Someone in my community was saying the HSBC Pulsar is a crap Investment-linked Policy (ILP).

I thought it is good to take a look at how the structure will look like. While I don’t recommend you to invest through such an ILP structure, I do think that folks look at ILP the wrong way as well. Some automatically default to saying it is not good… because everyone say it is not good. Perhaps sometimes it is good to have some good reasoning behind it.

I managed to take a look at an old Pulsar Product Summary which will give information about the structure. While there are usually protection elements in an ILP, the primary objective is for investment. And usually for investment, we are looking for a longer investment timeframe.

I don’t think is fair that if the alternative is to invest in a Vanguard FTSE All-World UCITS ETF (VWRA) for the long term, you should evaluate holding an investment in a HSBC Pulsar for short term.

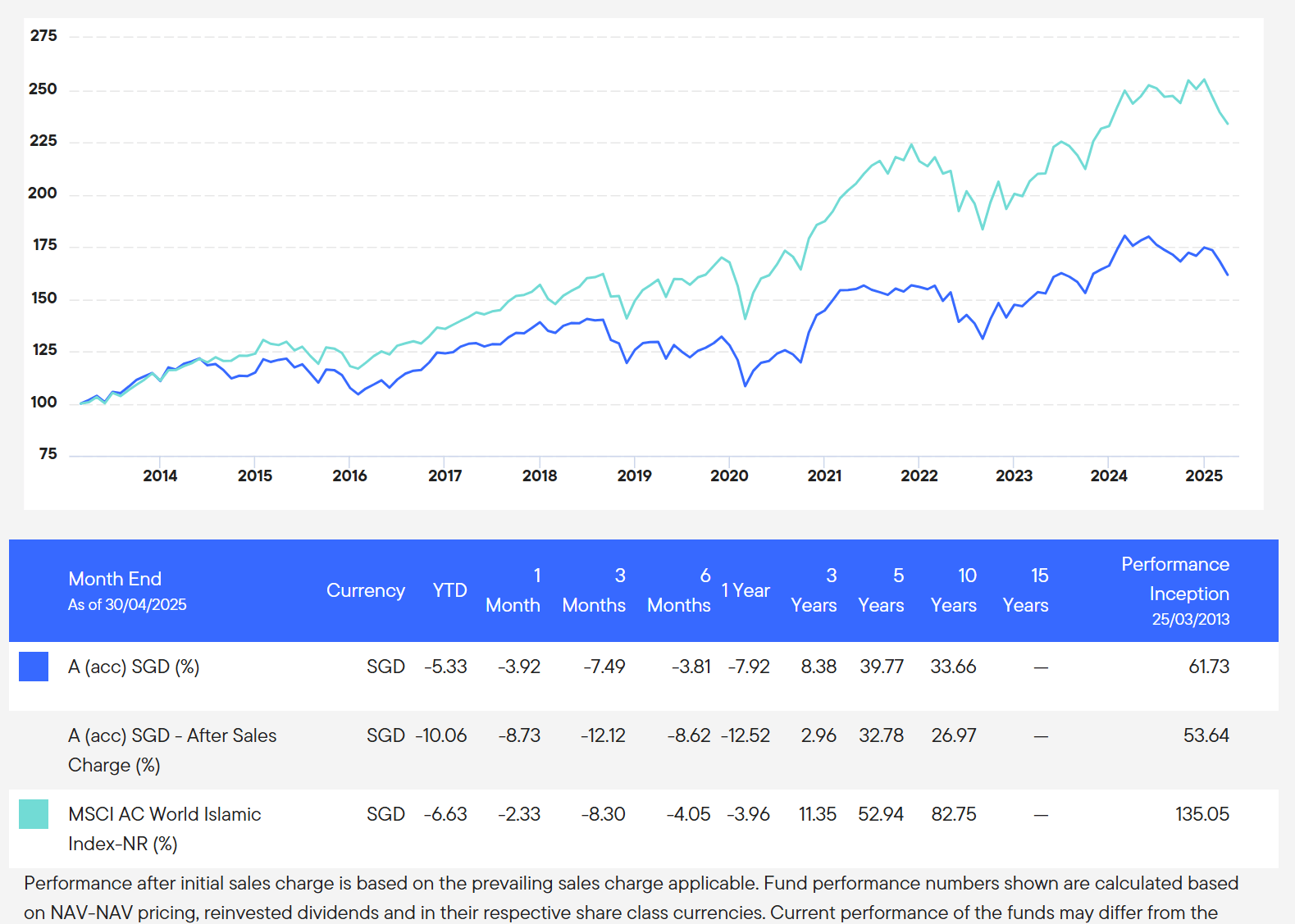

A typical ILP structure is one where there are bonus units given but you are also paid other fee. I have summarized them in a 30-year investment tenure diagram like below:

The green cells are positive benefits you receive and the purple cells are the costs/fees that you have to pay.

