Published on July 29th, 2025 by Bob Ciura

Income investors willing to look outside the U.S. should consider international dividend stocks.

Adding international dividend stocks brings geographical diversification. In addition, many international dividend stocks are offering higher yields, and lower valuations, than their U.S.-based peers.

Of course, there are risks to purchasing international stocks, such as currency risk. Still, there are many quality international stocks that have increased their dividends many years.

We consider stocks that have increased their dividends for over 10 consecutive years to be blue-chip stocks.

You can download our full list of over 500 blue-chip stocks by clicking on the link below:

This article will discuss the top 10 international dividend stocks. All the stocks on the list have increased their dividends for at least 10 years.

Furthermore, they have Dividend Risk Scores of ‘C’ or better in the Sure Analysis Research Database, signifying they have secure payouts.

As a result, these 10 international dividend growth stocks could be attractive for dividend growth investors, looking for international diversification.

Table of Contents

The table of contents below allows for easy navigation. The stocks are listed by 5-year annual expected returns, in ascending order.

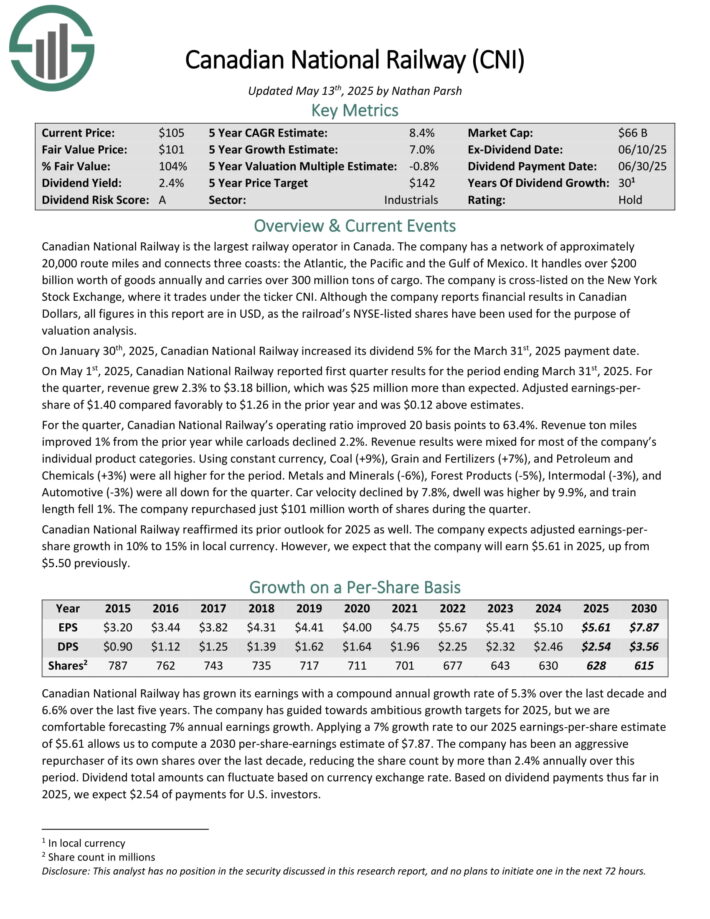

International Dividend Stock #10: Canadian National Railway (CNI)

- Annual Expected Returns: 10.2%

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico.

It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

On May 1st, 2025, Canadian National Railway reported first quarter results. For the quarter, revenue grew 2.3% to $3.18 billion, which was $25 million more than expected.

Adjusted earnings-per share of $1.40 compared favorably to $1.26 in the prior year and was $0.12 above estimates.

For the quarter, Canadian National Railway’s operating ratio improved 20 basis points to 63.4%. Revenue ton miles improved 1% from the prior year while carloads declined 2.2%.

Revenue results were mixed for most of the company’s individual product categories. Using constant currency, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemicals (+3%) were all higher for the period.

