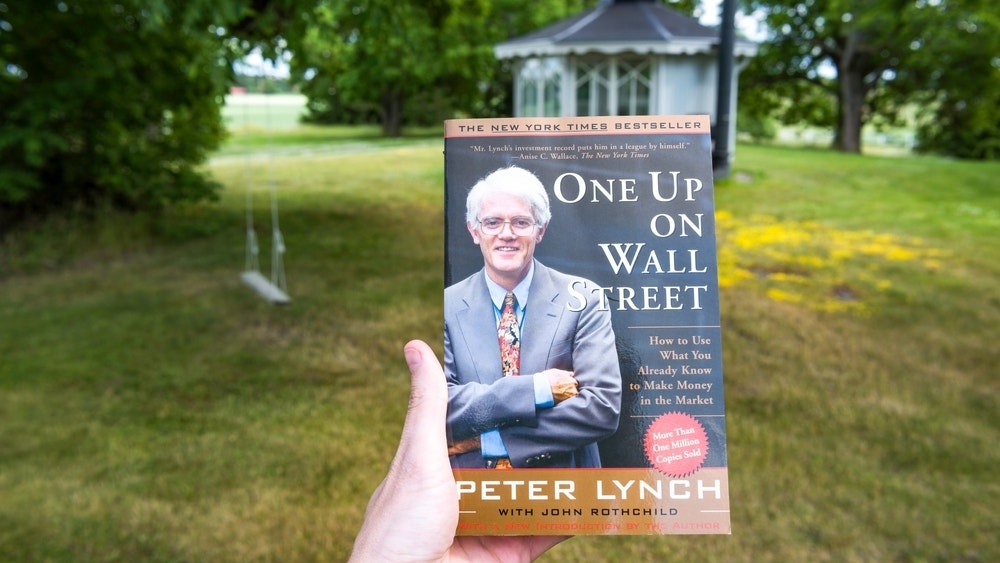

Famed investor Peter Lynch once underscored the significance of understanding the business behind a stock before investing in it, while also questioning the efficacy of economic forecasting.

What Happened: Lynch, who is recognized for his successful stint at Fidelity Investments, disclosed his investment insights during a 1997 speech.

He emphasized the importance of understanding the business behind the stock, advising, “If you can't explain to an 11-year-old in two minutes or less, why you own the stock, you shouldn't own it. Understanding the business behind the stock is the most important principle of investing in the stock market. This is why Buffett only invests into what he understands and what falls in his circle of competence. I buy stuff like Dunkin Donuts, Stop and Shop and made money on them,” Lynch said during the speech.”

This philosophy is in line with Warren Buffett‘s investment strategy, which advocates for investing in areas of personal expertise.

Lynch dismissed the concept of economic forecasting, identifying himself as a “bottom-up” investor who concentrates on individual stocks through comprehensive company and industry analysis.

He also underscored the significance of patience in investing, suggesting that substantial returns could be realized even a decade after a company’s initial public offering. He cited Walmart as an example, stressing that investing is a marathon, not a sprint.

“A decade after Walmart when public in 1970, it only had 15% penetration across the U.S. Thus, one could assume they had plenty of runway ahead to expand across the country, but success wasn’t guaranteed, so some investors might have though they already missed the bus,” Lynch said while talking about the Walmart.

Why It Matters: Lynch’s principles provide a valuable roadmap for both novice and seasoned investors. His emphasis on understanding the business, focusing on individual stocks, and practicing patience aligns with the strategies of successful investors like Buffett.

His insights serve as a reminder to investors that successful investing hinges on making informed decisions and playing the long game.

Read Next