Private equity (PE) buyouts are intricate financial maneuvers, often shrouded in complexity. By utilizing tiered acquisition structures and strategic vehicles, PE investors can unlock value while safeguarding investments. This article explores the nuances of these frameworks, from the role of acquisition vehicles to jurisdictional intricacies and the rise of offshore registrations. It is the first in a three-part series.

When PE investors acquire companies in a buyout, they typically use newly formed acquisition vehicles to do so, rather than directly acquiring the operating companies. These vehicles –- also referred to as holding companies, or special purpose vehicles (SPVs) — are created for the purpose of the buyout and have not traded prior to the transaction closing.

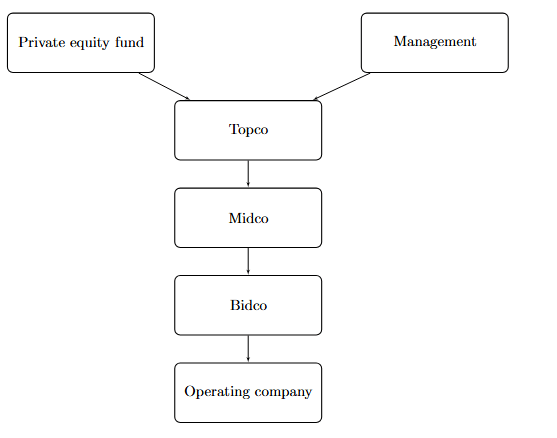

The number of acquisition vehicles which are created can vary and will depend on the complexity of the structure of the buyout and the jurisdictions involved. Figure 1 shows what a typical three-tiered acquisition structure may look like.

Figure 1: Tiered acquisition structure

In this example, Topco, Midco, and Bidco are vehicles which are created to facilitate the buyout of the operating company. A PE fund, very often alongside the target firm’s management team, invest into the newly created Topco acquisition vehicle. This vehicle lends the money into the Midco vehicle, which borrows some amount of debt — typically shareholder debt from the PE fund or junior debt from an external provider — and lends this, plus the money from the Topco vehicle, into the Bidco vehicle. Finally, the Bidco vehicle borrows some amount of external senior debt and uses its total amount of money to buy out all debtholders and shareholders of the operating company.[1]

Through this tiered structure, because the senior lender lends to the Bidco vehicle and not to the Topco vehicle, the senior lender has direct rights against the entity which owns the operating company, and therefore the assets of the target group. This structure ensures that the senior lender’s debt is not structurally subordinated to junior debtholders and equity holders. It gives the senior lender prior claim to the underlying assets of the target company. External senior debt providers in buyouts, such as banks, will often favor this structural subordination.

The number of different securities which are issued to finance the transaction and the complexity of the buyout are both important factors when forming a buyout structure. For example, in buy-and-build deals, where PE investors acquire one platform company and then bolt-on other targets to the platform, these acquisition structures can become more complex.

Differences in jurisdictions also play an important role in determining the transaction structure. For example, in the US Chapter 11 bankruptcy laws offer strong protection for junior lenders, so inter-creditor agreements and contractual provisions may suffice. The strong protections also mean there is less need for the creation of tiered acquisition vehicles as there may be in the United Kingdom or European jurisdictions.

Indeed, there may only be two vehicles in a US buyout structure: one for equity holders and another for all debtholders. All debt instruments used to finance the transaction may be loaned into a single entity, where there are contractual provisions and inter-creditor arrangements that achieve the required structural subordination, in the same way that UK and European buyouts do through the layering of different acquisition vehicles. Nevertheless, more complex US buyouts and multi-jurisdictional transactions may involve more elaborate structures.

It is also worth understanding the registration of acquisition vehicles in offshore jurisdictions – a popular practice in the United Kingdom in recent years, driven in large part to avoid withholding tax.[2] Many PE investors acquiring UK companies – whether they are based in the United Kingdom, the United States, or elsewhere — have created acquisition vehicles registered in offshore jurisdictions. Popular offshore jurisdictions include the Channel Islands, Luxembourg, and the Cayman Islands. Aside from tax-related reasons, registering these entities offshore may also provide PE acquirers with greater flexibility in receiving dividends from their portfolio companies. For example, distributions under Jersey or Guernsey law (in the Channel Islands) can be made without requiring distributable profits to be available.

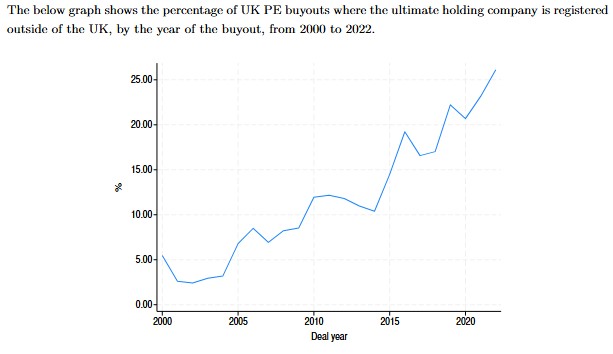

In a recent research paper, I document a considerable rise in the use of offshore vehicles in buyout transactions in the United Kingdom. In 2000, only 5% of buyouts involved an offshore ultimate holding entity, compared to more than 25% of deals in 2022 (see Figure 2). It appears to be particularly common in larger buyout transactions and in buyouts involving PE firms who are headquartered overseas. Given that when the ultimate holding entity is registered offshore its financial accounts are not publicly accessible (unlike when the entity is registered in the United Kingdom), this highlights an important decline in the transparency of PE buyouts in the United Kingdom over the last two decades.

Figure 2.

Key Takeaways:

- Acquisition Vehicles as Essential Tools: Private equity buyouts commonly rely on tiered acquisition structures, with vehicles like Topco, Midco, and Bidco playing critical roles in managing investments and debts.

- Structural Subordination Benefits: The layered structure ensures that senior debt providers retain priority over junior lenders and equity holders, safeguarding their claims against the operating company’s assets.

- Jurisdictional Differences Matter: Variations in laws, such as Chapter 11 bankruptcy protections in the United States, influence the complexity of acquisition structures. Stronger bankruptcy laws may reduce the need for multiple vehicles.

- Offshore Flexibility: Registering acquisition vehicles in offshore jurisdictions like the Channel Islands or Luxembourg offers tax advantages and operational flexibility, particularly for dividend distributions. This has become an increasingly popular practice in the United Kingdom in recent years.

- Complexity Grows with Strategy: Buy-and-build deals and multi-jurisdictional transactions add layers of complexity, making structuring crucial for effective management and risk mitigation.

By understanding these elements, stakeholders can navigate the intricate world of private equity buyouts with confidence and precision.

In my next post, I will cover the consolidation of PE company portfolio accounts.

[1] These acquisition vehicles can be called anything. Topco, Midco, and Bidco have traditionally been common in the United Kingdom and are used here for illustrative purposes.

[2] This does not apply to domestic US transactions.