he last article that I wrote about private investments was the research done by Dimensional, presented in one of their Advanced Conference.

The conclusion from the data piece then is:

- If you manage to invest in the best private listed funds, the returns can be better than comparable listed returns.

- If your luck is average, the returns tend to be not too different from the average returns of a diversified portfolio of listed stocks.

- If you pick a poor fund, you might end up with poorer returns than listed stocks.

- Measure against the right benchmark, you might realize that there are less outperformance. Part of the returns of the private funds also come from traditional sources of additional risks.

A couple of months ago, I came across this research from Carta on Venture Capital (VC) Funding and this research gives insights into VC returns.

This might interest those investors who may have access, considering it, and wonder about the reality of their returns. This would definitely build on to Dimensional Research.

Carta when through a fair number of venture funds. It is important to realize they are not referring to all private investments, which may include buyout funds, private real estate, and private infrastructure funds.

Their data will show the investments in these funds from 2017 to 2024.

When you hear people talk about a “vintage year” in private investing—like in venture capital or private equity—they’re referring to the year a fund starts investing its money. Think of it like the birth year of that investment fund. Just like a wine vintage refers to the year the grapes were harvested, a private investment vintage year tells you when the money was committed and the fund began buying stakes in companies.

Why does this matter? Because the economic conditions and market environment in a particular year can strongly affect how well that group of investments performs. A fund that started in a booming year might have overpaid for companies, while one that started during a downturn could have picked up great companies for less. So, investors often compare the performance of funds based on their vintage years to see how they did relative to peers who started at the same time and under similar conditions. It’s a way to benchmark and understand performance in context.

Different Measurements of Private Investment Returns

It might also be good to familiarize yourself with the different metrics they use to measure returns. There is no “best” way to measure returns. Each will tell you something that you wish to know and may have their own downsides.

Carta presented them in the report.

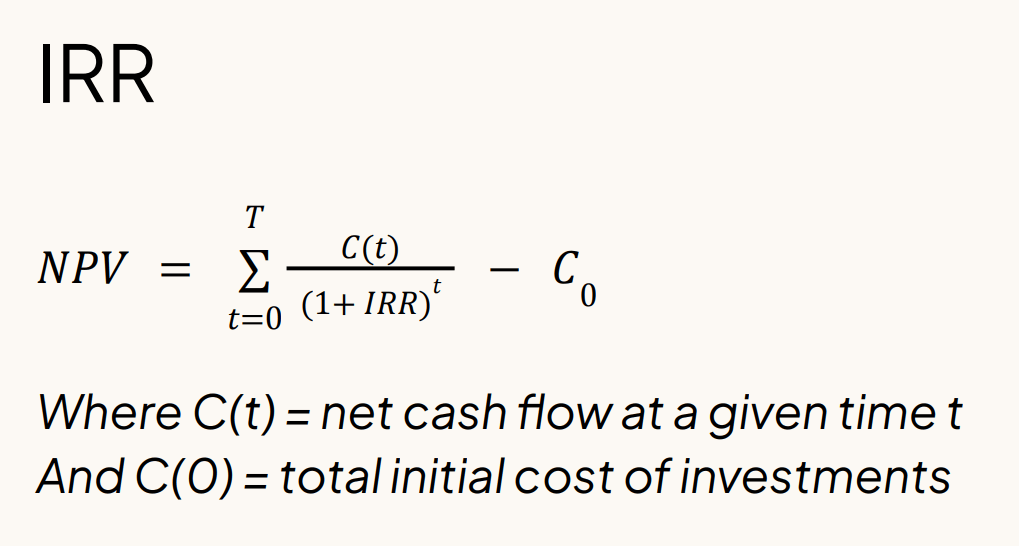

And NPV = net present value of the fund’s future cash distribution (set to 0 to numerically solve for IRR)

IRR is something that investors in public markets might be most familiar with. It measures the “annualized yield” of your decision to put in a stream of irregular money, take out a stream of irregular money, so that you can compare your return to say the bank interest, CPF OA interest rate etc.

It factors in time value of money, compounding, but also the weight of the money invested and taken out.

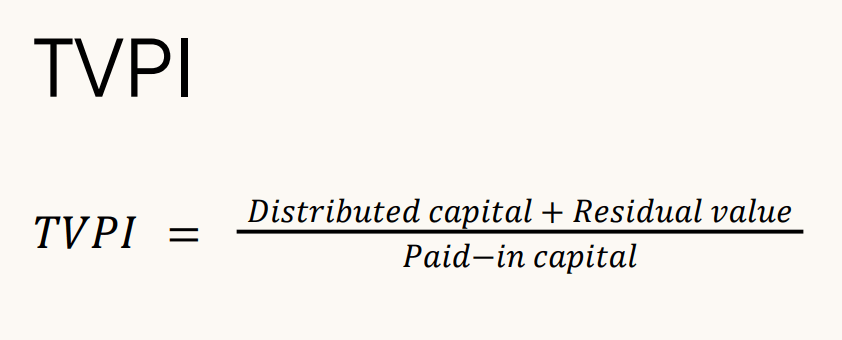

TVPI is simple in that it measures the money paid out to the investor and the residual value left in the investments, divided by the money you put in.

TVPI is like your simple returns.

If the number is above 1, and the higher it is, it shows that you make money!

But it doesn’t let you compare to the effects of inflation, or other investments that well.

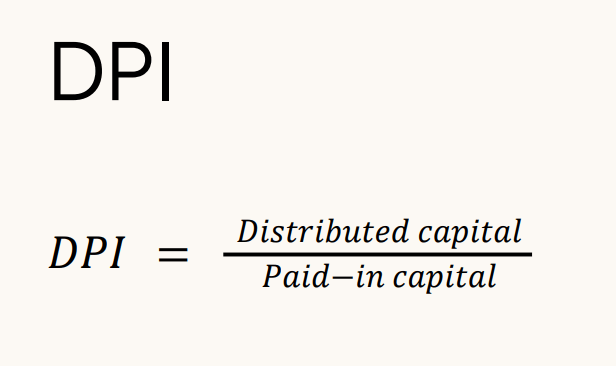

DPI lets you know how much distribution, compare to the money that you put in have you received.

Ok now to the performance data.

Number of LPs are Falling so Fund Raising Becomes more Challenging.

Goodness you can see the funding drop off for those LP that funds $100M to $250M. I think the smallest LP does show signs of increasing but generally those with money are cutting funding.

Your IRR Returns is One Draw of Returns from a Range of Returns.

