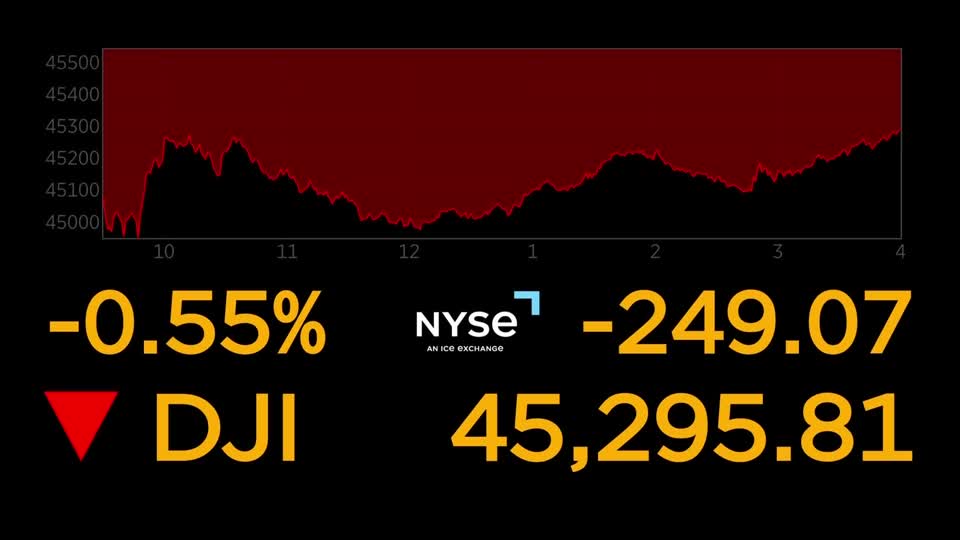

STORY: Wall Street started September on a sharply lower note on Tuesday, with the Dow losing more than half a percent, the S&P 500 shedding roughly seven-tenths of a percent and the Nasdaq sliding more than eight tenths of a percent.

Investors returned from the Labor Day holiday rattled by a Friday appeals court ruling that most of President Trump's tariffs are illegal.

Trump responded Tuesday afternoon by saying his administration will ask the Supreme Court for an expedited ruling on the tariffs.

The latest tariff turmoil comes as markets enter what is traditionally a weak month for stocks with more uncertainty, says Mike Mussio, president of FBB Capital Partners.

“And so now something that we thought was kind of settled isn't maybe as settled as we had expected. And thereby we're getting a little bit of market turmoil. Earnings are kind of behind us at this point. Last week was big earnings, kind of the final large earnings week. And we're heading into September with a much-awaited, or much anticipated, I should say, jobs report on Friday. So some concern over how far this tariff thing really has run through and a new data point ahead of a Federal Reserve meeting in a few weeks. And we got some weakness in the markets.”

Stocks on the move Tuesday included Alphabet, which soared more than 6% in extended trading after a U.S. district judge ruled that the tech giant does not have to sell off its Chrome browser. But the judge said Alphabet does have to share its data with online search rivals.

Shares of Kraft Heinz fell about 7% after the packaged goods giant said it will split into two listed companies, unwinding a decade-old merger, with the combined company never achieving its expected growth.

On the flip side, shares of PepsiCo gained roughly 1% after Elliott Management disclosed a $4 billion stake in the beverages company, urging it to revive its soda business, boost its share price and become more competitive.