After a powerful breakout last week that pushed Bitcoin into a new all-time high of $118,667, the world’s leading cryptocurrency appears to be taking a breather. As of the time of writing, Bitcoin is trading around $117,953, slightly below its recent peak. The move followed a string of consecutive daily gains as bullish momentum swept across the crypto industry.

In a technical analysis shared on the TradingView platform, crypto analyst RLinda pointed out two scenarios that may play out over the coming days and weeks, depending on how Bitcoin reacts to nearby resistance and support levels.

Related Reading

Support Zones Could Affect Bitcoin’s Next Big Move

RLinda’s technical analysis begins with identifying the significance of Bitcoin’s recent all-time high. Although Bitcoin has entered what seems to be a consolidation phase, there’s no confirmed top just yet. The market structure still favors bullish continuation, especially considering Bitcoin is just coming out of a prolonged two-month consolidation zone and entering a realization phase.

According to the 1-hour candlestick price chart, Bitcoin is currently trading just above a support area below $117,500. If Bitcoin fails to hold this zone, the leading cryptocurrency could kick off a cascade of corrections that could drive the price to $115,500, then potentially to $114,300, and even back to the previous all-time high of $111,800.

Below that, the 0.5 and 0.705 Fibonacci levels around $113,031 and $111,960 respectively may act as temporary cushions. The last major defensive buy zone is around $110,400, where bulls may step in for a bounce. Basically, what this means is that if Bitcoin loses the support level at $115,500, it could slip back to $110,000 before encountering another strong buy support zone.

Image From TradingView: RLinda

Bitcoin To $125K, But It Must Breach Resistance First

On the other hand, Bitcoin can still push above $118,000 and increase to $125,000, but only under certain conditions. The condition of the rally’s continuation depends primarily on Bitcoin registering a decisive daily close above $118,400 and $118,900. In her words, a daily close above these price levels would hint at a “breakout of structure.” This, in turn, would confirm a transition from consolidation into another impulsive phase upward.

In essence, both the bearish and bullish outlooks depend on how Bitcoin reacts at any of the important zones, either support at $116,700 or resistance above $118,400 before making a directional move. However, it is important to note that the consolidation after last week’s rally could last for weeks or even months, much like we’ve seen in previous rallies this cycle.

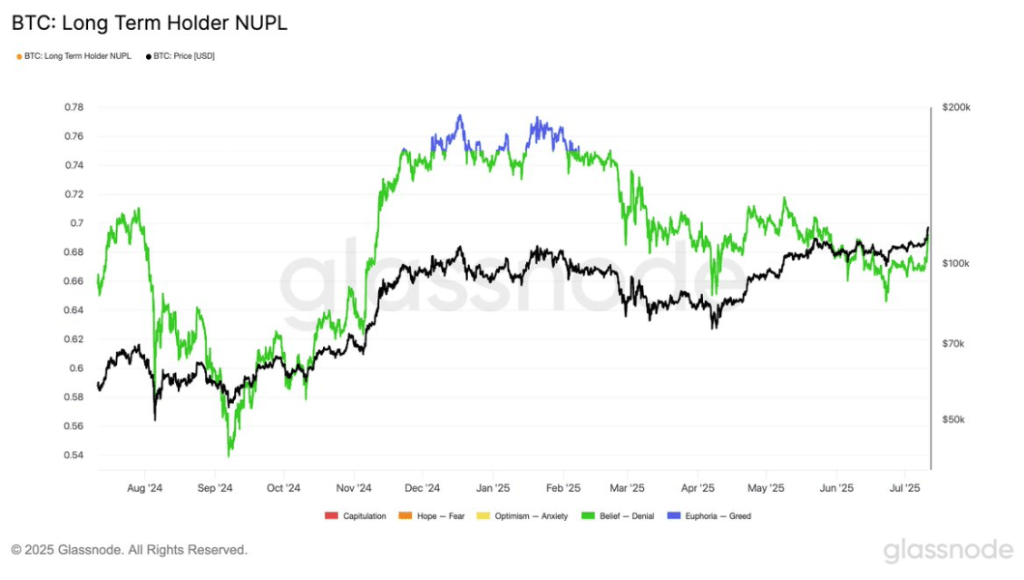

According to the Long-Term Holder Net Unrealized Profit and Loss (NUPL) metric from Glassnode, Bitcoin’s current level of long-term profitability sentiment is at 0.69. This is notably below the 0.75 mark associated with euphoric market conditions, despite Bitcoin having just printed a new all-time high.

Related Reading

Bitcoin spent around 228 days above the 0.75 euphoria threshold in the previous bull market cycle. In contrast, this current cycle has only seen about 30 days above that level, which suggests long-term holders have not yet fully exited into profit and the leading cryptocurrency hasn’t reached overheated conditions.

Featured image from Unsplash, chart from TradingView