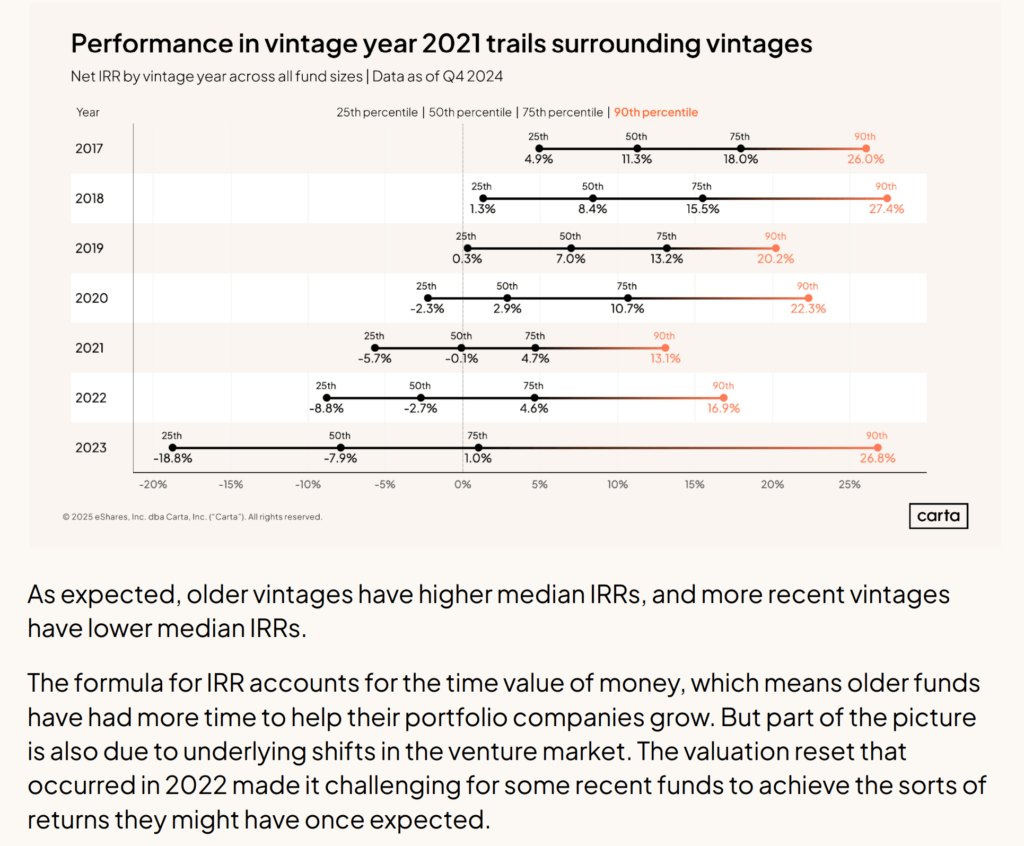

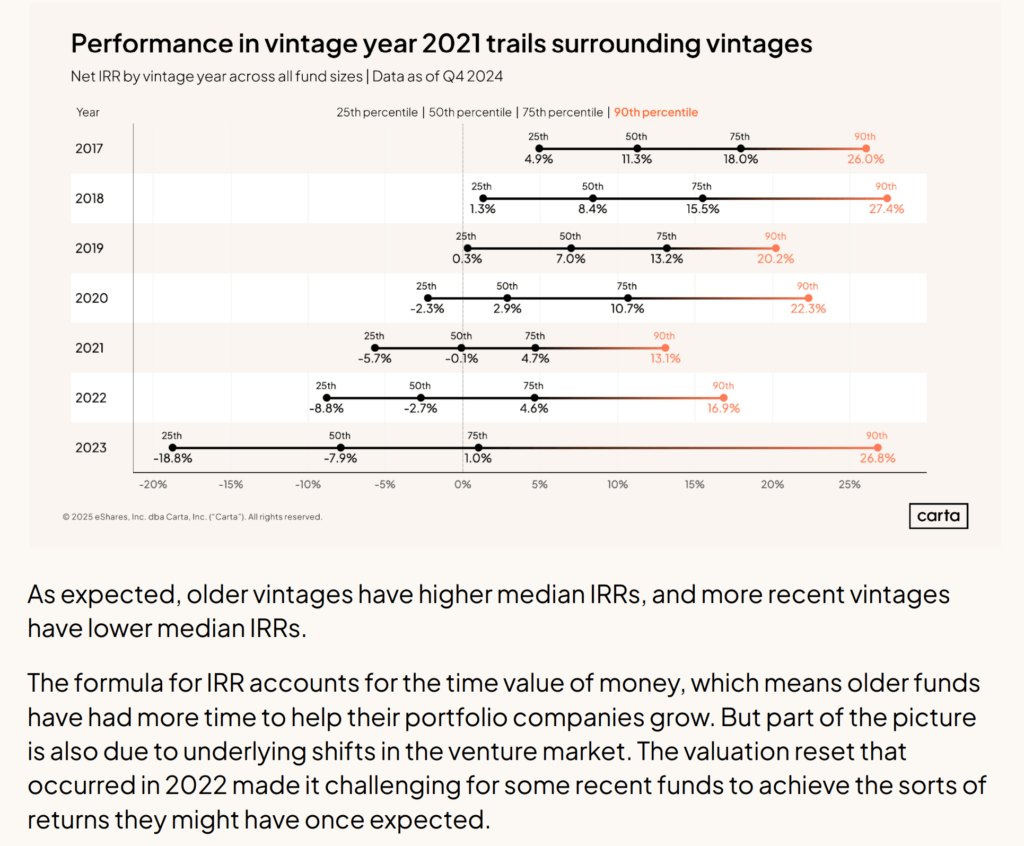

This table shows the Net IRR (after fees) based on Vintage year.

The first thing that should scream at you is how wide the returns. If you focus on the 2017 vintage, the longest vintage, the returns after 7 years range from 4.9% to 26.0%! And it is the same for the rest.

It is possible that you have invested in one year (vintage 2023) and have a 26% IRR, but more likely those vintages can be negative for the first few years.

