Today, I have something for the investors of Amundi’s low-cost unit trusts.

For the readers who are less aware, Amundi has a set of 6 index-tracking unit trust that allows you to craft a holistic portfolio:

- Amundi Index Global Aggregate Fund (both USD and SGD), which are accumulating funds, that tracks the Bloomberg Global Aggregate Bond index.

- Amundi Index MSCI World Fund (both USD and SGD), which are accumulating funds, that tracks the MSCI World index.

- Amundi Index MSCI Emerging Markets (both USD and SGD), which are accumulating funds, that tracks the MSCI Emerging Markets index.

They are all very low cost and you can now access them via Poems with no wrap fee and no platform fess currently. They are available via SRS and CPF.

These are also the funds, aside from the Dimensional, that forms Providend’s portfolios that was recommended to clients.

Now…Amundi actually lists these unit trust on the Luxembourg exchange as ETF. This means for each of these 8 fund ISINs, there are correspondingly 8 ETFs.

What is useful with the ETF is that they have the same performance profile as the unit trust. You can check to see their NAV of the ETF is similar to the unit trust that you can find in Endowus or Poems.

This means that if you use the ISIN of the 8 funds, you can find the ETFs listed on Luxembourg on Trading View:

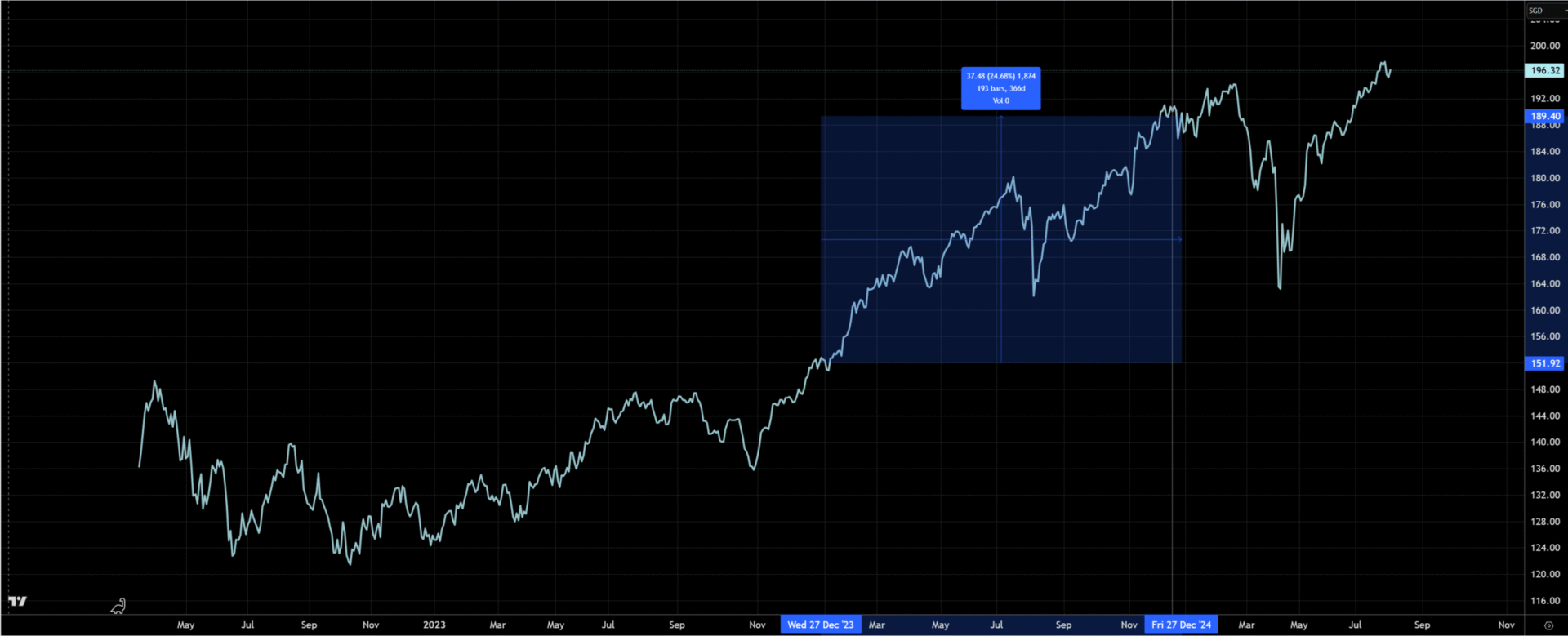

In this example, I line up the Amundi MSCI World Index Fund in SGD (light blue) against the USD (green).

The USD one is performing better because of the weaker USD.

Before I continue, Trading View is a part community part platform with lots of data of securities around the world. I have a paid subscription but the free one is very, very awesome already. It allows you to see the price data in charts for securities in many, many exchanges.

As you can see here, even Luxembourg exchange data also have!

