The move off the early April lows is impressive. The S&P 500 dropped 10% following President Trump's tariff announcement on April 2, so-called “Liberation Day,” but has since recaptured all its losses and made new highs.

The S&P 500's spring sell-off was fast and unexpected, sparking fear that trade war uncertainty would serve as a catalyst for stagflation or outright recession. As a result, many investors sold top performers, including Nvidia, before a massive post-sell-off run higher.

An 82% rally in Nvidia's stock price since its early April low likely surprised many, and investors who missed the buy-the-dip move are likely shaking their heads, wondering if it's too late to buy.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

One who wasn't caught flat-footed by Nvidia's move is veteran Wall Street fund manager Dan Niles.

In late April, he said Nvidia shares would likely continue climbing, writing in a post on X, “$NVDA: While their quarter ends in April, four reasons make me optimistic on the stock in the near-term,” citing surging AI inference demand, among other things.

It wasn't Niles's first correct call this year. In December, he chose cash as his top holding for 2025 over worries that stocks would drop before the S&P 500's 19% drop beginning in February. In April, he suggested the market sell-off was overdone, setting stocks up for gains.

Now that Nvidia has rallied sharply higher to become the US stock market's largest company, with an eye-popping $4 trillion market capitalization, Niles has updated his outlook in the wake of a surprising shift in US-China regulations.

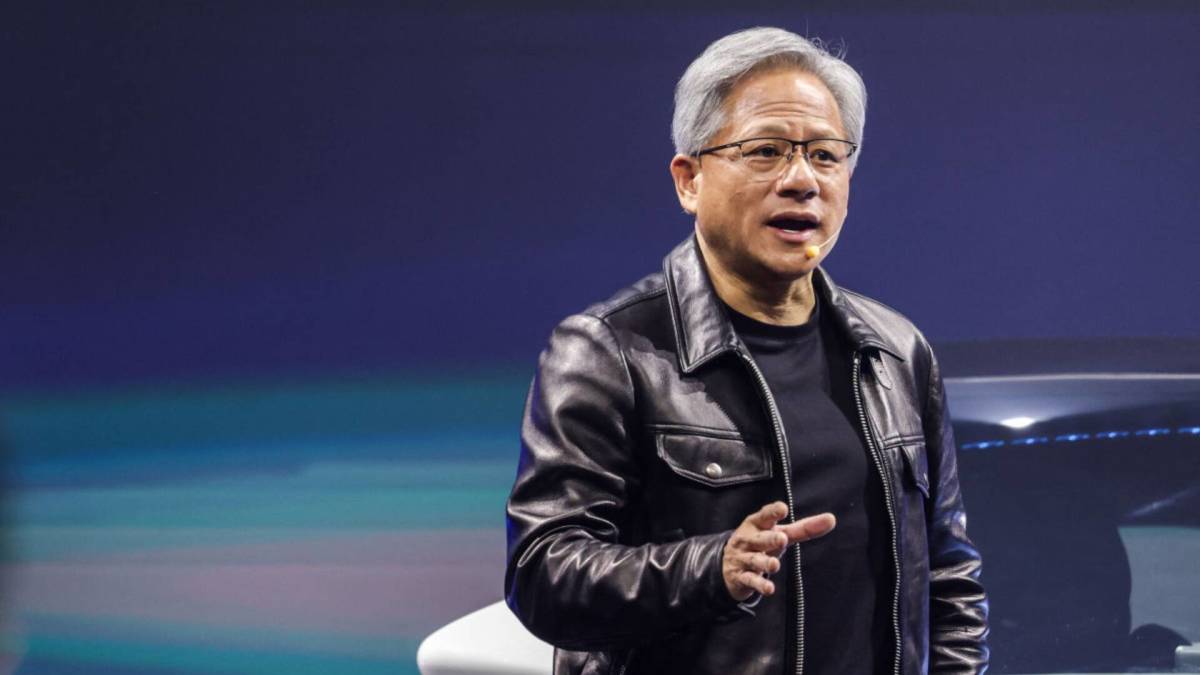

Image source: I-Hwa Cheng/AFP via Getty Images

Nvidia rides tsunami of AI demand to record highs

Nvidia's ascent over the past few years is one for the record books. OpenAI's launch of ChatGPT—the fastest app to reach one million users—uncorked a tidal wave of interest in artificial intelligence research and development, causing Nvidia's revenue, profit, and share price to skyrocket.

Related: Market legend makes surprising stock market bet

Seemingly, everyone is getting in on the AI action.

