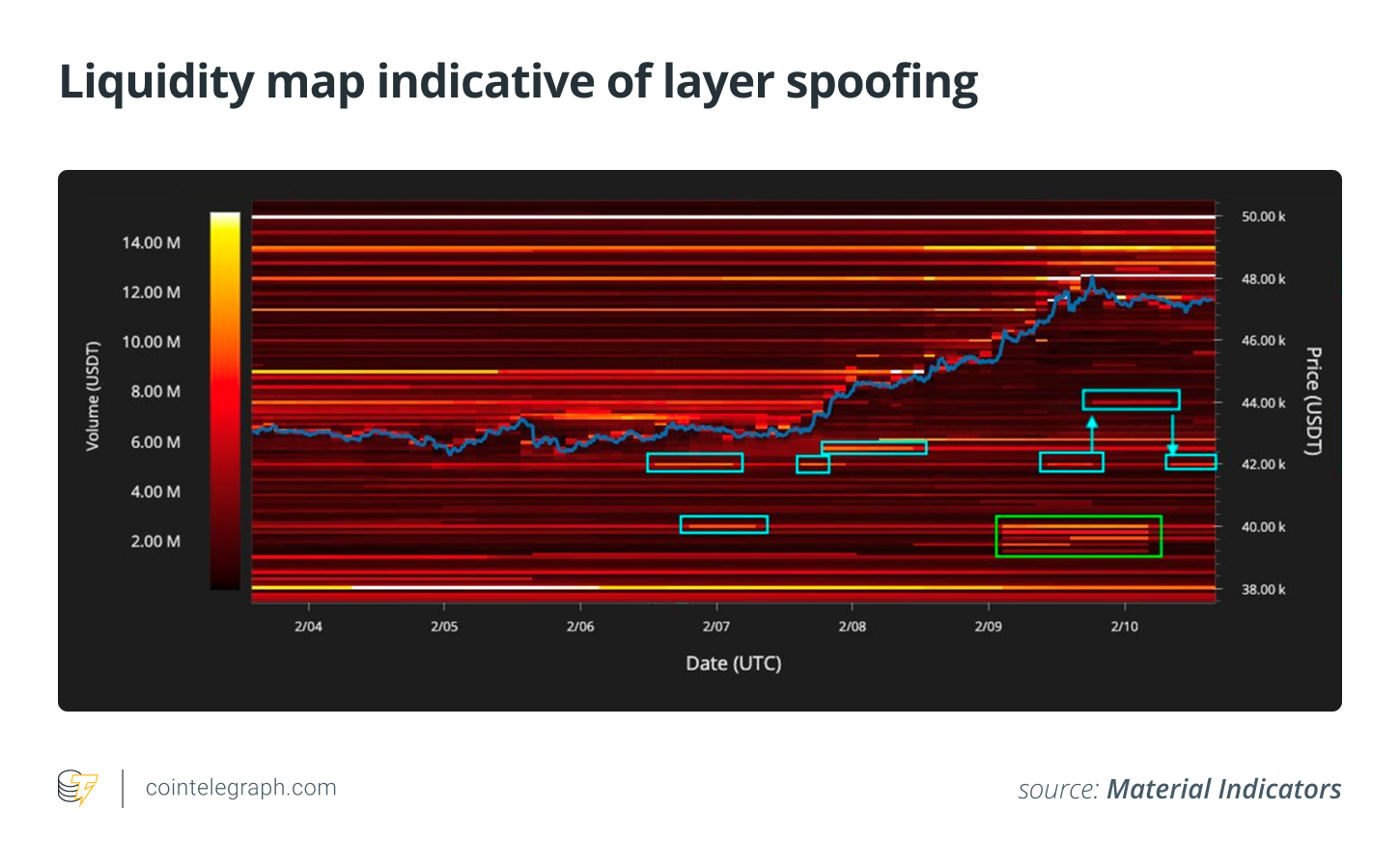

- Liquidity map fluctuations: Liquidity maps can help visualize imbalances. If a wave of liquidity disappears right before or during a price move, manipulation might be at play.

- Disjointed price and volume moves: Unexpected price swings or volume spikes that aren’t backed by news or market fundamentals may be signs of spoofing activity.

Over time, persistent spoofing can drive away investors by eroding confidence in a certain cryptocurrency or exchange. Although action by authorities such as the FCA and CFTC can discourage spoofers, real-time identification is still challenging, particularly on smaller exchanges with looser Know Your Customer (KYC) requirements. Nevertheless, the need for greater openness and more effective measures continues to grow along with crypto trading tricks.

Layer spoofing is a more sophisticated form of spoofing where the attacker places multiple fake buy or sell orders at different price levels, creating the illusion of strong market interest. These layered orders are not meant to be executed but to manipulate other traders into reacting.

Unlike basic spoofing, which might involve one large fake order, layer spoofing uses several smaller ones spread out across the order book to appear more legitimate and harder to detect. If you notice several orders stacked at regular intervals that suddenly disappear when the market price nears them, that could be a sign of layer spoofing.

Did you know? While spoofing includes moving prices without execution by using fictitious orders, wash trading entails purchasing and selling the same asset to create fictitious volume. Both are illegal manipulation tactics often seen on unregulated crypto exchanges.

How can investors protect themselves against spoofing?

Knowing how spoofing, wash trading and similar tactics work makes you a more informed and resilient investor.

While it’s not always easy to spot, investors can take several precautions to reduce risk.

- Stick to trusted and well-regulated exchanges: Trade only on platforms with a proven reputation for transparency and regulatory compliance. Regulated exchanges are more likely to have systems to detect and prevent spoofing. Unregulated platforms may lack these safeguards and are more likely to allow manipulative practices to go unchecked.

- Examine order books for unusual patterns: Pay close attention to large orders that appear and vanish rapidly. These “phantom” orders often aim to create false impressions of supply or demand. If you notice repeated patterns like this or sharp price shifts without broader market context, treat them with suspicion.

- Cross-verify market trends: Compare price movements and volume across multiple sources, such as CoinMarketCap, and different exchanges. Discrepancies between platforms may indicate manipulation on one of them.

- Use limit orders and trade rationally: Instead of reacting emotionally, use limit orders to set exact entry and exit points. This protects you from overpaying during sudden swings. Remember: If a market signal seems too good to be true, it probably is. Extra caution is not just wise in volatile markets but rather essential.