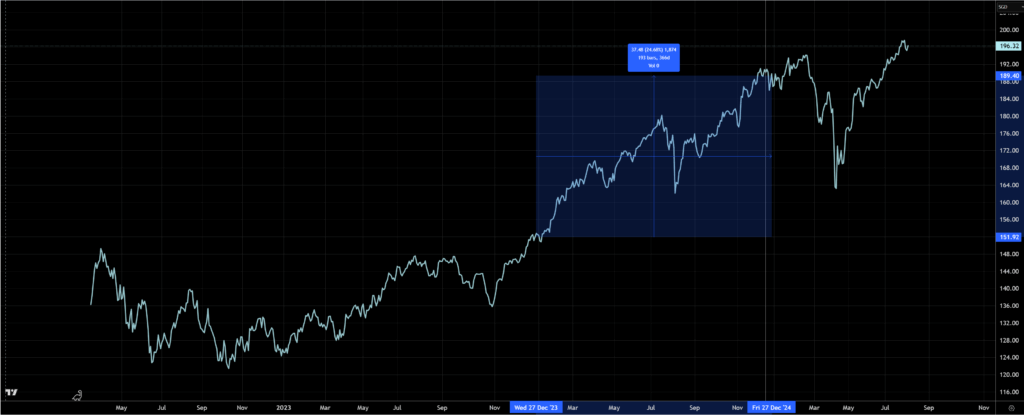

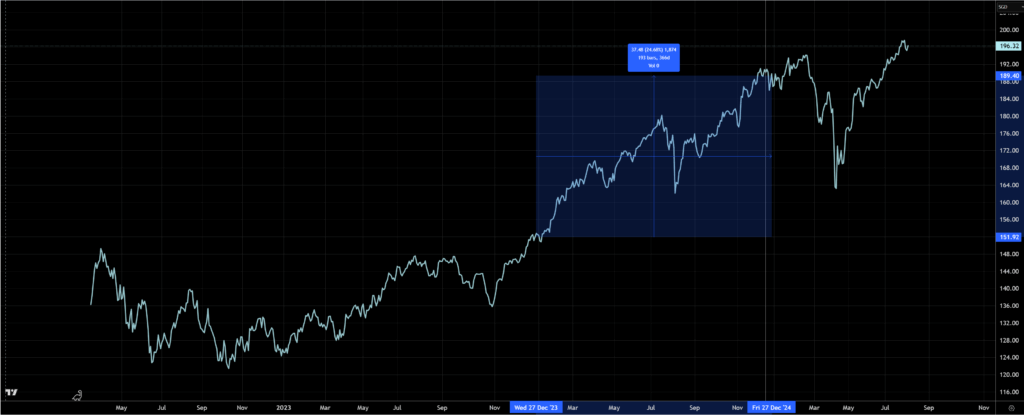

This allows you to measure the returns:

Since all 8 funds are accumulating funds, which factors in dividends, you can really compare the performance. In the screen shot above I am measuring roughly the 2024 returns of the SGD fund.

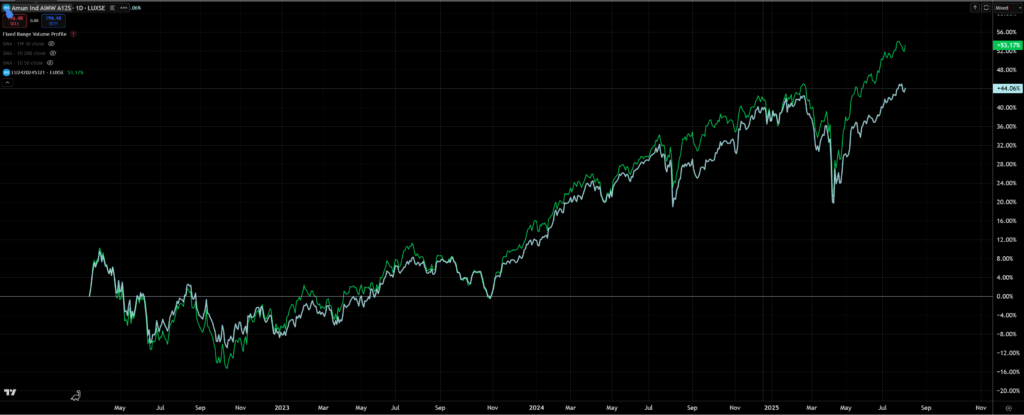

You can also compare them to other funds or securities:

Here are the Name of the Funds, follow by the ISIN code, which is the ticker you use to find the fund in Trading View, and the Trading View link.

Do note that if you view the charts in candlesticks, it looks pretty feathery. You might need to change to view them in lines instead of candlesticks.

USD Accumulating Funds:

- Index Global Aggregate Fund USD | LU2420245834 | Trading View Chart

- Index MSCI World Fund USD | LU2420245321 | Trading View Chart

- Index MSCI Emerging Markets USD | LU2420245750 | Trading View Chart

- Index Global Aggregate Bond 1-5Y ESG USD | LU3022519758 | Trading View Chart

SGD Accumulating Funds:

- Index Global Aggregate Fund SGD | LU2420246212 | Trading View Chart

- Index MSCI World Fund SGD | LU2420245917 | Trading View Chart

- Index MSCI Emerging Markets SGD | LU2420246139 | Trading View Chart

- Index Global Aggregate Bond 1-5Y ESG SGD | LU3022519832 | Trading View Chart

I think this is helpful for those who would like to benchmark funds to these Amundi funds.

I phrase it that way because these funds already mimics indexes so most likely, you will be comparing other funds to these funds to see if they measure up.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.