What do investors look for when they buy environmental, social, and governance (ESG) equity index funds? In principle, as in any fund investment decision, it could be higher financial returns, greater portfolio diversification, reduced volatility, etc.

But whatever investors hope ESG funds will deliver, they likely expect them to perform better on ESG criteria than their alternatives. After all, why call the funds “ESG” if they don’t take ESG factors into account in their investment decisions?

The issue is not just academic. ESG funds, including both mutual funds and exchange-traded funds (ETFs), have grown into a $400 billion market in the United States alone.

The first step in testing whether ESG funds deliver higher ESG scores is to determine what to compare them against.

Many ESG funds track ESG indexes that are often provided by such third-party index creators as MSCI and S&P. For example, the SPDR S&P 500 ESG ETF is managed by State Street, has $715 million in assets under management (AUM), and is listed under the ticker EFIV. EFIV “seeks to provide investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index,” according to its latest publicly available factsheet.

The S&P 500 ESG Index itself “is a broad-based, market-cap-weighted index that is designed to measure the performance of securities meeting sustainability criteria, while maintaining similar overall industry group weights as the S&P 500,” according to its latest factsheet from S&P Global.

The S&P 500, of course, is the standard market capitalization-weighted stock market index and serves as the benchmark for many index funds.

The S&P 500 ESG Index factsheet terms the S&P 500 its “benchmark” and compares its price performance with the S&P 500. Eight of the top 10 holdings of the S&P 500 ESG Index are also among the top 10 of the S&P 500. In fact, the same four companies — Apple, Microsoft, Amazon, and NVIDIA — in the same order, are listed as the top four holdings of each.

Since the SPDR S&P 500 ESG ETF tracks an ESG index, which itself tracks a market index, whether the ESG index has a higher ESG score than the benchmark S&P 500 ought to be of interest. The ESG designation, after all, is the key distinction between the two indexes. Nevertheless, the factsheets did not include ESG scores for these funds.

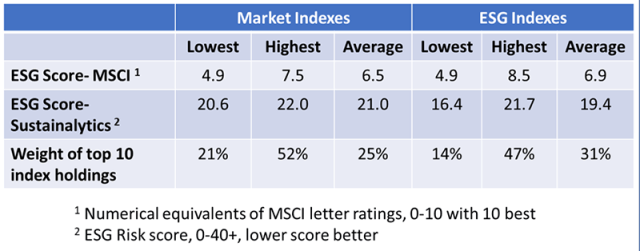

So to approximate their ESG scores, we took the top 10 holdings of each and manually calculated a cap-weighted score by using each company’s publicly available ESG ratings from MSCI and Sustainalytics.

We averaged the two rating agencies’ results and found that the S&P 500 ESG Index had a cap-weighted ESG score 6.0% higher than the S&P 500.

ESG Scores: ESG Indexes vs. Market Indexes

We repeated this exercise with 19 other popular ESG indexes. In each case, we verified that the ESG index compared its performance with a mainstream market index and calculated the ESG “uplift” over the benchmark on the basis of the top 10 holdings in each index.

To be sure, the top 10 holdings are an imperfect proxy for the overall index, but the companies in question do account for an average 25% and 31% of the total capitalization of the market indexes and the ESG indexes, respectively. Moreover, ESG index creators would presumably want to choose companies with the highest ESG ratings for their largest holdings, provided that didn’t create too large a tracking error relative to the benchmark. Such a selection process would further increase the apparent improvement in ESG criteria of the ESG index over its mainstream market benchmark.

ESG Index ESG Score Improvement vs. Market Index

Our key finding, however, is that the ESG indexes typically had only marginally higher ESG scores than their parent market indexes. Some ESG indexes had even less ESG value since their cap-weighted scores were lower than those of their parent.

While the range of variation between ESG indexes and market variation was wide, from -26% to +43%, most deltas fell in the 0 to 10% band with an overall average of 8.3%.

Whether the narrow margins of the ESG score improvements are material or not is a question for each fund’s investors. But if investors do not have this information, they cannot answer the question.

Investors pay 40% higher fees on average for sustainable funds than non-ESG funds. But according to our research, if investors think that higher fees buy much higher ESG scores, they should think again.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / george tsartsianidis

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.