I first notice Saga Partners during the frantic investment period coming out of Covid-19 (man that was so far away now…)

Sagar Partners is a Registered Investment Adviser (RIA) that manages an ultra concentrated fund that started in 2016/17. Joe Frankenfield created the fund, managed under an SMA structure. The fund charges 1.5% p.a. on the assets under management and no performance fee.

Joe philosophy is to invest long-only, in companies with durable competitive advantage, high quality management with a owner mentality and are attractively priced.

The time horizon that you should have should be pretty long. And you will soon see why.

Joe will update on performance frequently and we can find their past letters on their site. You and I can learn about a deeper, perhaps different perspectives about the companies they invested in.

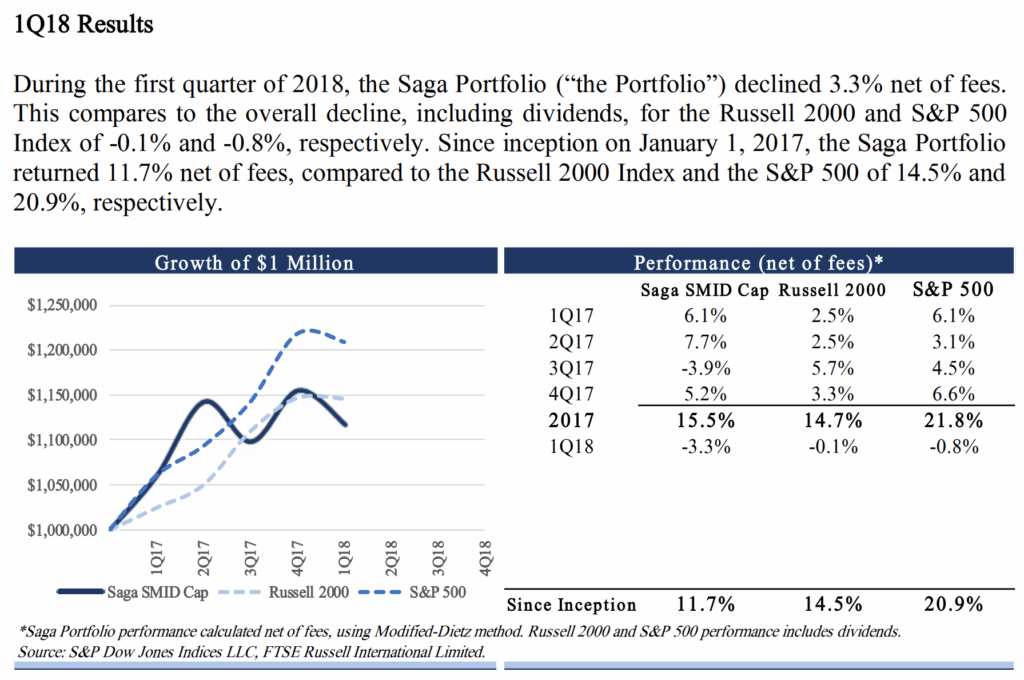

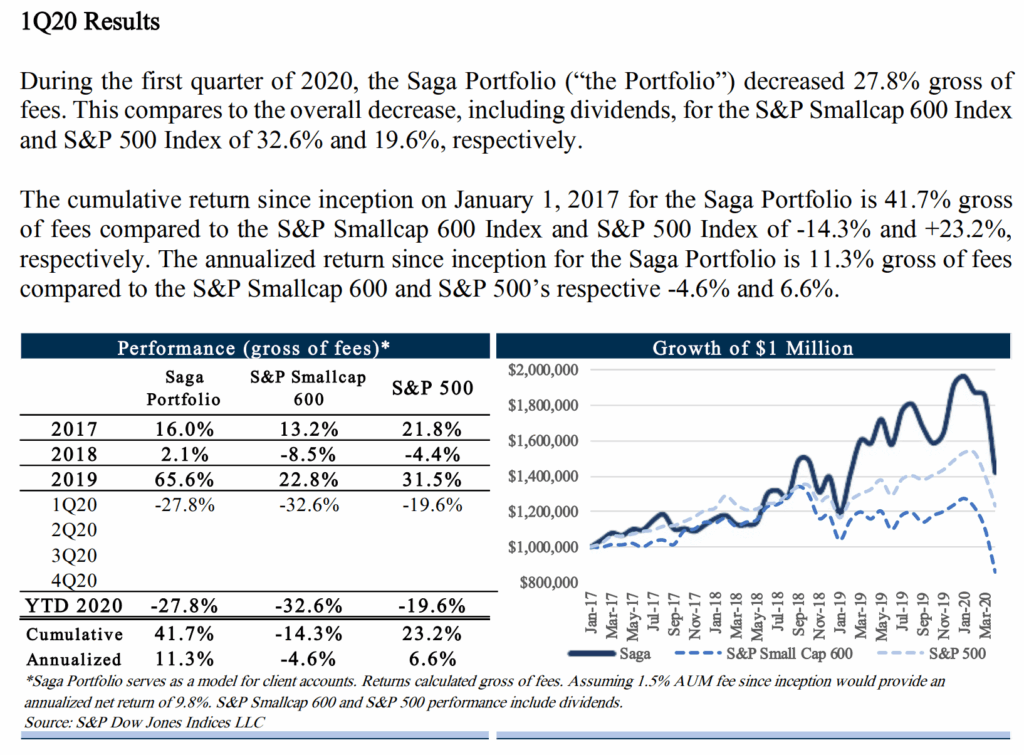

