In the race to decarbonise and modernise infrastructure, the world’s attention has largely been fixed on battery metals like lithium, nickel and cobalt. But behind the headlines, another mineral is just as critical — bauxite, the primary ore from which all the world’s aluminum is produced.

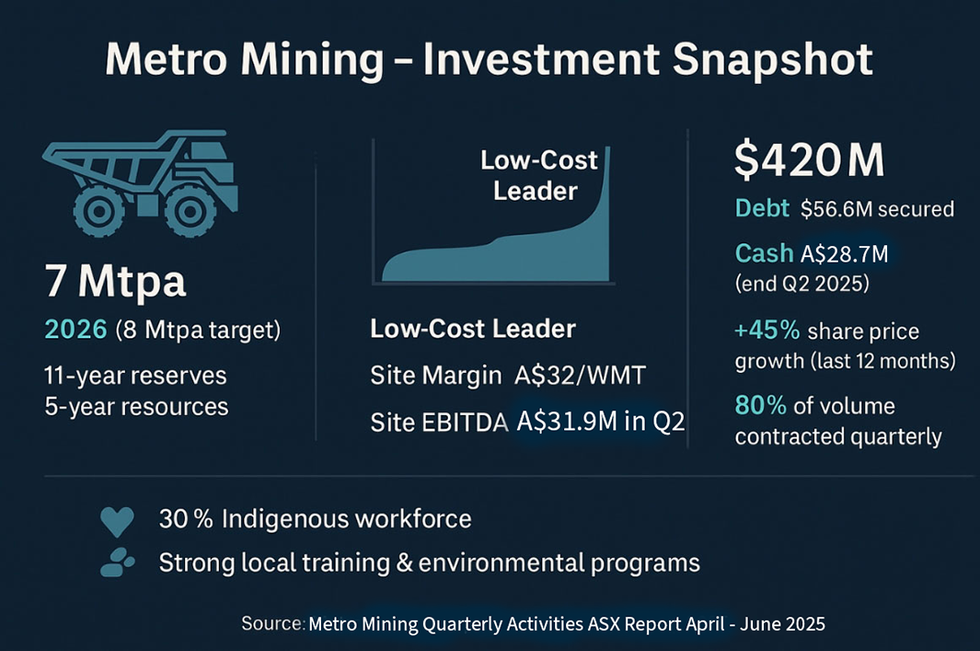

Infographic via Metro Mining.

Across North America, Europe and Asia, governments now recognise aluminum as a strategic material critical to 21st-century infrastructure and decarbonsation efforts. The US has included aluminum in its 2023 critical materials list, while the EU has added it under its Critical Raw Materials Act.

Surging demand, fragile supply

Rapidly growing bauxite demand is increasingly colliding with a supply base concentrated in just a handful of producers. Australia, Guinea and China account for roughly 65 percent of global output, underscoring the sector’s vulnerability to regional disruptions. Grand View Research projects an expanding global bauxite market driven by sustained demand from electric vehicles (EVs), lightweight transport and renewable infrastructure.

At the same time, geopolitical turbulence is affecting supply reliability.

Guinea, which has the world’s largest bauxite reserves, recently revoked some 51 mining licences — mostly targeting underperforming or inactive concessions — as part of broader regulatory reform. Even so, exports surged 36 percent year-on-year in H1 2025 to a record 99.8 million tonnes, and are projected to reach nearly 200 million tonnes annually. Chinese demand continues to remain robust, despite ongoing regulatory shakeup in Guinea.

Amid this supply concentration dynamic, geopolitical risk factors are now coming into play, where both investors and companies down the value chain are placing increased emphasis on securing stable supply sources.

While Guinea remains a critical supplier, its shifting regulatory landscape underscores the strategic value of sourcing bauxite from politically stable, low-cost jurisdictions such as Australia, where supply security is far less vulnerable to geopolitical disruption.

Infographic via Metro Mining.

Metro Mining: A strategic pure play

Based at Skardon River, 95 kilometres north of Weipa in Queensland Cape York Peninsula, Metro Mining’s (ASX:MMI) flagship Bauxite Hills Mine produces high-grade “Weipa-style” direct shipping ore with minimal processing requirements.

Its operations are streamlined — short haul distances, low strip ratios, no blasting — and logistics are optimised through efficient barge loading facilities and transhipping systems. These efficiencies have allowed Metro to expand production capacity to 7 million tonnes per year while driving down costs.

Infographic via Metro Mining.

Over the past four years, Metro has executed a disciplined turnaround strategy — recapitalising, improving operational resilience and securing quality offtake agreements. In Q2 2025 alone, the company delivered record production of 1.7 million wet metric tonnes and a site EBITDA margin of AU$32 per tonne, an impressive improvement from just AU$18 per tonne at the end of 2024. With 80 percent of volumes sold under quarterly contracts, pricing visibility is strong.

Infographic via Metro Mining.

Financially, Metro is on solid ground: a market cap of AU$430 million, secured debt of US$56.6 million, cash of AU$28.7 million and no warrants outstanding. The company is fully hedged for 2025 at a rate of 0.63 US$:AU$, further insulating it from currency swings.

Beyond operational and financial metrics, Metro’s ESG credentials are notable. About 30 percent of its workforce is Indigenous, it has injected AU$5.7 million into Indigenous-owned businesses, and it actively supports community development programs across Far North Queensland.

Looking ahead, Metro is targeting an expansion to 8 million tonnes per year by 2026, along with low-capex debottlenecking projects and exploration programs that could extend mine life well beyond the current 16-year reserve and resource profile. With alumina and aluminum demand set to climb in the clean energy and EV sectors, Metro offers investors a rare combination: low-cost operations, secured market access and scalability in a commodity that is only growing in strategic importance.

Investor takeaway

Bauxite may not yet enjoy the same media spotlight as battery metals, but its role in the energy transition is fundamental. Aluminum is the metal that builds the future — light enough for EVs, strong enough for skyscrapers and infinitely recyclable. Metro offers pure-play exposure to this growth story from one of the most reliable supply bases in the world.

For investors seeking a resilient, strategically positioned mining stock with both yield and growth potential, Metro deserves a place on the watchlist — and perhaps in the portfolio.

This INNSpired article is sponsored by Metro Mining (ASX:MMI). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Metro Mining in order to help investors learn more about the company. Metro Mining is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Metro Mining and seek advice from a qualified investment advisor.