Here is the update for my Daedalus portfolio for June 2025. If work is not too busy, I will try to provide an update where possible.

I explain how I constructed this portfolio in Deconstructing Daedalus Income Portfolio and Why I Currently Invest in These Funds for Daedalus. You might not understand what I wrote below if you haven’t read this post.

All my personal planning notes such as income planning, insurance planning, investment & portfolio construction will be under my personal notes section of this blog. You can also find the past updates in the section.

Portfolio Change Since Last Update

The portfolio was valued at $1.441 million at the end of May and is at $1.476 million at the end of June.

We reported a portfolio change of $35,000 for June 2025.

The portfolio is valued in SGD because that is the currency that I would most likely be spending on.

As of 3rd July 2025, the portfolio is valued at $1.497 million.

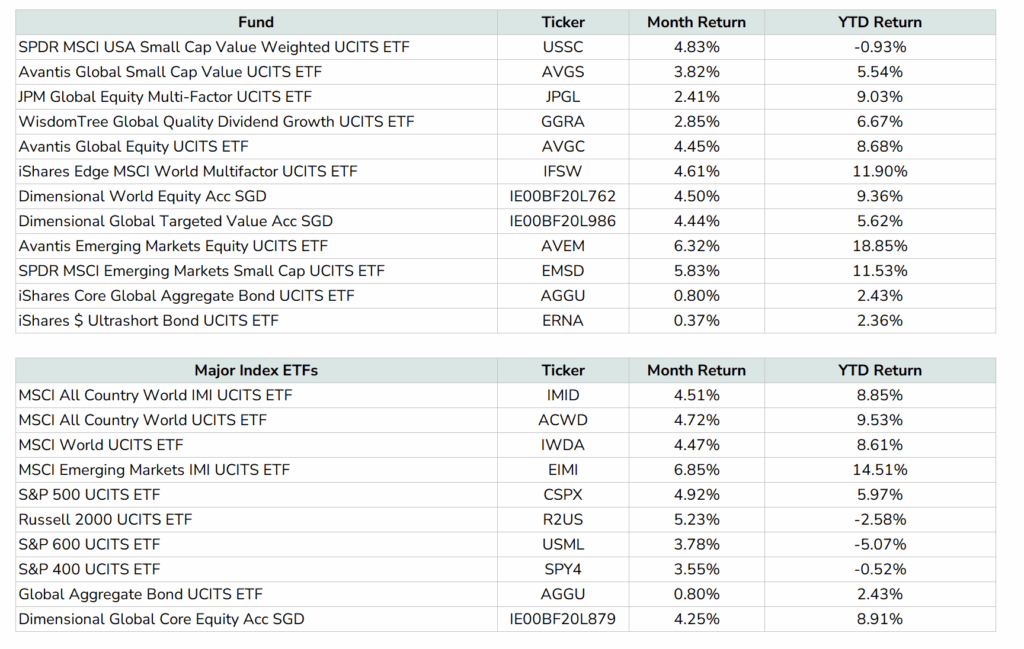

Here are the primary security holding returns for the month-to-date and year-to-date:

The table that shows the fund holdings denotes the month-to-date and year-to-date performance of the funds that I own, against Major Index ETFs. The Major Index ETFs is present to compare the performance. Just to be clear, I do not own the major index ETFs and you should see the top table as what I own.

The returns of all funds are in USD. This includes the performance of the Dimensional funds, which I use the returns of the USD share class so that the returns are comparable. I have also listed the major index ETF performance for comparison.

The market continues to digest and reprice whatever that is in the news.

If you look at the bottom table (Major Index ETFs):

- Emerging markets did the best of 6.8% after doing 4.8% last month. Their performance this year has been the best.

- The small caps globally pulled down the All Country World IMI results relative to the index without IMI.

- The smaller size and cheaper companies is not helping the Global Core Equity.

- The difference between the Russell 2000 and S&P 600 is probably healthcare and technology. Small cap technology have been doing better and we can see the better performance of the Russell 2000 compare to the S&P 600.

- Avantis Global Small Cap Value, Dimensional Global Targeted Value continues to do better than the Russell 2000, S&P 600, SPDR MSCI USA Small Cap Value Weighted due to the weaker USD, and monetary conditions easing in the international markets. Although we are observing better performance this month from USSC.

- JPGL, IFSW, AVGC, Dimensional Global Core Equity (which I don’t own in this portfolio) falls within the realm of MSCI World. You can review the performance of these funds against the MSCI World Index. AVGC and Global Core Equity are more levered to the profitability factor, which kind of help them keep up with the MSCI World Index performance, which has become pretty high in the profitability factor. IFSW is a different beast. They have change their methodology (which I should write about in the future). I have the least allocation to IFSW but it has been the best performer these two years.

- Emerging market small cap is not doing as well as international small cap but definitely doing much better than US small caps. They enjoy both the tailwind of correction from the low and USD weakness.

- Despite interest yield remaining high, the Global Aggregate bond continues to earn the coupon returns of the underlying.

The portfolio lost 1.52% due to the weakening USD against the SGD. YTD the portfolio lost 6.85% just from currency alone.