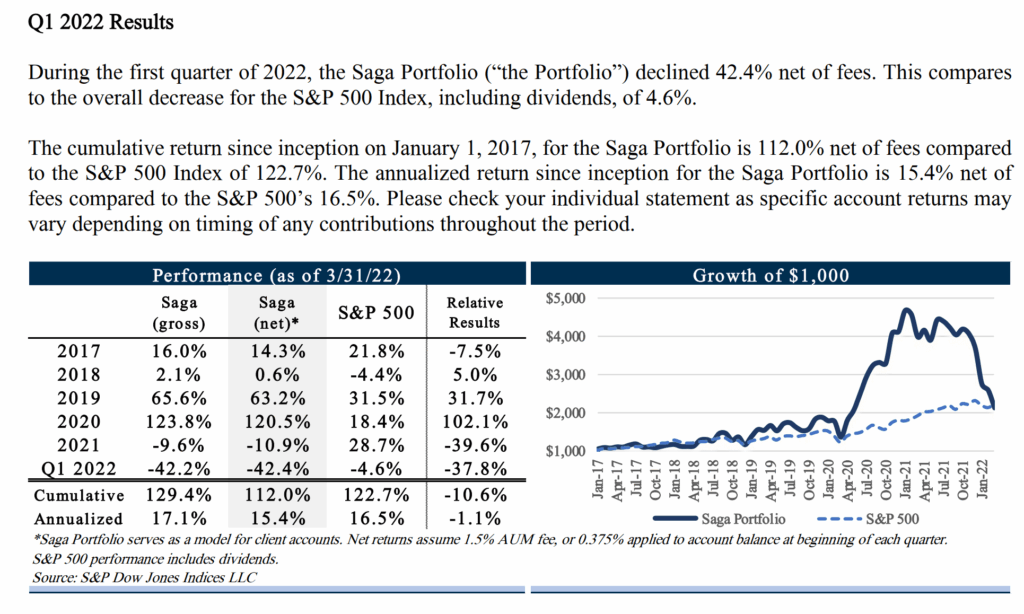

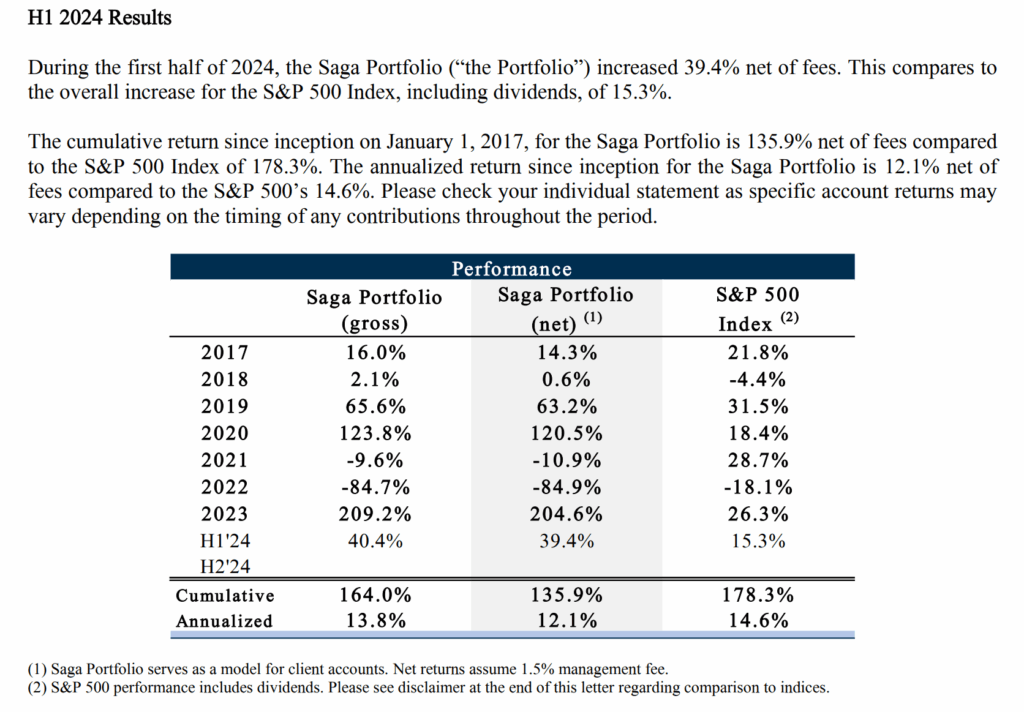

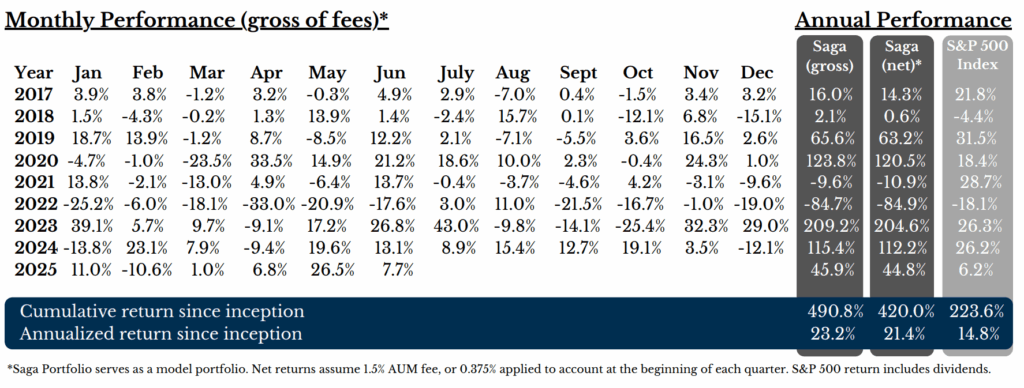

This is their result after 1 year:

The fund invest in the smaller, mid-sized companies so the right benchmark might be the Russell 2000 index, which is a blend of the 2000 smallest companies in the US. But it is also right to assess your performance if you are taking on more risk, and whether you could beat the S&P 500.