You can choose to pay premiums for a minimum of 11 years to 30 years but in this case, let us assume that you choose to pay roughly 20 years.

Many look at the cost but failed to account for the units given.

The challenge is because many cannot do the math of how the green and purple cells would work out.

Suppose you have the option of investing in a index-tracking investment that eventually gives you 8% p.a. after 30 years.

The net effect of this structure will reduce that 8% Internal rate of return to 6.67% p.a. So that is a 1.13% p.a. shave.

These structure becomes more costly when your investment time horizon is shorter. If you invest for 20 years, the cost will be higher.

In a way, these structures have cost and rewards earlier and it rewards you the longer you invest. So if the relative invest for 40 years, the “crazy high” account maintenance fee is not existent.

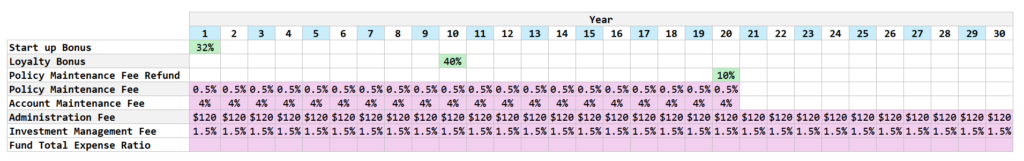

The reality is that the fund chosen Templeton Shariah Global Equity Fund did not do well.

While the ILP structure is not cheap, we would hope that the recommendation is decent. But the fund chosen is an actively-managed fund that is not systematic, very concentrated and the returns underperforms the index over a few longer term timeframes.

Ultimately, the ILP is an advise structure.

But if you did not receive quality advise that either helps you to stay invested, gives you a higher probability of achieving your financial or life goals, then you might have overpaid for it.

An ILP is also a structure that doesn’t match your planner’s compensation with the period that they need to help you stay invested. In this case, if you are to invest in the long term, majority of their compensation is paid to them in the first few years. This is quite a misalignment in economic incentive and we all would wonder how many planners would receive the money upfront and yet fully committed to guiding the clients despite not earning any more compensation when dealing with this client.

Here are some definitions of the fee and bonus.

