Investment advisors may be overestimating the risk of equities for longer-term investors. We analyzed stock market returns for 15 different countries from 1870 to 2020 and found that optimal equity allocations increase for longer investment horizons.

Optimization models that use one-year returns generally ignore the historical serial dependence in returns, so naturally they may over-estimate the risk of equities for longer-term investors, and this is especially true for investors who are more risk averse and concerned with inflation risk.

In our previous blog post, we reviewed evidence from our recent paper that returns for asset classes do not evolve completely randomly over time. In fact, some form of serial dependence is present in a variety of asset classes.

While there have been notable differences in the optimal equity allocation across countries, there is significant evidence that investors with longer investment horizons would have been better served with higher allocations to equities historically. It is of course impossible to know how these relations will evolve in the future. However, investment professionals should be aware of these findings when determining the appropriate risk level for a client.

Determining Optimal Portfolios

Optimal portfolio allocations are determined using a utility function. Utility-based models can be more comprehensive and relevant than defining investor preferences using more common optimization metrics, such as variance. More specifically, optimal asset class weights are determined that maximize the expected utility assuming Constant Relative Risk Aversion (CRRA), as noted in equation 1. CRRA is a power utility function, which is broadly used in academic literature.

Equation 1.

U(w) = w-y

The analysis assumes varying levels of risk aversion (y), where some initial amount of wealth (i.e., $100) is assumed to grow for some period (i.e., typically one to 10 years, in one-year increments). More conservative investors with higher levels of risk aversion would correspond to investors with lower levels of risk tolerance. No additional cash flows are assumed in the analysis.

Data for the optimizations is obtained from the Jordà-Schularick-Taylor (JST) Macrohistory Database. The JST dataset includes data on 48 variables, including real and nominal returns for 18 countries from 1870 to 2020. Historical return data for Ireland and Canada is not available, and Germany is excluded given the relative extreme returns in the 1920s and the gap in returns in the 1940s. This limits the analysis to 15 countries: Australia (AUS), Belgium (BEL), Switzerland (CHE), Denmark (DNK), Spain (ESP), Finland (FIN), France (FRA), UK (GBR), Italy (ITA), Japan (JPN), Netherlands (NLD), Norway (NOR), Portugal (PRT), Sweden (SWE), and United States (USA).

Four time-series variables are included in the analysis: inflation rates, bill rates, bond returns, and equity returns, where the optimal allocation between bills, bonds, and equities is determined by maximizing certainty-equivalent wealth using Equation 1.

Three different risk aversion levels are assumed: low, mid, and high, which correspond to risk aversion levels of 8.0, 2.0, and 0.5, respectively. These, in turn, correspond approximately to equity allocations of 20%, 50%, and 80%, assuming a one-year investment period and ignoring inflation. The actual resulting allocation varies materially by country. Any year of hyperinflation, when inflation exceeds 50%, is excluded.

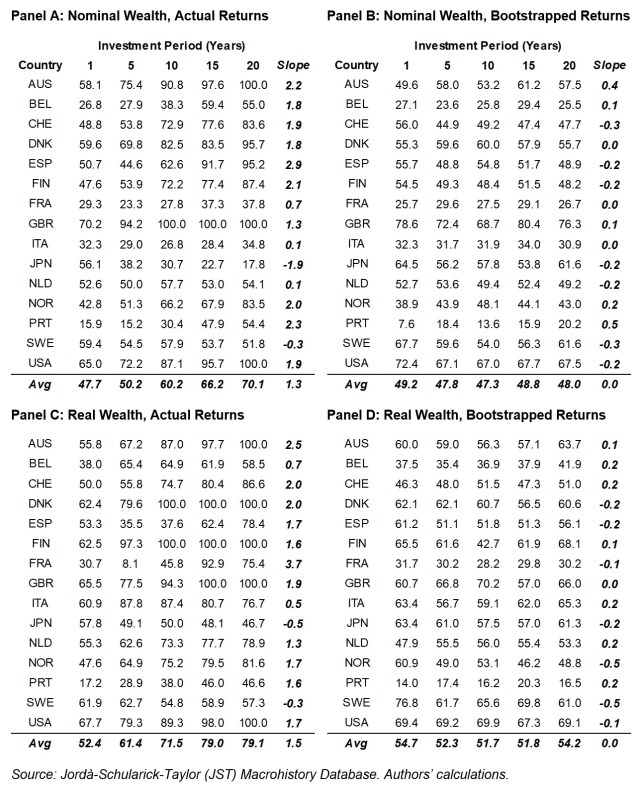

Exhibit 1 includes the optimal equity allocation for each of the 15 countries for five different investment periods: one, five, 15, and 20 years, assuming a moderate risk tolerance level (y=2) where the optimizations are based on the growth of either nominal wealth or real wealth, using the actual historical sequence of returns or returns that are randomly selected (i.e., bootstrapped) from the historical values, assuming 1,000 trials.