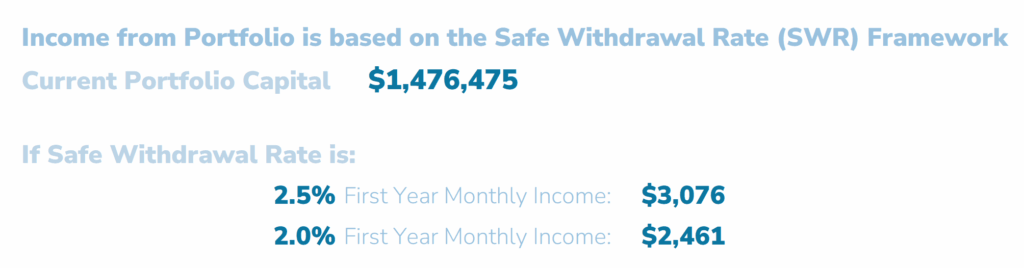

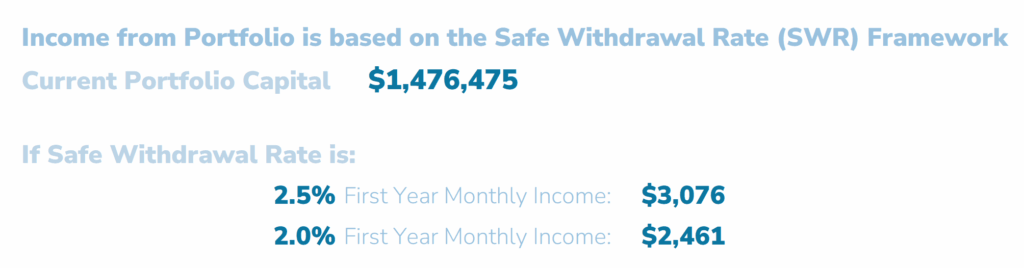

Role of Portfolio

The goal of the portfolio is to generate steady, inflation-adjusted income to cover my essential living expenses. It’s built using a conservative initial withdrawal rate of 2.0–2.5%, which is designed to hold up even under extremely tough market conditions — including scenarios like the Great Depression, prolonged periods of high inflation (averaging 5.5–6% over 30 years), or major global conflicts. In other words, it’s stress-tested to withstand some of the worst financial environments in history.

The income needs to last: from today (age 45) for the rest of your life — potentially forever.

I am currently not drawing down the portfolio.

For further reading on:

- My notes regarding my essential spending.

- My notes regarding my basic spending.

- My elaboration of the Safe Withdrawal Rate: Article | YouTube Video

Based on current portfolio value, the amount of monthly passive income that can be conservatively generated from the portfolio is

The lower the SWR, the more capital is needed, but the more resilient the income stream is.

Nature of the Income I Planned for

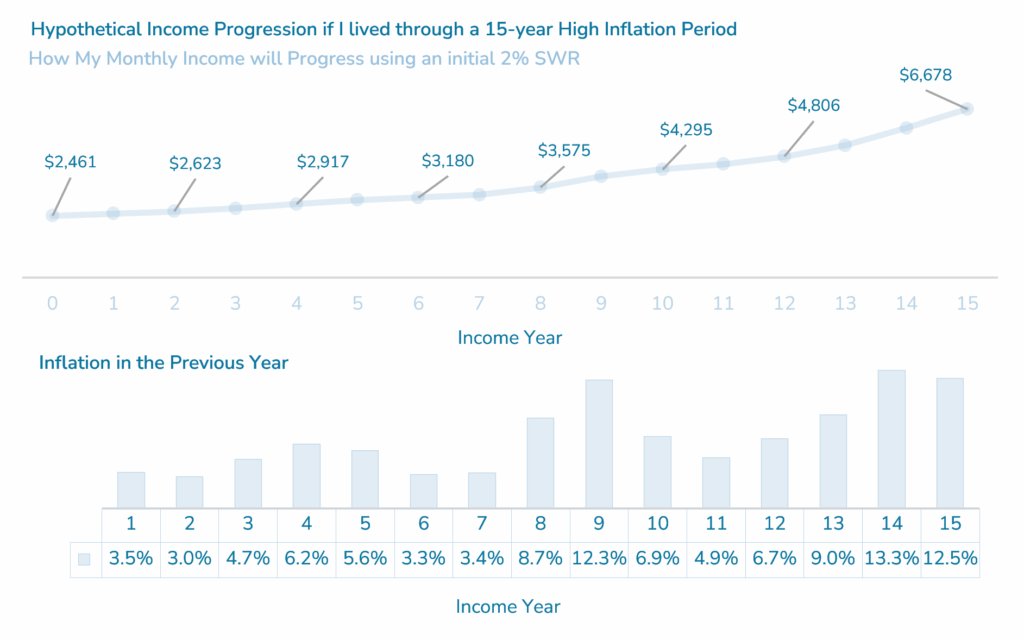

Generally, different income strategies produce different types of income streams. They can vary by:

- Consistency: Some provide steady income, others fluctuate over time

- Inflation Protection: Some adjust with inflation, others remain fixed

- Duration: Some last for a set number of years, others are designed to last indefinitely (perpetual)

An income stream based on the Safe Withdrawal Rate framework is consistent and inflation-adjusted, and if we use a low initial Safe Withdrawal Rate of 2.0-2.5%, the income stream leans towards a long duration to perpetual.