Click here to download our most recent Sure Analysis report on CNI (preview of page 1 of 3 shown below):

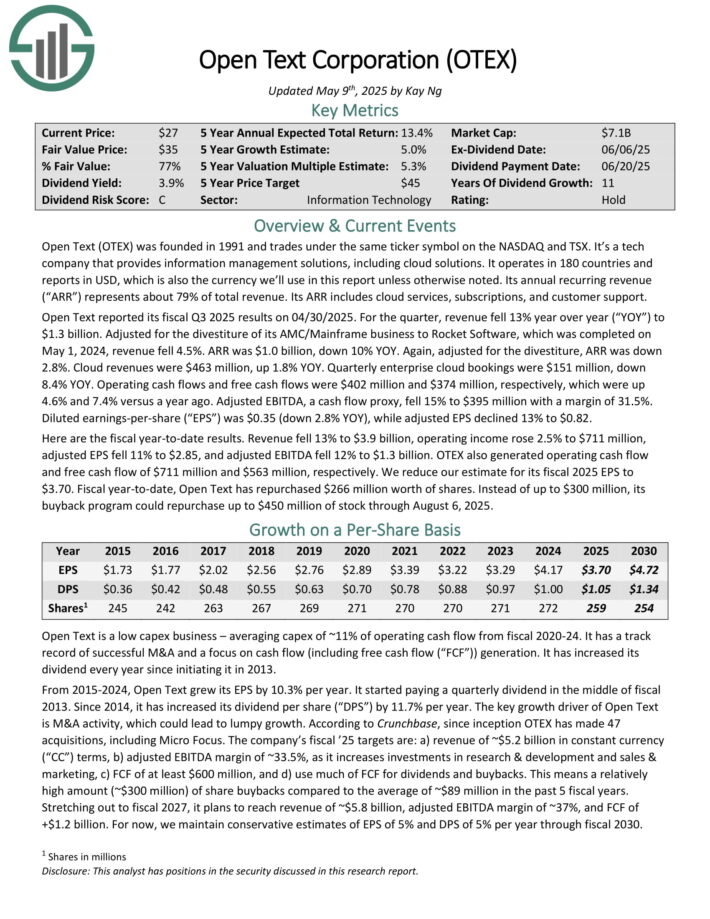

International Dividend Stock #9: Open Text Corp. (OTEX)

- Annual Expected Returns: 11.0%

Open Text was founded in 1991. It provides information management solutions, including cloud solutions. It operates in 180 countries and its annual recurring revenue (“ARR”) represents about 79% of total revenue.

Its ARR includes cloud services, subscriptions, and customer support. Open Text reported its fiscal Q3 2025 results on 04/30/2025. For the quarter, revenue fell 13% year-over-year to $1.3 billion. Adjusted for the divestiture of its AMC/Mainframe business to Rocket Software, which was completed on May 1, 2024, revenue fell 4.5%.

ARR was $1.0 billion, down 10% year-over-year. Again, adjusted for the divestiture, ARR was down 2.8%. Cloud revenues were $463 million, up 1.8% year-over-year.

Operating cash flows and free cash flows were $402 million and $374 million, respectively, which were up 4.6% and 7.4% versus a year ago. Adjusted EBITDA, a cash flow proxy, fell 15% to $395 million with a margin of 31.5%.

OTEX also generated operating cash flow and free cash flow of $711 million and $563 million, respectively.

