I want to review the sub-funds that are available to the people/investors who have already invested in Investment-linked policies (ILPs) that are sold to them by their AIA financial representatives.

Some have regretted their decision to commit to these ILPs. They made the decision when they were less financially conscious. After they became conscious, they realized that there are surrender charges that if they surrender the policy, they will get zero dollar to very little money back unless they finish paying the full premium term. The surrender charges goes down over time.

But they already made their decision to stick with the policy and not surrender it.

I want to help them explore what they could do to better align their ILP to their financial goals so that the ILP is less of an emotional burden to them.

An ILP nowadays is more recommended for wealth accumulation but in the past, it is recommended as a flexible structure both for protection and investment. Unlike the normal whole life policy with cash values, the ILP grows its value by investing in unit trust sub-funds. The financial representatives would recommend you to invest in one or two funds under the ILP structure.

The risks of the funds will drive the future returns of the ILP.

Making better decisions with the ILP involves whether you can better align the ILP to your current wealth plan.

You can switch your funds to funds that better fit your investment philosophy at no cost. But do check your policy documents because this may be different for the older, traditional ILPs.

The question is what funds could or should you switch to?

The AIA Sub-fund Unit Trusts that is Available

I think the first step is to review what are the funds available. Sub-fund and unit trusts may be used interchangeably here since we are talking about the funds that are available to drive the returns and risk of your ILP.

I took a look at what is available under AIA here.

