American households could see relief from high interest rates sooner than expected.

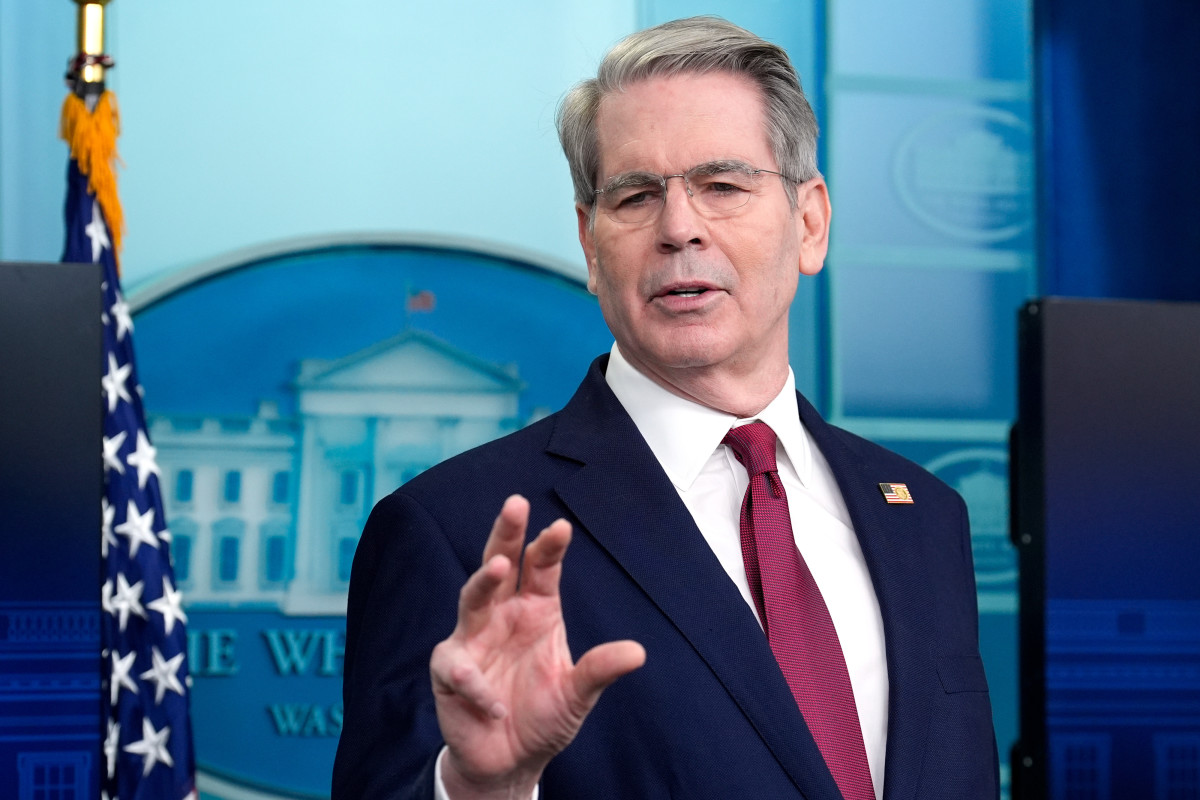

Treasury Secretary Scott Bessent is calling for the Federal Reserve to make a larger-than-expected interest rate cut in September, and then keep on cutting.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

Markets and some economists are applauding this aggressive stance, which reflects a decrease the Trump administration has been pushing for months.

The Fed last cut interest rates in December.

Fed Chair Jerome Powell has led a “wait-and-see” position this year, pending the impact of tariff inflation on the U.S. supply chain.

Inflation, jobs hint at pivot in Fed interest rate policy

The Aug. 12 CPI report boosted investor confidence of an upcoming rate cut.

July’s year-over-year CPI remained steady at 2.7%, slightly below forecasts.

Core inflation, excluding food and energy, rose to 3.1% which was higher than expected and signaling persistent price pressures.

The markets have also zeroed in on the surprise weak job data from the U.S. Bureau of Labor Statistics that significantly downgraded payroll growth in May and June while showing only a modest job gain in July.

The Federal Reserve’s dual mandate from Congress requires monetary policy that balances low unemployment and low inflation.

Related: Surprising CPI report sparks mixed Fed interest rate cut forecasts

The independent central bank uses interest rates as the benchmark tool to maintain both sides of its mandate.

But there is tension between the two, because higher interest rates lower inflation but increase job losses and lower interest rates decrease unemployment but increase inflation.

The Federal Open Market Committee in July voted to maintain the benchmark Federal Funds Rate at 4.25% to 4.50% because of uncertainty over whether the tariff-fueled inflation will be a one-time bump to the economy or continue through the rest of the year.

President Donald Trump has been increasingly critical of Powell and the FOMC, demanding a 3 percentage-point rate cut.

The president says lower rates are necessary to curb stagflation and recession fears, ease the stagnant housing market with lower mortgages, and reduce the interest on the federal deficit.

Secretary Bessent calls for huge Fed interest rate cuts

The CME Group FedWatch Tool, which tracks the probabilities of changes to the Fed rate as implied by 30-Day Fed Funds future prices, estimates the probability of Fed interest rate cut in September at 99.8%.

Bessent, who described the surprise July CPI data as “fantastic,” wants more.

“We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September,” Bessent said in a Bloomberg television interview Aug. 13. “We should probably be 150, 175 basis points lower.”

Bessent said the FOMC might have cut rates if they'd been aware of the revised data on the labor market that came out after the latest meeting, and he suspects rate cuts could have happened in June and July.

Related: Jobs report shocker resets Fed interest rate cut bets

The July inflation report “was a bit stronger than we have seen over the prior few months, but lower than many have feared,” said Rick Rieder, chief investment officer of global fixed income at BlackRock, in a note.

“As a result, we expect the Fed to begin cutting rates in September, and it could be justified cutting the funds rate by 50 basis points,” Rieder said.

TheStreet Pro’s longtime analyst Stephen Guilfoyle notes that Bessent is very highly respected both inside the administration and across business and economic circles.

“I think the Fed is about 100-basis points behind,’’ Guilfoyle wrote on Aug. 13, adding that Powell will have “the perfect opportunity to set up a September rate cut late next week from Jackson Hole, Wyoming.”

More Federal Reserve:

- GOP plan to remove Fed Chair Powell escalates

- Trump deflects reports on firing Fed Chair Powell ‘soon’

- Former Federal Reserve official sends bold message on ‘regime change'

The theme of this year's symposium, an annual gathering of economists, academics and others, is “Labor Markets in Transition.”

“Given recent developments at the Bureau of Labor Statistics, that gives him an easy way to deflect some blame for his inaction on policy,’’ Guilfoyle wrote.

How the Federal Funds Rate affects you

The Federal Funds Rate is the interest rate banks use to borrow money overnight.

It sets the cost of short-term borrowing, for example, the interest on credit cards, auto loans, home equity loans, and student loans.

When the Fed raises rates, yields on short-term securities typically climb and push up longer-term yields like the 10-year Treasury Bond, because investors demand higher returns to offset anticipated inflation and tighter credit conditions.

The 10-year Treasury yield is a benchmark for U.S. mortgage rates, since lenders use it to price long-term loans.

As the yield rises, mortgage rates usually increase, making borrowing more expensive for homebuyers. When the yield drops, so do mortgage rates.