How do whales influence Bitcoin?

If anyone comes close to “moving the market,” it’s the whales. These are the investors holding thousands of BTC, often institutions, funds or OG holders from the early days. And in 2025, they’re more active than ever.

The number of wallets holding over 1,000 Bitcoin (BTC) has climbed to 1,455 as of May 2025, marking a renewed wave of accumulation. Some of this growth is driven by institutional players: Strategy alone now holds over 580,000 BTC (around 2.76% of total supply), while BlackRock has added Bitcoin allocations to its iShares Bitcoin Trust ETF and related portfolios.

Together, the two firms control an estimated 6% of the total Bitcoin supply, a staggering figure in an ecosystem with fixed issuance and increasingly thin exchange liquidity.

Whales aren’t necessarily hodlers either. They buy at scale, take profits on strength, and often offload right when retail piles in. Since the start of 2025, several major corrections have followed large inflows to exchanges from whale wallets — a pattern onchain analysts flagged as early as February.

On the flip side, stretches of dormancy in whale wallets have coincided with upward price momentum, including Bitcoin’s climb past $110,000 in April.

That said, not all whales are short-term traders. Data from CryptoQuant shows that long-standing whale addresses have realized just $679 million in profits since April, while newer large holders — likely hedge funds or high-net-worth individuals — have taken over $3.2 billion off the table in the same period.

This suggests a bifurcation: Early whales appear to be consolidating for the long haul, while new entrants are quicker to cash out.

Whale behavior may be nuanced, but the impact remains blunt. Whether they’re accumulating or distributing, these entities continue to play an outsized role in setting the tone and direction of Bitcoin’s price action (BTC).

Did you know? The top 2% of Bitcoin addresses control over 90% of its supply, but most of them are cold wallets and exchanges. This means the actual number of individuals with whale-like influence is far lower than raw address data suggests.

Can developers influence the Bitcoin price?

Developer-led upgrades don’t happen often in Bitcoin, and when they do, they tend to make waves. New functionality, better scalability or more privacy? That gets attention — and attention affects price.

SegWit — August 2017

SegWit changed how data is stored in blocks, which meant more transactions could fit and fees could go down. It also paved the way for things like the Lightning Network.

What happened next? A surge. Bitcoin jumped from around $4,000 in August to nearly $20,000 by December 2017.

That wasn’t just because of SegWit (2017 was a bull market). But SegWit helped lay the groundwork.

Taproot — November 2021

Taproot made Bitcoin smarter and more private. Complex transactions could now look like simple ones on-chain, helping with privacy and efficiency. It also opened the door for more advanced scripting.

Taproot activated just days after Bitcoin hit its all-time high of $64,000. The price move wasn’t all about Taproot; there was ETF buzz, macro factors and more. But it definitely added to the sense that Bitcoin was maturing.

The upgrade was years in the making, with contributions from over 150 developers.