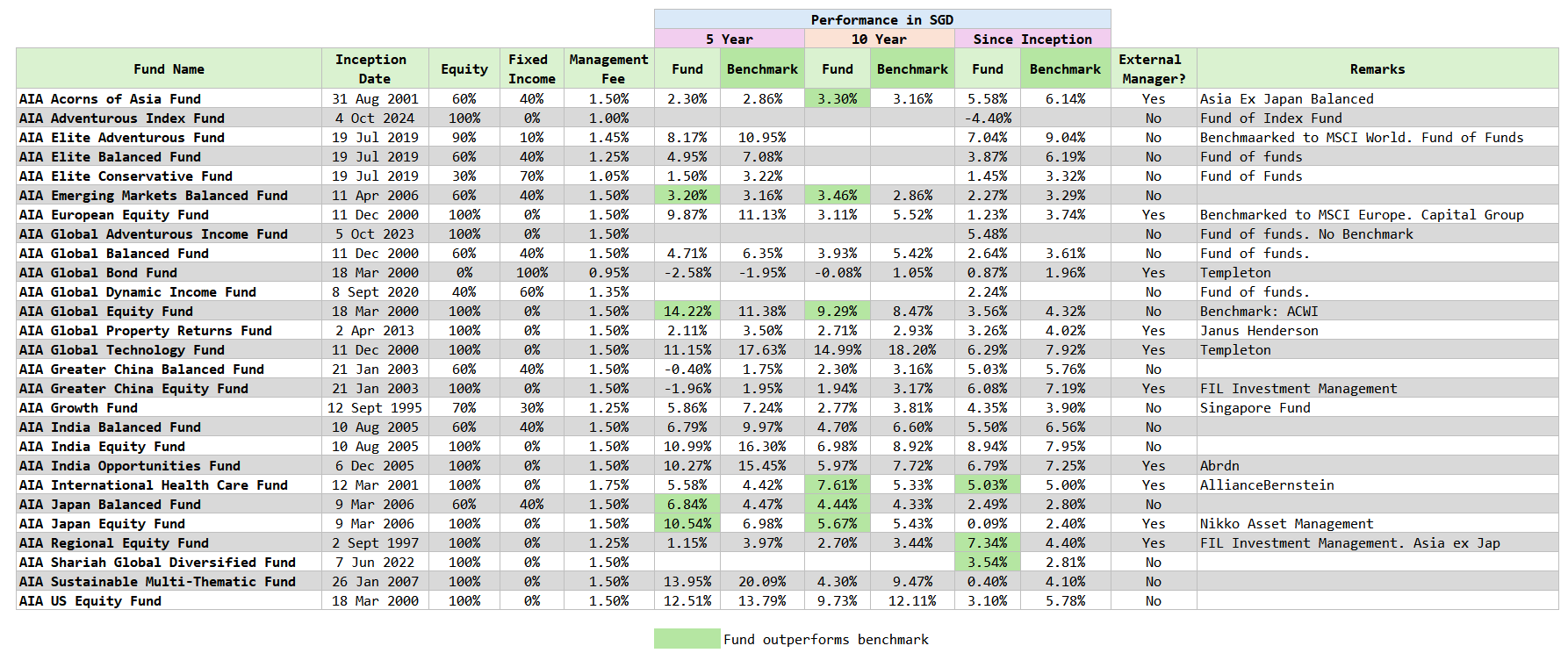

I have listed down majority of the funds except for the AIA Multiselect, AIA Portfolios in the table below:

You can’t really see the funds, or the performance of the funds unless you click to view a larger table.

The AIA sub-funds listed:

- AIA Acorns of Asia Fund

- AIA Adventurous Index Fund

- AIA Elite Adventurous Fund

- AIA Elite Balanced Fund

- AIA Elite Conservative Fund

- AIA Emerging Markets Balanced Fund

- AIA European Equity Fund

- AIA Global Adventurous Income Fund

- AIA Global Balanced Fund

- AIA Global Bond Fund

- AIA Global Dynamic Income Fund

- AIA Global Equity Fund

- AIA Global Property Returns Fund

- AIA Global Technology Fund

- AIA Greater China Balanced Fund

- AIA Greater China Equity Fund

- AIA Growth Fund

- AIA India Balanced Fund

- AIA India Equity Fund

- AIA India Opportunities Fund

- AIA International Health Care Fund

- AIA Japan Balanced Fund

- AIA Japan Equity Fund

- AIA Regional Equity Fund

- AIA Shariah Global Diversified Fund

- AIA Sustainable Multi-Thematic Fund

- AIA US Equity Fund

I listed the

- fund inception date,

- its rough equity to fixed income allocation,

- management fee and

- the 5-year and 10-year performance and the corresponding benchmark performances.

Do note that this table is not exhaustive. I remember that some readers telling me that AIA is bringing on more sub-funds from Capital Group, Blackrock and Baillie Gifford but I don’t seem to be able to find them.

Here are some things to note:

- I am not focusing on the poor or good investment performance. I am more reviewing how long the funds have been running, if they manage to keep up with the benchmark (because we know most active funds or portfolio underperform the index typically so that is not a surprise).

- I deem that 5 and 10 years to be long enough for us to reflect upon the investment performances.

- The returns are bid-to-bid returns, and would have factored in the expenses and the management fees.

- They do not include the ILP policy charges and recurring ILP fees, which are typically charged by deducting units that you own.

- All performances are in SGD.

AIA offered your usual staple fund of funds for balanced and full equity allocations. But there are also sectors and funds dealing with other regions.

Some of you might wonder: how come the returns are so low? If you felt the fund’s return is disappointing, then you see the benchmark returns.

The index returns will look lower as well. This means had you do the prudent thing, your returns will look like this.

How come?

That might be because a lot of the index return in media is measured in USD. Many of these funds have about 15-25 year of history and USD has largely depreciated against the SGD.

When you adjust the returns to review what you will earn as a Singaporean spending in SGD, then this is what you get.

Here are some quick observations:

- Majority of the funds do not outperform their respective index, after considering the fund fees.

- There are some funds, who outperform their index in these 5, 10 or even 25 year timeframe.

- The AIA Regional Equity outperformed their index (7.3% p.a. vs 4.4% p.a.) over a 26-27 year period.

- AIA International Health Care Fund (AllianzBernstein) kept up with their index (5% p.a.) over a 24 year period.

- AIA Global Equity fund outperformed its benchmark over the 5 and 10-year period.

