What caught my eye this week.

Well so much for the adults in the room. It turns out all the grown-ups in government are on the front benches. But Corbyn’s kiddos are still pulling the strings.

Keir Starmer and Rachel Reeves reminded me this week of college students back home to do a bit of babysitting.

At last it’s their turn to earn beer money watching Netflix! But they can’t be dealing with the actual kids so they lock them in a spare bedroom with a Nintendo Switch to amuse themselves.

Wait – is that smoke?

Spot the moment the resultant surely-terminal footage of a tearful Chancellor Rachel Reeves went viral:

Belaboured castle

Anyone who thinks this week’s bonfire of Labour’s modest welfare reforms must finally represent the low-water mark for British politics might want to book an appointment with 2029.

Because it’s now clear that sitting behind Starmer and Reeves are a cohort of leftwing MPs who don’t and won’t care how out-of-whack with they are with the mood of the nation.

Reeves always faced a thankless and perhaps impossible task. She and Starmer made it even worse by imposing fiscal constraints that won the election battle but have hamstrung the subsequent war.

Now either tax rises or more borrowing must come following this week’s events. And/or a loosening of those rules, which can only happen via the blood sacrifice substitution of a new Chancellor.

Probably all three? And neither the electorate nor the bond markets will approve.

It’s all good news for Nigel Farage and Reform. They can keep promising populist tosh to their credulous supporters, while postponing their own inevitable implosion for any future contact with our rickety reality.

Buckle up.

Counting the cost

It’s true I was never crazy for the Starmer/Reeves duo.

As I wrote after 2024’s General Election:

I’m not expecting miracles. I’m barely expecting anything.

Just not shooting ourselves in the foot for a few years would be nice.

The best hope for Labour – and more importantly the country – is that stability and sanity at the top, plus some judicious low-cost tweaks to planning and policy – might unlock capital spending and investment.

Rishi Sunak and Jeremy Hunt had already halted a seven-year-long limbo competition that had taken the bar for standards down to historic lows. I dared to believe Labour might raise it.

However given that – near-uniquely among commentators – I remember and am not afraid to state that Brexit has permanently impaired the UK economy and is responsible for at least £40bn in missing tax revenues – pretty much the sum that all these spending battles are being fought over, though the news reports never mention it – I noted:

This time things really can only get better.

Except that unlike in the 1990s, it’s now more akin to when you come around from a heart attack and a machine is faintly beeping in the background.

…and all we’ve had since waking is hapless palliative care.

Higher taxes on business (such as Employer’s NI), strong talk but little visible results yet on planning and infrastructure, still higher spending, and leaders too fearful to name the blunder that partly put us in this hole.

Belittled Britain

I know it’s boring to be reminded of it again, but it shouldn’t be controversial.

You can’t leave a huge trading bloc that boosted Britain’s GDP for 47 years without economic harm. And you can’t expect that damage not to show up in the nation’s finances.

Well, this is it showing up.

Add to that an unfortunate succession of further costly crisis – Covid, Ukraine – and the UK never stood much of a chance.

We needed a political titan – a Thatcher, an Atlee, maybe even a Heseltine – with the vision, command, and charisma to push through evasive action commensurate with the bodyblow of leaving the EU.

At best we’ve had journeymen. At worst shysters.

Allocate those labels to suit your prejudices. We can all agree that faced with a Herculean task we’ve been short one Hercules.

There aren’t easy options. But curbing state spending was a better difficult decision from here.

At least I’d have made it a multi-generational effort. Toughening up welfare payment rules but getting rid of the unsustainable pension triple-lock as a quid pro quo for starters.

We’re on a road to nowhere

As things stand, following this latest retreat fund manager Gordon Shannon told City AM that the markets will demand tax rises to maintain fiscal stability:

“The market is requiring you to put up taxes, so you do that but then that pushes down growth more, which makes everyone a bit less happy to make investments in the UK. So more money leaves, so your borrowing requirements are higher because you’re trying to support an economy that’s now floundering.

“What do you do there? You’ve got to borrow more.”