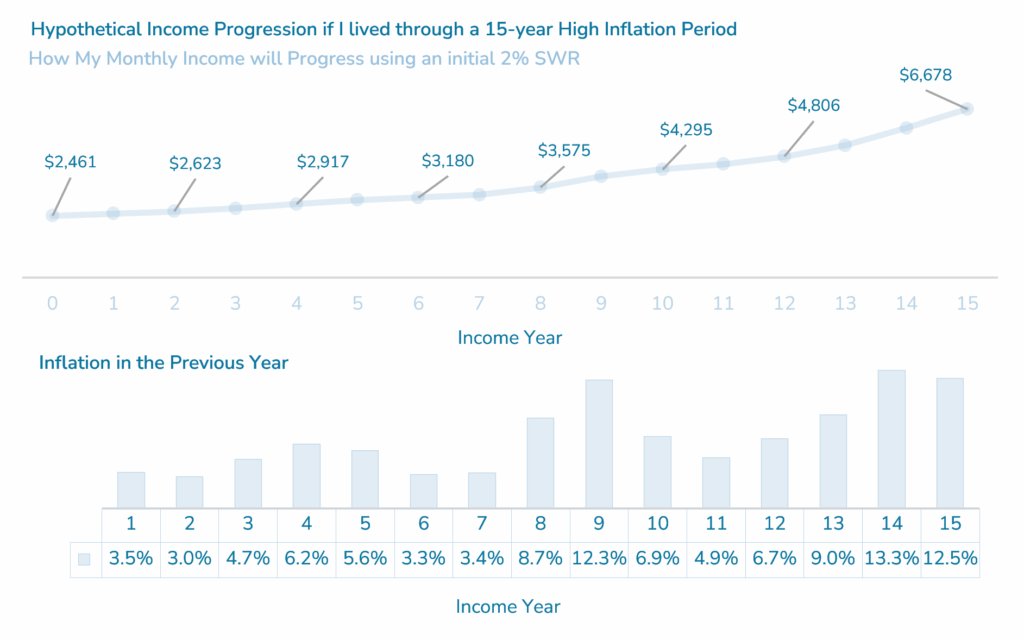

Here is a visual illustration of how the income stream will be based on the current portfolio value:

The income for the initial year is based on a 2% Safe Withdrawal Rate. The income for subsequent years is based on the inflation rate in the prior year (refer to the bottom pane of inflation in the previous year). If the inflation is high, the income scales up and if there is deflation, the income is reduced.

Investment Strategy & Philosophy

After trying my best to learn how to invest for a while, the portfolio expresses my thoughts about investing at this point.

The portfolio is run in a

- Strategic: allocation doesn’t change by short-term events.

- Systematic: rules/decision-tree-based implemented either myself or an external manager.

- Low-cost: investment implementation cost is kept reasonably low both on the fund level and also on the custodian level.

- Passive: I spend relatively little effort mentally considering investments and also action-wise.

You can read more in this note article: Deconstructing Daedalus My Passive Income Investment Portfolio for My Essential & Basic Spending.

Portfolio Change Since Last Update (Usually Last Month)

I held a small position in Matterport (MTTR) during the COVID period. I was down 91% on the position. Real estate information company CoStar (CSGP) purchased Matterport in a cash and shares transaction. So as a Matterport shareholder, I got some CoStar shares.

I decided to clean up my portfolio by moving CSGP to my other portfolio Crystalys. So CSGP is the only sale. However, I can’t sell all the shares so I am still left with 0.1312 CSGP shares on Daedalus.

