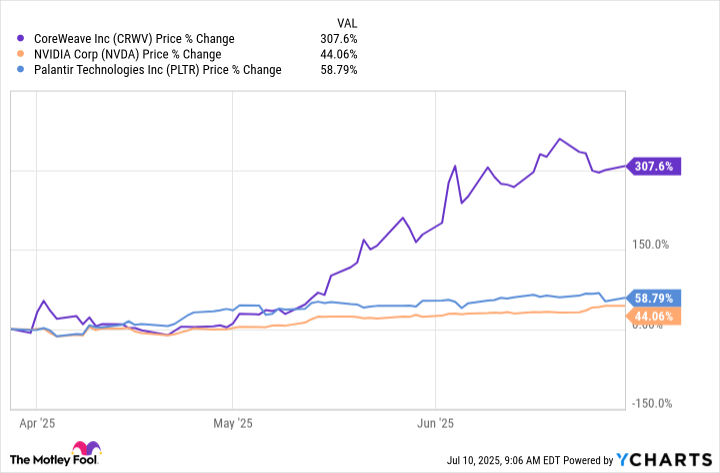

Over the past couple of years, Nvidia (NVDA 0.53%) and Palantir Technologies (PLTR -0.33%) have both shown their strengths in artificial intelligence (AI) — and as a result, their earnings and stock performance have soared. Last year, Nvidia was the best-performing component in the Dow Jones Industrial Average (though it only was added to the venerable blue chip index in November), and Palantir posted the biggest gain in the S&P 500.

Both of these players have continued to advance, and considering that we're in the early stages of the AI boom, more earnings growth and stock price gains could be on the way. But, in the first half of 2025, another company emerged as a potential AI powerhouse. In fact, this particular stock actually outperformed Nvidia and Palantir in the period, climbing by a mind-boggling 300%. Now you may be wondering whether this high flyer is still a buy.

Image source: Getty Images.

A company with close ties to Nvidia

This top-performing AI stock actually is new to the market, completing its initial public offering in late March, so its triple-digit gains took place over a period of only three months. I'm referring to CoreWeave (CRWV -9.01%), a company that is closely linked to Nvidia. This is because CoreWeave generates most of its revenue by renting out access to its vast collection of Nvidia graphics processing units (GPUs). The company has more than 250,000 of them deployed across its cloud infrastructure platform, and it specializes in handling AI workloads, offering customers the configurations they need to accomplish their goals faster.

Nvidia owns a 7% stake in CoreWeave, and made it possible for the young company to be the first to launch its latest GPUs. In February, CoreWeave became the first hyperscaler to make Nvidia's new Blackwell architecture broadly available — and it just did the same recently with the latest iteration, Blackwell Ultra.

So, a bet on CoreWeave is a bet on demand for Nvidia's latest chips. Its first-quarter earnings report showed this demand is going strong, as its revenue climbed by more than 400% year over year, and Nvidia's own Q1 earnings report offered additional clues: For example, Nvidia said it saw a leap in demand for inferencing computing power in the quarter. This sort of trend is likely to benefit CoreWeave.

GPUs to fuel inferencing

Inferencing is the process an AI model goes through when attempting to answer complex questions — and it takes significant parallel processing power of the type provided by GPUs and other AI accelerators. As more people and organizations apply AI to real-world problems, inferencing could drive a whole new era of growth for companies like Nvidia and CoreWeave. It's important to remember that the need for GPUs doesn't end once a model is trained. CoreWeave's fleet of cloud servers may have plenty of busy days ahead over the long term.

All of this is great, but CoreWeave still carries some risk for shareholders — and that's due to the enormous and ongoing investments in infrastructure required to serve demand for GPUs. The company will have to keep up its capital spending to increase the size and power of its fleet of GPU clusters, and considering that Nvidia aims to roll out new chip architectures annually, CoreWeave will have to make those investments frequently to keep its offerings top of the line.

All of this makes it difficult to estimate when CoreWeave will reach profitability. In the first quarter, its technology and infrastructure expenses surged by more than 500% to about $500 million, and it's fair to say the company is early in its growth story. It's also important to note that CoreWeave is in an expansion phase that involves other investments too. Some of those up-front costs may result in savings down the road.

Acquiring Core Scientific

One example is the company's recently announced plan to buy Core Scientific — once that deal closes, CoreWeave no longer will have to pay rent to the data center operator, resulting in the savings of $10 billion in future lease payments. Though this will be a positive, CoreWeave's stock fell after the announcement earlier this week due to investors' concerns about share dilution — it's an all-stock deal with a value of $9 billion. Investors also know that any acquisition comes with some risks and costs, as the buyer will have to integrate its new operations into its existing business.

So the question remains: After strongly outperforming two of the market's biggest AI companies year to date, is CoreWeave still a buy? The answer depends on your investment strategy. If you're a cautious or value investor, you'd be better off exploring other opportunities. But if you're an aggressive investor who buys and holds stocks for the long term, now would still be a good time to add a few CoreWeave shares to your portfolio — demand for AI and CoreWeave's immediate access to Nvidia's latest GPUs could result in major gains over the long run.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.