Click here to download our most recent Sure Analysis report on OTEX (preview of page 1 of 3 shown below):

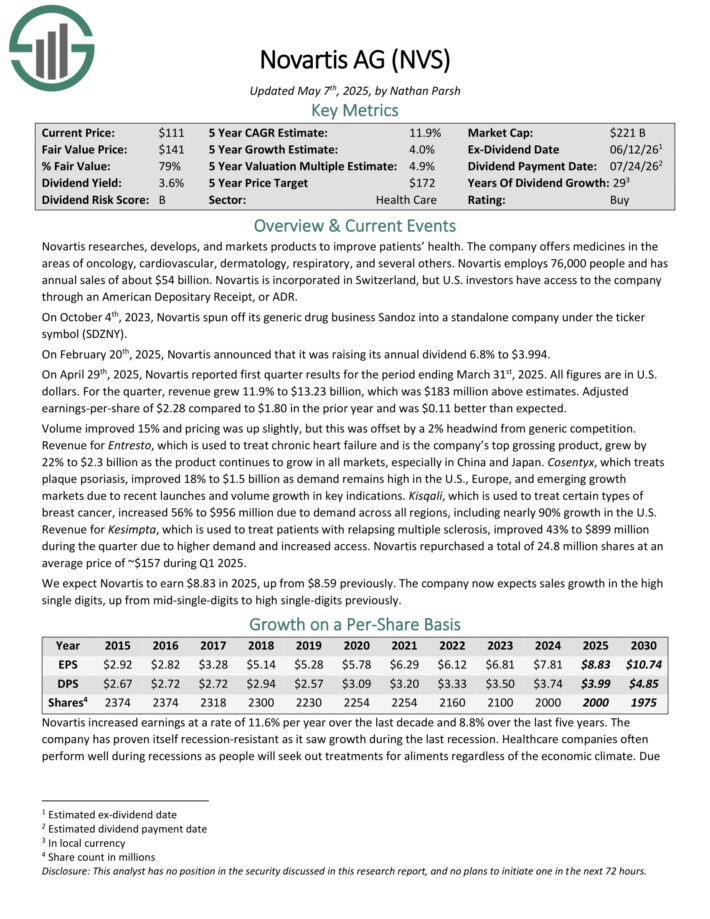

International Dividend Stock #8: Novartis AG (NVS)

- Annual Expected Returns: 11.3%

Novartis researches, develops, and markets products to improve patients’ health. The company offers medicines in the areas of oncology, cardiovascular, dermatology, respiratory, and several others. Novartis employs 76,000 people and has annual sales of about $54 billion.

Novartis is incorporated in Switzerland, but U.S. investors have access to the company through an American Depositary Receipt, or ADR.

On April 29th, 2025, Novartis reported first quarter results. All figures are in U.S. dollars. For the quarter, revenue grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 compared to $1.80 in the prior year and was $0.11 better than expected.

Volume improved 15% and pricing was up slightly, but this was offset by a 2% headwind from generic competition. Revenue for Entresto, which is used to treat chronic heart failure and is the company’s top grossing product, grew by 22% to $2.3 billion as the product continues to grow in all markets, especially in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand remains high in the U.S., Europe, and emerging growth markets due to recent launches and volume growth in key indications.

Click here to download our most recent Sure Analysis report on NVS (preview of page 1 of 3 shown below):