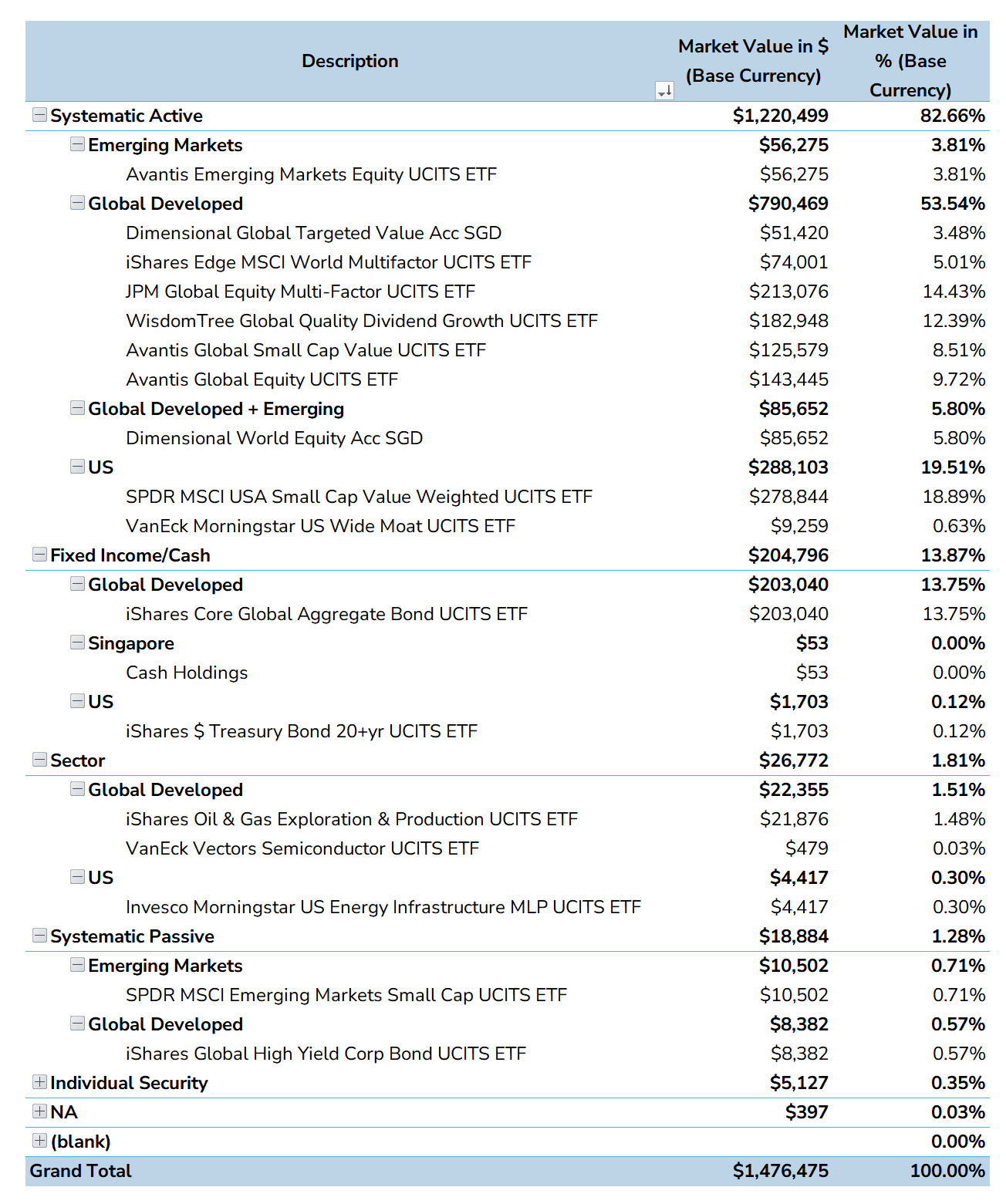

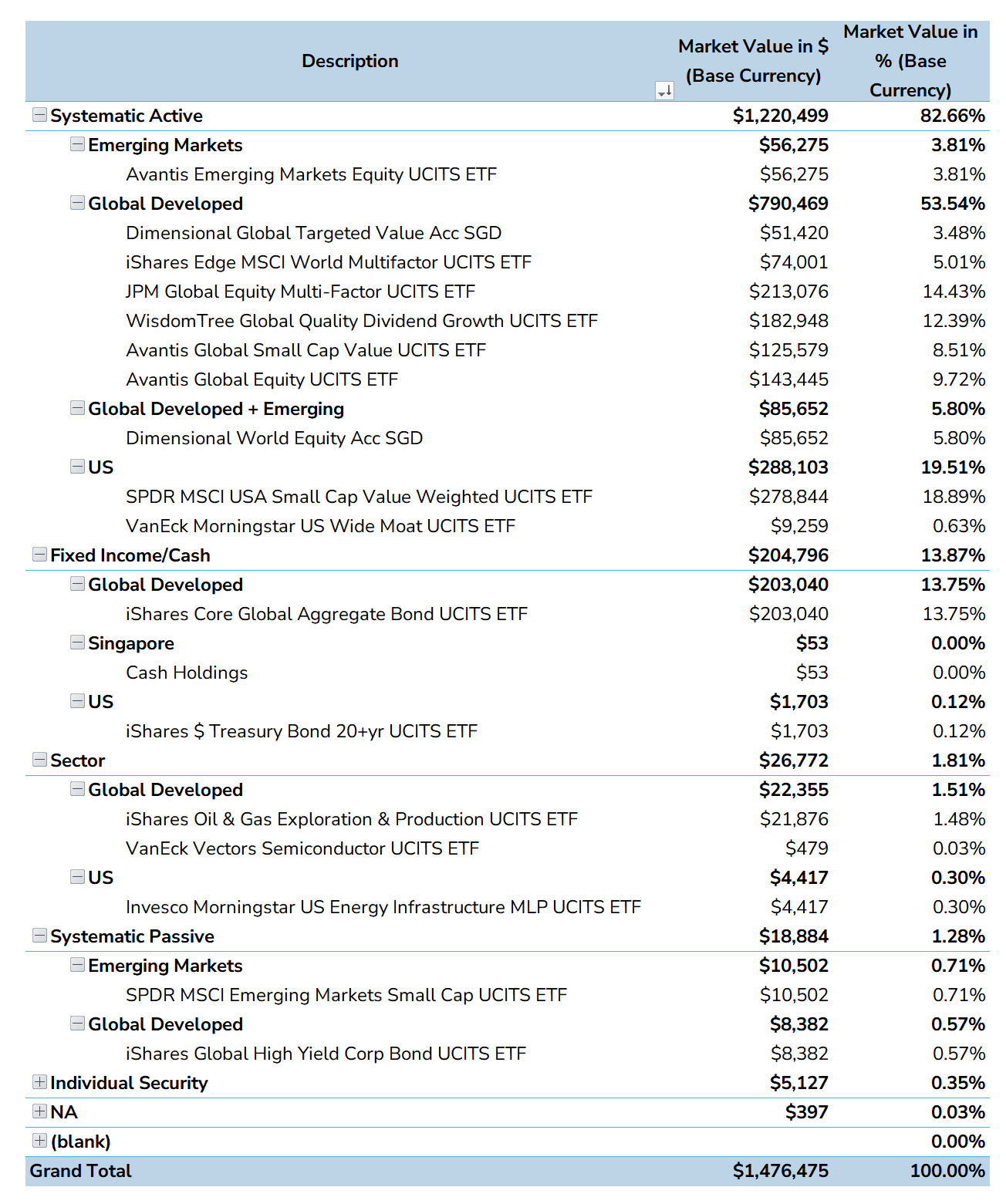

Current Holdings – By Dollar Value and Percentages

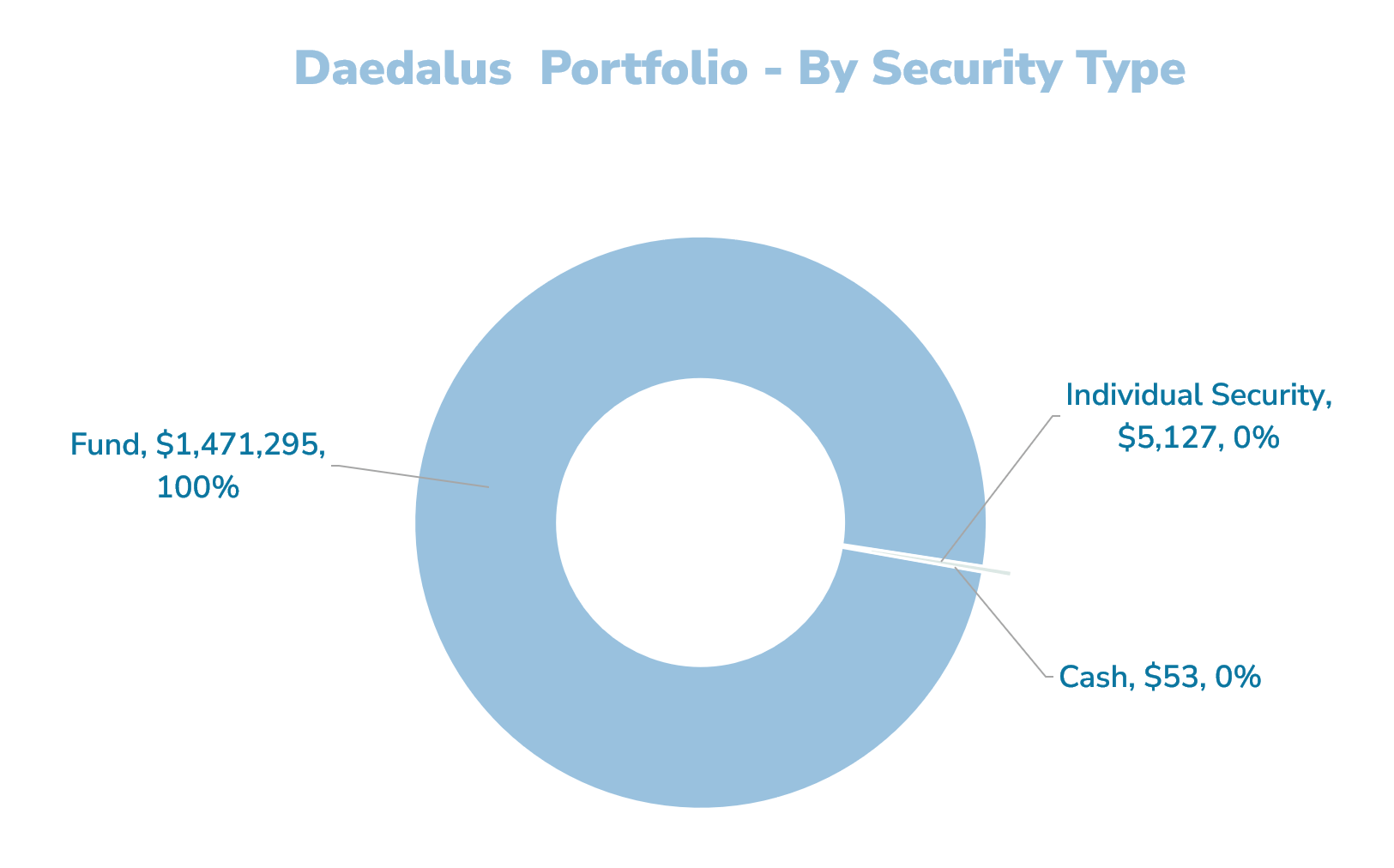