Now you got to ask yourself how you feel if returns can be 1.3% to 27%…

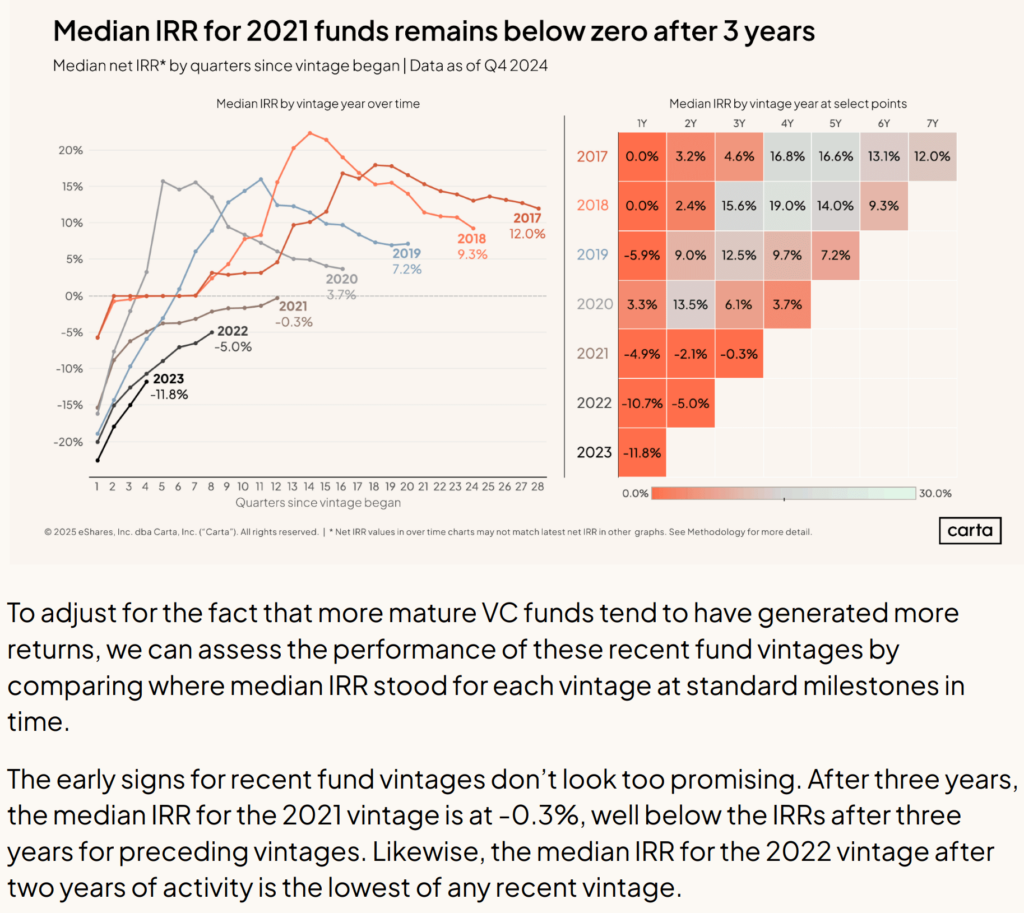

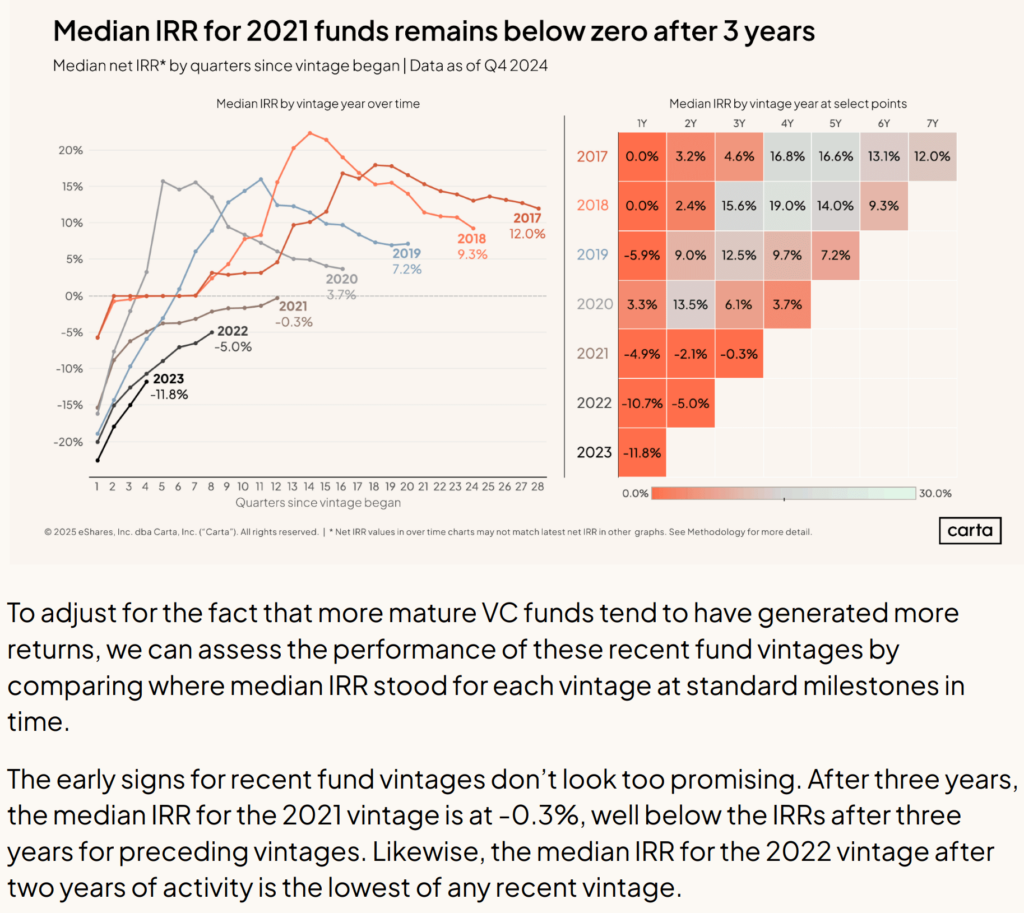

Carta then frames the return in a different way.

They look at the median IRR return of each vintage over 28 quarters (28 x 3 = 84 months or 7 years):

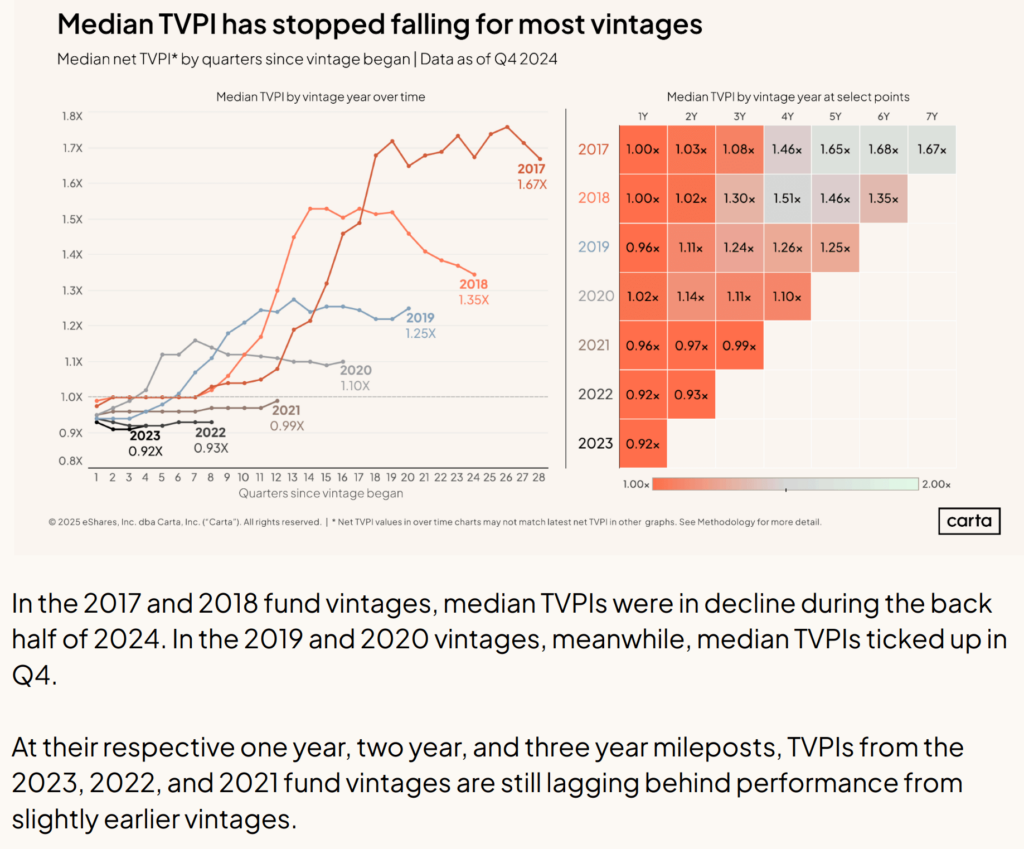

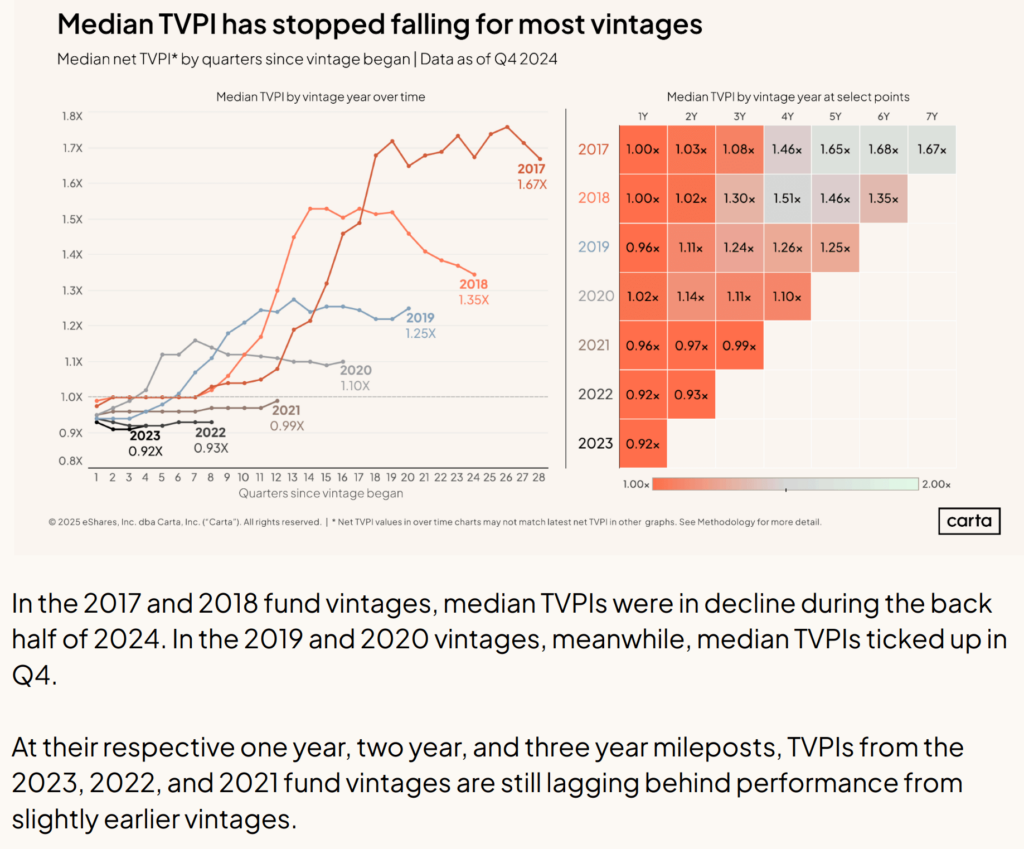

If your luck lands you on a median VC fund, you realize it takes a while for the VC funds to turn positive. Those vintages in 2021 to 2023 are still negative.