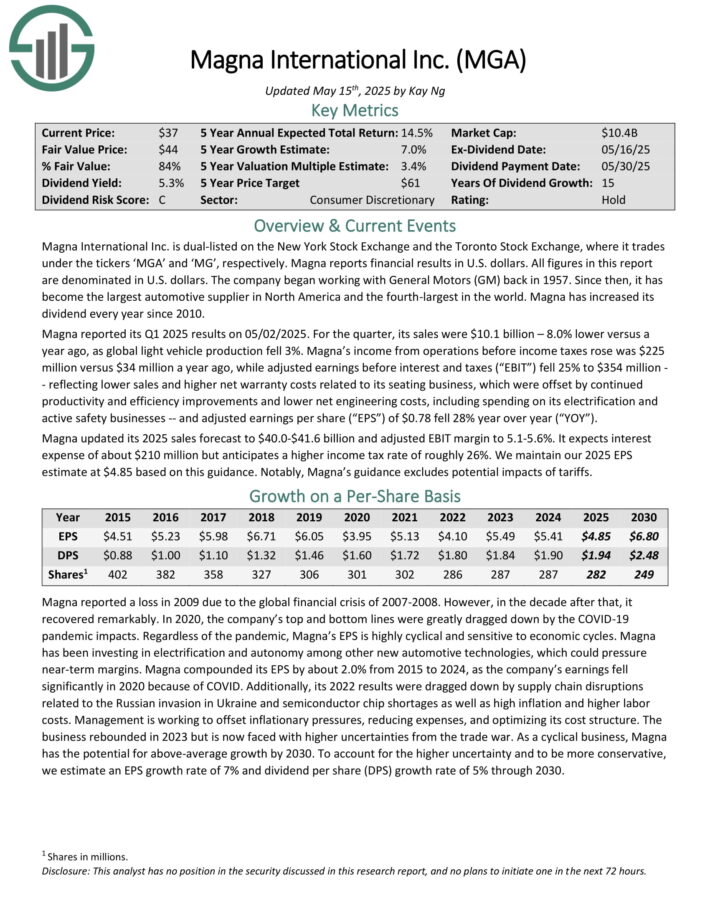

International Dividend Stock #7: Magna International (MGA)

- Annual Expected Returns: 11.4%

Magna International Inc. is dual-listed on the New York Stock Exchange and the Toronto Stock Exchange, where it trades under the tickers ‘MGA’ and ‘MG’, respectively.

It has become the largest automotive supplier in North America and the fourth-largest in the world. Magna has increased its dividend every year since 2010.

Magna reported its Q1 2025 results on 05/02/2025. For the quarter, its sales were $10.1 billion – 8.0% lower versus a year ago, as global light vehicle production fell 3%. Magna’s income from operations before income taxes rose was $225 million versus $34 million a year ago.

Adjusted earnings before interest and taxes (“EBIT”) fell 25% to $354 million — reflecting lower sales and higher net warranty costs related to its seating business, which were offset by continued productivity and efficiency improvements and lower net engineering costs, including spending on its electrification and active safety businesses.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna updated its 2025 sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to 5.1-5.6%.

Click here to download our most recent Sure Analysis report on MGA (preview of page 1 of 3 shown below):

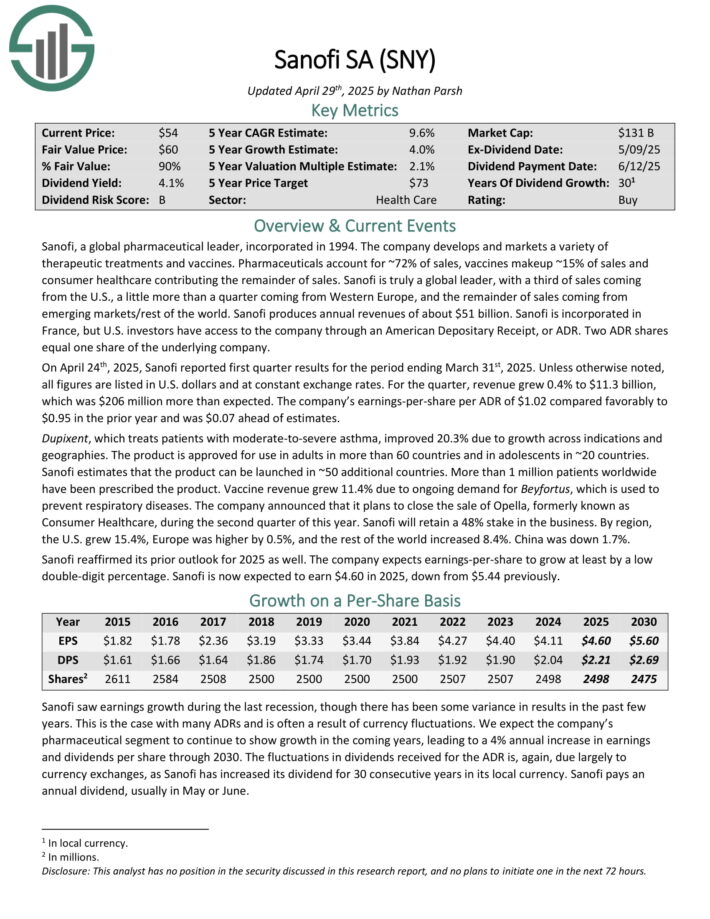

International Dividend Stock #6: Sanofi (SNY)