Banks are using AI to hedge risks on portfolios and loans, manufacturers are evaluating its use in quality control and automation, retailers are embracing it to stop retail theft and improve supply chains, and healthcare companies are seeing if it can improve drug development and treatment. Even the US military is considering its use on the battlefield.

AI may seem like a new thing, given that talk of it is everywhere. But AI R&D has been happening for many decades.

The mathematician and computer scientist Alan Turing investigated AI computer design in the 1950s, and Rand Corp. developed the first AI program in 1956. Over the years, many science-fiction books and movies, including Terminator, have examined the potential of machines someday thinking for themselves.

ChatGPT's launch has been AI's biggest Main Street moment, though. The large language model's ability to quickly parse data has spawned many rivals, including Google's Gemini, China's DeepSeek, and Amazon-backed Anthropic. Microsoft has rolled out CoPilot, and Meta Platforms is in the mix too.

There's also been a surge in agentic AI in the past 12 months as companies of all sizes look to find ways to leverage AI “agents” for productivity and cost savings.

All this means there's a tremendous need for computing power, and unfortunately, most networks aren't optimized to handle AI's heavy workloads.

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

As a result, hyperscalers like Google Cloud, Amazon's AWS, and Microsoft's Azure, along with most hybrid and private enterprise networks, have rushed to replace clunky servers running on legacy CPUs with high-end solutions like liquid-cooled server racks powered by Graphics Processing Units (GPUs).

This seismic shift in network infrastructure has created a tsunami of demand for Nvidia, the de facto leader in GPUs and the software necessary for running them efficiently.

The company's latest Blackwell GPUs can cost $30,000 to $40,000 each, and fully equipped server racks can cost millions.

Unsurprisingly, Nvidia's annual revenue has surged to over $130 billion from about $27 billion in 2022, and its profit has similarly skyrocketed thanks to juicy margins. Its net income was $73 billion last fiscal year, up from $9.8 billion in 2022.

Over this period, Nvidia's share price has catapulted 1,080% higher.

Nvidia regains footing as China headwind eases

Nvidia's rapid growth and share gains have rewarded long-term investors, but stocks don't rise or fall in a straight line, and even the most successful companies suffer hiccups.

Related: Billionaire Ackman has one-word message on stock market

After notching all-time highs in February this year, shares came under pressure as economic worries raised concerns that AI infrastructure spending is peaking, particularly in the wake of reports that DeepSeek's latest AI chatbot was developed for only $6 million on older, less costly hardware.

Nvidia was also dealt a blow by ongoing US regulatory scrutiny over selling next-gen technology to China. Worry that China may use Nvidia's GPUs against the US someday prompted significant restrictions on Nvidia's ability to market chips in China, resulting in a ban on sales of its most popular chip in China, the H20.

In response, Nvidia was forced to take a $5.5 billion write-off earlier this year.

The combination of a weakening stock market, economic recession risks amid tariff-fueled trade wars, AI spending risks, and product bans contributed to Nvidia stock falling 41% from its January high to its April low.

Nvidia's shares have since recovered lost ground, with investors broadly concluding that the worst is now behind it.

Hyperscaler and enterprise AI spending has yet to wobble and recently, President Trump's administration cleared the way for Nvidia to resume H20 chip sales in China, removing a key overhang.

The potential for agentic AI to fuel inference demand for chips has also accelerated.

The backdrop for improving tailwinds isn't surprising to Niles, given his late April conclusion that Nvidia's stock could head higher. And now that the China chip freeze has thawed, Niles has rebooted his bullish outlook.

“W/ export restriction coming off, expect an order surge from China for $NVDA given fears they could come back,” wrote Niles on X. “China has half the AI researchers in the world & is at least 20% of AI chip demand. China rev was out of Nvidia estimates post write-down but is now coming back.”

In April, Niles said he didn't anticipate removing China restrictions, which could now allow Nvidia to eventually “get clearance to sell a detuned version of their latest Blackwell chip into the China market at some point.”

That possibility could lead to a rethink of analysts' forward revenue and earnings estimates, with increases potentially supporting stock prices. Gene Munster of Deepwater Asset Management thinks consensus revenue estimates could climb 10%.

And, as for the risk that slowing AI R&D for training new AI chatbots and AI apps could ding demand for chips, Niles isn't convinced given token growth associated with using AI agents.

“As agentic AI increasingly gets adopted and proliferates across the one device consumers always have with them, the smartphone, this token growth should remain strong,” wrote Niles. “Hardware demand for inference should ultimately dwarf the demand for training.”

Todd Campbell has owned shares in Nvidia since 2017.

Related: Legendary fund manager has blunt message on ‘Big Beautiful Bill'