Though interest rates are at the heart of this clash, it all boils down to inflation.

Though volatility is a given when putting your money to work on Wall Street, it's been an exceptionally wild ride for investors through the first seven months of 2025.

During the first week of April, uncertainty crescendoed following President Donald Trump's tariff and trade policy announcements. This led the benchmark S&P 500 (^GSPC -1.60%) to its fifth-steepest two-day percentage decline since 1950 and pushed the iconic Dow Jones Industrial Average (^DJI -1.23%) and growth stock-powered Nasdaq Composite (^IXIC -2.24%) into correction territory and a bear market, respectively.

However, all three indexes have enjoyed an equally robust three-plus-month rebound in the wake of President Trump pausing higher “reciprocal tariffs” on select countries. For only the sixth time in its storied history, the S&P 500 gained at least 25% in a three-month period.

President Trump speaking with Fed Chair Jerome Powell. Image source: Official White House Photo by Daniel Torok.

But just because the S&P 500 and Nasdaq Composite have hit new highs doesn't mean Wall Street's biggest showdown — Donald Trump vs. Federal Reserve Chair Jerome Powell — is taking a back seat.

While Trump is insistent that the central bank needs to lower interest rates, this ongoing battle between two key figures has, in all likelihood, already been decided — and it may not be for the reason you're thinking.

Can Fed Chair Jerome Powell be fired?

Interest rates are at the heart of this Wall Street clash.

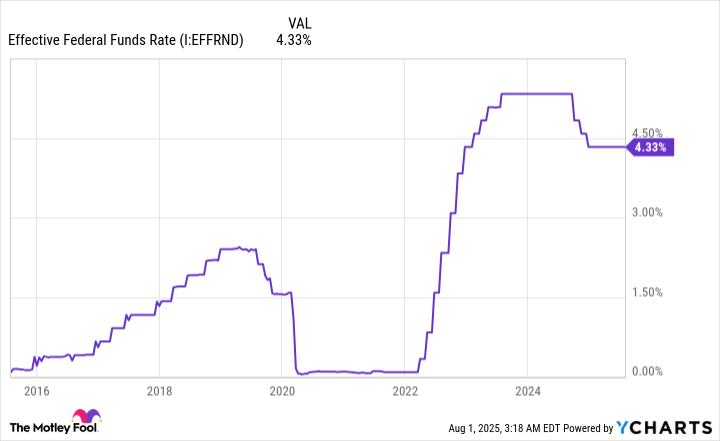

When U.S. money supply skyrocketed at its fastest pace in history on a year-over-year basis during the COVID-19 pandemic, it sparked the highest prevailing rate of inflation in four decades. In response to rapidly rising prices, the Fed kicked off its most aggressive rate-hiking cycle in decades, with the fed funds rate (the overnight lending rate between U.S. banks) moving up 525 basis points between March 2022 and July 2023. Adjusting the fed funds rate influences everything from lending rates to yields on savings accounts.

During tightening cycles, which is where the central bank increases the fed funds rate, the Fed is usually attempting to cool down the prevailing rate of inflation. In comparison, it tends to lower the fed funds rate during shock events and/or economic downturns to encourage borrowing, which can lead to corporate hiring, acquisitions, and innovation — i.e., catalysts that can drive corporate growth and consumption.

The Federal Reserve's undertook its most-aggressive rate-hiking cycle in decades from March 2022 to July 2023 to combat historically high inflation. Effective Federal Funds Rate data by YCharts.

Thus far, Fed Chair Jerome Powell has balked at Trump's stern requests to lower the fed funds rate, with some media outlets suggesting the president may “fire” the central bank chief. But can Powell actually be fired?

Truth be told, no one knows with 100% certainty, because there's no historical precedent to such an act, nor any legal clarity. Although the Federal Reserve Act of 1913 allows members of its Board of Governors to be “removed for cause by the president,” there's no definition of what justifies cause.

The assumption would be that Trump's administration would have to prove Powell neglected his duties as Fed Chair or was somehow negligent and caused irreparable harm to the U.S. economy. It's a tall order for which no precedent exists.

Furthermore, a ruling from the Supreme Court in May intimates that America's highest court views members of the Board of Governors as having unique protections. Specifically, the Supreme Court ruling noted, “The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical traditional of the First and Second Banks of the United States.”