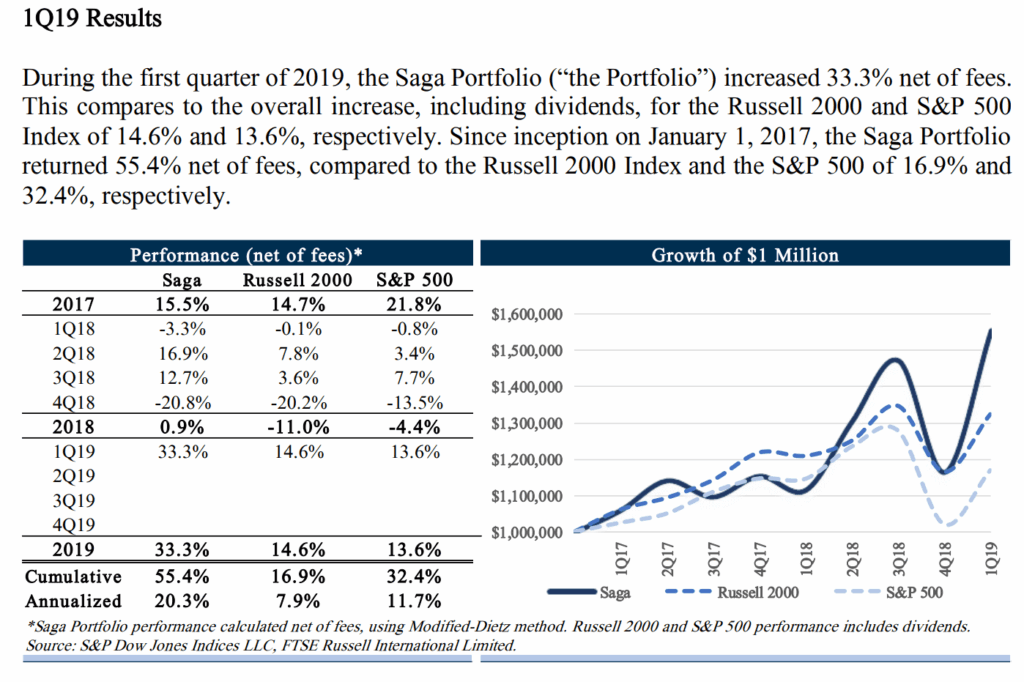

One year later, or after investing for two years, you can start seeing the fund vastly outperforming the Russell 2000 but also the S&P 500.

During this period, Saga revealed they have invested in:

- The Trade Desk (TTD) | Commentary letter

- Platform Specialty Products (PAH)

- Linamar Corporation (LIMAF)

- Under Armor (UA)

- LGI Homes (LGIH)

- Facebook (FB)

- Trupanion (TRUP) | Commentary letter

Very concentrated and in small caps. And they were in some of these names that benefited greatly from Covid long before Covid.

Their results one year later happens to be right at the depths of Covid. Since they are concentrated, small caps and long only, the gains they had evaporated. The benchmark comparison changed from Russell 2000 to S&P 600. Despite losing 28% they still did better than the S&P 600 but not better than the S&P 500 for the year.