- Annual Expected Returns: 11.6%

Sanofi is a global pharmaceutical company that develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for ~72% of sales, vaccines makeup ~15% of sales and consumer healthcare contributing the remainder of sales.

Sanofi produces annual revenues of about $51 billion. It is incorporated in France, but U.S. investors have access to the company through an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying company.

On April 24th, 2025, Sanofi reported first quarter results for the period ending March 31st, 2025. Unless otherwise noted, all figures are listed in U.S. dollars and at constant exchange rates.

For the quarter, revenue grew 0.4% to $11.3 billion, which was $206 million more than expected. The company’s earnings-per-share per ADR of $1.02 compared favorably to $0.95 in the prior year and was $0.07 ahead of estimates.

Dupixent, which treats patients with moderate-to-severe asthma, improved 20.3% due to growth across indications and geographies. The product is approved for use in adults in more than 60 countries and in adolescents in ~20 countries. Sanofi estimates that the product can be launched in ~50 additional countries.

Vaccine revenue grew 11.4% due to ongoing demand for Beyfortus, which is used to prevent respiratory diseases.

Click here to download our most recent Sure Analysis report on SNY (preview of page 1 of 3 shown below):

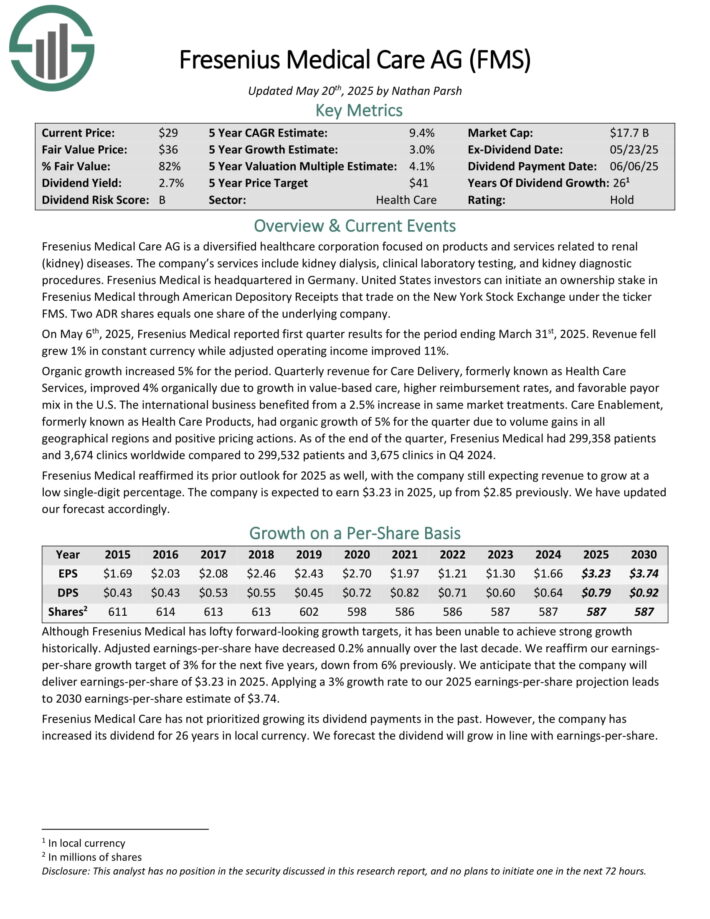

International Dividend Stock #5: Fresenius-Medical Care AG (FMS)

- Annual Expected Returns: 12.3%

Fresenius Medical Care AG is a diversified healthcare corporation focused on products and services related to renal (kidney) diseases.

