In 2025, the vanadium market is navigating a complex landscape shaped by its traditional role in steelmaking and its emerging importance in energy storage technologies.

Approximately 90 percent of vanadium consumption continues to be driven by the steel industry, where it is used to strengthen alloys. However, the growing adoption of vanadium redox flow batteries (VRFBs) for grid-scale energy storage is creating new avenues for demand, particularly as countries pursue decarbonization goals and renewable energy integration.

On the supply side, vanadium sees relatively limited primary production from ore and instead relies on co-production from steel slag and uranium mining, with a portion also coming from recycling. Global production has remained relatively consistent in the 2020s at around 100,000 metric tons per year.

Four countries contribute to the vast majority of that output. Below is a brief overview of these top vanadium-producing countries based on data from the US Geological Survey's 2025 Mineral Commodity Summary.

1. China

Mine production: 70,000 metric tons

China remains the world’s top vanadium-producing country by far, with output of 70,000 metric tons in 2024. Production has remained steady out of China in 2023 and 2024. The Asian nation far outpaces all other countries in terms of vanadium output, and leads the world in vanadium consumption as well due to its high steel production. The majority of its vanadium is produced from steel slag.

In terms of vanadium exports, China's are “quite small,” according to Fastmarkets, as producers can turn a bigger profit in the domestic market.

2. Russia

Vanadium production: 21,000 metric tons

Second on the list is Russia, whose vanadium output totaled 21,000 metric tons in 2024, essentially on par with production in the previous two years. Russia’s vanadium reserves are the second largest in the world at 5,000 MT.

EVRAZ KGOK, part of EVRAZ, is a major mining company in Russia that produces vanadium. Little other information is available about vanadium mining in Russia, and the majority of the country's vanadium production is a co-product of steel slag.

3. South Africa

Vanadium production: 8,000 metric tons

South Africa's vanadium output declined last year, slipping to 8,000 metric tons in 2024, The country's vanadium output had previously held above the 8,500 MT per year a level since 2019.

South Africa’s contributions to the vanadium market consist of primary production from Bushveld Minerals (LSE:BMN) and Glencore (LSE:GLEN,OTC Pink:GLCNF). Bushveld Minerals’ vanadium division includes the Vametco mine and processing facility, the Vanchem processing facility, and the future Mokopane vanadium mine and the Belco production plant. Glencore's Rhovan open-cast mine and smelter complex mainly produces ferrovanadium and vanadium pentoxide.

4. Brazil

Vanadium production: 5,000 metric tons

Brazil's vanadium output has also contracted year-over-year, totaling 5,000 metric tons in 2024 compared to 5,420 MT in 2023.

Brazil’s vanadium production is largely thanks to Largo Resources (TSX:LGO,NASDAQ:LGO), which describes itself as the only pure-play vanadium producer. The company’s Maracás Menchen vanadium asset is one of the highest-grade vanadium mines in the world.

FAQs for vanadium

Who is the largest exporter of vanadium?

Brazil is the world’s largest exporter of vanadium, with Russia in second place and China and South Africa nearly tied. Brazil alone is responsible for over one-quarter of the metal’s global export market, and the four combined represented 84 percent of the market in 2023.

Which country has the most vanadium reserves?

Australia has the highest vanadium reserves in the world, coming in at 8.5 million MT as of 2024, although it should be noted that only 3 million MT are JORC compliant. Russia is in second place with 5 million MT of vanadium reserves, while China is next in line with vanadium reserves of 4.1 million.

What is vanadium used for?

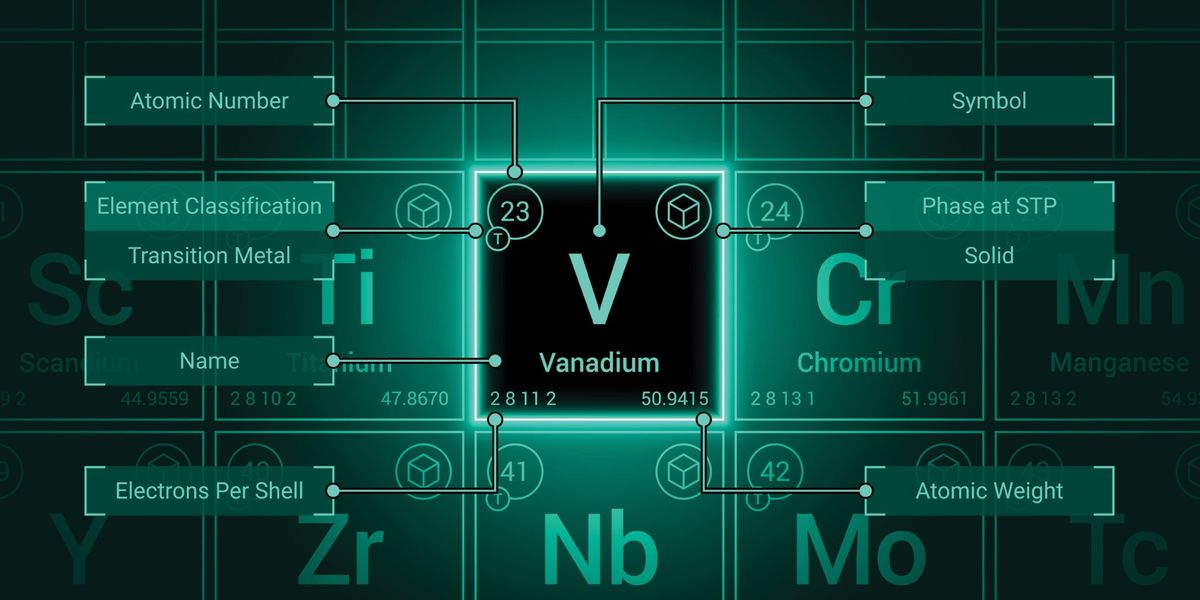

Vanadium is essential in various alloys, with the most common being ferrovanadium, an alloy of iron and vanadium metal that is used in steel production. Beyond these traditional applications, the silvery-gray metal's uses in the battery industry are growing — it's increasingly being used in vanadium redox batteries for large-scale stationary energy storage.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web