Bonuses and Fee Definition

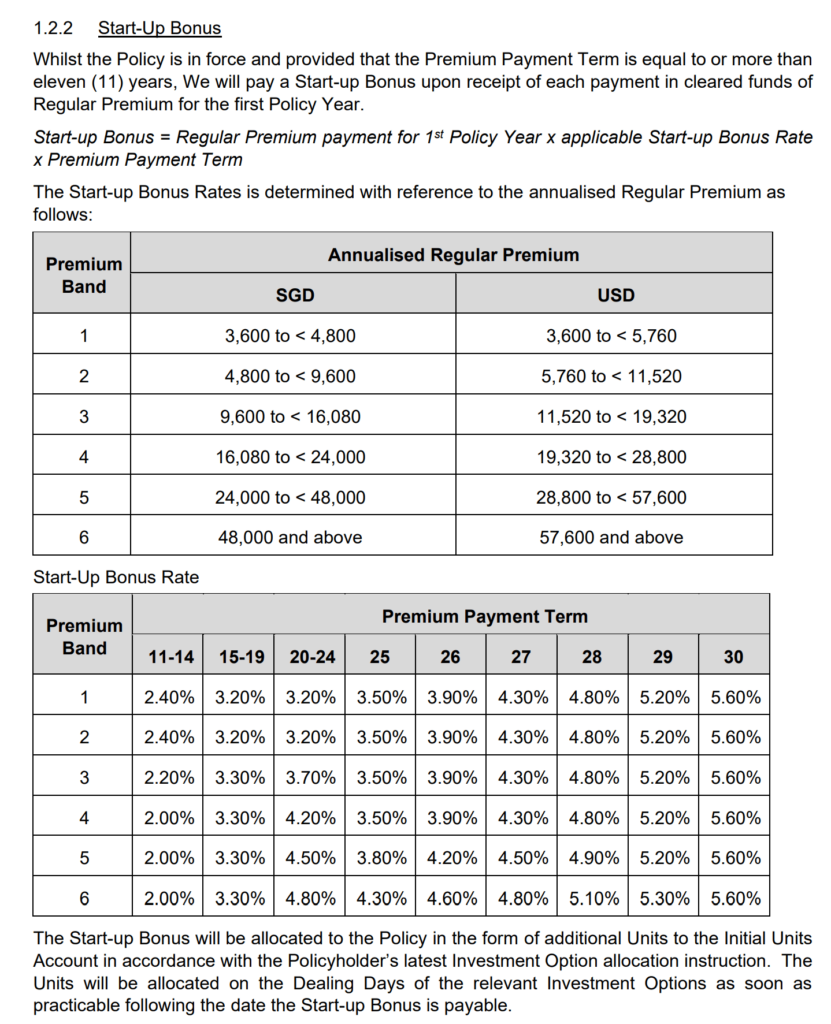

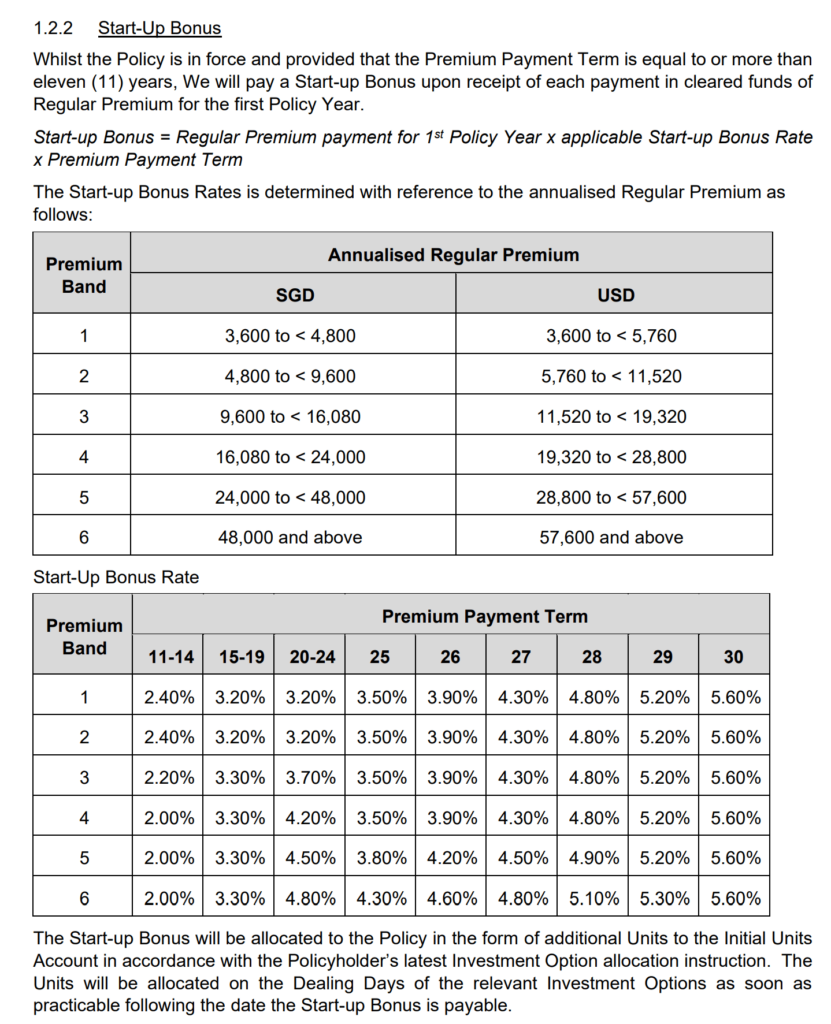

Start-up Bonus

The start-up bonus is a one-time increase in units. It is based on the regular premium of the 1st year x the rate x premium payment term.

The rate is based on the amount you put in, which determines the band and how long you pay the premium.

So in my example of 20 years, you can kind of derive the start-up bonus is about 32-48% depending on my premium paid.

