Key takeaways

-

Exchanges top the list, with Binance and Robinhood holding the largest BTC wallets.

-

Strategy leads corporate holdings with nearly 600,000 BTC.

-

The US now holds 207,189 BTC, the largest sovereign stash.

-

Mid-tier wallets are growing, signaling broader BTC adoption.

Who owns the most Bitcoin?

As of July 2025, Bitcoin remains on solid footing. Daily inflows into spot ETFs continue to surge, backed by a noticeable drop in exchange-held reserves, suggesting rising investor confidence and long-term accumulation.

But what really turned heads this month was a sudden move of 20,000 BTC, worth over $2.1 billion, from two wallets untouched since 2011. These dormant Bitcoin wallets didn’t send their funds to exchanges, but rather to new, unidentified addresses.

With dormant coins waking up and ETF-driven demand heating up, the key question is once again front and center: Who owns the most Bitcoin (BTC) in 2025? From exchanges and ETFs to corporations and crypto billionaires, the latest Bitcoin rich list 2025 reveals a shifting but still highly concentrated distribution of BTC power.

Did you know? On July 7 alone, US-based Bitcoin ETFs pulled in $217 million in net inflows, a third straight day of strong institutional buying.

The exchange giants: Top Bitcoin holders in 2025

At the top of the richest Bitcoin addresses list are not individuals, but the massive cold wallets run by crypto exchanges. These custodial reserves are used to manage platform liquidity and safeguard customer funds, and they dominate the upper ranks of any Bitcoin wallet ranking tool.

Leading the pack is Binance’s primary cold wallet, which currently holds around 248,600 BTC, roughly 1.25% of Bitcoin’s circulating supply, valued at over $26 billion.

According to Glassnode BTC wallet data and trackers like BitInfoCharts and CoinCodex, it is the largest BTC wallet. The wallet’s infrequent but significant transactions point to long-term reserve management, not trading.

Next is the Robinhood cold wallet, holding about 140,600 BTC (~$15 billion). This address sees only occasional withdrawals, likely reflecting end-user flows rather than internal trading.

It’s followed by Bitfinex’s cold wallet, which stores about 130,010 BTC, though earlier counts placed it closer to 156,000 BTC. Minor fluctuations aside, Bitfinex remains one of the top Bitcoin holders in 2025.

Other massive exchange-held wallets include:

-

Binance cold wallet #2: 115,000 BTC

-

Bitfinex hack recovery wallet (now government-held): 94,600 BTC

These custodial wallets account for several of the largest BTC wallets in 2025, anchoring the infrastructure that supports billions in daily trading volume.

