Moneywise and Yahoo Finance LLC may earn commission or revenue through links in the content below.

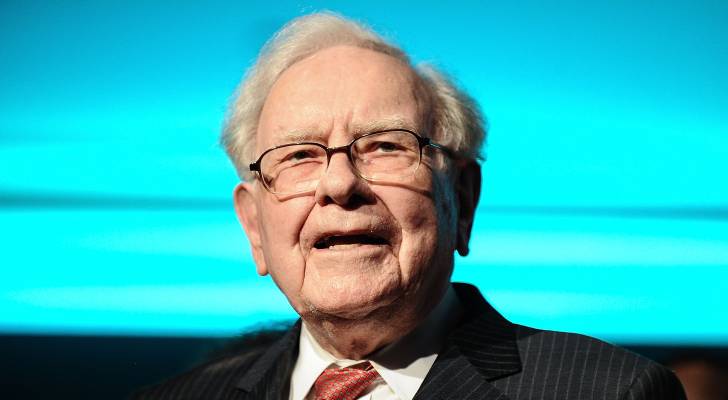

Investing is a notoriously noisy industry, but Warren Buffett has always managed to cut through the clutter with his simple yet powerful advice.

One of Buffett's most overlooked nuggets of wisdom is about focusing on the right type of business.

In a letter to Berkshire Hathaway shareholders, he once wrote that “the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

“The worst business to own,” Buffett continued, “is one that must, or will, do the opposite — that is, consistently employ ever-greater amounts of capital at very low rates of return.”

At age 94, Buffett recently decided to retire from his longtime post as CEO of Berkshire Hathaway. At the time of his announcement in May, he ranked fifth on the Forbes real-time billionaires index, with a net worth of $160 billion.

Here are some great examples of his advice — and holdings — in action.

Buffett’s largest holding is Apple, the iPhone maker based in Cupertino, California. Despite a major selloff in 2024, when Berkshire Hathaway dumped roughly $80 billion of Apple stock, the company still makes up 22% of Berkshire’s portfolio. That’s more than any other single holding.

The iPhone’s continued popularity, alongside solid high-margin segments for its services and software makes Apple an attractive investment.

Most tellingly, Apple’s return on invested capital (ROIC) is currently sitting around 47%. That’s exactly the kind of capital efficiency that Buffett described as the hallmark of a great investment. It means for every dollar Apple reinvests into the business, it earns nearly half of it back in profit annually. That’s Buffett’s investing principle in full force.

Robinhood offers a simple and convenient way to invest like Buffett in a wide variety of stocks, ETFs and options. Its platform provides commission-free investing in companies like Apple — meaning you won’t pay any extra fees to invest with Robinhood. It’s an easy and cost-effective way to add some of Buffett’s favorite stock picks to your portfolio.