The company’s services include kidney dialysis, clinical laboratory testing, and kidney diagnostic procedures. Fresenius Medical is headquartered in Germany.

On May 6th, 2025, Fresenius Medical reported first quarter results for the period ending March 31st, 2025. Revenue fell grew 1% in constant currency while adjusted operating income improved 11%.

Organic growth increased 5% for the period. Quarterly revenue for Care Delivery, formerly known as Health Care Services, improved 4% organically due to growth in value-based care, higher reimbursement rates, and favorable payor mix in the U.S. The international business benefited from a 2.5% increase in same market treatments.

Care Enablement, formerly known as Health Care Products, had organic growth of 5% for the quarter due to volume gains in all geographical regions and positive pricing actions.

Fresenius Medical reaffirmed its prior outlook for 2025 as well, with the company still expecting revenue to grow at a low single-digit percentage. The company is expected to earn $3.23 in 2025.

Click here to download our most recent Sure Analysis report on FMS (preview of page 1 of 3 shown below):

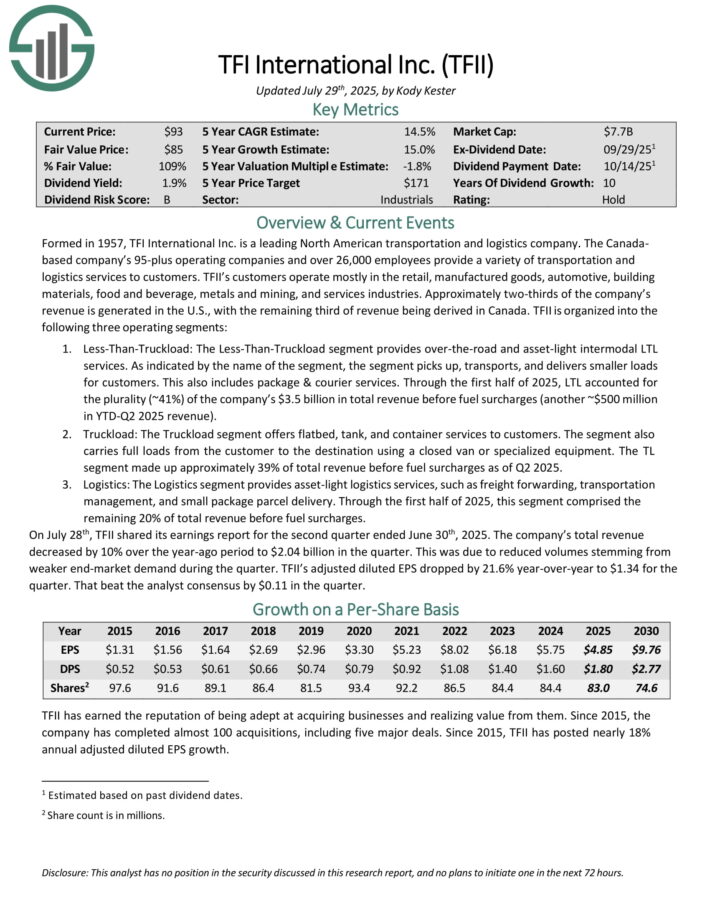

International Dividend Stock #4: TFI International (TFII)

- Annual Expected Returns: 12.6%

TFI International Inc. is a leading North American transportation and logistics company. The Canada-based company’s 95-plus operating companies and over 26,000 employees provide a variety of transportation and logistics services to customers.

TFII’s customers operate mostly in the retail, manufactured goods, automotive, building materials, food and beverage, metals and mining, and services industries.

Approximately two-thirds of the company’s revenue is generated in the U.S., with the remaining third of revenue being derived in Canada.