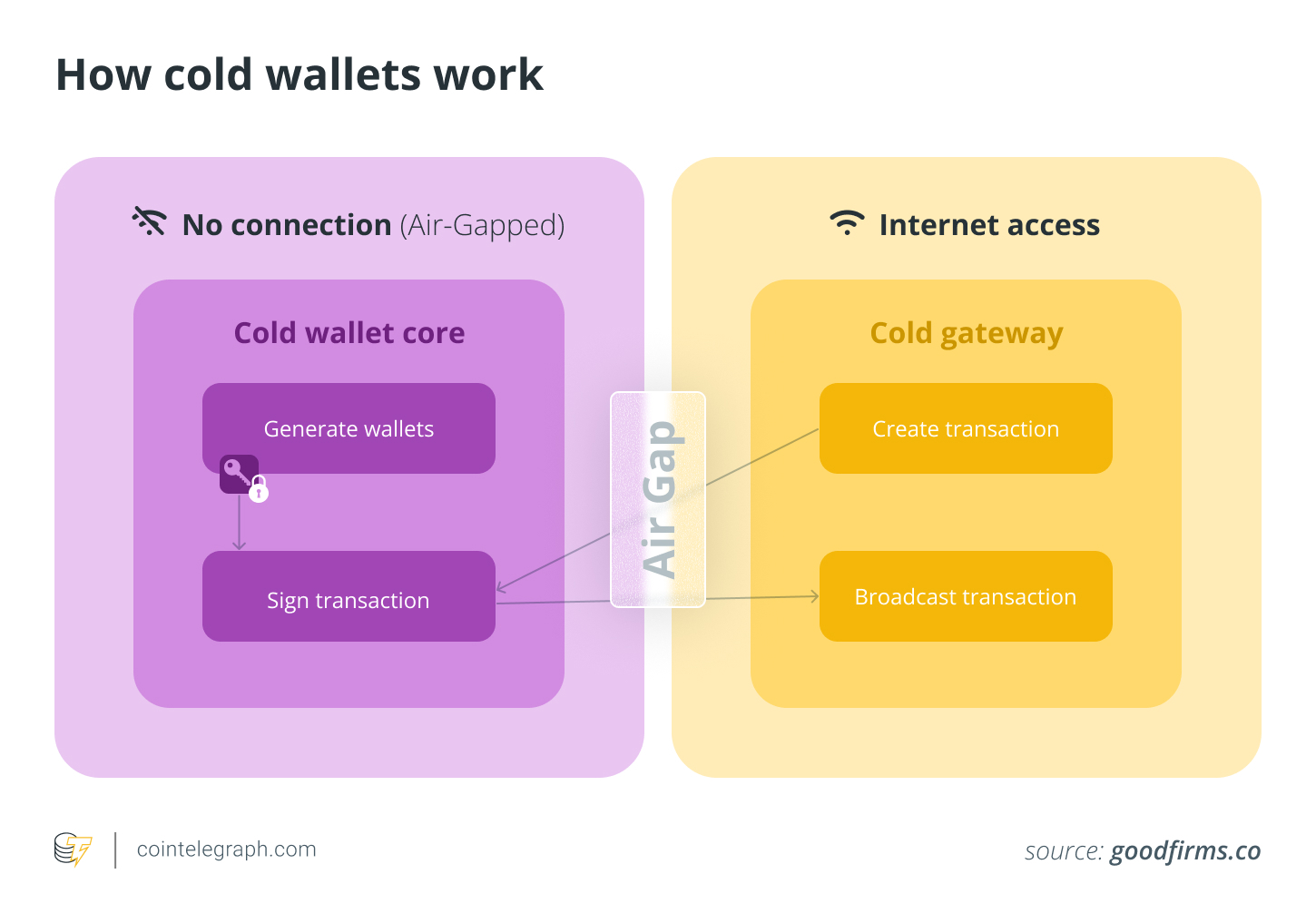

Did you know? Exchange-held cold wallets use offline hardware devices to sign transactions without ever exposing private keys to the internet. This “air-gapped” setup makes them virtually hack-proof, even if online systems are compromised.

Institutional BTC holdings: What you need to know

Strategy (formerly MicroStrategy)

No corporate entity is more synonymous with Bitcoin accumulation than MicroStrategy, now rebranded simply as Strategy.

By mid-2025, the firm had amassed about 597,325 BTC, spending over $42.4 billion with an average cost of $70,982 per coin. That makes Strategy the largest public Bitcoin holder in the world by a wide margin. Nearly 92.5% of its balance sheet is now in BTC, a bold bet that continues to define corporate treasury strategy in crypto.

Other public Bitcoin holdings in 2025

Aside from Strategy, as of 2025, roughly 130 publicly traded companies have integrated Bitcoin into their balance sheets, holding a combined total of about 693,000 BTC, around 3.3% of all Bitcoin in circulation.

Well-known participants include:

-

Tesla, with an estimated 11,509 BTC, quietly maintained under the now-legendary Elon Musk Bitcoin wallet.

-

Block (8,584 BTC), GameStop (4,710 BTC), Semler Scientific (4,449 BTC) and XXI by Twenty One Capital (37,230 BTC), each holding BTC as part of broader asset diversification plays.

-

Metaplanet, an unexpected contender from outside the tech sector, currently holds 15,555 BTC as of July 9, 2025, with ambitious plans to accumulate 210,000 BTC by 2027.

ETFs and institutional trusts

Institutions have gone beyond direct purchases. ETFs and trusts now hold vast Bitcoin reserves on behalf of millions of investors:

These Bitcoin ETF holdings have introduced a more regulated, familiar format for traditional investors, and they’ve done so at scale.

Which countries hold the most Bitcoin?

