-

Apple is losing market confidence this year as it experiences changes in tariffs and works on AI.

-

It has a strong ecosystem with loyal users and a differentiated platform, and that should help push it forward.

-

Unless there's a major change in Apple Intelligence, Apple stock may not have so much room to run over the next five years.

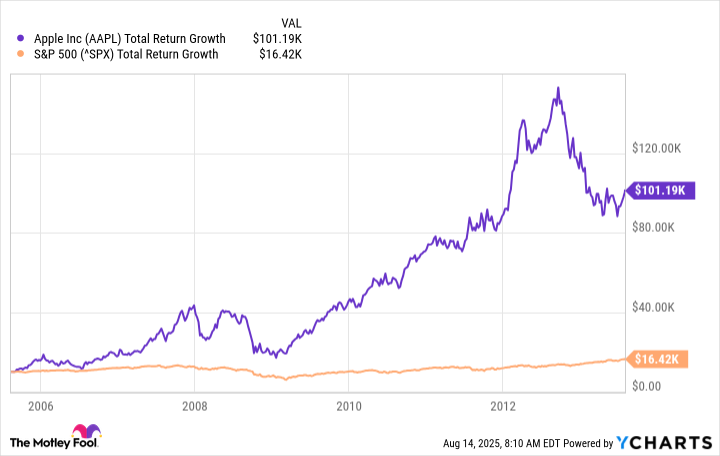

Apple (NASDAQ: AAPL) stock has been one of the best-ever investments on the market, crushing the market over several decades. Consider how much money you'd have today if you'd invested $10,000 in Apple stock 20 years ago vs. in the S&P 500; the difference gets wider as you go back in time.

It has outperformed the market over the past five years, too, but only by a hair's breadth. That's largely due to its performance this year, which has been dismal.

However, there have been many times in the past when Apple stock plunged, and there were times it remained low even for several years before rebounding in a big way. For example, it hit a high in 2007 before the mortgage crisis and didn't reach it again until 2009. Let's see what's happening at Apple and where it might be in five years.

There are several factors working together against Apple stock these days, as there usually are when there's a drastic change from the norm. They are mostly concentrated in tariff uncertainty, iPhone sales, and artificial intelligence (AI).

The market has been worried about how Apple will be impacted by tariffs, considering its reliance on getting its products made in China. It has already diversified its supply chain to include India to a large degree, but tariffs went there, too, and seem to have chased it into a corner where it recently announced that it would invest $600 billion in manufacturing in the U.S.

The tariff issue is stabilizing, and should be a blip five years from now. However, there could be large-scale aftereffects as it changes its supply chain. Having more operations domestically could lead it in many different directions that are unforeseeable today, such as having a more expensive workforce but a lower tariff rate.

There's also been concern that it has too few products, which means that any change in one of them could impact the business in a big way. iPhones account for nearly half of total sales, and as artificial intelligence changes how people engage with technology, the iPhone business is vulnerable to innovation in new areas from competitors.