America’s trading partners have largely failed to retaliate against Donald Trump’s tariff war, allowing a president taunted for “always chickening out” to raise nearly $50bn in extra customs revenues at little cost.

Four months since Trump fired the opening salvo of his trade war, only China and Canada have dared to hit back at Washington imposing a minimum 10 per cent global tariff, 50 per cent levies on steel and aluminium, and 25 per cent on autos.

At the same time US revenues from customs duties hit a record high of $64bn in the second quarter — $47bn more than over the same period last year, according to data published by the US Treasury on Friday.

China’s retaliatory tariffs on American imports, the most sustained and significant of any country, have not had the same effect, with overall income from custom duties only 1.9 per cent higher in May 2025 than the year before.

Combined with limited retaliation from Canada, which has yet to release second-quarter customs data, the duties imposed on American exports worldwide represent a tiny fraction of the US revenue during the same period.

Some other US trading partners decided against responding in kind while negotiating with Trump to avoid even higher threatened tariffs.

The EU, the world’s biggest trading bloc, has planned counter-tariffs but has repeatedly deferred implementation, now linking them to Trump’s August 1 deadline for talks.

The cost of Trump’s tariffs are also not falling solely on American consumers, supply chain experts say, as international brands look to spread the impact of cost increases around the globe to minimise the impact on the US market.

Simon Geale, executive vice-president at Proxima, a supply chain consultancy owned by Bain & Company, said major brands such as Apple, Adidas and Mercedes would look to mitigate the impact of price increases.

“Global brands can try and swallow some of the tariff cost through smart sourcing and cost savings but the majority will have to be distributed across other markets, because US consumers might swallow a 5 per cent increase, but not 20 or even 40,” Geale said.

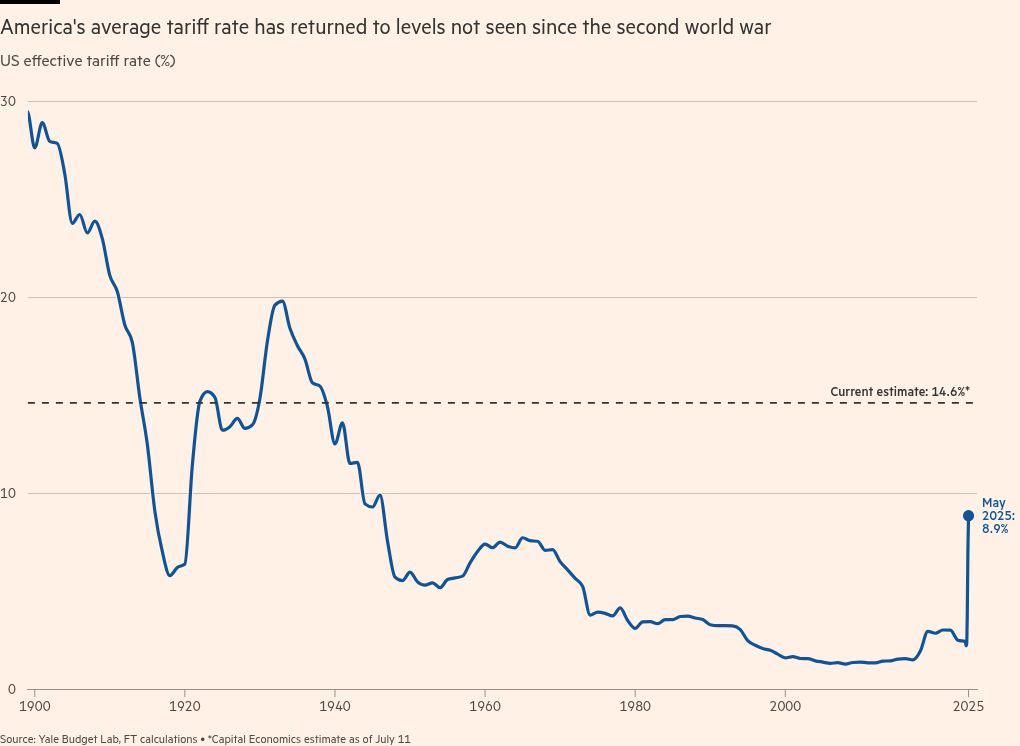

But despite US tariffs hitting levels not seen since the 1930s, the timidity of the global response to Trump has forestalled a retaliatory spiral of the kind that decimated global trade between the first and second world wars.

