Inflation expectations are controversial for obvious reasons.

You go to the public, ask them how they think prices will change over a selection of different time periods, and then draw conclusions about what might actually happen.

Capturing this data is a core function of the Bank of England’s Inflation Attitudes Survey, carried out quarterly by pollster Ipsos via its “proprietary panel” and “trusted partners”. The survey’s methodology says a “rigorous set of quality procedures” ensure that these panellists are “real, unique, fresh (not over surveyed on the topic), and engaged”. It does not particularly care whether they know the slightest thing about inflation.

We recently wrote about the oddness of questions 11 to 14 of the Bank of England’s IAS, which appear designed to confuse, embarrass and frustrate participants.

What we didn’t clock at the time is that Ipsos releases individual responses to those questions, allowing us to create the macroeconomic survey version of Takeshi’s Castle — look at the cohort as a collection of individual humans, and watch them struggle through this cruel and unusual questionnaire.

So, obviously, we did that.

Ipsos’ press release says about 2,000 people take the IAS, but in reality it seems to be roughly double that. February’s outing had 4,270 respondents, with unique IDs from #235864 to #240133. Let’s get to know them:

Round 1: Slippery Wall Rate-setter Relay

We start, of course, with Question 11:

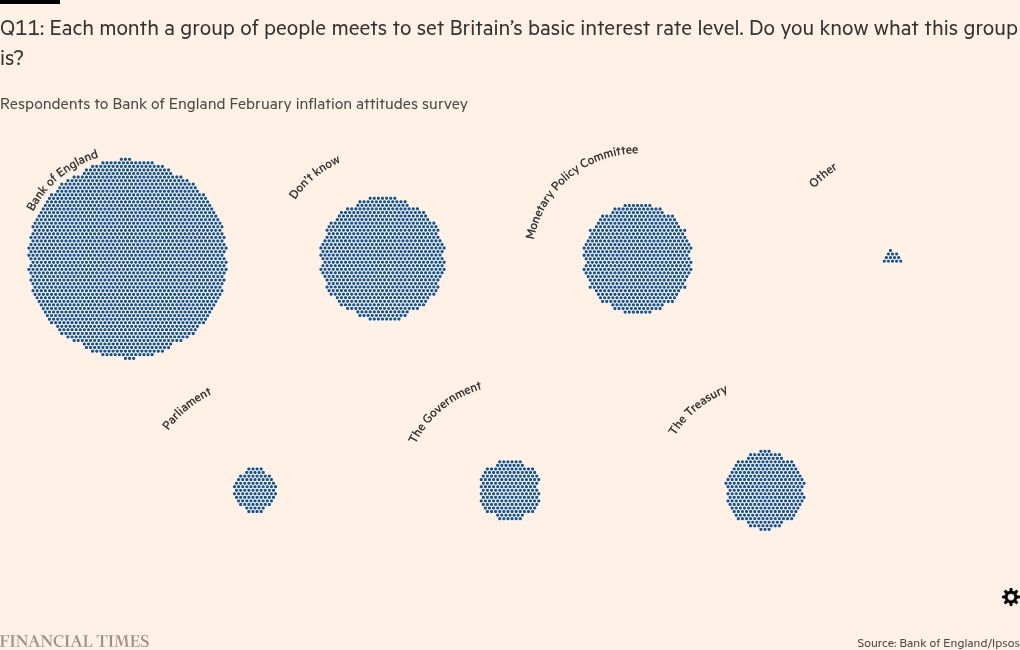

Q11: Each month a group of people meets to set Britain’s basic interest rate level. Do you know what this group is?

Here are the options:

-

Monetary Policy Committee

-

Bank of England

-

The Government

-

The Treasury

-

Parliament

-

Other

-

Don’t know

From that selection, we’d argue that Monetary Policy Committee is the only truly correct answer. How many respondents got that?

It’s a brutal first round, taking our plucky 4,270 down to 648. Hit the cog icon on the right to filter the results and confirm/refute your own biases.

