Ethereum (ETH) has lost some of its upward momentum after nearing its all-time high, mirroring a broader correction across the cryptocurrency market. The second-largest digital asset by market capitalization briefly touched $4,776 last week, just shy of the $4,878 record set in 2021, before retreating.

At the time of writing, ETH trades at $4,280, reflecting a 5.7% decline in the past 24 hours and nearly $500 below its recent peak. The pullback comes as analysts closely watch trading activity in derivatives markets.

According to data shared by CryptoQuant analyst CryptoOnchain, retail participation in Ethereum’s futures market has surged significantly in recent sessions. This heightened activity, combined with elevated open interest levels, has sparked debate about whether the market is approaching a tipping point.

Related Reading

Ethereum Futures Market Shows Overheating Signals

CryptoOnchain noted that Ethereum’s futures trading frequency has entered what he describes as the “Many Retail” and “Too Many Retail” zones, thresholds that historically appear near the late stages of strong uptrends.

“Retail participation has sharply increased as ETH prices moved above $4,500,” he explained, adding that such conditions often bring greater volatility and sudden pullbacks.

Additional indicators support this cautious outlook. The analyst highlighted Ethereum’s Futures Volume Bubble Map, which currently shows clusters of large red bubbles near recent price highs. These patterns, he said, have frequently preceded either sharp breakouts or rapid corrections when excessive leverage unwinds.

Meanwhile, open interest (OI) on Binance futures climbed to nearly $12 billion before easing back to around $10.3 billion. While still at historically high levels, the recent dip suggests some traders may already be reducing exposure.

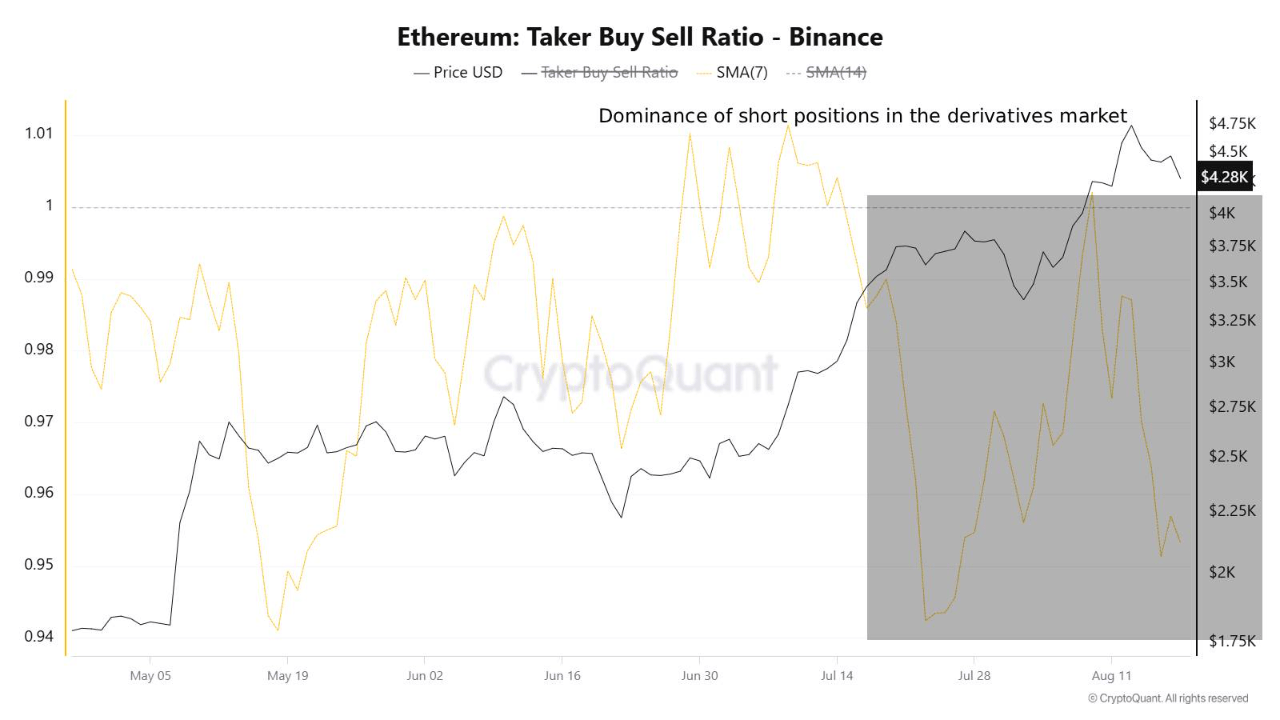

“Extreme open interest expansion near price peaks can either provide fuel for further upside or trigger squeezes when the market turns,” CryptoOnchain wrote. He also pointed out that Binance’s taker buy/sell ratio has remained below 1, indicating selling pressure has dominated trading activity in recent days.

