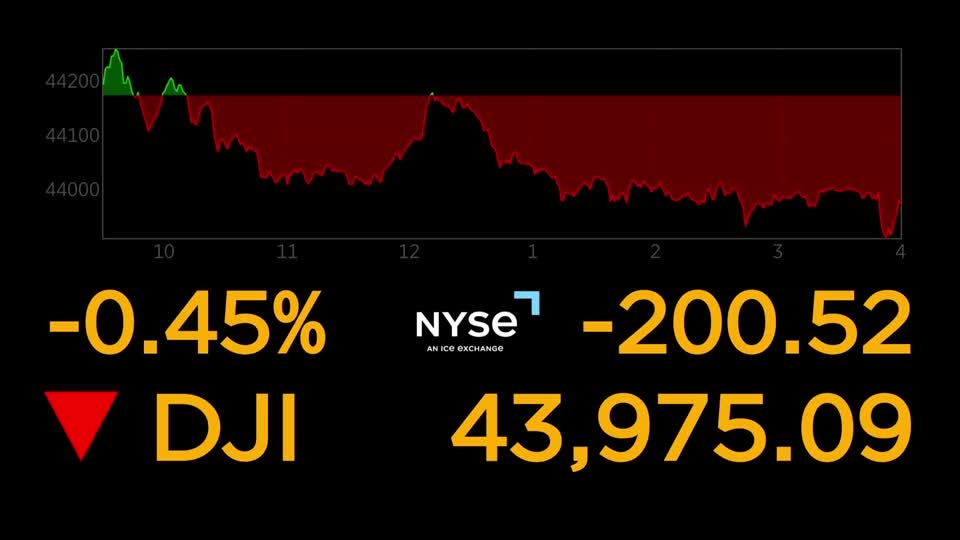

STORY: Wall Street's main indexes ended lower on Monday, with the Dow dropping almost half a percent, the S&P 500 shedding a quarter of a percent and the Nasdaq losing nearly one-third of a percent.

Investors digested reports that major semiconductor companies Nvidia and AMD had agreed to give the Trump administration 15% of revenue from sales of their advanced chips to China.

Separately, President Trump said gold would not be subject to tariffs, appearing to reverse Friday's reports that tariffs could be placed on some gold imports.

Trump also signed an executive order extending a pause in sharply higher U.S. tariffs on Chinese imports for another 90 days.

The latest news trade news contributed to Monday's risk-off sentiment for stocks, said Ross Mayfield, investment strategist at Baird Private Wealth Management.

“There's still a little bit of uncertainty around the macro backdrop, right? Tariffs, you had kind of some headlines about whether gold would be under tariffs. You had some mixed news around semiconductors and the new, pretty unusual kind of collaboration, if you want to call it that, between AMD and Nvidia and the US government. So I think markets, again, sitting right near all-time highs, sentiment has caught up to price.”

Among individual movers, shares of Micron Technology gained 4% after the chipmaker raised its forecast for fourth-quarter revenue and adjusted profit.

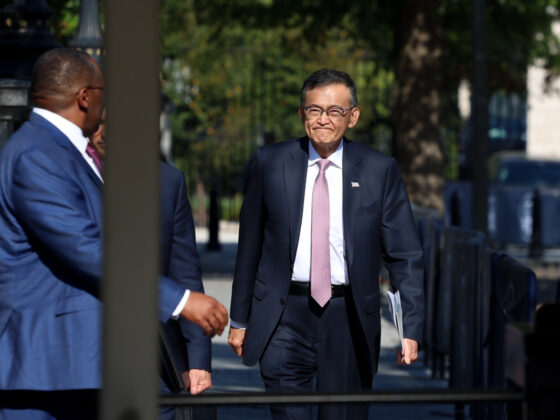

Intel's stock rallied 3.5% after a report said CEO Lip-Bu Tan arrived at the White House on Monday. Trump had called for his removal last week.

Investors now turn their focus to July's consumer price index inflation report, due on Tuesday, for clues on whether the Federal Reserve will lower interest rates at its September policy meeting.