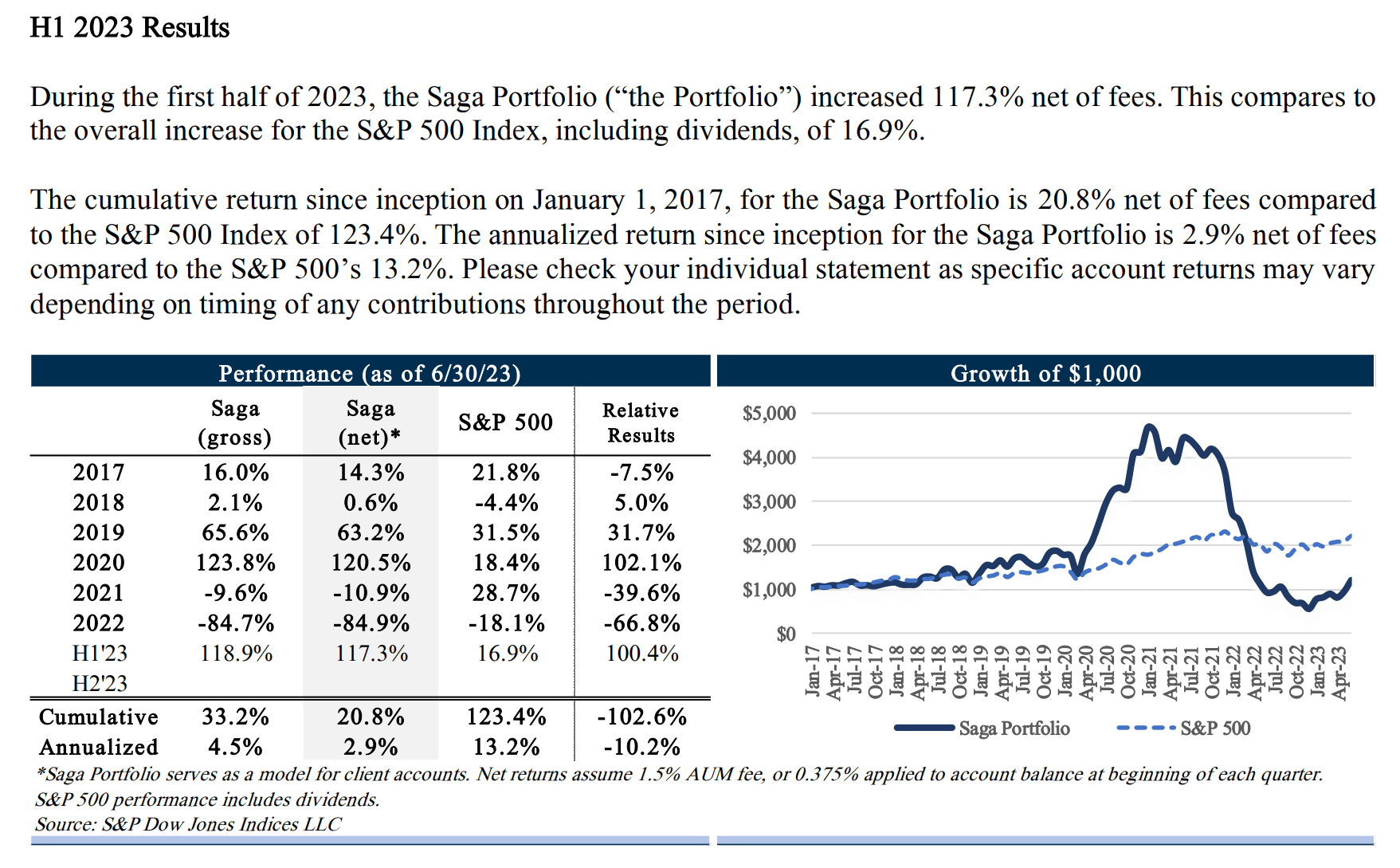

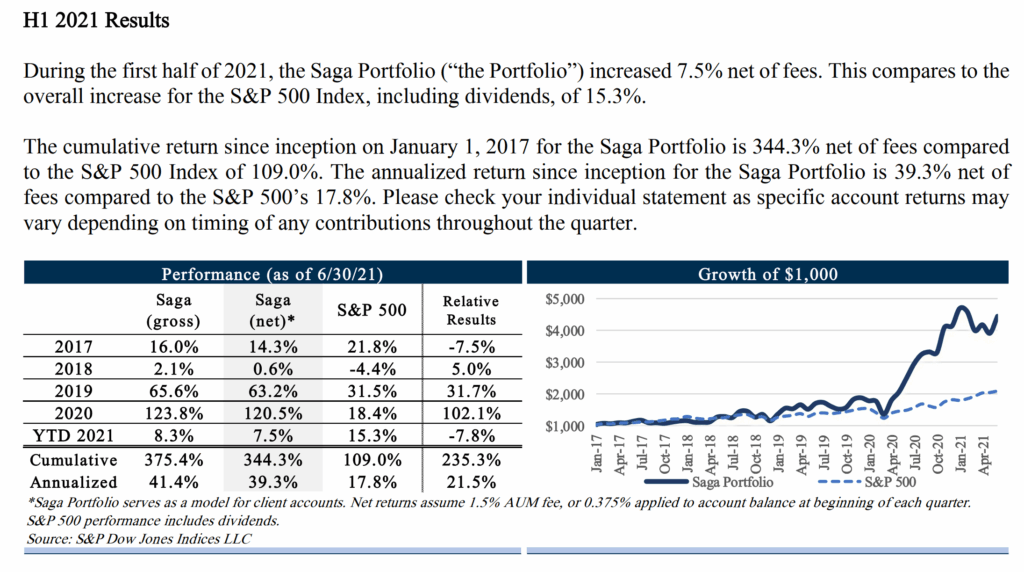

One year later, the fund achieved its best performance to date, doing 120% while the S&P 500 did 18%. The annualized return over 4 years is 41% p.a.

That came crashing down one year later because a lot of the small caps that benefited from the Covid pulled forward could not sustain the prices. The fund dropped 9% for the year, but in 1 quarter dropped 42%!

Saga’s less than 10 concentrated portfolio contains the names such as Carvana and Redfin, which were heavily sold down.