- AIA Emerging Markets Balanced Fund outperform its benchmark over the 5 and 10-year period.

- Even if funds do not beat their respective index, had you been invested in these funds in a low-fee structure, you would have build wealth. For example, AIA Acorns of Asia Fund did not beat the index over 24 years but it did make 5.6% p.a. over that period. AIA India opportunities fund did not beat the index over 21 year, but you would have earn 6.8% p.a. over that period.

- It doesn’t mean if it is externally manage, returns are better.

If we recognize that ILP is a structure, just like a wrap fee structure, and take out the fee or commission cost of the structure, you will realize that what we are reviewing is no different if you go FSMOne Fundsupermart to review the funds. You will get some funds severely underperforming their benchmark, some new funds, and some funds that managed to keep up with the index.

How Should You Consider Potentially Restructuring the Investments in Your ILP to better Align to your Financial Goals or Investment Philosophy?

You should be able to switch from your current sub-fund to other sub-funds. Under the current 101 ILP structure, switching are mostly free. Check your policy documents if your funds are similar. Restructure would involve deciding about the unit trust sub-funds in the ILP.

Before thinking about the funds, you need to figure out what you want out from your ILPs.

1. Consider what are the financial goals that you are trying to achieve

What is the financial goal here?

In the past ILPs are sold as a very flexible structure that can offer insurance protection and wealth accumulation. The ILPs of the past are flexible to do both. However, you have to consider what the policy is meant TO YOU. Which financial goal does it serve?

If the ILP is meant for insurance protection, then you need to review & consider how to re-structure the policy to align to that financial purpose.

If the ILP is meant more for wealth accumulation, than we should review & consider how to re-structure the policy to alight to that financial purpose.

ILPs that is sold more recently tend to be the 101 ILPs, which are mainly for wealth accumulation with very little focus on protection.

So they are more meant for wealth accumulation or perhaps provide income for wealth decumulation for you.

2. Review the Time Horizon to Reach Your Financial Goal and Your Risk Capacity

Thinking in terms of wealth accumulation, you have to consider:

- Your time horizon. The longer your time horizon, you can invest in higher percentage of equities because equities are more volatile, especially in the short term. If you need the money soon, your investments might fall short when you need the money. Is that 5 years, 10 years or 15 years away?

- Your risk tolerance. Everyone of us have different capacity to understand and endure volatility & uncertainty. You don’t want to invest in something, then end up cannot sleep well at night primarily due to your investments. Even if the potential return is lesser, at least you can sleep well at night.

If the time horizon to your goal is 2-3 years, no matter how you restructure your ILP in the right funds might be futile because you cannot surrender the policy in the short span with enough money for your goals. You might have a borderline situations where it has been mis-sold to you. Hard luck.

Majority of ILPs are sold with the prospect for longer term wealth building and likely most of you have 20 years away. The cost of the ILP structure goes down the longer you stay with the policy because most of the costs tend to be front-loaded (you pay greater policy charges earlier and after the premiums paid, for each year more, the costs gets spread over a longer period).

That 20 and beyond time horizon should be enough for you to invest in an equities heavy portfolio, provided you can endure the volatility (risk tolerance). If you cannot, I suggest structuring your ILP in a more balanced allocation (60% equity 40% fixed income).

3. What is Your Investment Philosophy? What do you think Drives Your ILP’s Future Returns (Besides Costs)?

Next, what you invest in depends on your investment philosophy of how your returns would be generated.

I would guess that most of you don’t have a certain philosophy because your adviser will give you some ideas what returns you could potentially achieve and likely some hot-sub-funds then. Or… you could not remember what he or she says.

If you currently have an investment philosophy how returns come about, and if the investment strategy is a more buy-and-hold something for the long term approach, then your job is to restructure and switch to sub-funds that better align to that philosophy.

Is your philosophy that technology stocks will do better over the next 20-30 years and I only want technology companies? Or is it that United States is very overvalued and I would want an ILP portfolio that is less concentrated in the US? Or do you prefer less volatility?

