Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

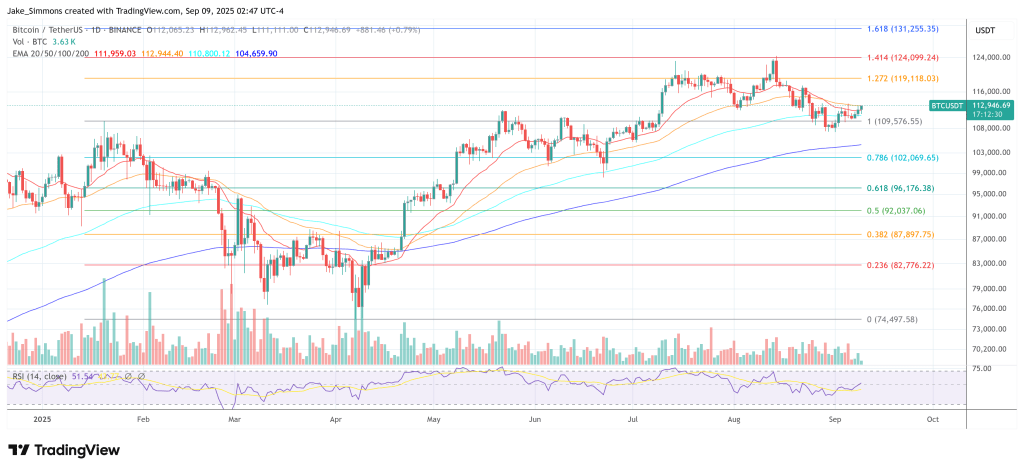

Real Vision analyst Jamie Coutts argues that the current bitcoin market is being driven less by the asset’s four-year issuance cadence and far more by a broadening tide of global liquidity that is only now beginning to roll. In a wide-ranging interview with “Crypto Kid,” Coutts laid out a cycle framework anchored in policy, bank credit, and balance-sheet dynamics, while cautioning that classic momentum warnings and a cooling of corporate-treasury buying warrant respect.

Why This Bitcoin Cycle Is Different

“From a first-principles basis, global liquidity…drives risk assets,” Coutts said, adding that when he regresses bitcoin against his preferred liquidity composite—built from central-bank balance sheets, global money supply, FX reserves and elements of commercial/shadow banking—“you find that there’s explanatory power.” The danger, he warned, is over-fitting a moving relationship. “Markets are non-stationary… The correlation itself is a moving target, so I wouldn’t get too tied up in charts where you’re fine-tuning the lag. That lag period will change all the time.” Even so, he called the connection between liquidity and risk “as good as anything I’ve ever seen.”

Related Reading

The interview opened on a point of contention in recent months: short-term divergences between rising global liquidity gauges and bitcoin’s price since US spot ETFs launched. Coutts pushed back on the idea that the linkage has “broken,” arguing that, sized to bitcoin’s volatility, the current gap is unremarkable. “Within the volatility scope of the asset, [there’s] nothing to worry about,” he said, while noting that his own dollar-sensitive proxy has “been flatlining for a little bit longer” than some popular versions. The right question, he stressed, is not micromanaging a lag but asking whether liquidity is rising on a multi-quarter view—and why.

That macro lens leads directly to policy. Coutts expects an imminent inflection in Western central-bank posture, with rates likely headed lower and balance-sheet tightening at least tapering. “I think it’s very likely we’ll see interest-rate cuts in the September meeting,” he said.

“The question is will the Fed also announce the end of QT or further tapering of QT?” Behind the pivot, in his view, is “fiscal dominance”: the US government’s outsized deficits and refinancing needs compelling monetary authorities to ensure smooth absorption of Treasury supply. “You can forget what they tell you about stable prices and unemployment. They are there to hold up the financial system… and now they are very much tied to the hip of the US government.”

Crucially, Coutts reminded viewers that most money creation comes not from central banks but from commercial banks extending credit. “They’re responsible for around 85% to 90% of all the new money supply,” he said. In practice, liquidity can be “supercharged” when central banks also expand their own balance sheets or alter regulations to encourage banks to accumulate more Treasuries. He also framed Washington’s friendlier posture toward crypto and stablecoins through this prism, calling dollar stablecoins a potential new distribution rail for US debt. The result is a structural backdrop that, in his view, favors higher liquidity over time even if the near-term path is noisy.