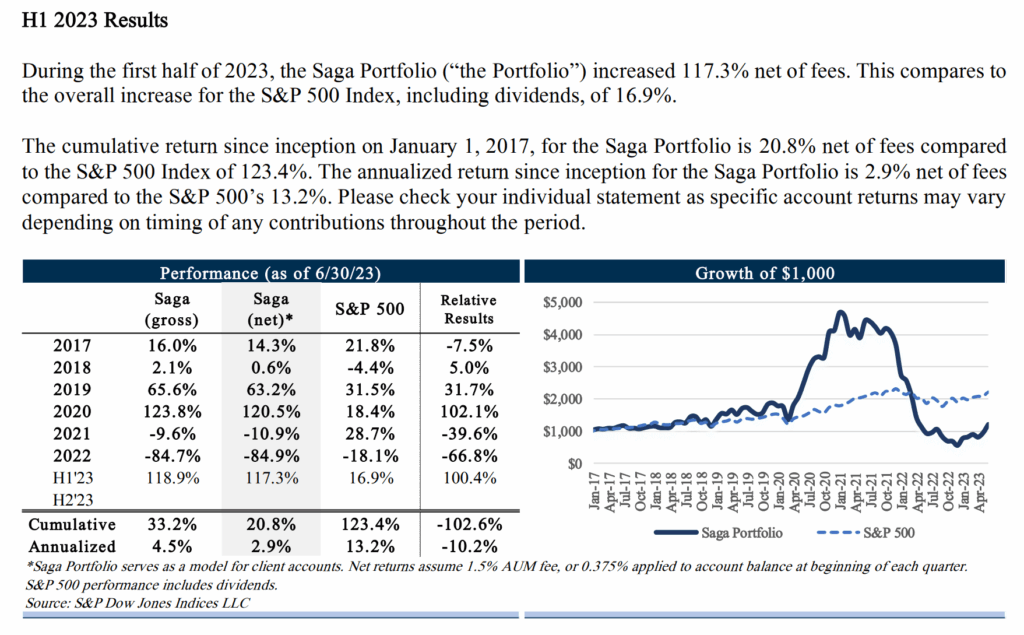

They would end that year down 84%.

Throughout this period, they didn’t make big changes to their portfolio. They still held Carvana, the company that people thought its destined not to survive because they think the thesis is still there. They sold GoodRX, which they admitted was a mistake. By now, they have under perform the S&P 500 (2.9% p.a. vs 13.2% p.a.).

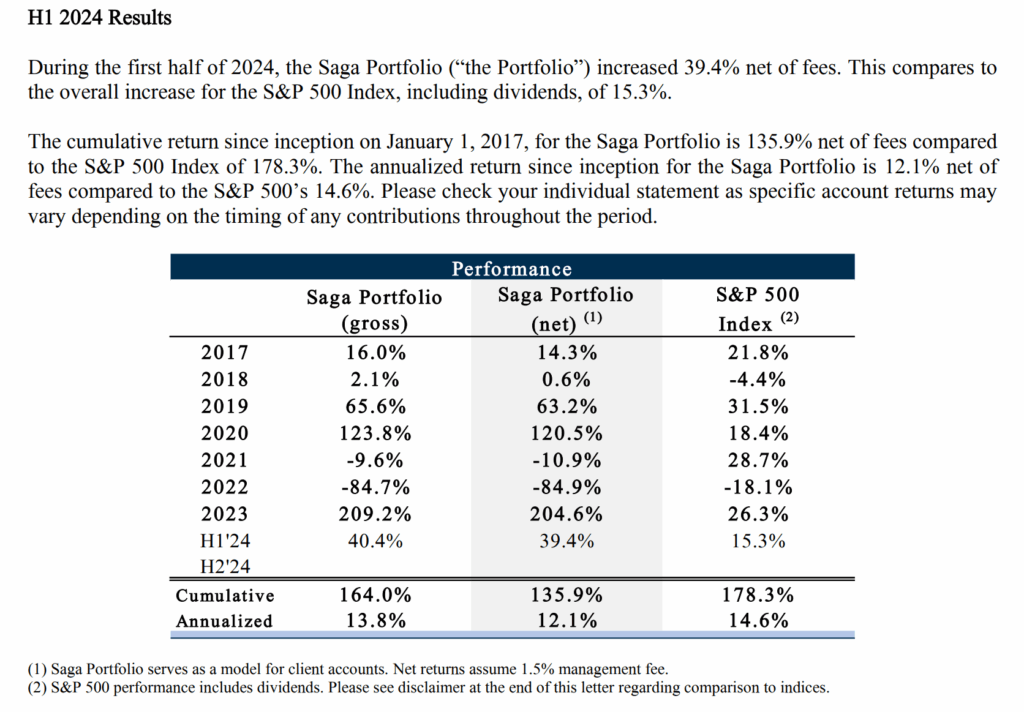

They did 200% in 2023 and probably another 40% in the first half of 2024. While they are still underperforming the S&P 500, they managed to make up ground.