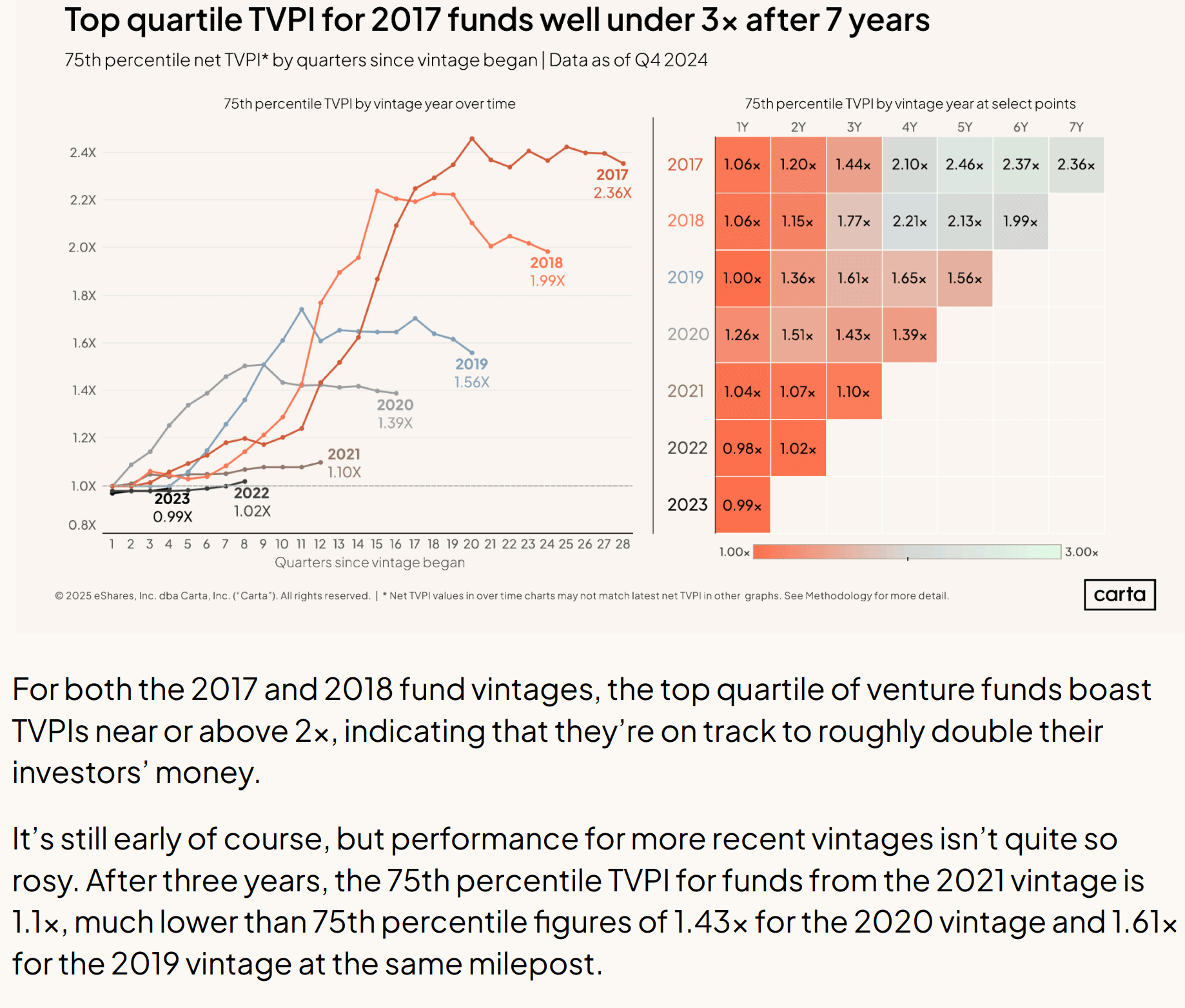

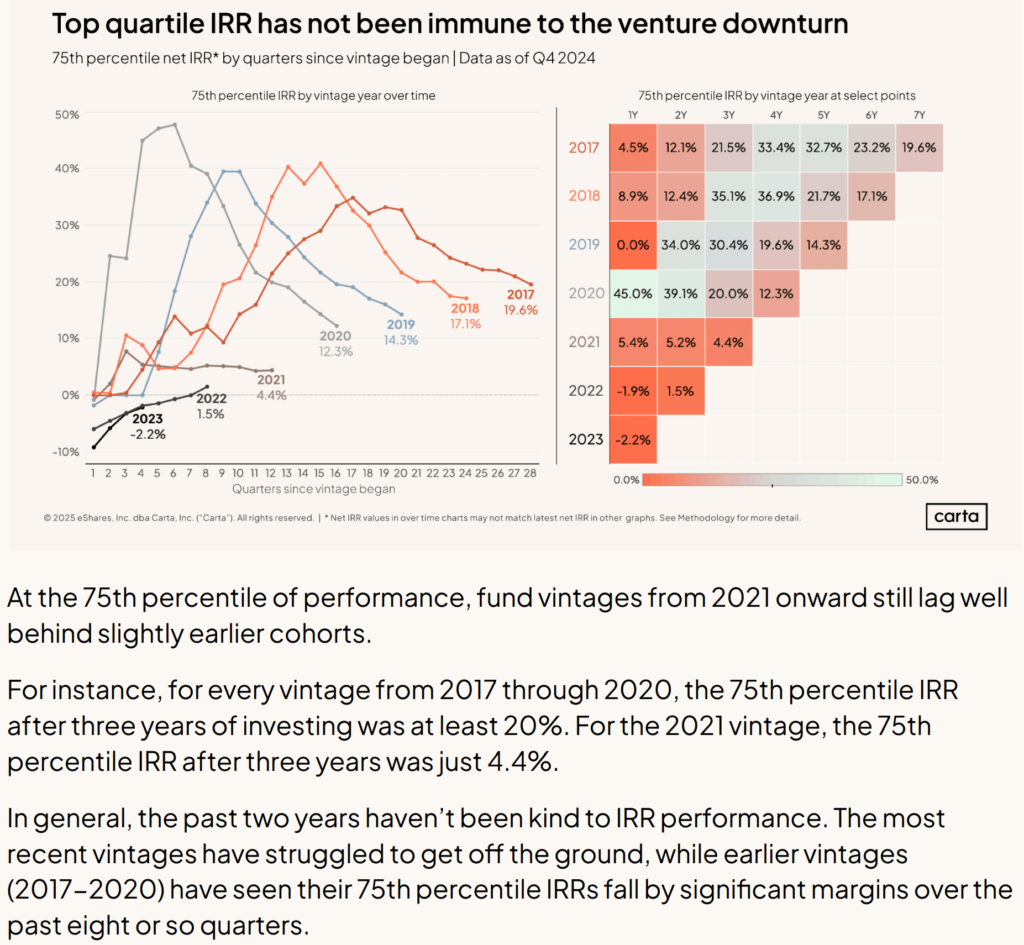

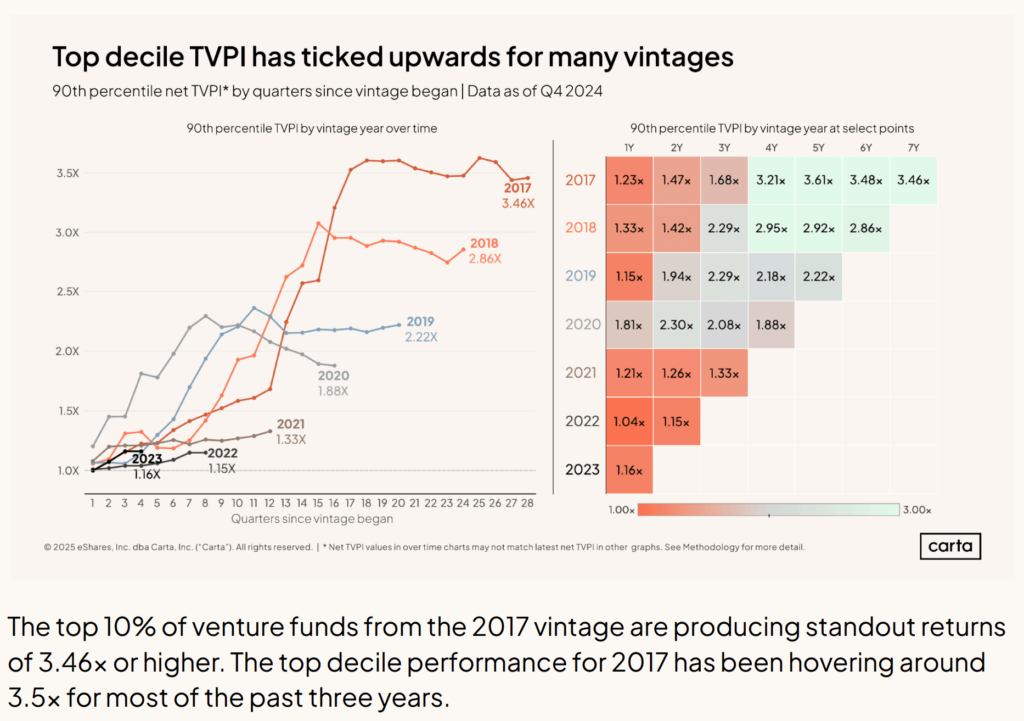

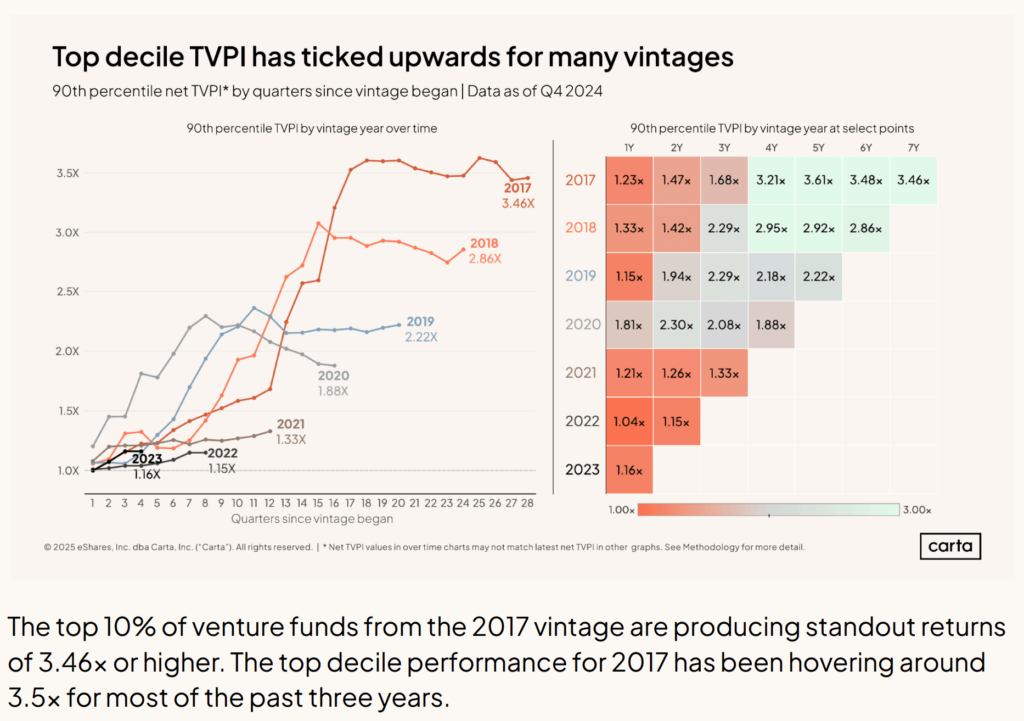

How Did the Top VC Funds Fare?

