Land has always played a quiet but powerful role in real estate. While flashy buildings and sky-high rents tend to grab the headlines, the foundation beneath it all — literally — offers some of the strongest long-term value. As we move through 2025, the landscape around land acquisition is shifting in ways that make it worth a closer look for both seasoned investors and those just starting to explore it.

Why Land is a Compelling Investment Right Now

Housing Demand Isn’t Slowing Down: There’s no denying the data — people need more places to live, and fast. Population growth, especially in and around major cities, continues to outpace what builders can deliver. In the past decade, the U.S. population jumped by around 7.6%. Cities like New York added nearly 240,000 apartments, and Texas metros like Houston and Austin are still issuing tens of thousands of permits every year.

But even with all that building, the housing shortage remains a real problem. We’re still facing a supply gap of nearly 4 million units across the country. The South has the largest shortfall by volume, but areas in the Northeast are feeling it more severely relative to their size.

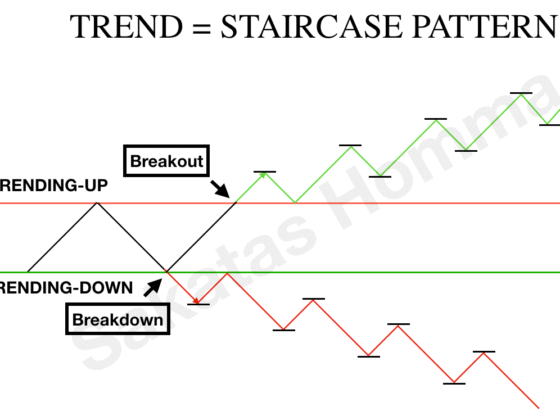

All of this has made land, particularly in areas with decent infrastructure and room to grow, a hot commodity. Developers are chasing whatever land they can get their hands on, and that’s driving prices up, especially in suburban and secondary markets.

Zoning and Incentives Are Changing the Game: Across the board, local governments are rethinking outdated zoning rules. The focus now is on higher-density housing solutions, more mixed-use developments, and policies that support sustainable growth.

Take Charlotte, for example. In 2023, they overhauled their development ordinance, making it easier to build townhomes in formerly single-family zones. It’s a move aimed at easing housing pressures while encouraging smart growth, and other cities are following suit.

On the federal side, Opportunity Zones are still in play. There’s even talk in D.C. about expanding and modernizing the program to draw more investment into underdeveloped areas. If that happens, land values in targeted zones could appreciate quickly.

What this means for investors: Parcels that were once too limited by zoning or overlooked due to a lack of incentive are now on the radar — and in some cases, already climbing in value.

What’s Trending in 2025

Here’s what’s shaping land deals right now:

Urban Infill Is Back: Developers are shifting away from far-flung suburbs (aka exurbs) and turning their attention inward. Infill development — putting new projects on vacant or underused land inside existing urban cores — is gaining serious traction. It makes sense: the infrastructure is already there, zoning is typically more progressive, and demand for close-in housing has picked up again.

Infill also helps avoid the skyrocketing costs of horizontal development (earthwork, utilities, roads, etc.) that come with building in rural locales. Land that used to be too expensive in the city core is starting to pencil much better.

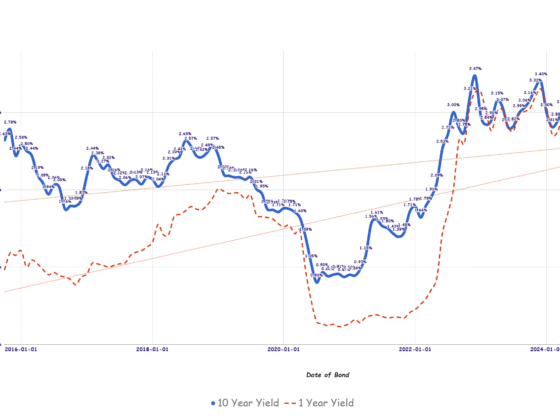

Build-to-Rent Makes a Comeback: After a slowdown caused by rising interest rates, the build-to-rent (BTR) market is heating up again. With interest rates inching lower, financing is becoming more accessible. Builders are moving quickly to deliver rental homes that feel more like single-family residences — with more space, better finishes, and community-style amenities.

Over 100,000 of these units are under construction as we speak. Investors are paying attention, especially in markets where homeownership feels increasingly out of reach for younger buyers.

Site Selection Is Getting Smarter: Technology is quietly transforming how land is evaluated. Tools using AI, GIS, and predictive analytics are helping developers and investors spot good opportunities faster — and with better accuracy.

Instead of relying solely on gut instinct or traditional comps, these tools crunch massive amounts of data to forecast price trends, market demand, and even buyer behavior. It’s a brave new world. Those who can leverage this tech have a leg up in competitive markets.

Transit and Infrastructure Equals Opportunity: When new infrastructure goes in, land values usually follow suit. Whether it’s a light rail extension, a new highway, or even a sewer line expansion, municipalities often rezone surrounding areas to encourage development. That means investors who are watching infrastructure plans closely can often buy land at a lower basis before values spike.

There’s also long-term federal support for transit-oriented development through the Infrastructure Investments and Jobs Act. These projects are helping cities push for denser, mixed-use areas around transit hubs — exactly the kind of places where land values can rise fast.

Looking Ahead

If you’re in real estate, you already know how quickly things can change. And when it comes to land, those changes can open big windows of opportunity — if you’re paying attention.

More investors are jumping into land deals, whether to hold for appreciation, build for rent, or reposition for future development. But as always, success comes down to timing, research, and being willing to act when the right piece of land becomes available.

There’s no perfect formula here. But for those who understand the drivers — population growth, policy shifts, infrastructure, and tech — 2025 could be the year land investment steps into the spotlight.

Analyze Deals in Seconds

No more spreadsheets. BiggerDeals shows you nationwide listings with built-in cash flow, cap rate, and return metrics—so you can spot deals that pencil out in seconds.