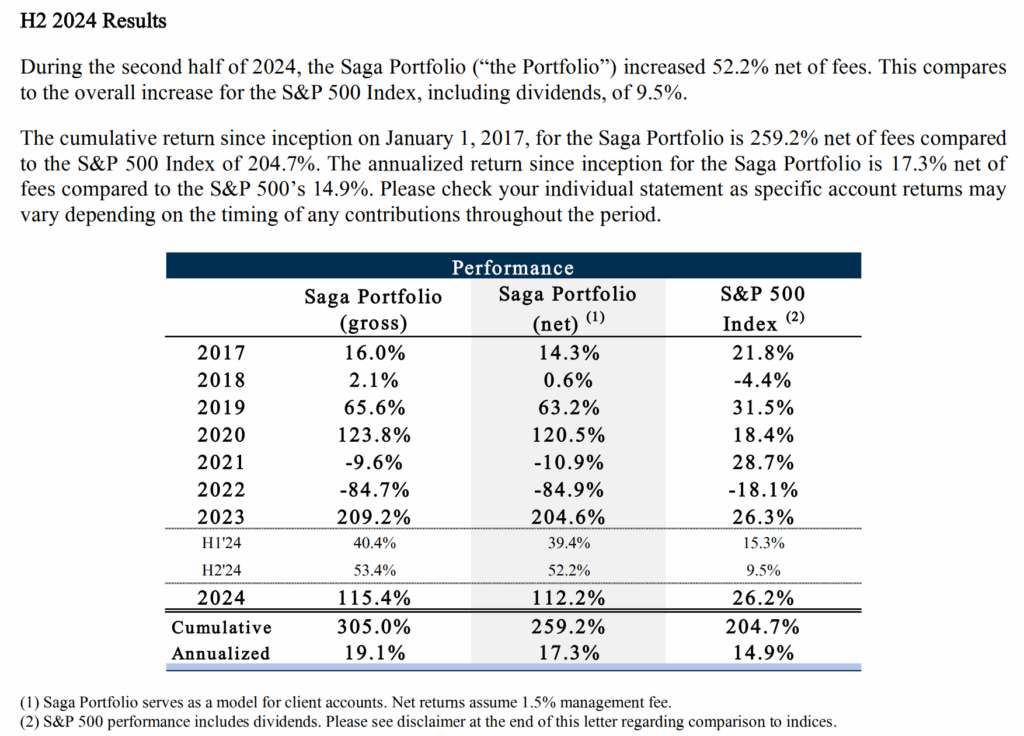

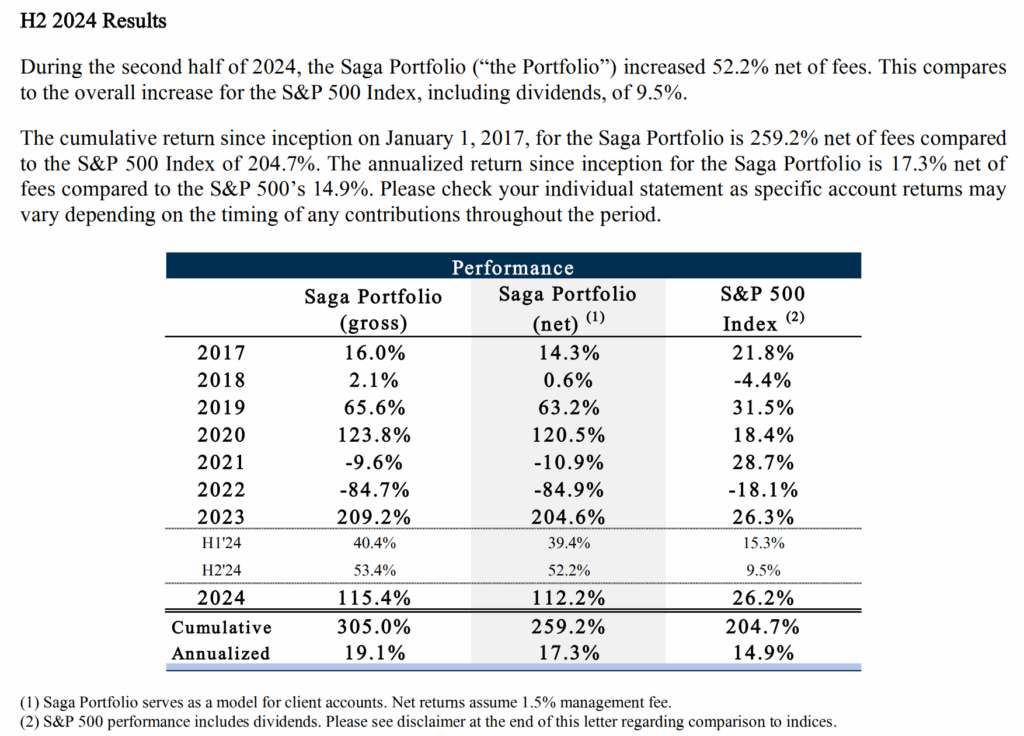

This is the latest update in the end second half 2024:

They did 115% in 2024. Over the past eight years, they managed to compound the early client’s wealth, those who still stuck with them at 17% p.a. after fees.