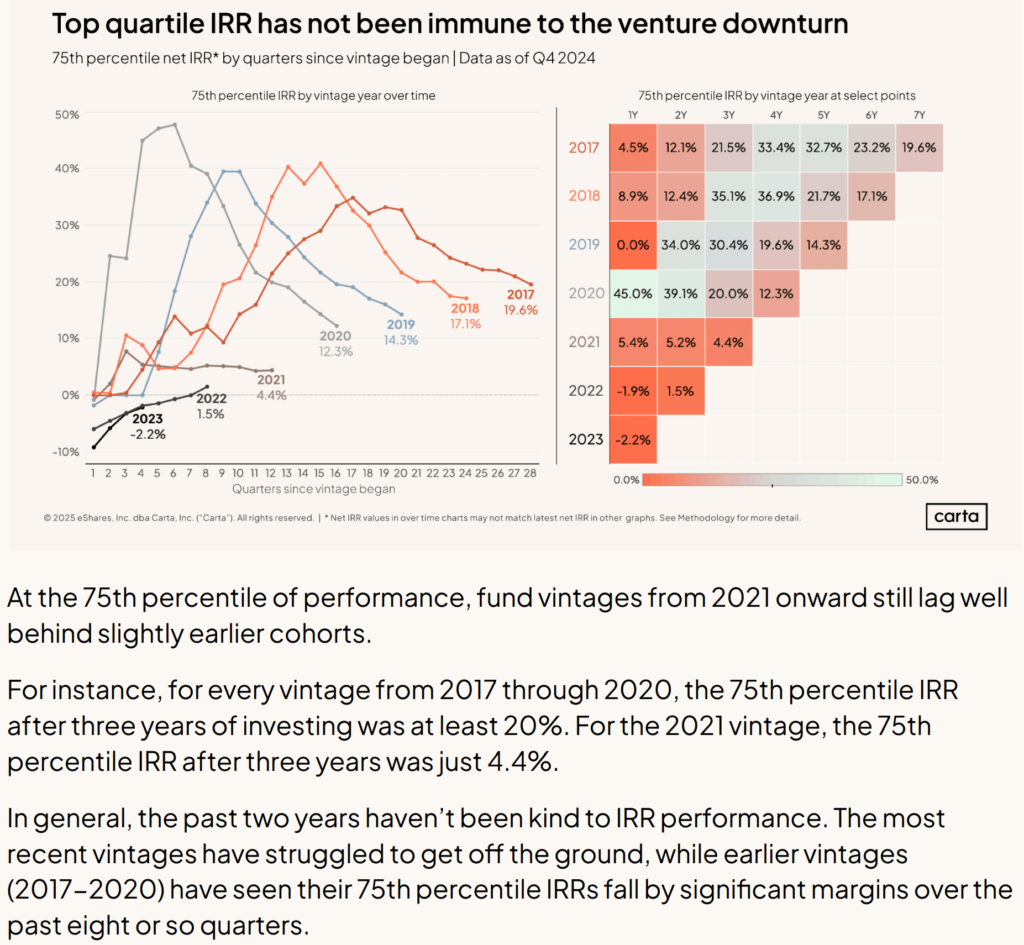

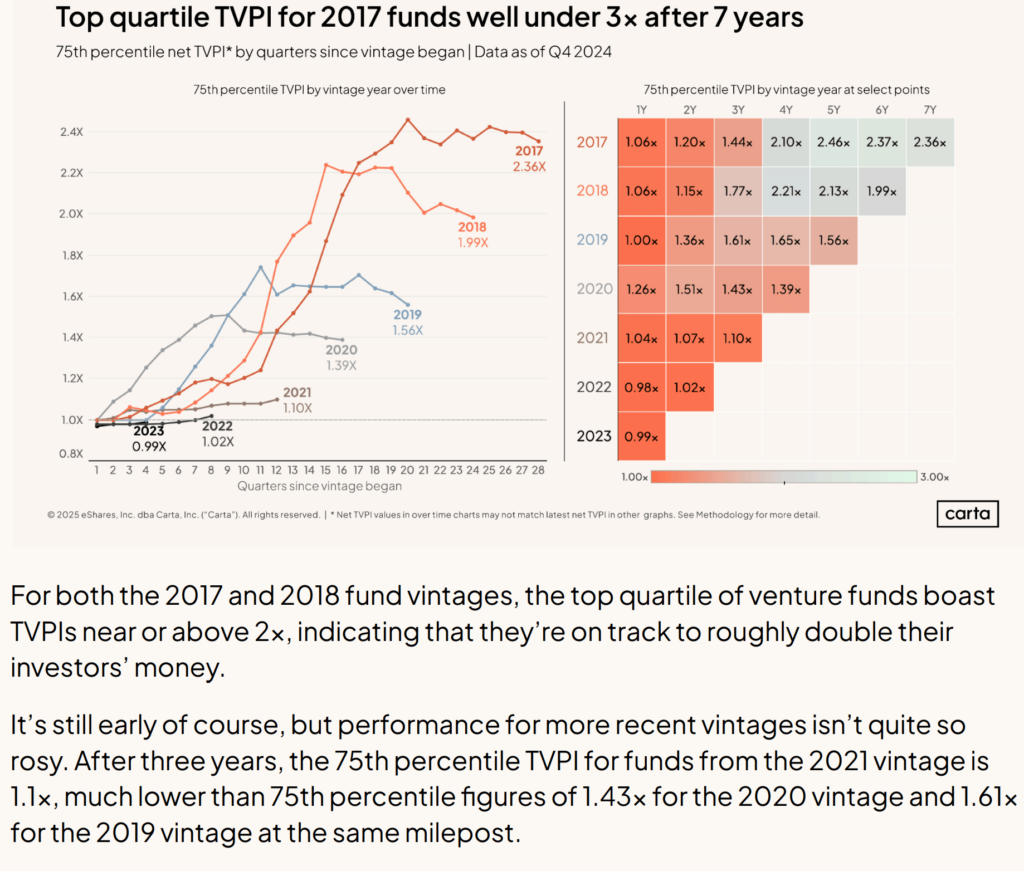

What about those in the top 75% or top quartile:

They are better. Those of vintage 2021 in the top quartile would have broken even.