“And that means that, you know, an awful lot of things just won’t happen, whether that’s building a new factory or employing new workers starting a business, a lot of these things won’t come through. And at the margin, that definitely means a lowering of the growth trajectory…which was already in a pretty lackluster state. So, yeah, you’re in a bit of a hell slide there.”

It means non-core taxes up again while mainstream tax thresholds are frozen for even longer. The economy paddling nowhere. And voters who feel like they’re going backwards – or who increasingly even leave the UK, if they are rich enough.

There better be something distracting to watch on Netflix…

Have a great weekend.

From Monevator

Our updated guide to find you the best broker – Monevator

How to keep Child Benefit and retire richer despite the High Income Child Benefit Charge – Monevator

From the archive-ator: Why I’m saving and investing for the disaster to come – Monevator

News

Rachel Reeves poised to cut ISA allowance – Yahoo Finance

Disposable income per head slumps despite economic growth – City AM

First-time buyers and retirees set to gain from mooted mortgage changes – Independent

UK on track for biggest year of takeovers since 2021… – City AM

…even as IPO fundraising in London is at a 30-year low… – CNBC

…though Revolut and Octopus mulling joining new Pisces exchange – City AM

AstraZeneca pops on news CEO wants to move base to US – Proactive Investors

MPs tell Rachel Reeves Lifetime ISA rules are ‘nonsensical’ – City AM

Santander to buy TSB: what does it mean for customers? – This Is Money

IFS proposes abolishing triple-lock in wide-ranging pension review [Research] – IFS

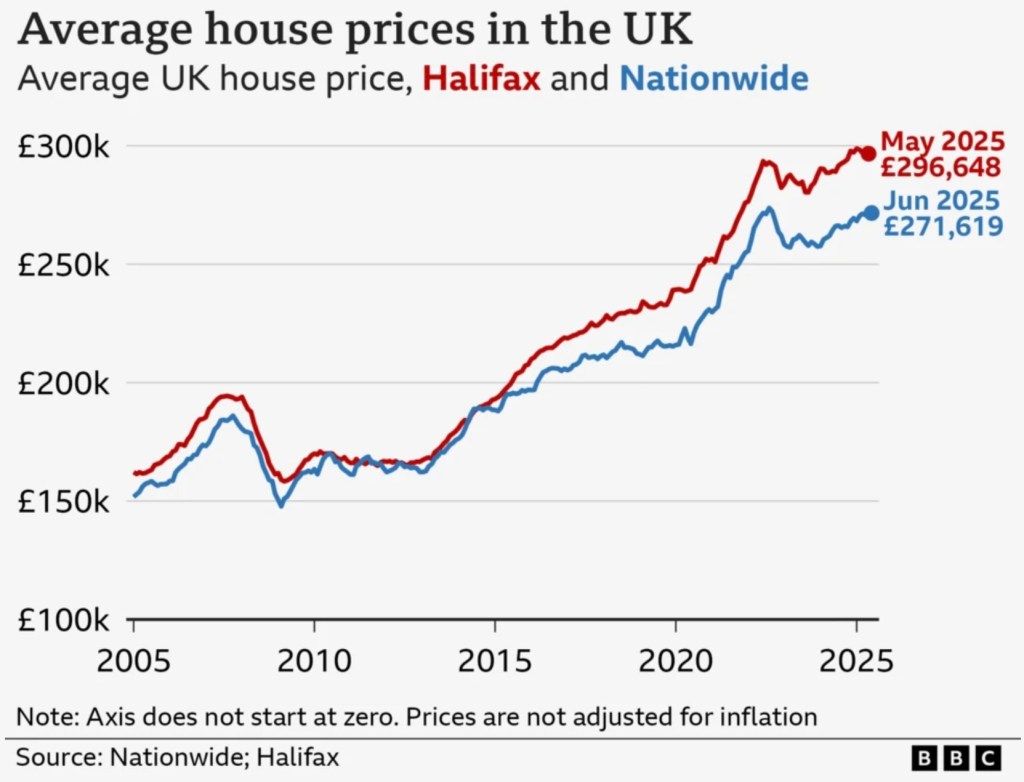

House prices see biggest monthly fall for over two years – BBC

Products and services

NS&I launches new fixed-rate savings accounts – This Is Money

Robin Hood offers EU customers access to 200 ETFs and stocks – ETF Stream

Get up to £2,000 when you switch to an Interactive Investor SIPP. Terms and fees apply. – Interactive Investor