The Business Cycle

On top of policy, Coutts layered the business cycle. He argued that the US is edging back into expansion—with recent ISM readings above 50 cited during the discussion—and that the “Goldilocks” setup emerges when an upturn in growth overlaps with a turn higher in liquidity. This, he suggested, is the deeper driver behind the familiar four-year bitcoin rhythm: “Are we really looking at a liquidity cycle that’s dressed up as a bitcoin halving cycle?” As issuance declines over successive halvings, he said, the supply-shock effect becomes “less significant,” while liquidity and growth conditions dominate allocations to “anti-debasement assets.” In that race, he added, “Bitcoin is the emergent anti-debasement asset of the present and the future,” with Ethereum alongside it on longer-horizon performance.

China features prominently in Coutts’ map. He highlighted the People’s Bank of China’s rising balance sheet amid a property-led debt deflation and the government’s push to revive risk assets. “They’re really the only central bank that’s going up,” he said, linking that liquidity to improving Chinese equities and surging gold in yuan terms. In prior cycles, he noted, late-stage bitcoin strength lined up with Chinese equity peaks, and he currently sees “an inverse double head-and-shoulders” pattern pointing to roughly 5,100 on a key China equity benchmark. Two cycles are not “statistically significant,” he conceded, but the mechanism is straightforward: “What’s driving Chinese equities, what’s driving bitcoin? The same thing—it’s liquidity.”

Related Reading

If the structural message is supportive, the tape still demands humility. Coutts called out a weekly-timeframe bearish divergence in bitcoin’s momentum as a genuine risk signal. “Divergences are warning signals… The trend is losing momentum,” he said, recalling similar set-ups ahead of the 2008 crisis and the 2020 pandemic shock. Such signals are probabilistic, not fate, but he urged investors to consider “countervailing circumstances” and risk-management overlays rather than dismissing them.

Why This Bitcoin Cycle is DIFFERENT! (Explained by @Jamie1Coutts)

Timestamps:

00:00 Intro

01:05 Global Liquidity and M2 Money Supply

07:19 Fed’s Balance Sheet

14:45 Liquidity Cycles or Halving Cycles

19:04 Chinese Equities and Bitcoin

23:25 The Bearish Divergences

35:08… pic.twitter.com/VIuA5BFTyu— Crypto Kid (@CryptoKidcom) September 6, 2025

Bitcoin Momentum Fades (For Now)

Related to momentum, he flagged a cooling in the marginal demand engine that powered much of 2024: corporate-treasury accumulation of bitcoin, led by MicroStrategy and followed by a long tail of imitators. “The marginal buyer of bitcoin has been treasury companies and ETFs,” he said, but the “intensity of buying” by treasury vehicles “peaked in Q4 of 2024.” As premiums compress and capital-markets windows narrow, “they can’t buy at the same intensity anymore,” which acts as a drag at the margin.

The host noted that MicroStrategy’s market-to-NAV premium had recently been around 1.5%, adding that Michael Saylor has suggested issuance is far more attractive above roughly 2.0; Coutts’ broader point was that a proliferation of copycats diluted the strategy and left many smaller names trading below intrinsic value—potential acquisition fodder for stronger operators if discounts persist. ETFs, he said, are a steadier bid but lack the leverage-like reflexivity of equity issuance.

On “altseason,” Coutts was blunt that this time will not rhyme with 2021’s helicopter-money mania. He argued that crypto has now found product-market fit, with higher-quality networks boasting users, cash flows and token-burn mechanics that make sense to traditional allocators, while indiscriminate speculation fades.

“The new buyers are much more discerning. They’re not going to buy the 15th or 16th L1, the 10th L2,” he said, predicting concentration in a handful of credible platforms and real-world use cases. He hopes the industry will “never say the word ‘altseason’ again,” preferring to describe what’s coming as a broader “asset-class bull market” with far greater dispersion. The prior “banana zone,” he added, was a creature of lockdowns and stimulus checks; the “velocity of stimulus is different” now, so expectations should be, too.

At press time, BTC traded at $112,946.

Featured image created with DALL.E, chart from TradingView.com