As of mid-2025, an estimated 529,000 BTC, about 2.5% of the total supply, is sitting in sovereign vaults, reshaping the geopolitical dynamics of digital currency.

The United States made headlines in March 2025 when President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve. Sourced entirely from criminal seizures, this 207,189 BTC stash, worth over $17 billion, isn’t for sale.

It’s a long-term asset, stored indefinitely as a kind of “digital Fort Knox.” This move cemented the US as a top player on the Bitcoin rich list in 2025 by institutionalizing BTC’s role in national strategy.

Despite its domestic ban on crypto trading, China holds an estimated 194,000 BTC, mostly from its 2019 crackdown on the PlusToken scam. The coins remain dormant but present, proof that even in restrictive regimes, dormant Bitcoin wallets can quietly shape the market.

Other sovereign holders include (as of July 8, 2025):

-

United Kingdom: 61,245 BTC

-

Ukraine: 46,351 BTC, much of it donated during conflict

-

Bhutan: 11,924 BTC, generated via hydro-powered state mining

-

El Salvador: 6,229 BTC, a result of its legal tender strategy launched in 2021

On a side note, sovereign Bitcoin reserves show that the digital asset is becoming a strategic one, shaping central bank policy and signaling institutional legitimacy worldwide.

Did you know? The nation of Georgia holds one of the smallest official sovereign Bitcoin funds, around 66 BTC, worth roughly $8 million at today’s prices.

Richest Bitcoin addresses: Who are the top crypto billionaires?

While corporations and custodians dominate the biggest addresses, individual holders still command staggering BTC wealth. Some are public figures. Others remain shadows on the blockchain.