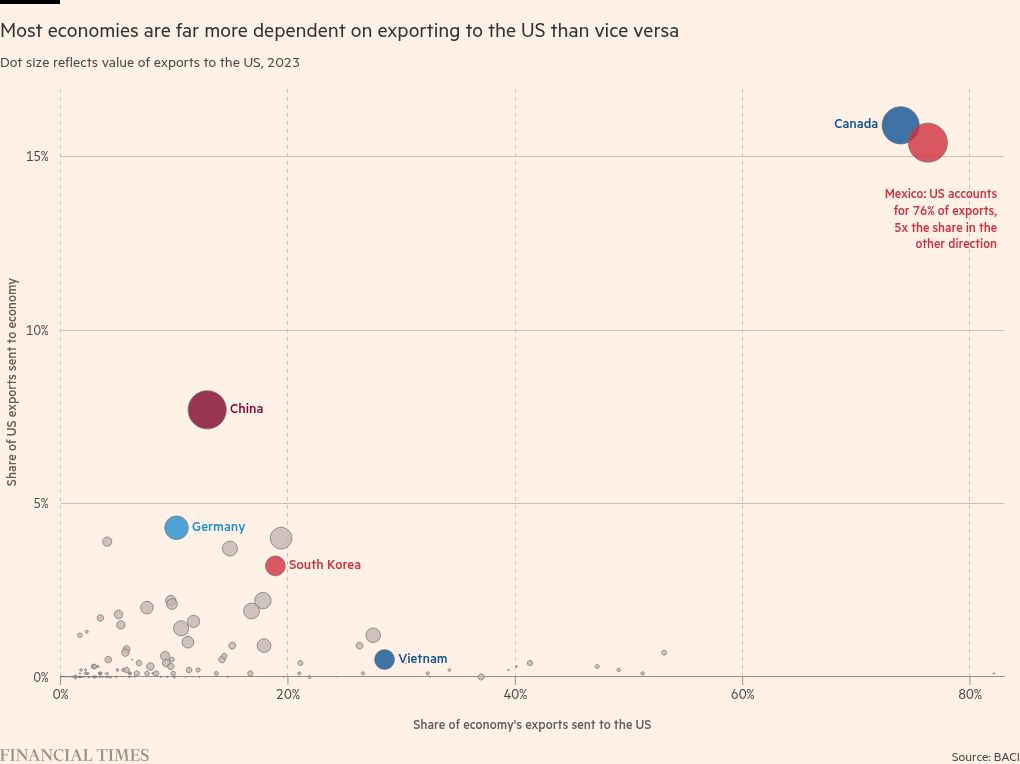

Economists said the US’s dominant position as the world’s largest consumer market, coupled with Trump’s threats to redouble tariffs on states that defy him, meant that for most countries the decision to “chicken out” was not cowardice, but economic common sense.

Modelling by Capital Economics, a consultancy, found that a high-escalation trade war where the average reciprocal tariff rate reached 24 per cent would cause a 1.3 per cent hit to world GDP over two years, compared with 0.3 per cent in a base case it remained at 10 per cent.

“Unlike the 1930s when countries had more balanced trading relationships, today’s world features a hub-and-spoke system with the US at the centre,” said Marta Bengoa, professor of international economics at City University of New York. “That makes retaliation economically less desirable for most countries, even when it might be politically satisfying.”