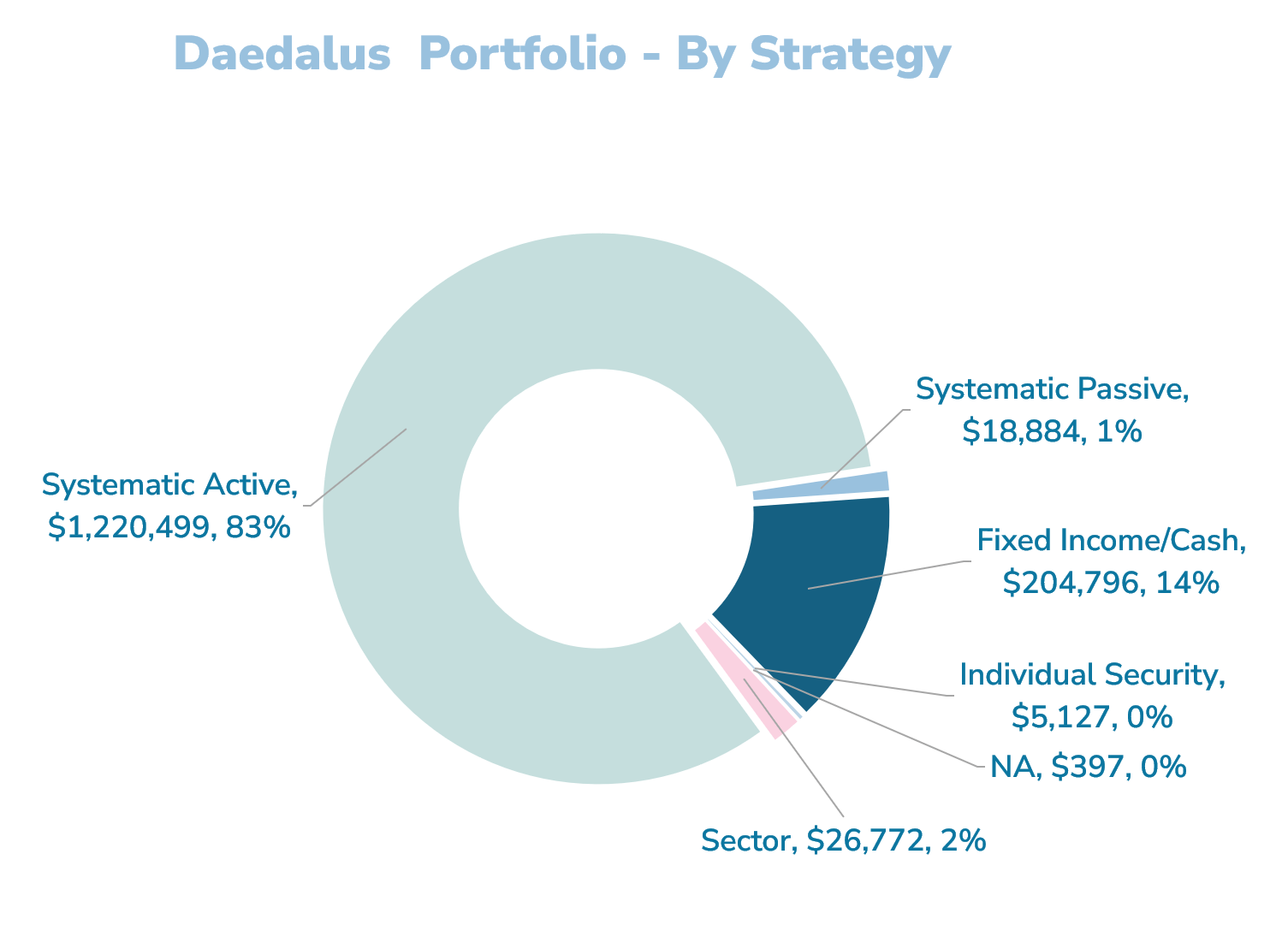

The following table is grouped based on general strategy, whether they are:

- Fixed Income / Cash to reduce volatility.

