In Renaissance Macro’s weekly update, technician Jeff deGraff has this to say about their use of the credit spreads:

The one area the economist is not strong on in predicting recessions is what has been happening in the credit markets. Renaissance Macro has always been big on using credit market data. For 25 of 35 years of his career, Jeff has been focused on credit because credit is such a good window into the soul of the economy.

There is not a lot of value in corporate credit. Corporate credit spreads are incredibly tight and we will be hard-pressed to have a recession when the corporate credit spreads is this tight.

Credit spreads will reflect the expectations of aggregate demand because if aggregate demand is contracting, a person’s ability to pay your bills or interest payments go down. Your margins get compressed and that will be reflected in the credit markets.

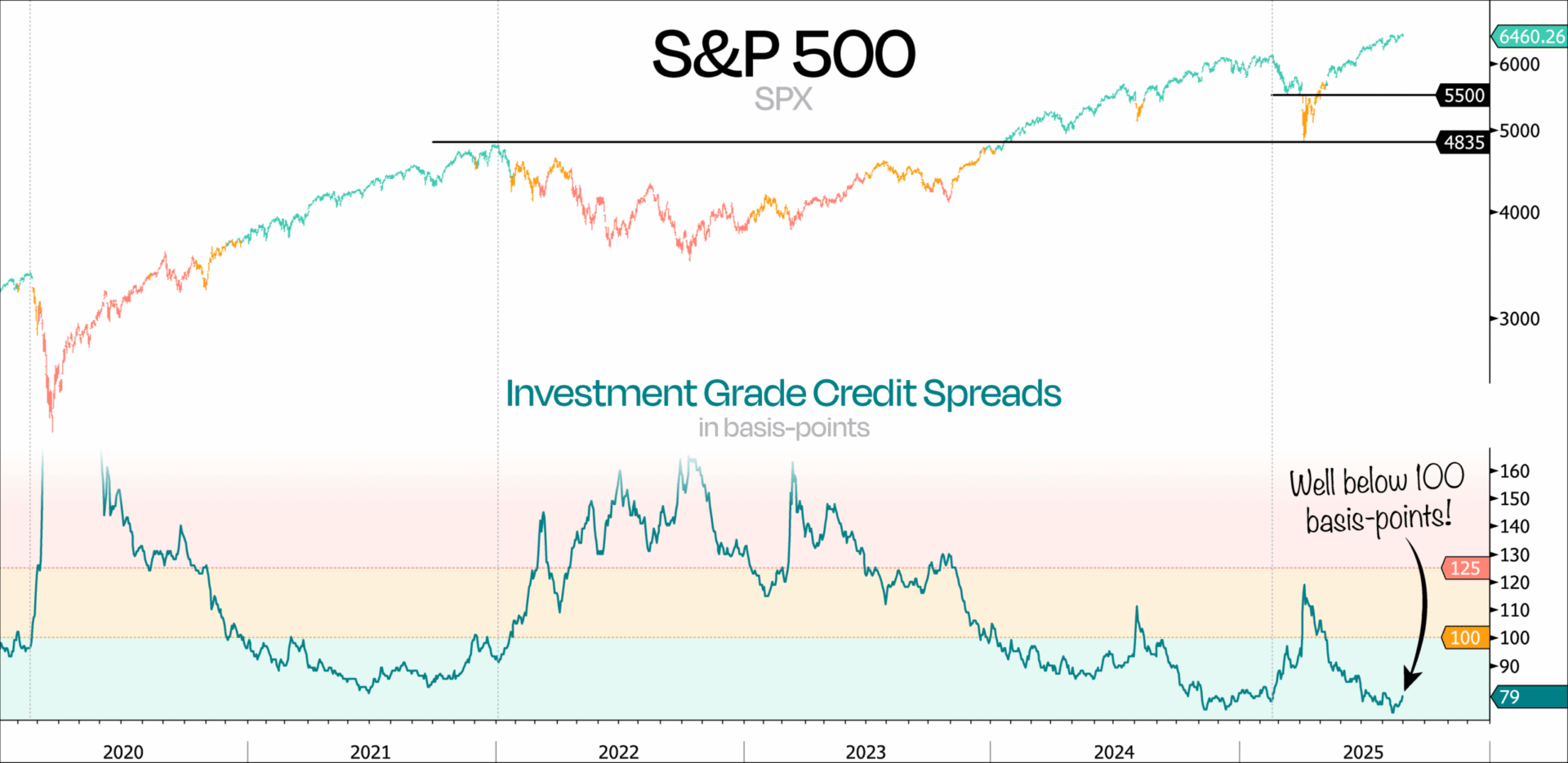

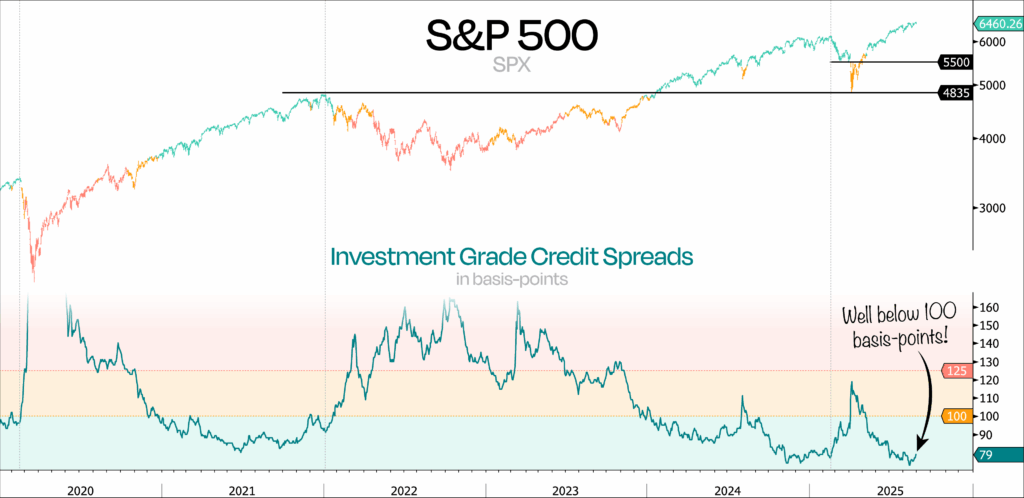

This morning, I saw this updated illustration that probably explains what Jeff is talking about:

The top of the chart is the S&P 500 and the bottom is the spread between investment grade fixed income and government fixed income. Currently it is at one of the lowest points in the past five years.

But in a way, the person illustrating this chart would like us to view it more in regimes. The green part is when the credit spread is very tight. You can see the corresponding color code. The equity index tends to do well when investment grade credit spread is tight.

When it is amber or red there are greater volatility.

It kind of feels like the same behavior in the VIX, or the spot implied volatility index of the S&P 500.

When the VIX is high or mid, you get rougher markets. But when the VIX is real low, that is when equities run.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.