Alexander Klein, professor of economic history at Sussex University, added that short-term considerations — reducing exposure to tariffs and minimising the risk of inflation — were driving most negotiations with Trump, which gave the White House the upper hand.

“I’d like to think leaders were learning the lessons of history, but I fear that’s optimistic. More likely, the EU, Canada and many other governments fear the hit to global supply linkages and inflation from escalation,” he said. “Trump cares less about that, so is taking advantage.”

The US’s largest trading partner Mexico did not retaliate after being hit with 25 per cent tariffs in March on exports not covered by the US-Mexico-Canada Agreement. From the beginning of her talks with Trump, President Claudia Sheinbaum said she preferred a deal.

The failure of the world to unite and collectively face down Trump’s threats has also left the US president more space to pick off individual states. He threatened a 50 per cent tariff on Brazil last week, citing largely political justifications.

“Trump has made it clear that he is prepared to raise tariffs further in the face of retaliation,” said Bengoa of City University of New York. “Many countries learned from the 2018-2019 trade war that retaliation often leads to counter-retaliation rather than negotiated solutions.”

Even within unified blocs such as the EU, the competing interests of individual member states, combined with wider fears over whether a confrontation with Trump could undermine US security guarantees to Europe, have bred intense caution.

Trump’s decision to threaten to increase tariffs to 30 per cent did not provoke a major reaction in Brussels, in part because senior US officials, including Treasury secretary Scott Bessent, reached out behind the scenes to counsel caution, according to insiders.

An EU official familiar with the talks added that negotiations were not taking place in isolation, at a time when Europe was looking for continued US backing for Ukraine. “They affect the whole spectrum of US relations including those regarding security,” they said.

As a result, unlike China which matched Trump tariff for tariff in April, the EU has repeatedly delayed implementing its packages of retaliatory measures as it seeks to leave space to cut a deal with Trump ahead of August 1.

When the European Commission published its latest list of potential retaliatory targets on €72bn of goods on Tuesday — including Boeing aircraft, cars and bourbon — it put no specific tariff rates against individual products, in an apparent attempt not to rile Trump further.

Even Canada and China have been wary of antagonising Trump despite being the only two countries to impose retaliatory tariffs.

US tariffs on China escalated to 145 per cent by mid-April, causing Chinese exports to the US to plummet by a third in May. Both sides quickly stepped back, agreeing a 90-day pause in Geneva in May, cutting the rate down to 30 per cent.

In February and March Canada imposed nearly C$155bn in retaliatory tariffs, including on steel and auto parts. In recent weeks though it has retreated in the face of US pressure despite election promises by Canadian premier Mark Carney to confront Trump.

With US trade accounting for 20 per cent of Canadian GDP — compared with 2 per cent for the US — Carney has calibrated his responses. He ditched a digital services tax under US pressure and did not match Trump’s decision last month to double steel tariffs to 50 per cent.

“Carney’s ‘elbows up’ rhetoric worked during the election campaign, but we can’t be confrontational with the US,” said Dan Nowlan, an adviser to former Conservative Canadian premier Stephen Harper. “It’s now a much more realist approach.”

Diplomats say whether the world will eventually unite to confront Trump will depend in part on where tariff levels settle around the August 1 deadline.

Trade commissioner Maroš Šefčovič said this week that a 30 per cent tariff on EU exports would leave the bloc with nothing to lose since transatlantic trade would be “almost impossible”. He added the EU was talking with “like-minded” trading partners about potential joint measures.

Longer term, the failure to retaliate would also give US companies a relatively free pass into global supply chains while EU and Asian manufacturers still faced high tariffs into the US, said Creon Butler, head of global economy at Chatham House.

“The calculation is short term versus long term,” he said. “It makes sense not to retaliate in the short term, but long term, there’s a calculation for other countries over the extent to which we are going to fight for global supply chains outside the US.”

Additional reporting Henry Foy in Brussels and Christine Murray