TFII is organized into the following three operating segments. The Less-Than-Truckload segment provides over-the-road and asset-light intermodal LTL services. Through the first half of 2025, LTL accounted for the plurality (~41%) of the company’s $3.5 billion in total revenue before fuel surcharges.

The Truckload segment offers flatbed, tank, and container services to customers. The segment also carries full loads from the customer to the destination using a closed van or specialized equipment.

Lastly, the Logistics segment provides asset-light logistics services, such as freight forwarding, transportation management, and small package parcel delivery.

On July 28th, TFII shared its earnings report for the second quarter ended June 30th, 2025. The company’s total revenue decreased by 10% over the year-ago period to $2.04 billion in the quarter. This was due to reduced volumes stemming from weaker end-market demand during the quarter.

TFII’s adjusted diluted EPS dropped by 21.6% year-over-year to $1.34 for the quarter. That beat the analyst consensus by $0.11 per share.

Click here to download our most recent Sure Analysis report on TFII (preview of page 1 of 3 shown below):

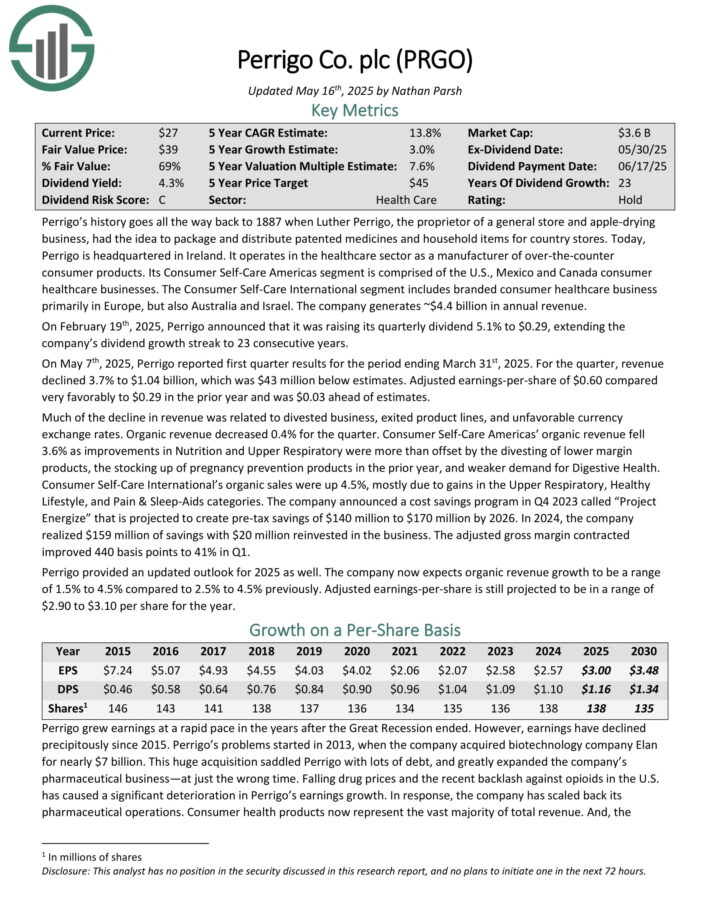

International Dividend Stock #3: Perrigo Company plc (PRGO)

- Annual Expected Returns: 12.9%

Perrigo operates in the healthcare sector as a manufacturer of over-the-counter consumer products. Its Consumer Self-Care Americas segment is comprised of the U.S., Mexico and Canada consumer healthcare businesses.

The Consumer Self-Care International segment includes branded consumer healthcare business primarily in Europe, but also Australia and Israel. The company generates ~$4.4 billion in annual revenue.

On May 7th, 2025, Perrigo reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue declined 3.7% to $1.04 billion, which was $43 million below estimates. Adjusted earnings-per-share of $0.60 compared very favorably to $0.29 in the prior year and was $0.03 ahead of estimates.

Much of the decline in revenue was related to divested business, exited product lines, and unfavorable currency exchange rates. Organic revenue decreased 0.4% for the quarter.