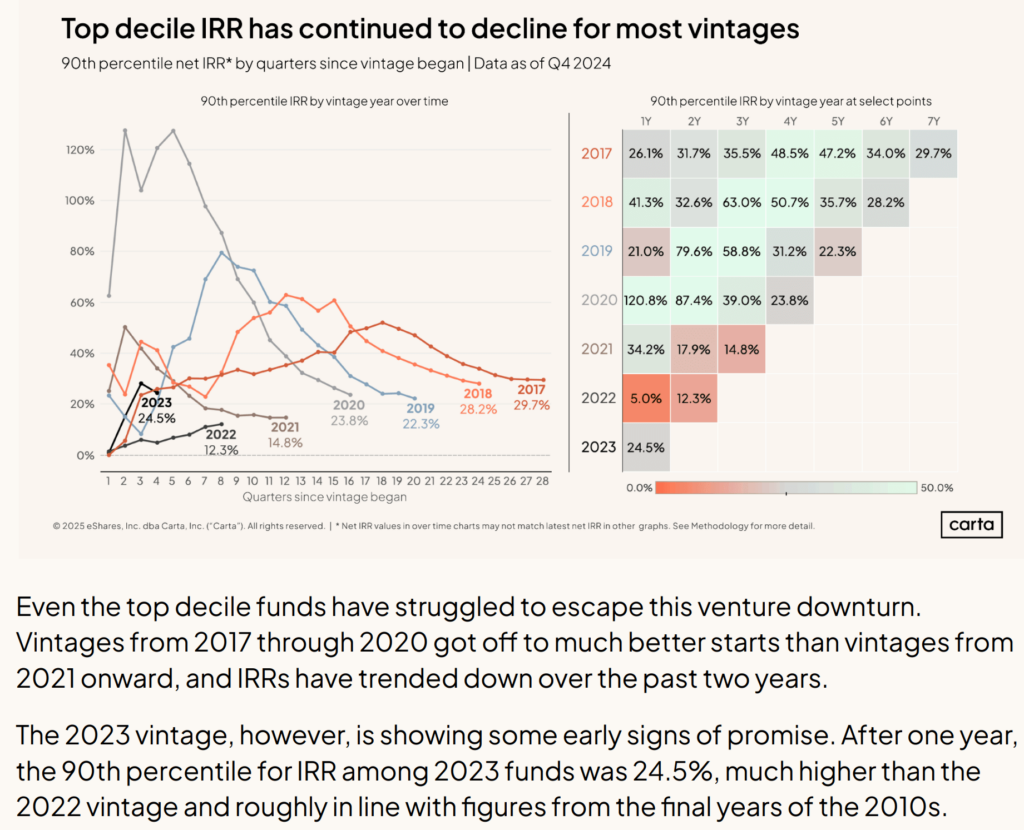

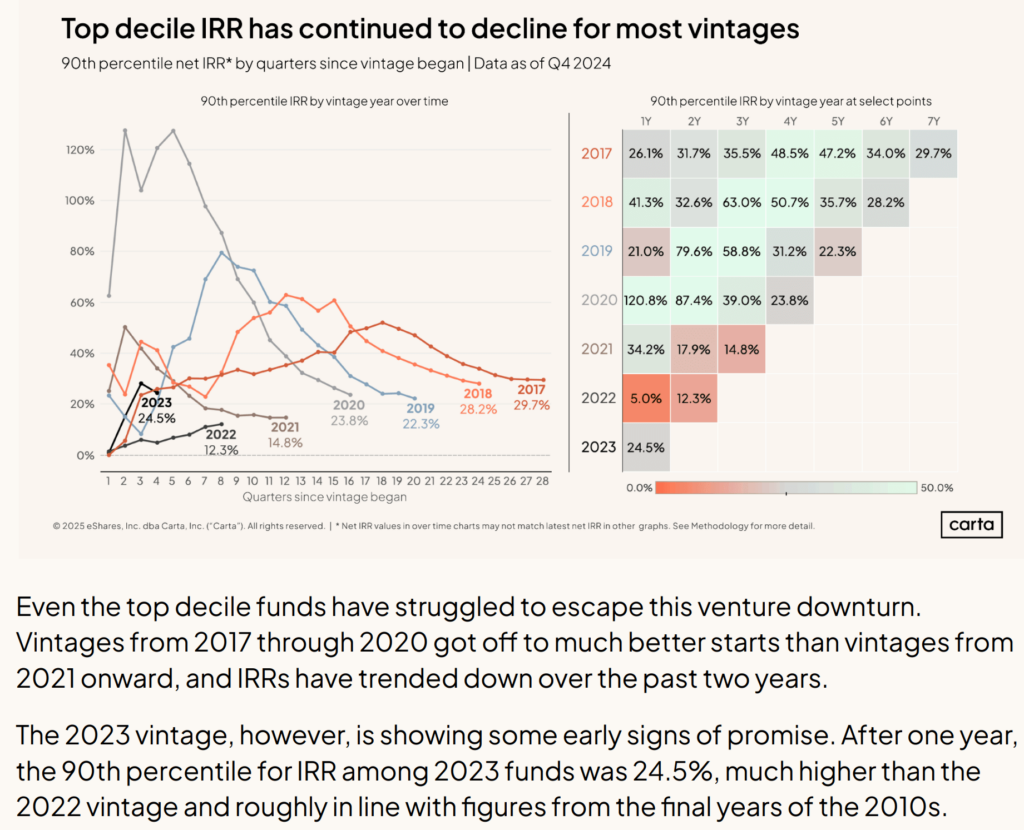

What about those top 10%:

Whoa, they will be positive from the first quarter!

I think it emphasize the point that the good returns in private investments tend to be concentrated in the top funds. If you struggle to get into it, then your return experience might not be too different from public investments.

What you will also notice about the SHAPE of those returns over time. They all go up damn high before moderating. I would not read too much into it because I suspect that may be the result of 2020-2021 period where a lot of returns of risk assets did extremely well until they didn’t do so well.