So, just under one in seven respondents are left. On to round two.

Round 2: Square Maze Inflationary Trap

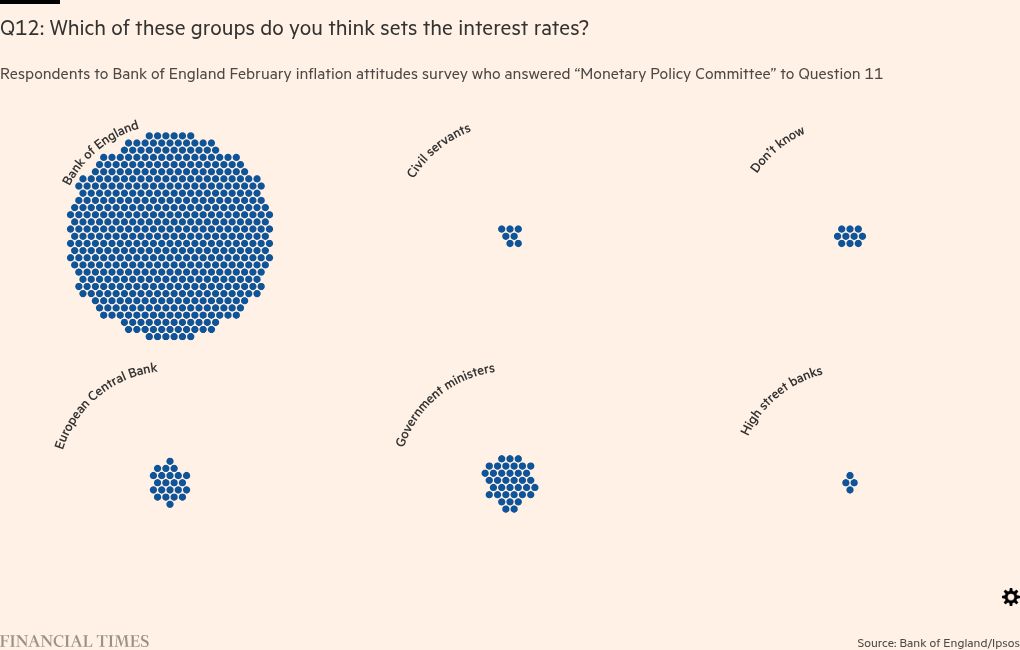

Q12: Which of these groups do you think sets the interest rates?

-

Government ministers

-

Civil servants

-

Bank of England

-

High street banks

-

European Central Bank

-

Don’t know

Question 12 is a tough one. As we discussed in our previous piece, in the context of Question 11 there’s no clearly-correct answer here. Also note the vagueness — where Q11 refers to “Britain’s basic interest rate”, this is a far more nebulous “the interest rates”.

Government ministers and civil servants surely aren’t correct answers, but — depending on the interpretation of the question — Bank of England, high street banks and European Central Banks are all close. But if Monetary Policy Committee was the answer before, surely we should demand the same specificity here?

Therefore, the only correct answer is don’t know. As Marla Daniels says in The Wire:

The game is rigged, but you cannot lose if you do not play

How many people stuck with their convictions and avoided the trap?

Yikes, just ten people left. On to round three.