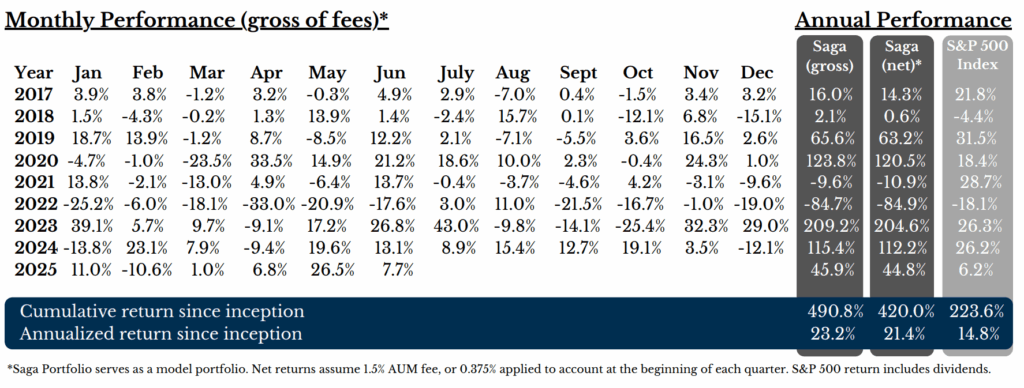

You can see the month by month performance, taken from their factsheets over here. This allows you to see the volatility of the fund.

This is their current portfolio. Just six companies. Except for Wise many held long.

Reflections

I experienced a different feeling looking at the performance of the fund after I subscribe to get the updates of the fund since 2020. I could have unsubscribed because I don’t do individual stock investing so much anymore but I find a lot of value hearing Joe’s thoughts about investing and also his company perspective.

I have a very… unvested but unique emotion when I read the poor performance of 2021 and 2022.

I wonder how the new investors are feeling when they see their capital go down like 90%.

I wonder how the early investors in the fund, who enjoyed great returns felt when they see

- all their unrealized gains wiped out,

- and then getting into losses

i am pretty sure the manager will be fielding calls why you would stick with companies like Carvana, GoodRX, Redfin and Roku.

It is also interesting if you review the fund today.

Our advisers reviewed the existing portfolios of their clients and prospects and they would see many funds. One question we got the advisers and associates to ask is: Did the fund beat their benchmark index?

Well we sit here and look at it today and it DID beat any of the benchmark.

You ask anyone if a fund did 21% p.a. or 420% in 8.5 years, net of fees, and they would say this is great performance.

But are there things you won’t be able to tell just by reviewing JUST historical performance?

Many would take a chance with these managers, throwing caution to the wind, dismissing if they can sit with such a fund.

Because if this fund works out, they can reach their financial goal.

Different groups of Saga Partners investors would experience different emotions.

If you want such performance:

- You cannot just closet index and try to beat the index every year. You got to be willing to underperform the index.

- You would need to have an investment philosophy to guide you about what kind of companies you would invest and how you would manage them.

- You have to concentrate.

- You need to be able to find ways to dig into yourself and see if you can dig out enough conviction about the few stocks you invest in, while managing rationality that potentially you might be wrong.

I deliberately laid out the returns year by year, so that you can soak them in but I think reading the past updates might sell what I want to sell you.

The emotional part of investing is very underrated.

Imagine if you sunk in 70% of your net wealth as a 55-year-old, trusting this manager because you know him well enough, and then you see this string of monthly return:

- -4.6%

- 4.2%

- -3.1%

- -9.6%

- -25.2%

- -6%

- -18.1%

- -33.0%

- -20.9%

- -17.6%

- 3.0%

Can you stay in the game? (The fund has no lock-up)

If you are thinking about investing today, would you have the mindset that this was “special circumstances” and won’t happen to you?

I think sometimes the reason investors get themselves into certain situations is not because of the fund manager or the external people but what kind of conversations you have with yourself.

It may also be interesting to wonder if you are more diversified, would such poor sequence of performance don’t hit you? That must be what many have in mind right now.

If you diversify adequately, your investments won’t show this kind of negative surprises that you won’t be expecting.

You can think for yourself how true that will be.

Let me know if you would sink 70-80% of your net wealth as a 55-year old into this fund.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.