-

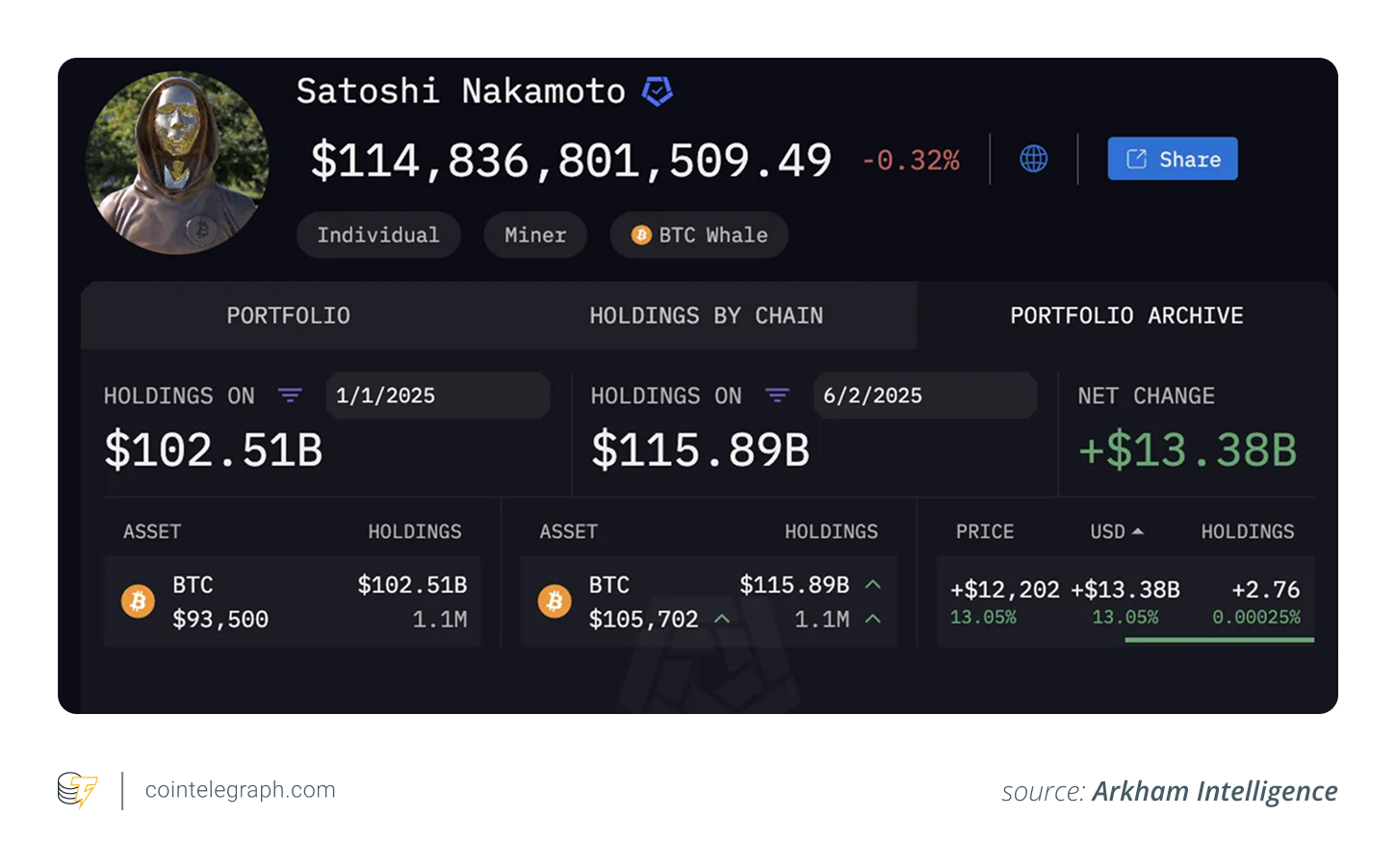

At the very top sits Satoshi Nakamoto, Bitcoin’s elusive creator. His (her, or their) BTC wallet, estimated to contain between 968,000 and 1.1 million BTC, has been untouched since 2010. This stash, nearly 5% of all Bitcoin, looms like a sleeping giant. If it ever moves, markets would erupt in speculation.

-

Next are the Winklevoss twins, estimated to hold about 70,000 BTC. As founders of Gemini and vocal crypto advocates, they remain among the most visible top crypto billionaires.

-

Tim Draper, a venture capitalist and early Bitcoin backer, still holds around 30,000 BTC, purchased at a 2014 US Marshals auction. He’s long predicted a $250,000 price tag, and still stands by it.

-

Michael Saylor, through his company and personally, is a dual holder. Beyond Strategy’s massive stash, Saylor himself owns 17,732 BTC (as of August 2024), worth nearly $2 billion today.

-

One mystery remains: the 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF address, holding 79,957.26 BTC. It’s believed to be tied to early exchange exploits and is currently frozen, yet it ranks among the richest Bitcoin addresses ever recorded.

BTC whale tracker: Onchain wealth distribution

Bitcoin's ownership remains heavily concentrated, but the story is slowly changing.

The top 10 BTC wallets (excluding Nakamoto’s holdings) control about 1.1 million BTC, roughly 5.5% of the total supply. Zooming out, the top 100 addresses collectively hold about 2.9 million BTC, close to 14.7% of all circulating coins. These are largely exchange reserves, institutional holdings or high-net-worth Bitcoin whales of 2025.

However, the real shift is happening just below: Wallets holding between 100 and 1,000 BTC have grown significantly. Over the past year, these mid-tier addresses expanded from 3.9 million BTC to 4.76 million BTC. That’s a major uptick in crypto wealth distribution, signaling that small institutions, funds and even wealthy individuals are stacking sats more aggressively.

This trend aligns with broader adoption, clearer regulation and improved BTC whale tracker visibility. While big players still dominate liquidity, Bitcoin’s economic base is widening, which could stabilize price behavior over time.

Who holds the keys to Bitcoin? From cold wallet giants to a growing middle class

At the top sit the massive exchange cold wallets — Binance, Robinhood, and Bitfinex — followed by corporations like Strategy, institutional vehicles like Grayscale, sovereign treasuries and legendary personal wallets like Satoshi Nakamoto’s BTC address.

Still, it’s the ongoing shift that matters. More mid-tier Bitcoin holders are entering the scene, while ETF flows and sovereign reserves legitimize Bitcoin’s role in mainstream finance.

Yet, questions remain:

-

Will dormant wallets awaken?

-

Will companies like Strategy keep buying, or pivot as market conditions evolve?

-

Will the largest BTC wallets of 2025 continue to grow or be redistributed?

The answers to these questions will only be revealed in the next chapter of crypto.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.