The bootstrapping analysis would capture any skewness or kurtosis present in the historical return distribution because it is based on the same returns, but bootstrapping effectively assumes returns are independent and identically distributed (IID), consistent with common optimization routines like mean-variance optimization (MVO).

Exhibit 1. Optimal Equity Allocations for a Moderate Risk Aversion Level by Country and Investment Period: 1870-2020

Important Takeaways

There are several important takeaways from these results. First, there are considerable differences in the historical optimal equity allocations across countries, even when focusing on the same time horizon (one-year returns). For example, the equity allocations range from 16% equities (for Portugal) to 70% (for the United Kingdom) when considering nominal, actual historical returns.

Second, the average equity allocation for the one-year period across all 15 countries is approximately 50%, regardless of whether wealth is defined in nominal or real terms.

Third, and perhaps most notably, while the equity allocations for the optimizations using actual historical return sequences increase over longer investment optimizations, there is no change in optimal allocations for the bootstrapped returns. The equity allocations for the nominal wealth optimizations increase to approximately 70% at 20 years, and equity allocations for the real wealth optimizations increase to approximately 80% at 20 years, which represent annual slopes of 1.3% and 1.5%, respectively. In contrast, the equity allocations for the boostrapped optimizations are effectively constant (i.e., zero).

This finding is worth repeating: the optimal allocation to equities is different using actual historical return data (which have nonzero autocorrelation) than in the bootstrapped simulation where returns are truly IID.

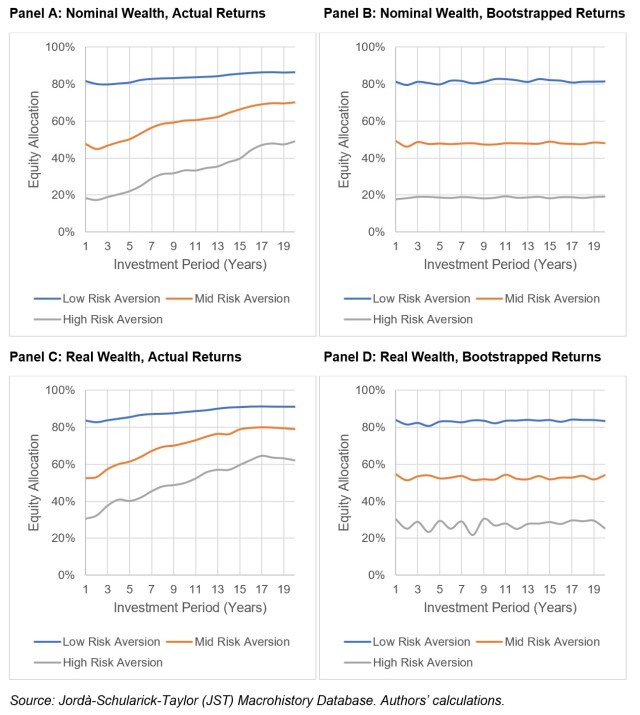

Exhibit 2 includes the average allocations to equities across the 15 countries for the three different risk aversion levels when focused on nominal and real wealth and on whether the actual historical sequence of returns are used or if they are bootstrapped. Note, the average values in Exhibit 1 (for the one, five, 10, 15, and 20 year periods) are effectively reflected in the results in the next exhibit for the respective test.

Exhibit 2. Optimal Equity Allocation by Risk Tolerance Level and Investment Period (Years)

Again, we see that optimal equity allocations tend to increase for longer investment periods using actual historical return sequences, but the bootstrapped optimal allocations are effectively constant across investment horizons.

The impact of investment horizon using the actual sequence of returns is especially notable for the most risk averse investors. For example, the optimal equity allocation for an investor with a high-risk aversion level focused on nominal wealth and a one-year investment horizon would be approximately 20%, which increases to approximately 50% when assuming a 20-year investment horizon.

These results demonstrate that capturing the historical serial dependence exhibited in market returns can notably affect optimal allocations to equities. In particular, the optimal allocation to equities tends to increase by investment duration using actual historical returns, suggesting that equities become more attractive than fixed income for investors with longer holding periods.

One potential explanation for the change in the optimal equity allocation by time horizon using the actual historical sequence of returns could be the existence of a positive equity risk premium (ERP). We explore this more fully in our paper, and CFA Institute Research Foundation regularly convenes leading investment minds to discuss new ERP research and share divergent views on the topic.

Even if the ERP is eliminated, we find that allocations to equities remain and increase over longer investment horizons, suggesting that equities can provide important long-term diversification benefits even without generating higher returns.

So What?

Investment horizon and the implications of serial correlation need to be explicitly considered when building portfolios for investors with longer time horizons. As the analysis demonstrates, this is especially true for more conservative investors who would typically get lower equity allocations.

In our forthcoming blog post, we will explore how allocations to an asset class (commodities) that may look inefficient using more traditional perspectives, can be efficient when considered in a more robust way.