Goldman Sachs’ Marcus offers 4.55% one-year savings to new sign-ups – Marcus

Warning over hefty car renewal price rises – Guardian

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply. Capital at risk) – InvestEngine

Experian (re)launches free credit reports – Be Clever With Your Cash

Budget airlines increase cabin baggage sizes ahead of EU rules – Guardian

Homes for sale with outbuildings and studios, in pictures – Guardian

Comment and opinion

£100,000 isn’t a big salary, and we need to talk about it – City AM

Why financial independence is overrated – Of Dollars and Data

Passive investing is fuelling the rise of mega-firms [Research] – Morningstar

Whatc new FCA ‘targeted support’ rules mean for your finances – Which

Slow, steady, sustainable – A Teachable Moment

The boomerang bankers for whom escape becomes exile [Paywall] – FT

How house sitting services enabled one couple to save to buy in London – Standard

Can you get Berkshire-like returns without Buffett? – Meb Faber

Solving the retirement income puzzle [Podcast] – Humans vs Retirement

Private markets update mini-special

Private equity mid-year report – Bain and Company

A valuation reckoning looms – Verdad

The past is prologue for private equity fund returns – K.O.I.

Naughty corner: Active antics

WisdomTree Europe Defence ETF passes $3bn AUM in three months – Trustnet

Buying baskets of swan-diving stocks can work – Morningstar

Just keep going, or reflect and adapt? – Value and Opportunity

How Harry Stebbings went from a podcast to a $650m VC firm – Forbes

This metric suggests it’s time to chase US stocks – Sherwood

London-listed companies pile into Bitcoin [Paywall] – FT

Surprisingly winning chat with billionaire Mike Novogratz [Podcast] – My First Million

Productivity mini-special

Why ‘micro-efficiencies’ are on the rise – Guardian

A new approach to productivity – VegOut

Kindle book bargains

The Tipping Point by Malcolm Gladwell – £0.99 on Kindle

Chip War: The Fight for the World’s Most Critical Technology by Chris Miller – £0.99 on Kindle

The Everything Store: Jeff Bezos and the Age of Amazon by Brad Stone – £0.99 on Kindle

Essentialism: The Disciplined Pursuit of Less by Greg McKeown – £1.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

In Japan, fewer people doesn’t always mean more biodiversity – The Conversation

Scientists question this startup’s plan to save the oceans – Associated Press

Can mirrors in space and underwater curtains save the Arctic ice caps? – Guardian

Dual heat domes hit Europe and US [Paywall] – FT

Leeds-Liverpool canal lock gates closed due to lack of rainfall – BBC

Robot overlord roundup

How to get the most out of AI deep research – Operator’s Handbook

Swedish ‘vibe coding’ AI startup Lovable raises $150m at near-$2bn valuation… – T.N.W.

…while GitHub CEO asks: has AI made ‘learn to code’ obsolete? – Freethink

ChatGPT wipes out entry-level jobs – City AM

Productivity, AI, and pushback – Seth Godin

Second-order beneficiaries of AI [Research, April, PDF] – Morgan Stanley

Not at the dinner table

Would you rather have cheap energy, or stupid culture wars? – Noahpinion

The alarming rise of officers behind masks in the US – Guardian

Off our beat

Biscuit museum’s Jaffa Cake display reignites old debate – Guardian

The story of how Google became Google [Podcast] – Acquired

Are two Star Wars Jawa figures from the 1970s worth £60,000? – This Is Money

The ascendance of algorithmic tyranny – Noema

Salvation from slop – Not Boring

The U-shaped happiness/age curve has become a slope [PDF] – NBER

Indie music legends pick their favourite Oasis songs – Guardian

And finally…

“To finish first you have to finish.”

– Charlie Munger, Damn Right!

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.