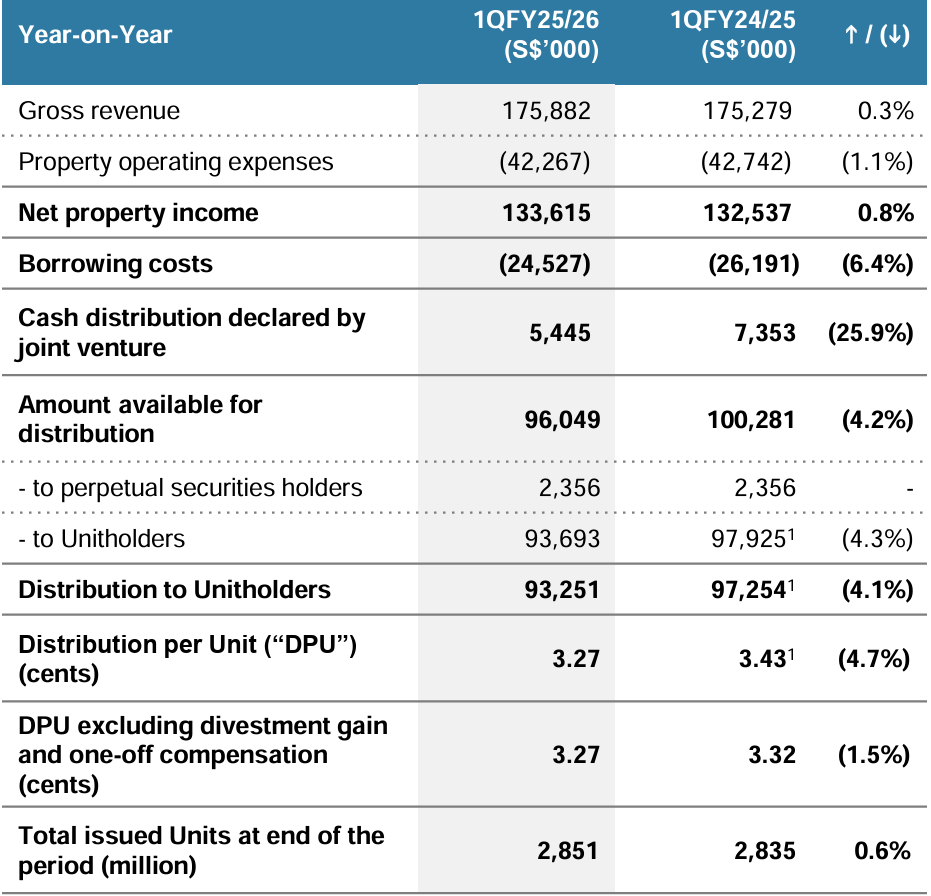

Gross revenue and NPI remained relatively stable year-on-year, with NPI up slightly due to stronger contributions from the Osaka and Tokyo data centres and new leases in the Singapore portfolio. Borrowing costs declined, supported by:

Lower interest rates on unhedged loansA weaker USD against the SGD

However, the amount available for distribution and DPU declined, primarily due to:

A significant drop in distributions from joint ventures, as a result of higher borrowing costs from repriced interest rate swapsAbsence of distribution from net divestment gain, which was present in the same quarter last yearSlight DPU dilution from an enlarged unitholder base

Excluding the impact of the divestment gain, DPU would have declined by around 1.5% YoY.

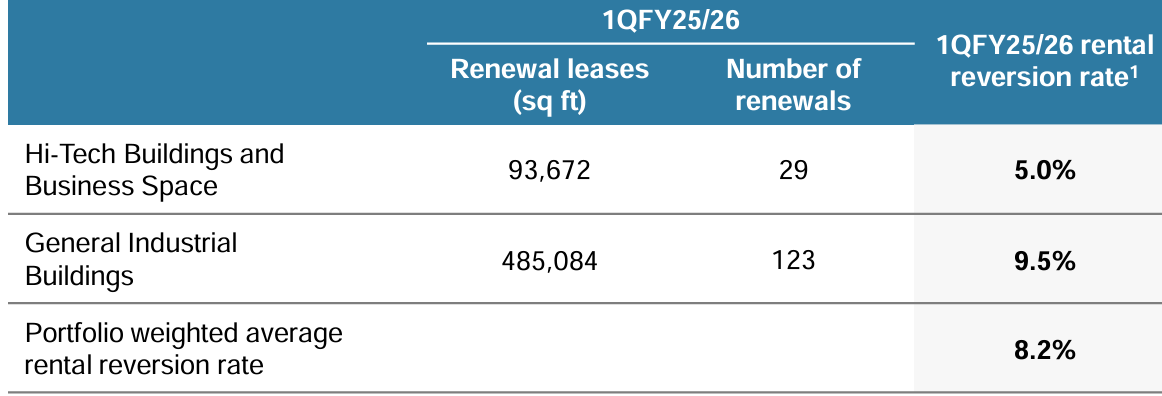

MIT recorded a healthy weighted average rental reversion of +8.2% in 1Q FY25/26.

…