Spot Market Dynamics Offer a Different Perspective

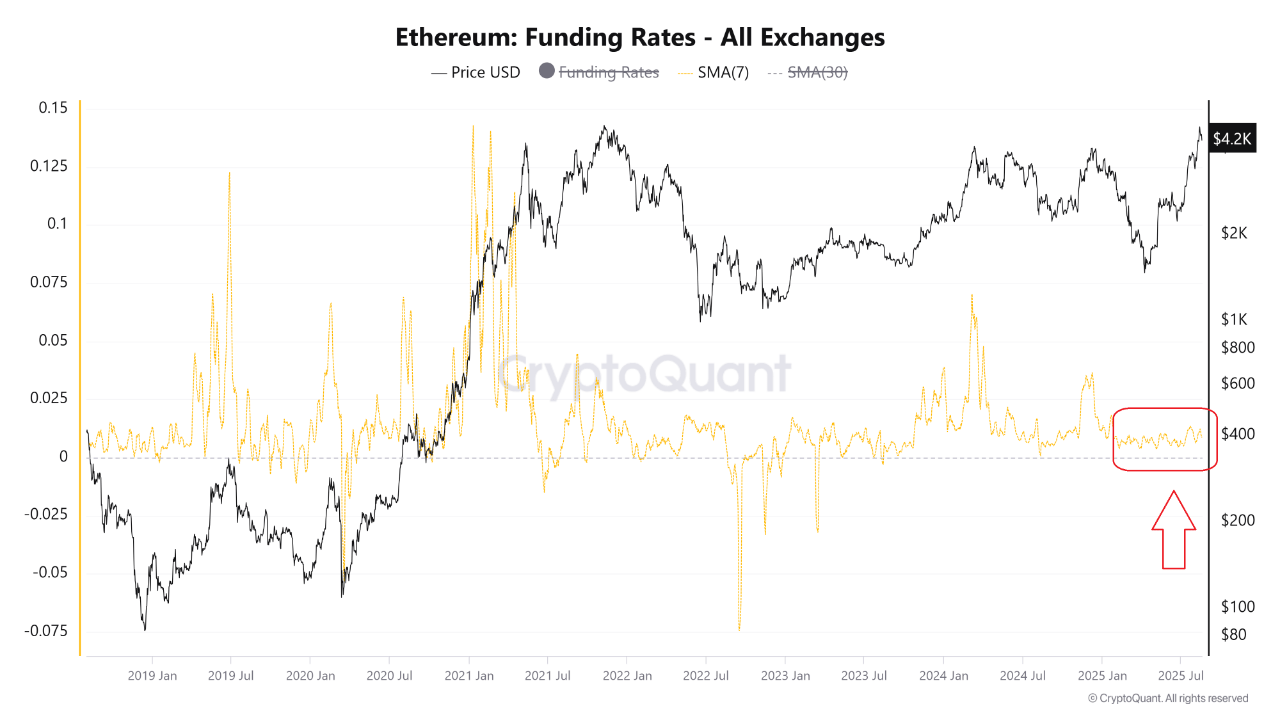

Not all analysts see the current pullback as an immediate sign of market stress. In a separate post, CryptoQuant contributor Woominkyu observed that funding rates for ETH perpetual futures remain flat around zero.

This contrasts with previous bull runs in 2020–2021 and early 2024, when funding rates spiked above 0.05–0.10, signaling overheated long positions.

“ETH just pushed above $4.2K, but funding is still sitting flat,” Woominkyu explained. “That suggests the rally has been driven more by spot buying rather than leverage.”

Related Reading

According to the analyst, this dynamic indicates a relatively healthier market environment compared to past rallies, as it reduces the risk of forced liquidations. He added that a funding rate surge above 0.05 would be the level to watch for potential short-term tops.

Featured image created with DALL-E, Chart from TradingView