Nvidia (NVDA) has shrugged off broader market jitters and become one of this year’s biggest stock market winners.

Its ubiquitous GPUs have been the gold standard in powering AI breakthroughs, making it a must-have for chip stock investors.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

Moreover, despite hitting record highs this year, Nvidia still has plenty of gas left in the tank.

As we look ahead, it's gearing up to roll out its next-gen GPU system, separating itself further in the data-center space.

If all goes to plan, the chip king’s grip on AI could tighten, and with fresh nods of approval, the runway’s looking long.

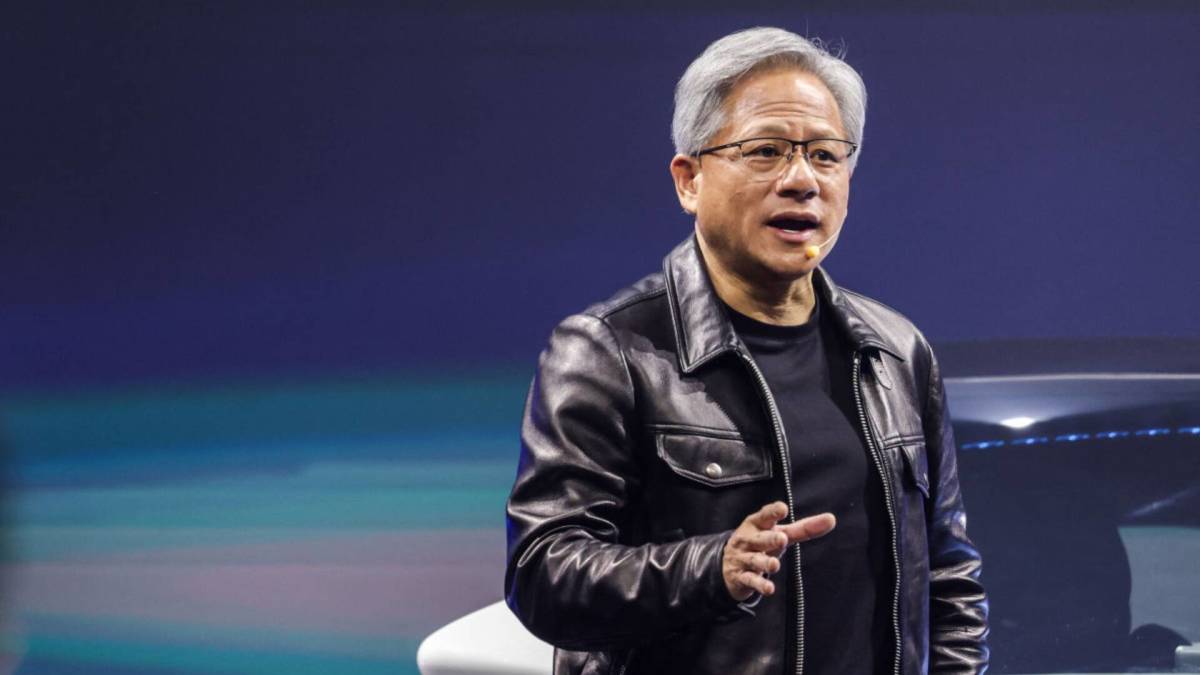

Image source: I-Hwa Cheng/AFP via Getty Images

Why Nvidia’s ecosystem keeps rivals chasing its tail

It’s fair to call Nvidia’s GPU lineup a string of mini revolutions, with each chip line outdoing the last by a country mile.

It started with Ampere, a massive step-up in performance-per-watt lift and beefed-up Tensor cores. Ampere was a smash hit with the hyperscalers, who looked to power everything from recommendation engines to early AI proofs of concept.

Then we had Hopper. Nvidia packed in a special Transformer Engine, boosted NVLink speed, and tweaked its chips so LLMs could train quicker without blowing the budget.

Hopper cemented Nvidia’s spot as the top dog, both in research labs and mega-scale data centers.

Next came Blackwell Ultra, which turned the game around with smarter data handling, faster memory, and techniques to cut lag.

Related: Veteran analyst drops shocking Tesla target

Suddenly, we saw generative AI come into its own with real-time video, big simulations, and instant data crunching.

Now, there’s Rubin, Blackwell’s successor, which claims to be 3.3× faster. That leap isn’t the usual clock-speed bump, but it means you can cram way more AI workloads into the same rack.

Its next-generation Tensor cores, high-bandwidth memory interface, and liquid-cooled design let companies run multiple models simultaneously.

More Tech Stock News:

- Veteran Tesla bull drops surprising 3-word verdict on robotaxi ride

- Apple could make big change to Siri, delight fans

- Veteran analyst issues big Broadcom call, shakes up AI stock race

Rubin seamlessly ties in with Nvidia’s mature CUDA ecosystem, with every library, toolchain, and optimization getting a lift.

For AI teams, that means shorter training cycles, denser inference deployments, and the freedom to experiment with more complex models simultaneously.

If it all lives up to the hype, Nvidia will prove yet again why it's the indispensable engine behind the AI revolution.

Mizuho analyst backs Nvidia’s AI chip dominance with bold Rubin call

Nvidia stock just scored another stamp of approval from Wall Street.

Mizuho’s top chip analyst, Vijay Rakesh, doubled down on his bullish take on the AI bellwether, with his eyes on the future.

Rakesh expects Nvidia to ship north of 5.3 million AI accelerators this year, jumping to 6 million by 2026. However, he feels the real hype is around Rubin, the next-gen server that Nvidia claims will be 3.3 times faster than Blackwell Ultra.

In addition, if Rubin can shift to an air-cooled option instead of liquid cooling, we could see a lot more data centers adopting Nvidia’s gear.

That tweak alone could lead to an explosion in demand for Nvidia GPUs, as companies look to build their AI muscle without massive infrastructure upgrades.

Related: Veteran analyst offers eye-popping Nvidia, Microsoft stock prediction

Also, Mizuho is keeping an Outperform rating on Nvidia stock with a $170 price target (an 8% jump from July 2's close).

Cantor Fitzgerald, in a recent note, is even more upbeat, keeping its Overweight rating and setting the bar even higher at $200 (27.2% higher than July 2’s close).

Nvidia continues riding high on the tailwind of a blowout second quarter, its 10th consecutive quarter of top- and bottom-line beats. It delivered nearly 60% top-line growth, while its earnings per share of 81 cents beat estimates by six cents.

However, it hasn’t all been smooth sailing for the AI titan.

Two Chinese AI startups, one led by a former Nvidia executive, just filed to go public, stirring up fresh competition. Also, the looming U.S. ban on H20 chip sales to China and Huawei’s rumored H100 challenger have kept the pressure on.

Nevertheless, Nvidia’s pushing hard on new fronts. It's been going all-in on sovereign AI projects in Europe and Saudi Arabia, while building colossal U.S. production hubs for Blackwell to hedge against tariffs.

It’s important to note that on June 25, NVDA spiked 4% to a record $154.10, briefly overtaking Microsoft as the world’s most valuable company,

So it's clear Nvidia’s still the king of AI chips, and the Street’s betting there’s still plenty of room to run.

Related: Veteran analyst drops bold new call on Nvidia stock