While the use of Markov chains — a statistical framework to decipher the probability of one event transitioning to another — in finance is not a novel concept, it’s not deployed effectively. In my research, I have come across two papers analyzing Markovian principles in the stock market: “Stock market analysis with a Markovian approach” by the KTH Royal Institute of Technology and “Forecasting Stock Prices using Markov Chains: Evidence from the Iraqi Stock Exchange” by the University of Sumer.

Conceptually, both papers attempt to decipher the utility of Markov chains to predict future market trajectories, which should yield compelling results. After all, the concept originated from Russian mathematician Andrey Markov, one of the most brilliant scientific minds and thought leaders. Unfortunately, the researchers from the aforementioned academic institutions extracted only negligible to marginal performance metrics relative to a coin toss — so, what the heck is going on here?

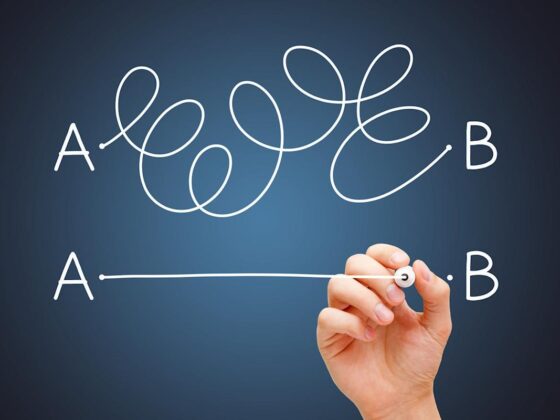

Fundamentally, the problem centers on the researchers’ deployment of a “literal” Markov chain — one time unit in the past to determine one time unit in the future. To be fair, KTH ran a study featuring two time units in the past but the same problem applies — the analysis would only capture an isolated price action without consideration of the underlying context or sentiment regime.

In short, the academic papers’ input is Gaussian in nature; therefore, we shouldn’t be surprised if the output is also Gaussian. In order to generate a true Markovian framework, the input must also be Markovian.

To achieve a proper framework, it’s vital to apply the spirit of the law rather than the letter of the law. My solution is to discretize the last 10 weeks of price action and segregate the profiles into distinct, discrete behavioral states. This way, we’re not just capturing isolated price action but sustained behaviors — behaviors that can better predict outcomes based on underlying situational dynamics.

Using modified Markov chains optimized for the stock market, below are three statistically compelling ideas to consider this week.

While shares of Domino’s Pizza (DPZ) are up nearly 8% so far this year, they’re down nearly 3% in the trailing month. In the past two months, the price action of DPZ stock can be converted as a “3-7-D” sequence: three up weeks, seven down weeks, with a negative trajectory across the 10-week period.