- Systematic Passive, which tries to capture the market risk in a systematic manner.

- Systematic Active, which tries to capture various proven risk premiums such as value, momentum, quality, high profitability, and size in a systematic manner.

- Long-term sectorial positions.

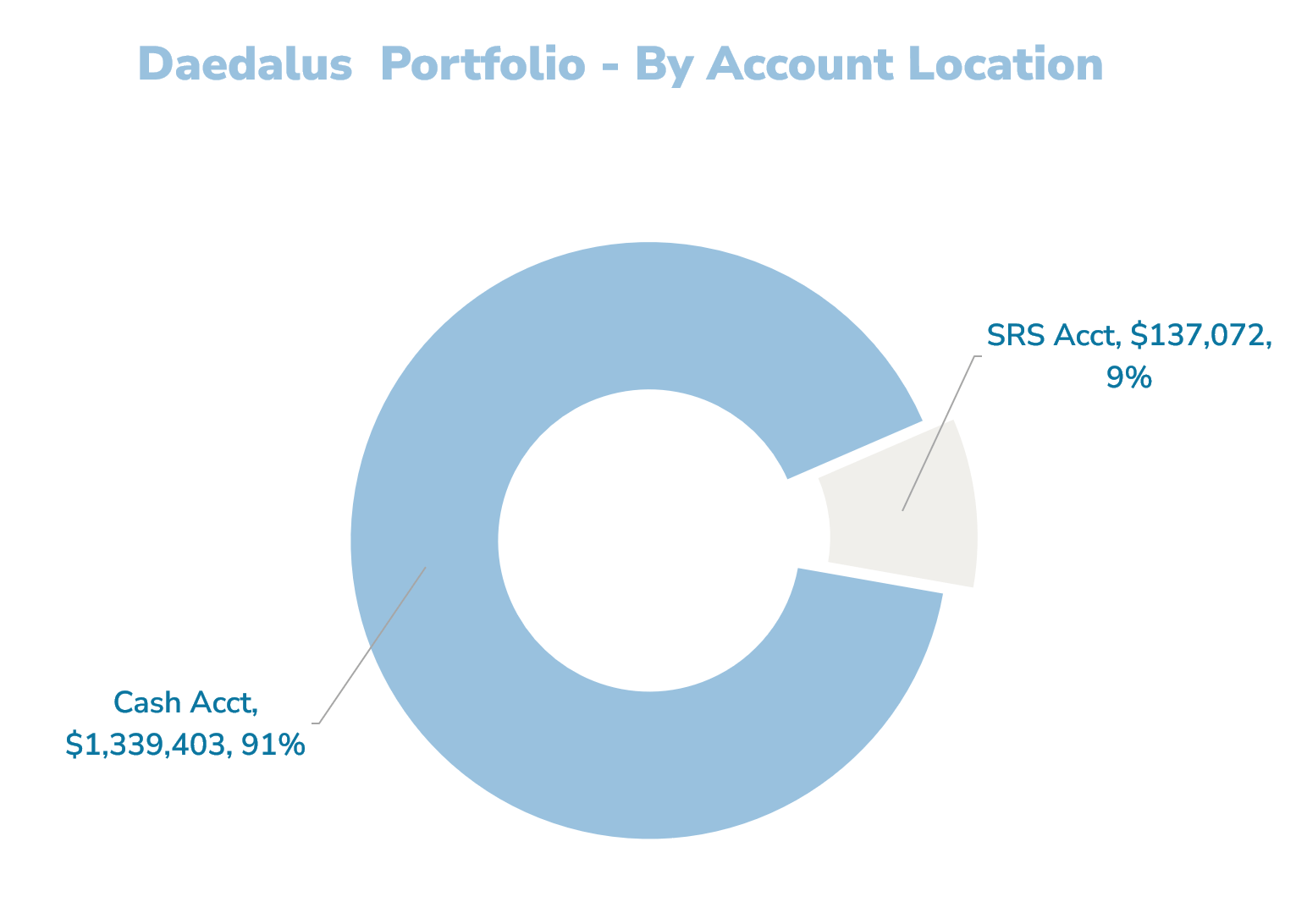

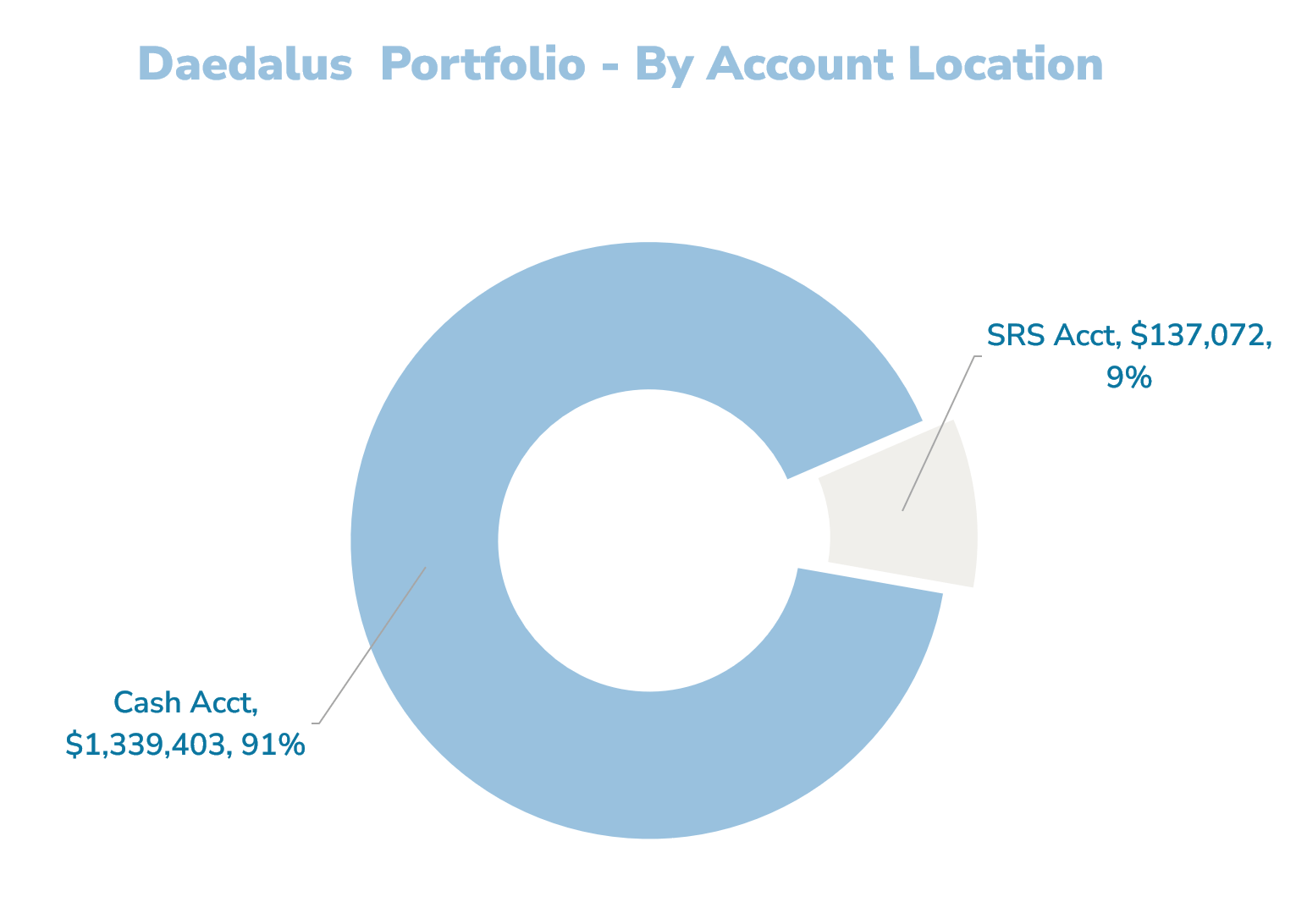

Portfolio by Account Location

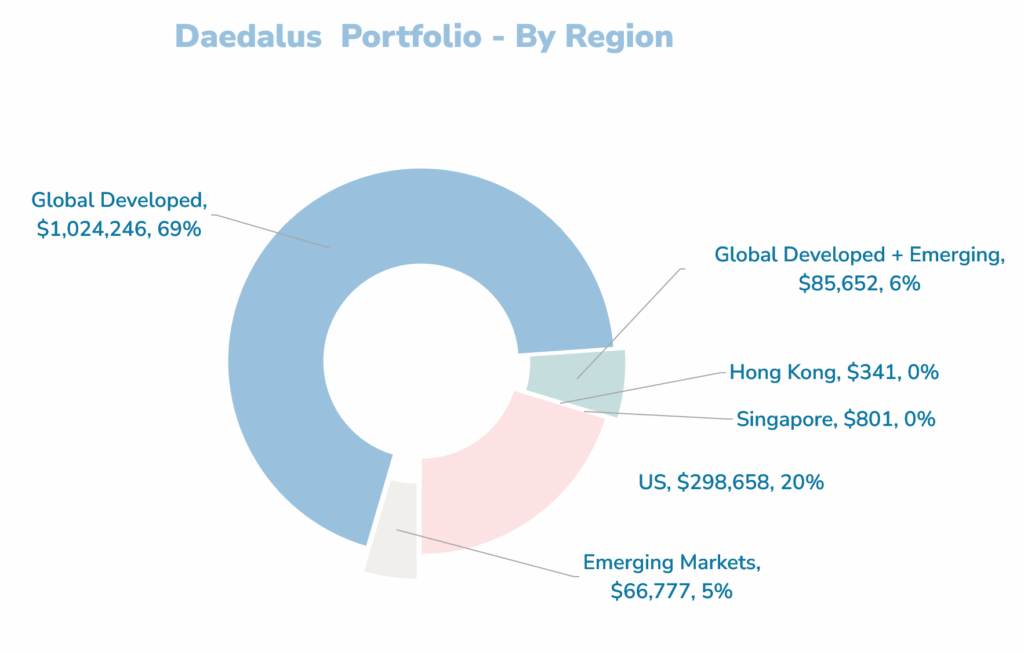

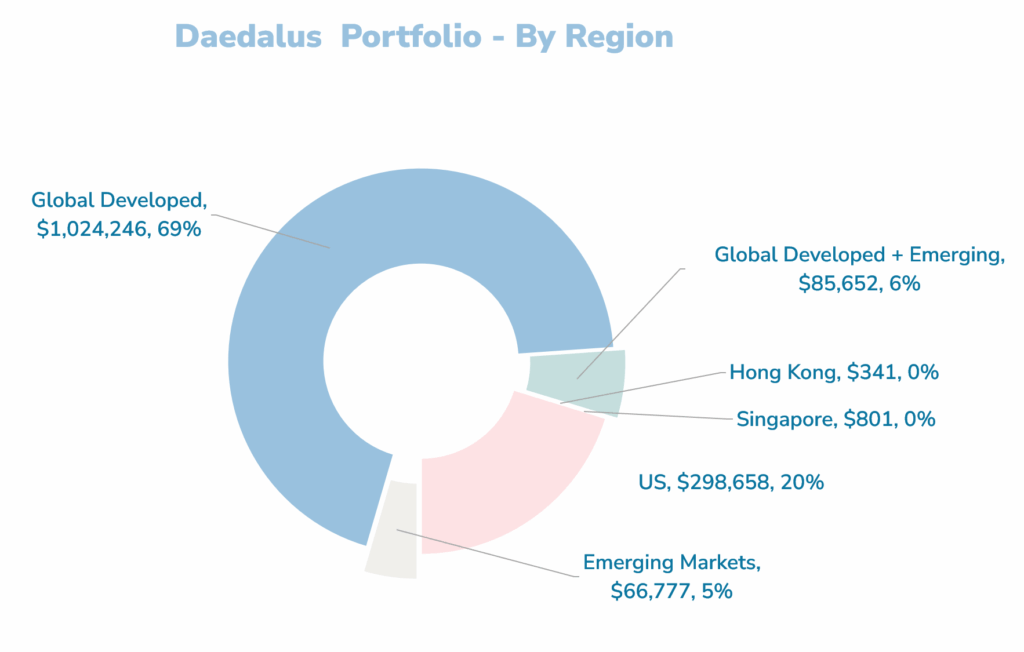

Portfolio by Region of Securities

