Ethereum (ETH) is currently trading above the $4,400 level, showing resilience despite recent selling pressure and market-wide volatility. However, price action has entered a consolidation phase, with bulls struggling to reclaim higher levels and momentum appearing muted. This has fueled speculation across the market, as analysts remain divided on ETH’s next move.

Related Reading

Some market participants expect Ethereum to retrace below $4,000, pointing to weakening momentum and sustained resistance near the $4,600–$4,800 range. They argue that a correction could provide healthier conditions for the next major leg upward. On the other hand, more optimistic analysts see this consolidation as a launchpad for a breakout, with ETH potentially pushing above the $5,000 mark in the coming weeks if demand remains strong.

Supporting the bullish case, CryptoQuant data reveals that despite Ethereum’s ongoing correction following its recent all-time high, demand for ETH remains robust. Exchange reserves continue to trend lower as investors withdraw their holdings, while onchain activity highlights persistent accumulation. This divergence between price volatility and underlying demand suggests that ETH fundamentals remain solid.

Ethereum Demand Remains Strong Despite Correction

According to CryptoQuant analyst Crypto SunMoon, Ethereum continues to demonstrate strong investor interest despite its recent price correction. After reaching new all-time highs, ETH has entered a consolidation phase, pulling back from peak levels. Yet, unlike many assets that typically see declining demand during corrections, Ethereum’s fundamentals show a different picture.

Data highlights a clear divergence between Ethereum and Bitcoin reserves on Binance. While Bitcoin reserves have remained relatively stable, Ethereum reserves have shown a persistent downward trend. This consistent outflow indicates that market participants are actively withdrawing ETH from exchanges, a common sign of accumulation. Investors appear more inclined to hold Ethereum in private wallets or deploy it in decentralized finance (DeFi), reflecting growing confidence in its long-term potential.

This trend also aligns with the broader capital rotation from Bitcoin to Ethereum that has been unfolding in recent weeks. Reports of whales moving billions into ETH have repeatedly surfaced, reinforcing the narrative that large players are positioning for Ethereum’s next major move. Even as short-term volatility pressures the price, demand dynamics suggest that institutional and whale interest is not only intact but increasing.

For many analysts, this divergence between stable Bitcoin reserves and falling Ethereum reserves underscores Ethereum’s leadership in the current market cycle. While BTC remains the benchmark for crypto, ETH’s role as a cornerstone of DeFi, Layer 2 scaling, and institutional adoption continues to attract capital.

Ultimately, the resilience of Ethereum’s demand during a corrective phase signals strength beneath the surface. If accumulation persists, the consolidation period could set the stage for Ethereum’s next breakout, potentially pushing prices toward the $5,000 level and beyond.

Related Reading

Price Analysis: Holding Key Support Amid Consolidation

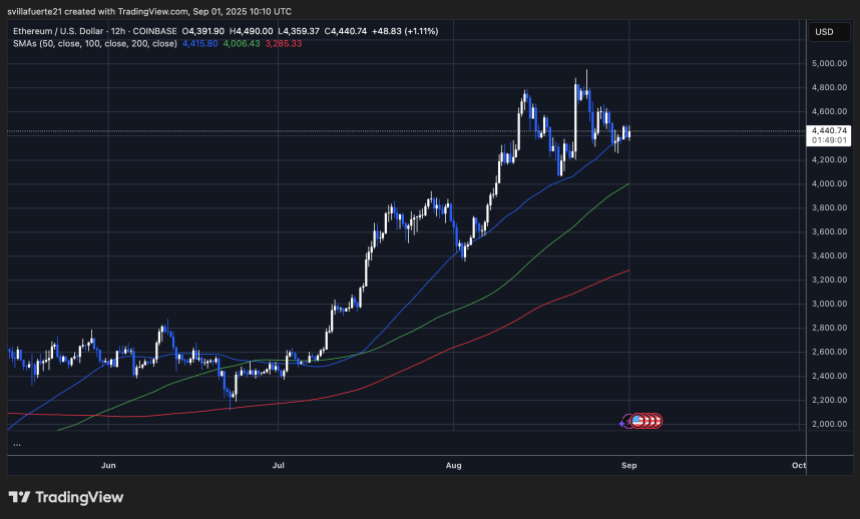

Ethereum (ETH) is currently trading around $4,440, holding above key support levels despite recent volatility. The chart shows that ETH has been consolidating after retracing from its recent all-time highs near the $4,900 region. Importantly, the 50-day moving average (blue line) continues to act as immediate support, aligning closely with the current trading zone.

The price action reflects indecision as bulls attempt to defend the $4,400–$4,300 zone, which has now become a critical demand area. A breakdown below this range could expose ETH to further downside toward the $4,000 psychological level and the 100-day moving average (green line), which would serve as the next layer of support. On the other hand, reclaiming momentum above $4,600 could pave the way for another test of the $4,800–$5,000 region.

Related Reading

From a technical perspective, the consolidation phase appears constructive as ETH continues to trade above its 200-day moving average (red line), highlighting the strength of its long-term bullish structure. While selling pressure remains visible, fundamentals and recent whale accumulation trends provide a supportive backdrop. The coming sessions will be decisive, with ETH needing to hold current support levels to prevent a deeper retrace and set up for its next breakout attempt.

Featured image from Dall-E, chart from TradingView