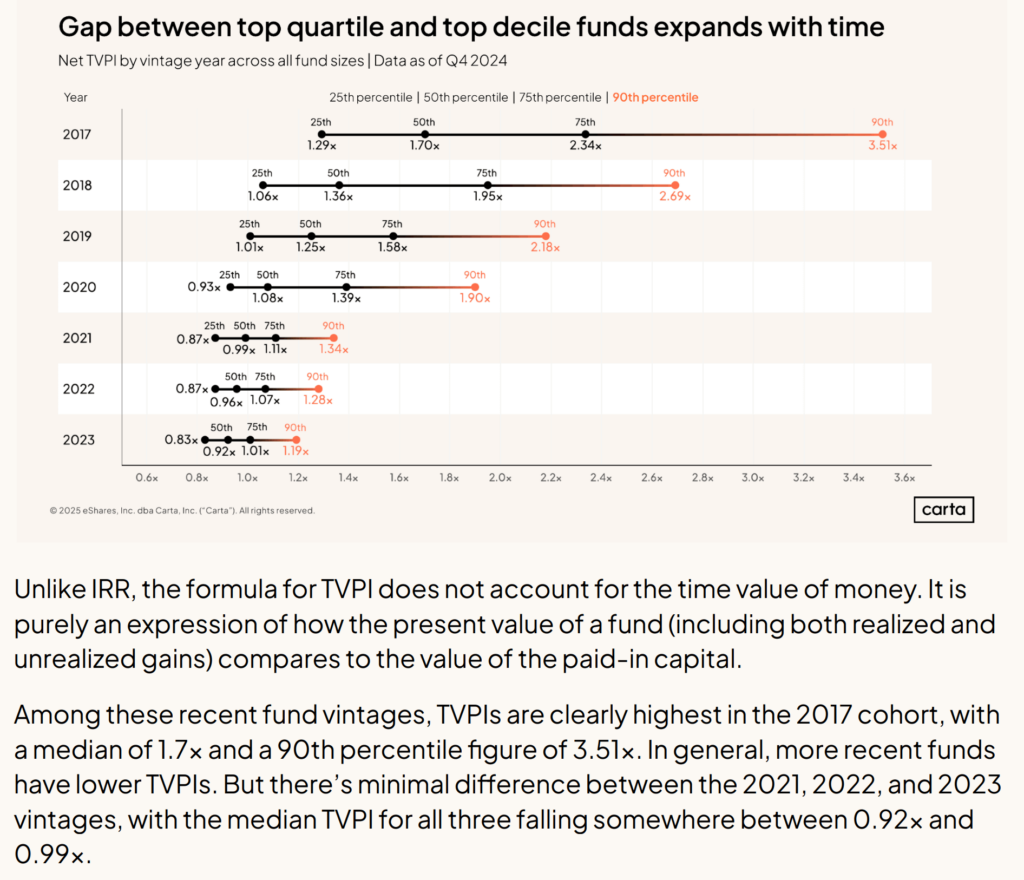

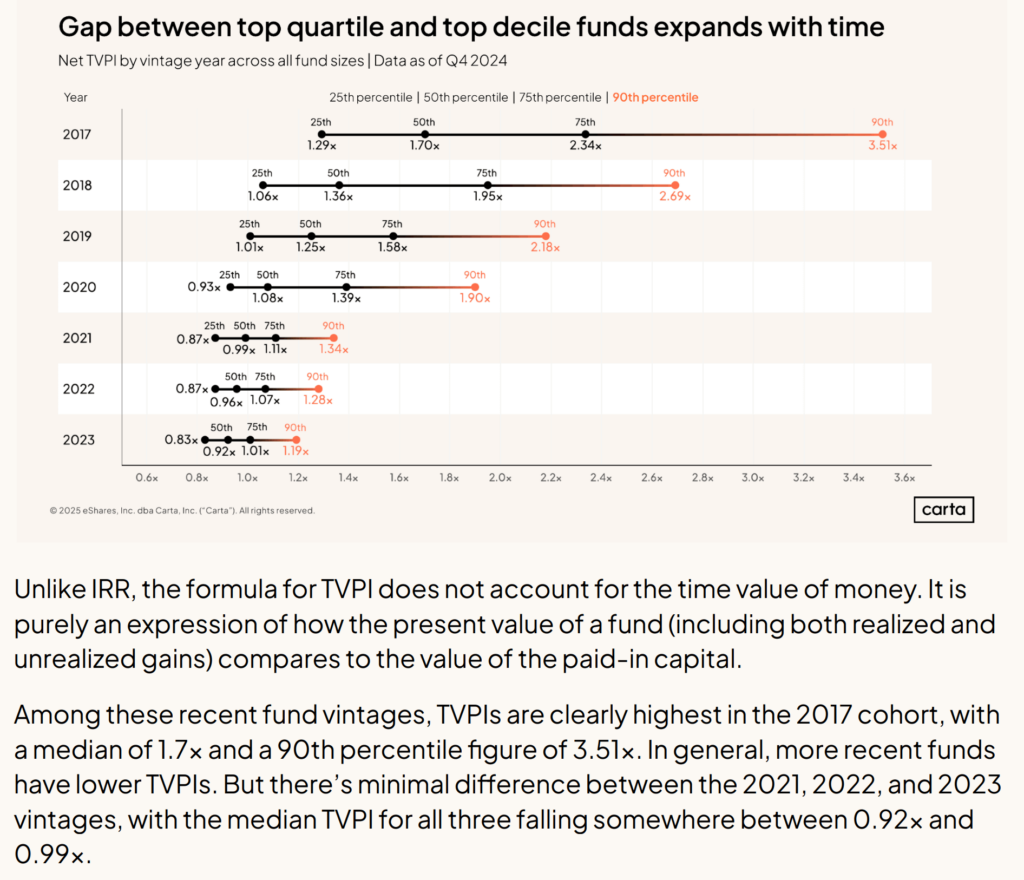

Performance by TVPI is Wide

The median fund did an 11% IRR and the median fund in this case did 1.7x in 7-8 years. But those that did very well has returns pretty far from the 75th percentile.

If TVPI is a type of simple returns that people can understand, i wonder if their investors would be happy that their funds did 1.25x. I got a feeling they might not.