If it is 30 years then its 168%!

But the regular premium for 30 years is lesser than that of 10 years.

So these are really mental gymnastics of how impactful this is.

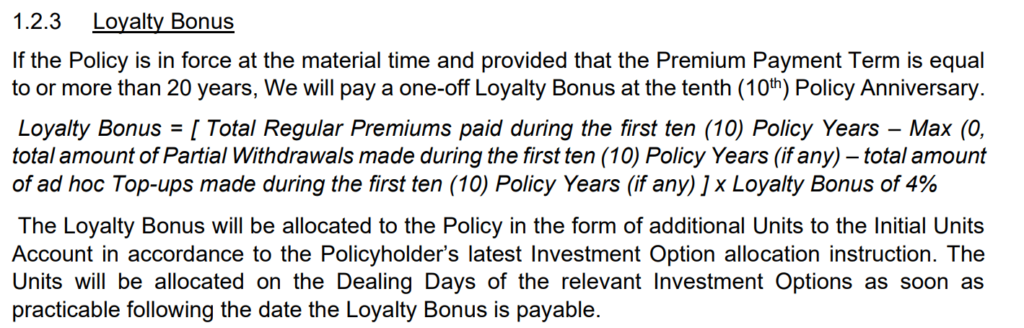

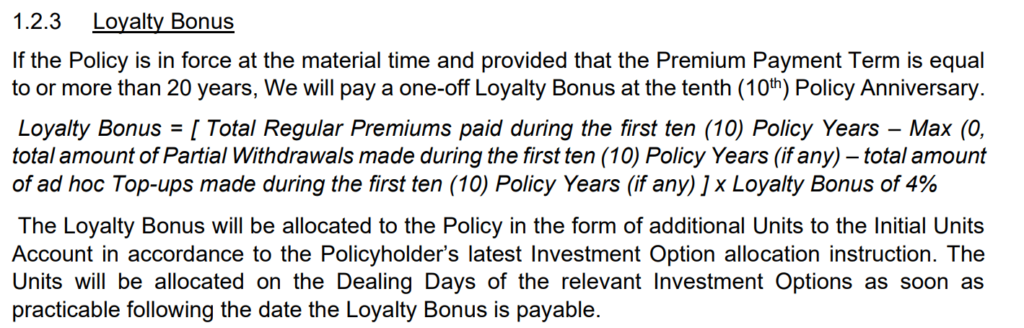

Loyalty Bonus

If you pay premium for 20 years or more, they will pay a one-off loyalty bonus at the 10th year.

This is equal to the yearly premium x 10 x 4%. So that is about 40% one time.

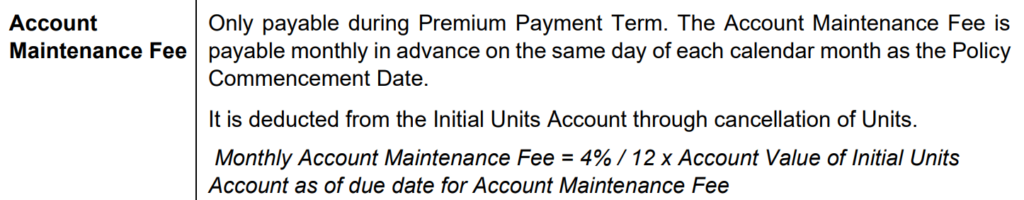

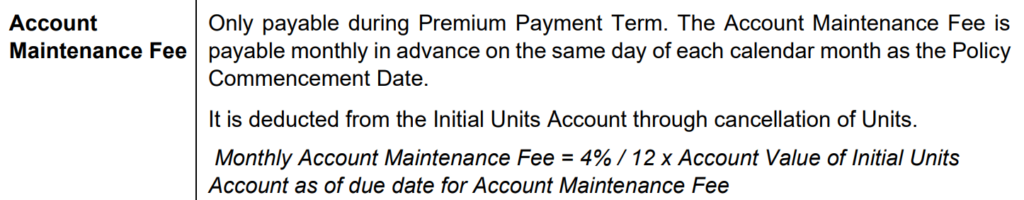

Account Maintenance Fee

Since the premium term is 20 years, we will basically pay 20 years of 4%.