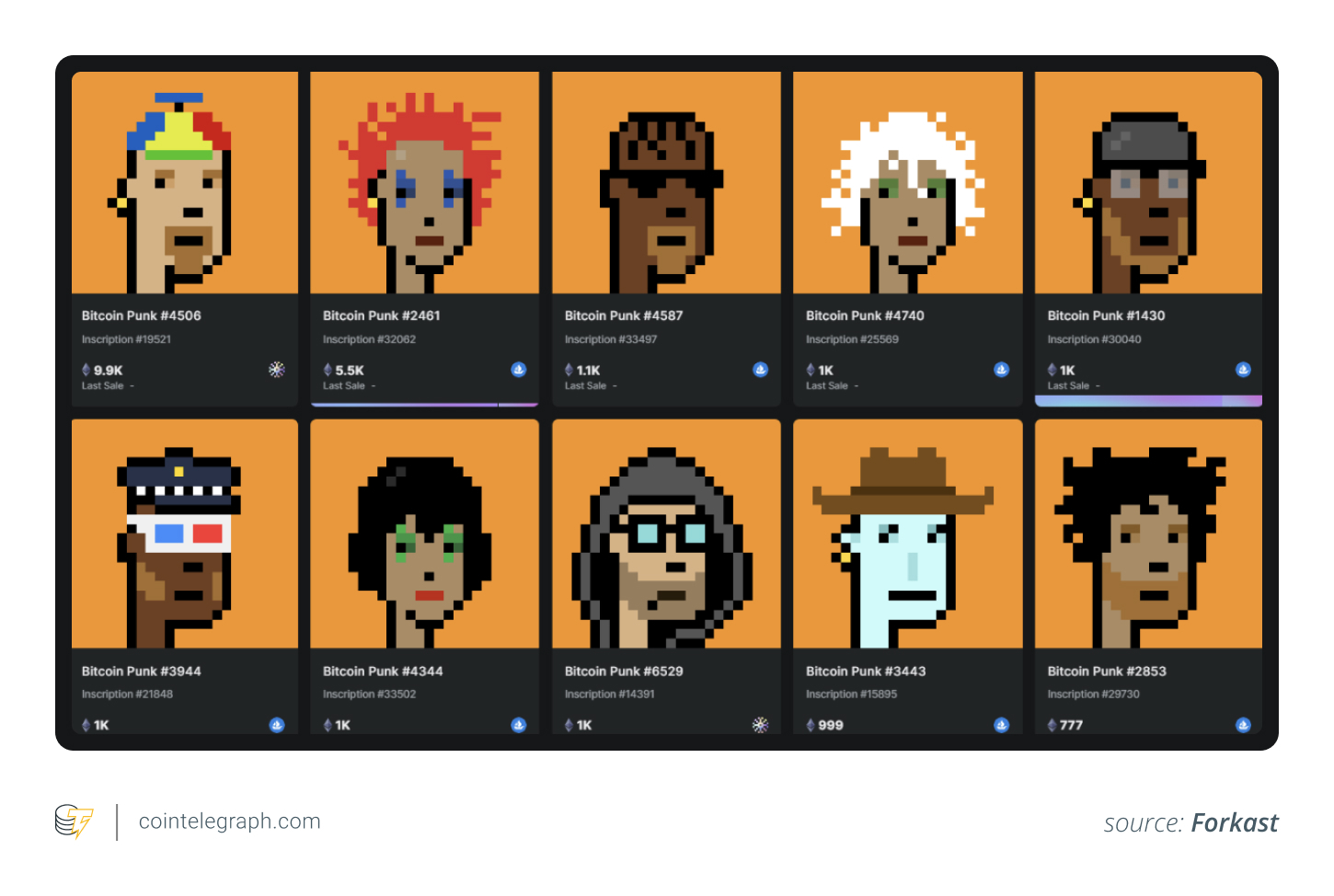

Ordinals and BRC-20 — 2023-2024

Then came something no one really saw coming: NFTs and memecoins… on Bitcoin.

Thanks to Taproot and some creative developers, users began “inscribing” data onto individual satoshis. It started with JPEGs, then evolved into BRC-20 tokens (basically, meme tokens that lived entirely on Bitcoin).

Over $2 billion in market value was created in a matter of months, and miner fees soared.

Covenants, OP_CAT and OP_CTV

As of May 2025, developers have been talking about the next big things: covenants and new opcodes like OP_CTV and OP_CAT. These could bring more flexibility, like vaults and programmable spending conditions — big ideas for Bitcoin’s long-term utility.

Did you know? Bitcoin developer activity has surged in 2025, with over 3,200 commits recorded across its repositories in the past year. This marks a significant rebound from the 2022 slowdown, signaling renewed momentum in protocol development.

How governments don’t control Bitcoin — But still move the market

No single government controls Bitcoin, but that doesn’t mean they don’t move the needle. From ETF approvals to surveillance laws, regulatory shifts have become some of the biggest triggers of major market moves.

Take the 2024 approval of spot Bitcoin ETFs in the US. It was a watershed moment: Multiple funds got the green light, and Bitcoin rocketed past $73,000. Billions flowed in through platforms like BlackRock’s IBIT, and the message was loud and clear: Institutions were finally here.

On the flip side, the EU’s proposal to tighten surveillance on self-custodial wallets rattled markets in 2023 and 2024. It wasn’t just about privacy; it raised concerns that crypto was being fenced off rather than embraced. Investors reacted accordingly, with a brief pullback reflecting that anxiety.

Macroeconomics plays its part, too. Bitcoin still behaves like a high-beta tech stock. When the US Federal Reserve paused rate hikes in late 2023 and hinted at cuts in 2024, BTC responded quickly. Lower rates meant more liquidity, a weaker dollar and renewed appetite for hard assets, including Bitcoin.

And yet, even outright bans haven’t stopped it. China’s ongoing restrictions on trading and mining haven’t erased demand. Users continue to access BTC through over-the-counter (OTC) desks, VPNs and offshore platforms.

In fact, 2025 OTC volumes in China remain surprisingly robust. That kind of resilience shows how tough it is to enforce borders around something that was built to be borderless.

So, while governments can’t control Bitcoin, their actions shape the environment it moves in.

Did you know? The launch of spot Bitcoin exchange-traded funds (ETFs) also sent CME Bitcoin futures open interest to a record $9.6 billion in Q1 2025.

What drives Bitcoin’s price?

So, who really controls Bitcoin’s price?

It’s not the whales alone. Not the core devs. Not the SEC, the Fed or the Chinese politburo. It’s all of them — and none of them — tangled in a decentralized tug-of-war, where power is shared, situational and constantly shifting.

- Whales still move volume, especially in illiquid moments.

- Developers shape the protocol, laying the rails for future use cases.

- Governments add pressure or permission through regulation, taxation and enforcement.

- And macro forces — interest rates, inflation and dollar strength — set the broader risk appetite.

But those are just the headline players.

Sentiment, too, holds real weight. Retail euphoria can create parabolic runs. Institutional caution can trigger sharp retreats. Even social narratives — from AI hype to global instability — now influence how Bitcoin is positioned in portfolios.

In 2025, you’ve seen this interplay in action:

- Spot ETF approvals brought record inflows, but not always sustained rallies.

- Regulatory crackdowns in one region were met with growth in another.

- Whale movements triggered less panic in calmer markets.

- And sometimes, the biggest surges came from narrative momentum alone — not fundamentals.

That’s the paradox of Bitcoin: It’s decentralized but not immune to influence. It reflects belief, behavior and a constant negotiation between users, builders, institutions and regulators.

The price is less a verdict than a pulse — tracking confidence, uncertainty and conviction in real time.