How clear and strong is your belief will help you restructure and switch to the funds that better align to that. You can see from the table above that the funds might be limited, but some might better align to your philosophy.

I think there are many of you with totally NO Investment Philosophy. Firstly, you better figure out something if not, its not an ILP problem because you have zero investment blueprint at all. Even if you don’t buy an ILP, you might lose money in other mistakes of investment.

For those who are in need of some sensible investment philosophy, I suggest mine. You can read this article of the investment philosophy part that goes into why I structure my portfolio Daedalus the way it is:

How you can implement a portfolio that better align to this philosophy is to invest in the sub-funds that are more broad-based, and globally diversified because:

- We want to take risks because with risks that we get compensated for the risks we take.

- But we are not sure where the risks and returns will be focus on in the next 10-30 years. History would give us a guide but the future is less clear than definite. So we try to be diversified across regions, sectors. In this way, we can try our best to capture the returns of the small segments that will drive majority of the returns of your ILP. Diversification is not just risk mitigation but improve returns capture.

- We also don’t want the risk of single sector, region dying to kill our portfolio. Since we invest in diversified funds, we don’t suffer the problem of one or two companies suddenly dying, and we didn’t rebalance out of them and potentially killing our wealth. But you have the choice of funds that are concentrated in Technology, Health Care, India, US or China. And the suggestion here is to not do that because you don’t want to bet all on India and turns out India didn’t do well for the next 10 years and the portfolio is so emotionally challenging to live with.

- We are not sure what the future returns are going to be, we just want to buy-and-hold in a portfolio that are more optimized so that we can live and experience it emotionally while we hold on to it. We let the financial and wealth planning to take better care if we fund our goals well rather than depend on returns so much. We take what the market can give us.

- We want to keep costs as low as we can. But since we are in an ILP structure, you are left with funds with pretty horrendous management fees or expense

If you abide to this investment philosophy, then you can consider the more broad based sub-funds that AIA offer.

The more 100% equity ones will be:

- AIA Adventurous Index Fund

- AIA Elite Adventurous Fund (90% equity)

- AIA Global Equity Fund

The more balanced funds (60% Equity 40% Fixed Income):

- AIA Elite Balanced Fund

- AIA Growth Fund (70% equity)

The more conservative funds (40% Equity or less)

- AIA Elite Conservative Fund

The 100% fixed income fund:

- AIA Global Bond Fund

While they are active-funds, you made the decision to stay invested and not surrender and you should try your best to align your ILP to an allocation that fits your investment philosophy better.

If you look at the ILP as a portion of your overall portfolio, you might want to consider the ILP to be the 100% equity portion. This is because there are some costs that comes with the ILP structure, and if we consider the ILP as the fixed income portion for the long term (10-20 years), the fixed income returns can make up for the high management fees (the management fee on the Global Bond fund is 0.95% p.a. when you compare to the AGGU at 0.10% p.a.!)

Conclusion

I hope people get the spirit behind this article and hope people don’t give me comments like “ILPs are a scam!” or “They are so costly!” or “They should just surrender the policy even if they get zero money back!”

This is more for those people who have committed and want to try to make the best out of their current situation now that they are more financially aware. Sometimes it is easy for us to say because it is not our own money.

I meant it when I say that you might in a worse position if you bought this, and have no idea how to restructure your ILP because it meant that you lack any proper idea how you can bring you to your financial goals.

There are those who eventually learn about low-cost investing, decide to express it with a diversified portfolio like the VWRA and this article might proof useful how to better align to what they know about VWRA.

While the funds might not perform as well as VWRA eventually, the returns capture would be in the same mode as VWRA.

If you do not have any blueprint or conviction, the bigger problem is that you are rudderless in how to invest. Buying an ILP and not knowing what is going on 2-3 years from now is symptomatic of a bigger issue. And now might be a time to start learning.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.