Crypto traders are becoming increasingly bullish on social media over Bitcoin’s chances of reclaiming $110,000, but the surge in optimism isn’t always a good sign, says blockchain analytics platform Santiment.

“It’s pretty clear that the crowd is starting to salivate over a potential $110K+ Bitcoin market value,” Santiment analyst Brian Quinlivan told Cointelegraph.

Bullish Bitcoin comments surge to three-week high

Santiment data shows that for every bearish comment on Bitcoin (BTC), there are now 1.51 bullish comments — the highest sentiment ratio in the past three weeks. The data was pulled from multiple platforms, including X, Reddit, Telegram, 4chan, BitcoinTalk and Farcaster.

While rising sentiment may seem positive, Quinlivan cautioned that similar spikes in trader optimism were followed by Bitcoin price drops on both June 11 and July 7.

“As we know, prices move in the opposite direction of the crowd’s expectations as retail perpetually loses money from overly emotional decisions,” he said.

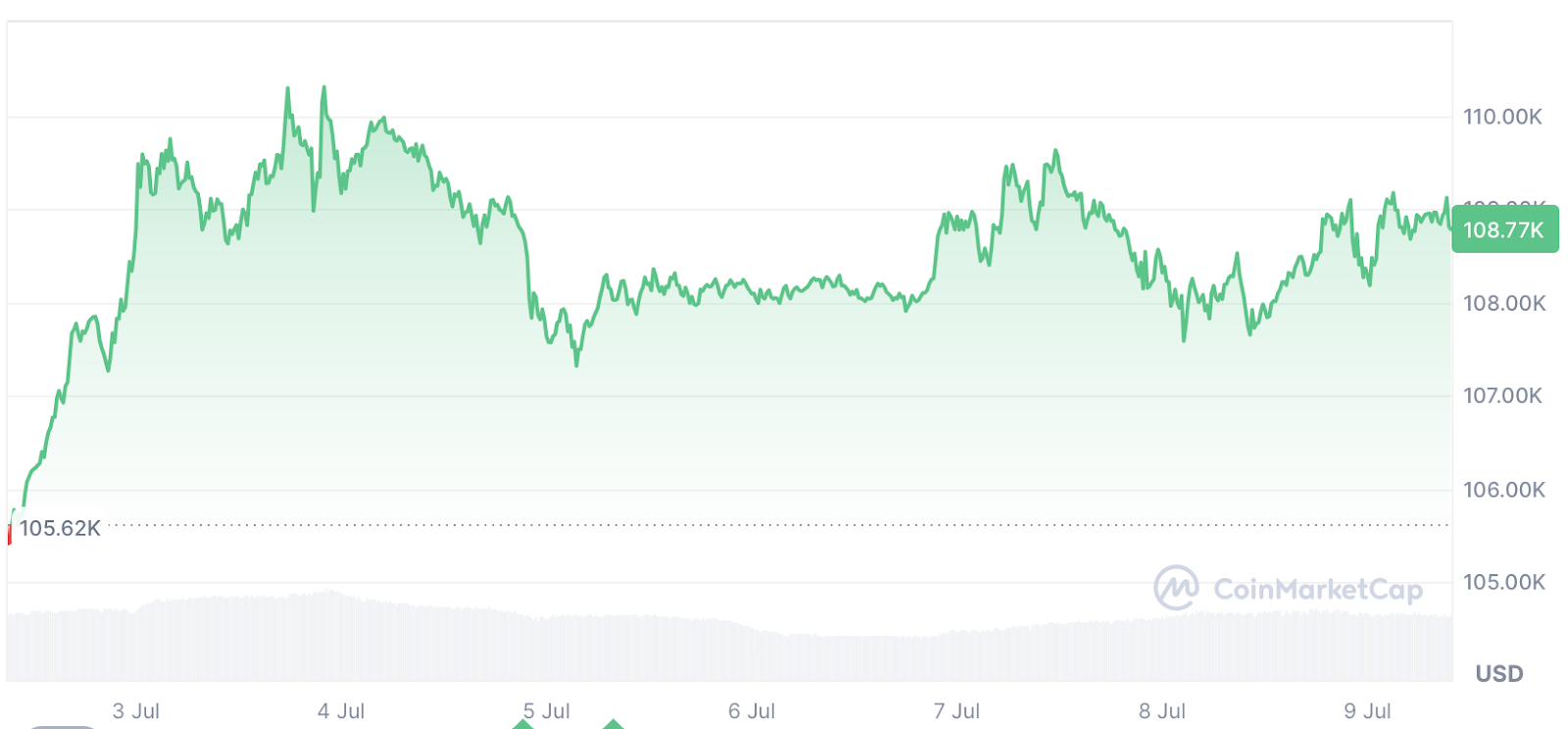

Quinlivan pointed to trading activity on Monday, where an uptick in bullish commentary coincided with Bitcoin hitting a local top of $109,595, before quickly retracing to $107,681.

“We saw clear signs that retail was buying into the rising momentum of Bitcoin's price,” he said.

“Mild pullback” on the table for Bitcoin before a new all-time high

Quinlivan believed Bitcoin would likely see a “mild pullback” before it breaks through its all-time high of $111,970, which it reached on May 22. Bitcoin is trading at $108,791 at the time of publication, up 2.84% over the past seven days, according to CoinMarketCap data.

Quinlivan also noted that Bitcoin whale wallets — those holding between 10 and 10,000 BTC — have shown little recent activity, which could signal caution in the market.

Related: Bitcoin price gained 72% and 84% the last two times BTC holders did this

“For now, these wallets have been somewhat suspiciously flat,” Quinlivan said, adding that whales have sold off 14,140 BTC over the past week.

“When they accumulate, prices often follow closely. When they dump or even just temporarily stop accumulating, it often signals that market values across crypto may see some declines.”

However, he emphasized that the long-term trend remains bullish, pointing to six months of steady accumulation by whales and sharks.

Macro headwinds lie ahead

Javier Rodriguez-Alarcon, chief commercial officer at digital asset trading firm XBTO, told Cointelegraph that several upcoming events could test the overall crypto market’s resilience in the weeks ahead.

While his earlier concerns about the US tariff deadline tied to US President Donald Trump have eased following its delay to Aug. 1, Rodriguez-Alarcon highlighted other macroeconomic factors that could still influence Bitcoin’s price trajectory.

He said the release of minutes from the Federal Reserve’s rate-setting committee on Wednesday may have an impact on the broader crypto market and cause “significant headwinds for risk assets.”

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.