This is on the Account Value of Initial Units, which is usually the premiums. Since your start-up and loyalty bonus units are allocated to the Initial Units account, so this fee also increases with the bonus units.

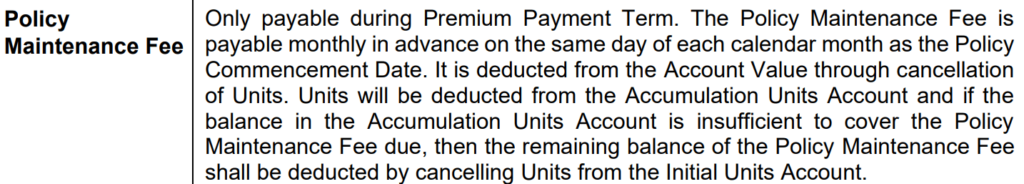

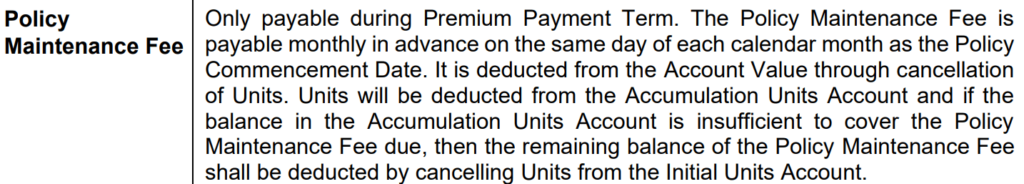

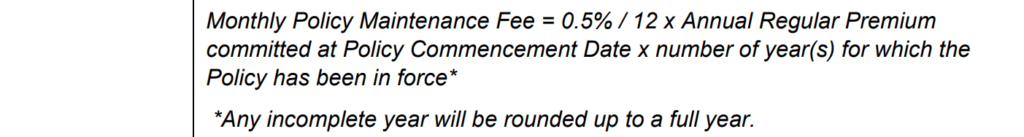

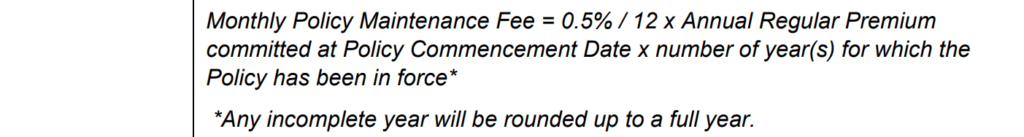

Policy Maintenance Fee and Fee Refund

A policy fee is payable for the premium payment term.

If you diligently pay, they will 100% refund the total policy maintenance fee paid during the premium payment term.

Administration Fee

The administration fee is a flat-fee that is levy for the whole time you have the policy. This one is not on the initial units but on the units you accumulated.

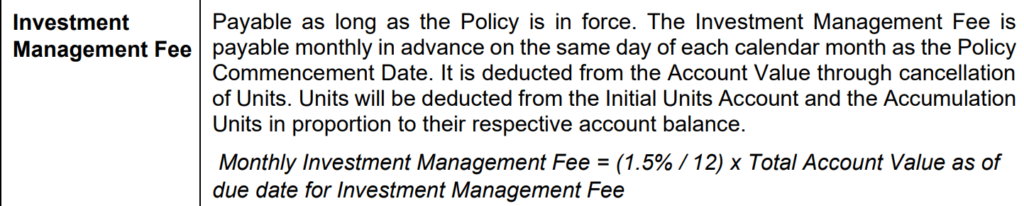

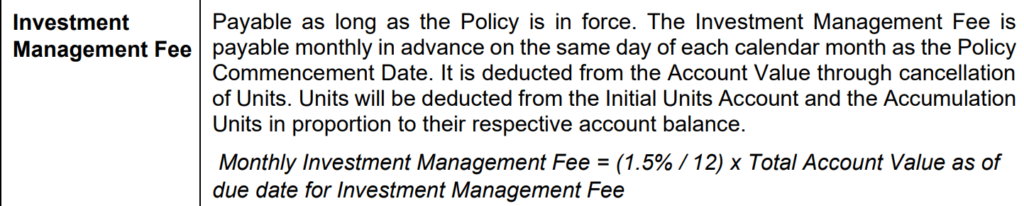

Investment Management Fee

The investment management fee is a 1.5% p.a. ongoing fee as long as you stay invested. This is probably the most painful fee.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.