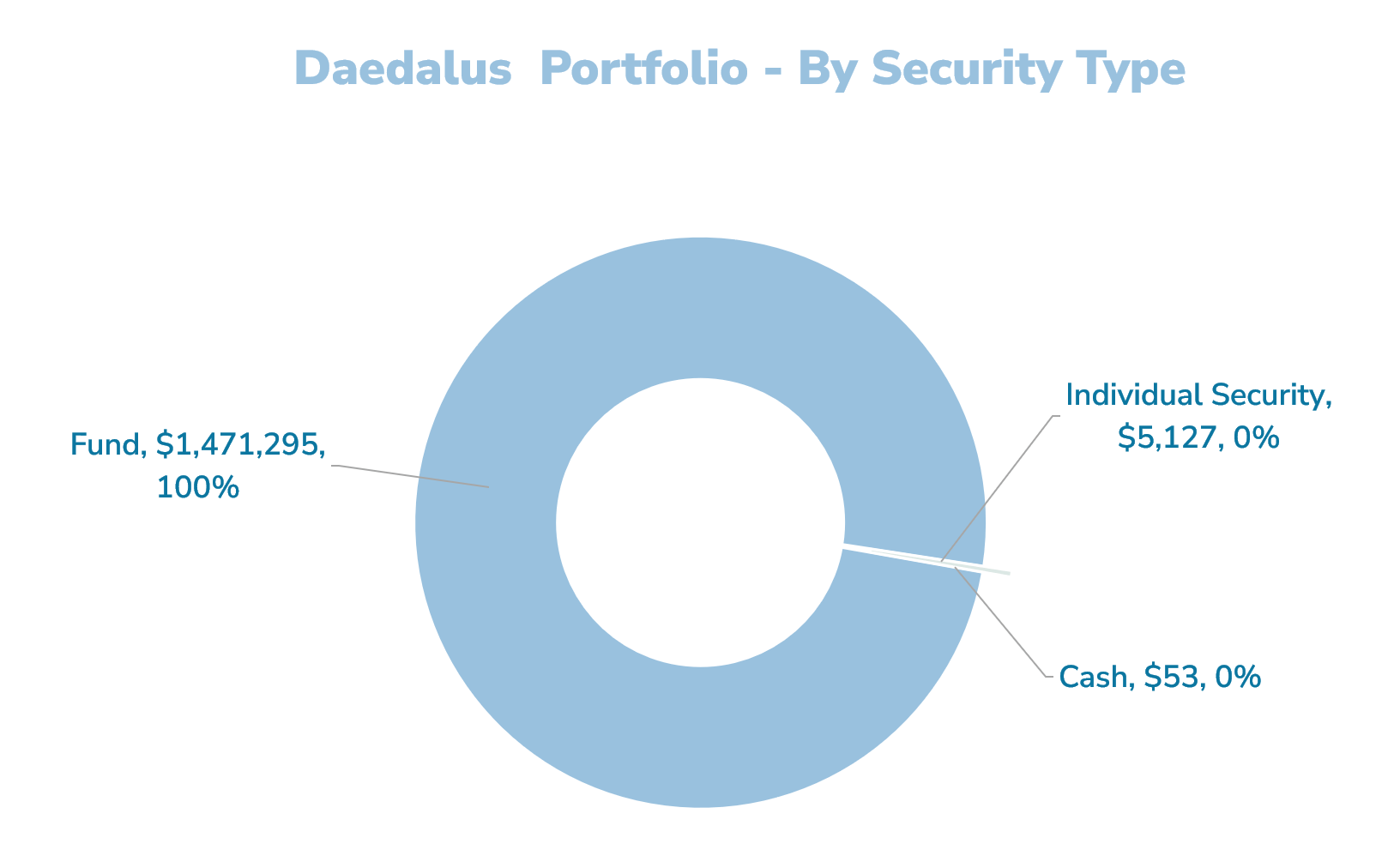

Portfolio by Fund, Cash or Individual Security

Portfolio by Strategy.

Main Custodians

The current custodians are:

- Cash: Interactive Brokers LLC (not SG)

- SRS: iFAST Financial

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.