Without justifiable cause, it would appear Donald Trump has little chance of removing Powell from office prior to the end of his four-year term as Fed Chair in May 2026.

But what if I told you this Wall Street showdown has likely been decided — and it has absolutely nothing to do with the legality of whether or not Fed Chair Powell can be fired?

Image source: Getty Images.

President Trump's tariff policy has made this battle a moot point

While all eyes are on interest rates, the foundation of this rivalry between Donald Trump and Jerome Powell boils down to inflation.

The key inflationary measure here is the Consumer Price Index for All Urban Consumers (CPI-U), which takes into account more than 200 specific spending categories, each of which has its own unique percentage weighting. These percentage weightings allow the CPI-U to be expressed as a single figure each month, which makes it incredibly easy to decipher if prices are, collectively, rising (inflation) or falling (deflation) on a month-to-month or year-over-year basis.

While there's some level of subjectivity introduced by the Fed when making its interest rate decisions, there's more of an impetus to reduce the fed funds rate when the prevailing rate of inflation is declining. Traditionally, the Fed has targeted an arbitrary long-term inflation rate of 2%.

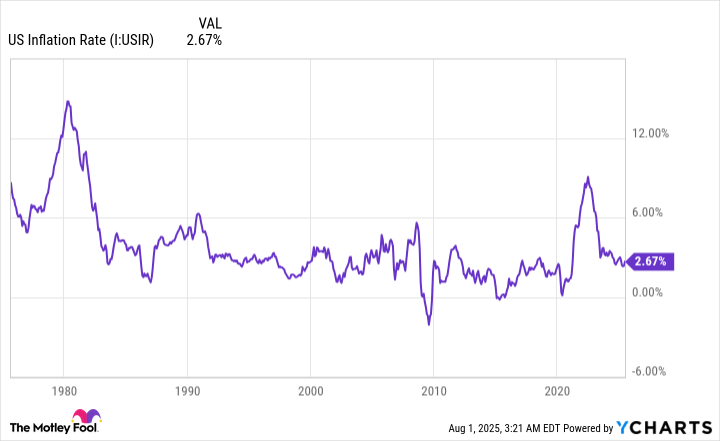

Although the prevailing inflation rate has come way down from a peak of 9.1% on a trailing-12-month basis in 2022, it's still above the central bank's long-term target of 2%. More importantly, inflation appears to be reaccelerating due to the implementation of Donald Trump's tariff and trade policy.

On April 2, Trump unveiled a 10% base global tariff, as well as introduced aforementioned reciprocal tariffs on dozens of countries that have historically run adverse trade imbalances with America. With the president pausing and/or adjusting these reciprocal tariff rates on numerous occasions since his initial announcement, there's been a bit of lag in determining whether or not these tariffs are having an inflationary impact.

US Inflation Rate data by YCharts.

Following the release of the June inflation report from the U.S. Bureau of Labor Statistics, it's pretty evident that Trump's tariff and trade policy is providing upward pressure on prices. Between May 2025 and June 2025, the trailing-12-month CPI-U inflation rate jumped by 32 basis points to 2.67%. Core inflation, which excludes volatile food and energy costs, climbed to 2.9%. This represents the fastest uptick in core inflation since February 2025.

In other words, Trump's tariff and trade policy looks to be ending this Wall Street face-off before it has a chance to ramp up. The June inflation data strongly suggests there's no immediate catalyst to lower the fed funds rate. The uncertainty created by Trump's tariffs, including the lack of differentiation between input and output tariffs, which threatens to further drive up the prevailing rate of inflation, implies that pricing pressures will persist for the foreseeable future.

The narrative investors should be monitoring isn't whether or not the Fed's monetary policy is hindering corporate growth. Rather, it's whether Trump's tariffs will adversely impact corporate hiring, labor productivity, sales, and profits as they did when the president implemented tariffs on China in 2018 to 2019.

Last week, the S&P 500 hit its third-priciest valuation during a continuous bull market when back-tested 154 years (based on the Shiller price-to-earnings ratio), which means there's virtually no margin for error on Wall Street. With more businesses alluding to tariff-related uncertainty in their sale and profit forecasts, it's crystal clear that attention needs to be paid to the inflationary impact(s) of Trump's tariff policy on Wall Street's most influential companies.