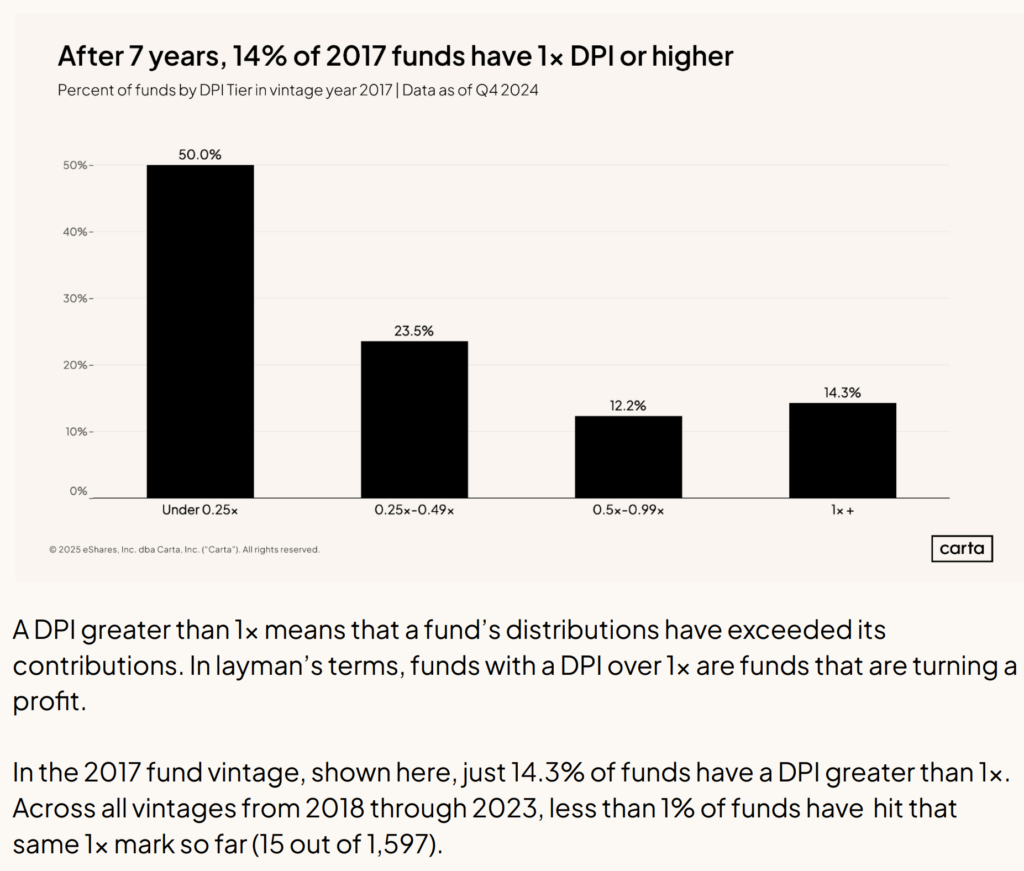

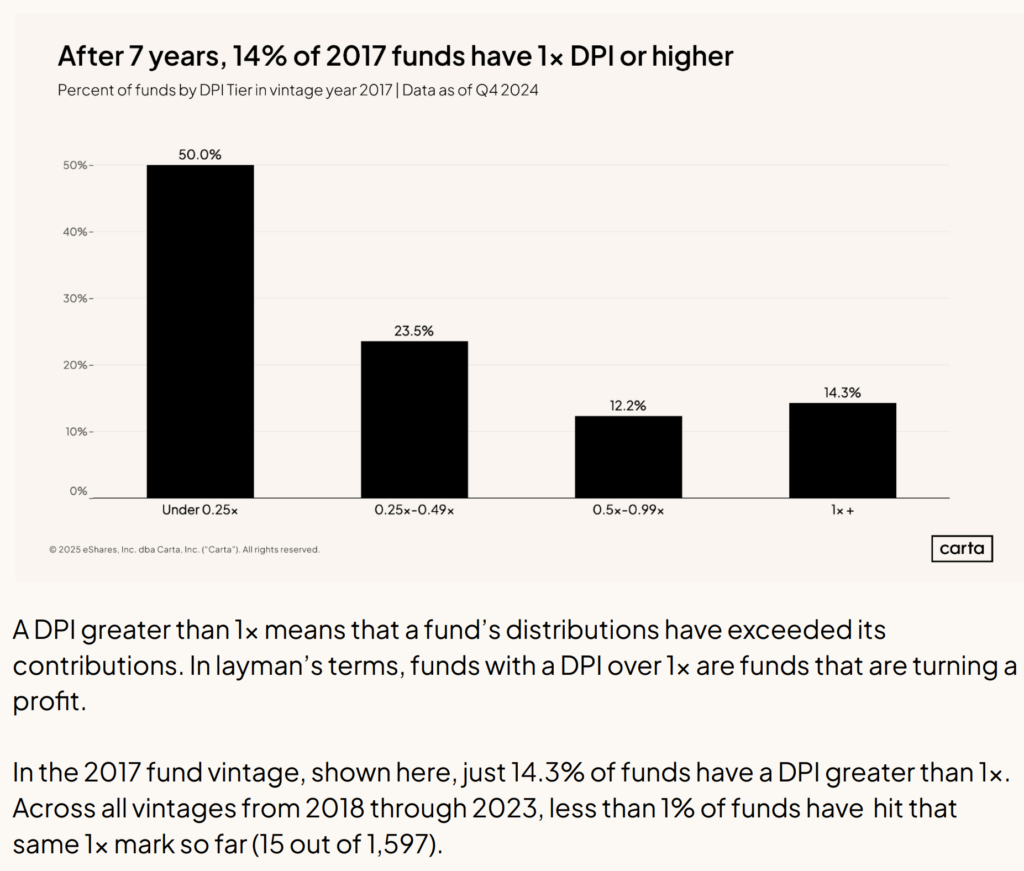

VC Funds Can be Truly Illiquid

It is no coincidence that whenever I hear a podcast of someone talking about their private investments, they will mention casually “I don’t know when I will see my money…”.

Which is true because part of the potential premium of these investment is the exchange of your liquidity.

DPI will show how much money you got back from the funds after they realize the gains from selling off the underlying. Funds that are less than 5 years have very little distribution.

Aside from the 2017 vintage, even the 90th percentile of funds have only distributed 0.46x of their committed capital.

This slide above shows the number of funds that distribute more than the capital the LPs have put in. This is a small number. If you are looking for fast returns, you might want to consider more thoroughly.

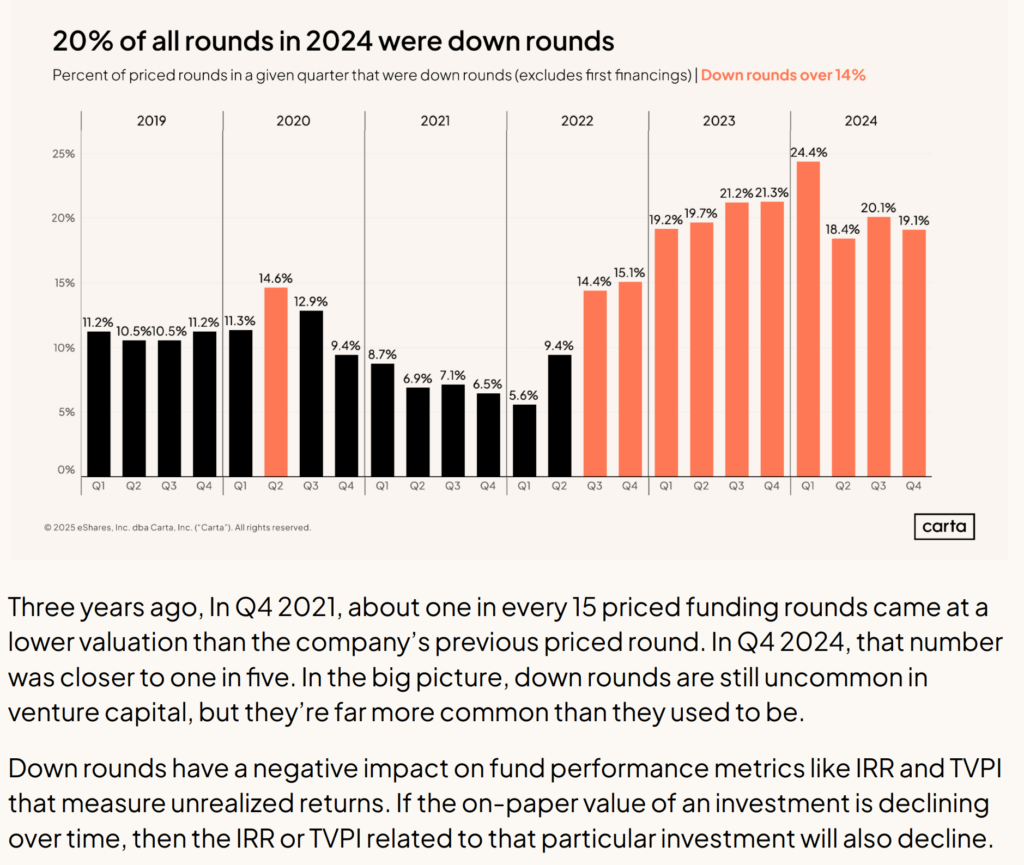

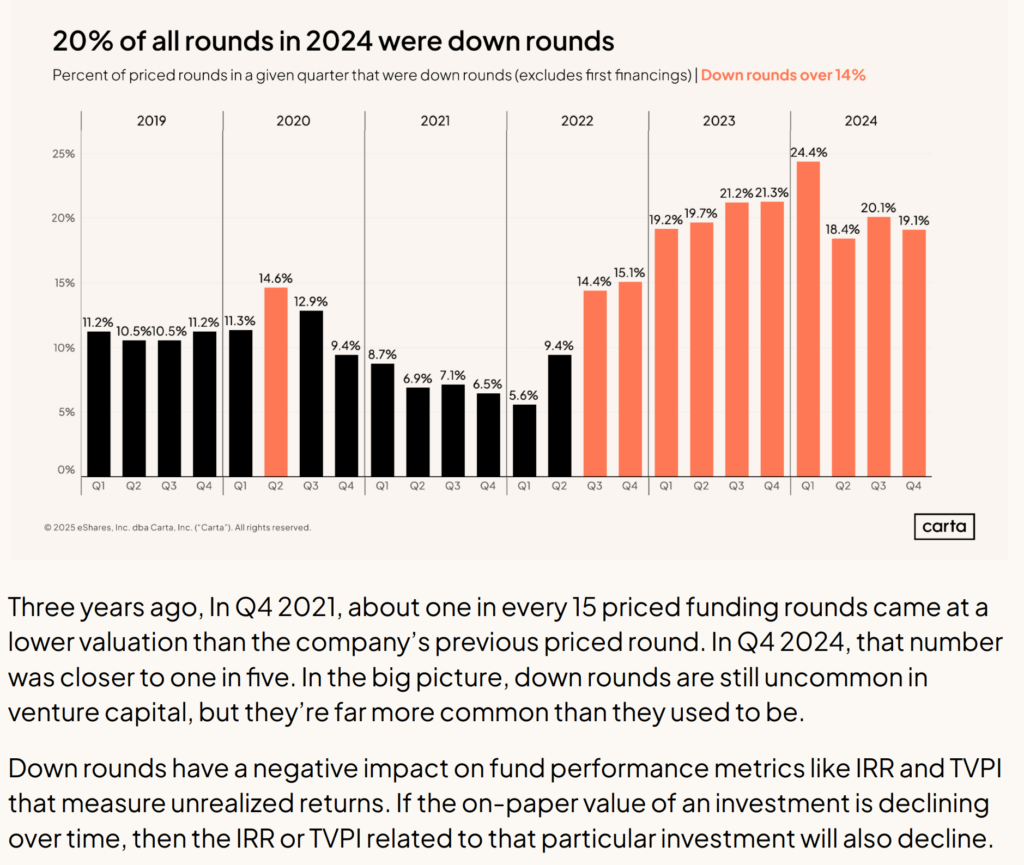

1 in 5 fund raising rounds in the past 3 years were down rounds.

Finally, every fund raising round is an opportunity to realize the value of your company.

If 20% of the fund raising are down rounds, it means that your investment returns ends up lower at this moment.

What does this mean?

I think the four concluding points that I brought over from the Dimensional Research article are still valid more or less.

While there are funds that generate great returns, you might need to be read that you may get returns that are not so good.

VC funds is not magical such that you won’t lose money.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.