Round 3: Uphill Garden Bad Attitudes

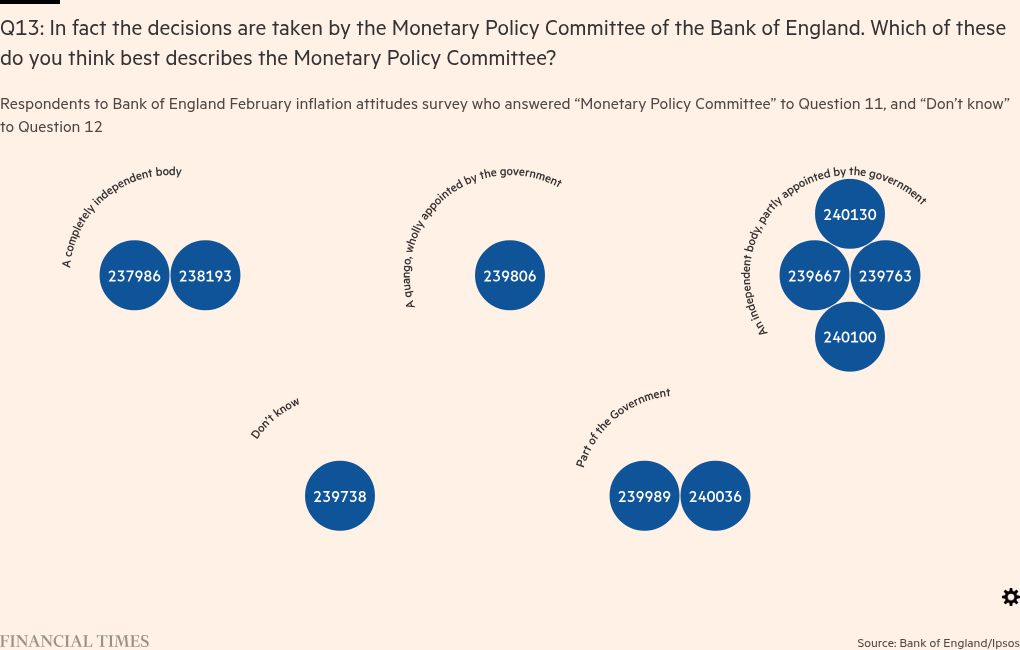

Q13: In fact the decisions are taken by the Monetary Policy Committee of the Bank of England. Which of these do you think best describes the Monetary Policy Committee?

-

Part of the Government

-

A quango, wholly appointed by the government

-

An independent body, partly appointed by the government

-

A completely independent body

-

Don’t know

Having acknowledged cruelly trapping their respondents, Ipsos throws another curveball here.

As we see it, part of the government is arguably correct, as is an independent body, partly appointed by the government. The MPC certainly isn’t itself a quango, and if we’re going to be brutal it also can’t fairly be described as a completely independent body. We think don’t know is once again an acceptable answer.

Let’s see how our respondents did:

So… seven survivors — three men, and four women — who correctly made it through the BoE/Ipsos survey trap and survived to tell the tale. Finally, Britain has its magnificent seven:

What can we learn about these heroes? Well, all except #239763 describe themselves as neither satisfied nor dissatisfied with the job the Bank of England is doing on inflation (even though, really, they know it’s the MPC’s job). As for #239763, she’s chuffed, giving a “very satisfied” response.

Round 4: Wipe Out The Final Filtration

Can we further whittle down this group? One of the few other questions where there’s a correct answer is 1:

Q1: Which of these options best describes how prices have changed over the last 12 months?

Taking the position that respondents would, without any other information, treat this as a UK-specific question, the answer in February was 2.8 per cent (assuming you believe the ONS).

Of our seven, only one got this correct: #240130, who answered “Up by 2% but less than 3%”. All the others picked at least 4 per cent, or said they didn’t know.

So . . . we have a winner! #240130 is the one IAS respondent with what FT Alphaville would sufficient savvy to bother listening to.

#240130, who we’re going to call Hannah, is a Scottish woman aged 16–24. She’s a student, but earns £20,000 to £34,999 a year. She has A-level equivalent qualifications but no degree (yet!), and probably privately rents or lives with her parents. Hannah, we salute you.

Having filtered this in the only sensible way we can, let’s hear Hannah’s annual (shop) inflation predications:

-

12 months out: Don’t know.

-

2 years out: Go up by 2 per cent but less than 3 per cent

-

5 years out: Don’t know.

No short-term certainty, no long-term certainty, but sure that inflation will be on target in a couple of years: we don’t know what the future holds for young Hannah, but central banker is definitely an career option she should consider.