Consumer Self-Care Americas’ organic revenue fell 3.6% as improvements in Nutrition and Upper Respiratory were more than offset by the divesting of lower margin products, the stocking up of pregnancy prevention products in the prior year, and weaker demand for Digestive Health.

Click here to download our most recent Sure Analysis report on PRGO (preview of page 1 of 3 shown below):

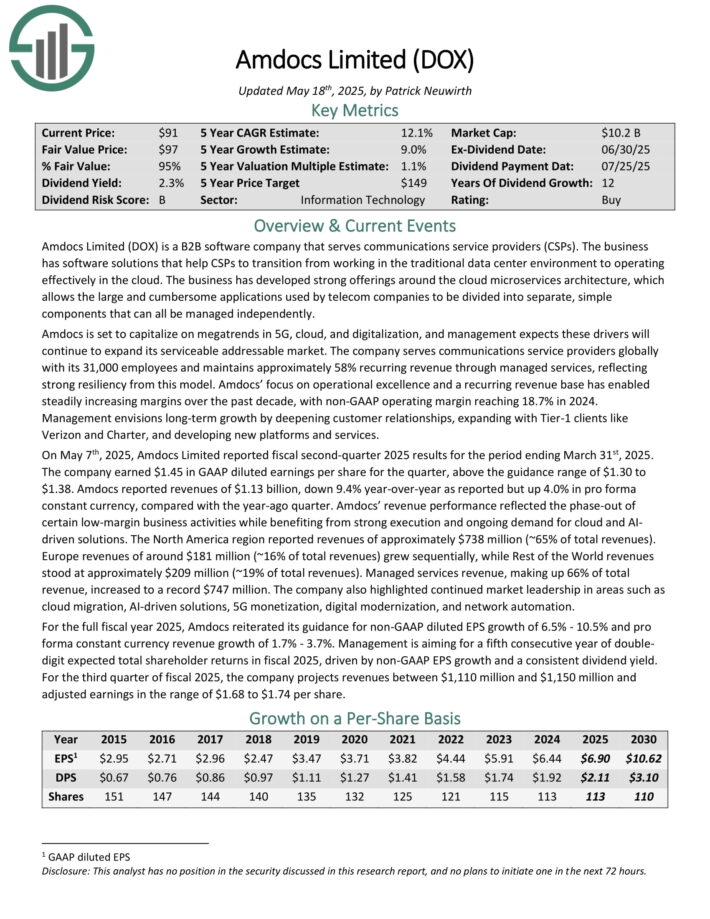

International Dividend Stock #2: Amdocs Ltd. (DOX)

- Annual Expected Returns: 13.3%

Amdocs Limited is a B2B software company that serves communications service providers (CSPs). Its software solutions that help CSPs to transition from working in the traditional data center environment to operating effectively in the cloud.

The business has developed strong offerings around the cloud microservices architecture, which allows the large and cumbersome applications used by telecom companies to be divided into separate, simple components that can all be managed independently.

Amdocs is set to capitalize on megatrends in 5G, cloud, and digitalization, and management expects these drivers will continue to expand its serviceable addressable market.

The company serves communications service providers globally with its 31,000 employees and maintains approximately 58% recurring revenue through managed services.

Management envisions long-term growth by deepening customer relationships, expanding with Tier-1 clients like Verizon and Charter, and developing new platforms and services.

On May 7th, 2025, Amdocs Limited reported fiscal second-quarter 2025 results for the period ending March 31st, 2025.

The company earned $1.45 in GAAP diluted earnings per share for the quarter, above the guidance range of $1.30 to $1.38. Amdocs reported revenues of $1.13 billion, down 9.4% year-over-year as reported but up 4.0% in pro forma constant currency, compared with the year-ago quarter.

Click here to download our most recent Sure Analysis report on DOX (preview of page 1 of 3 shown below):

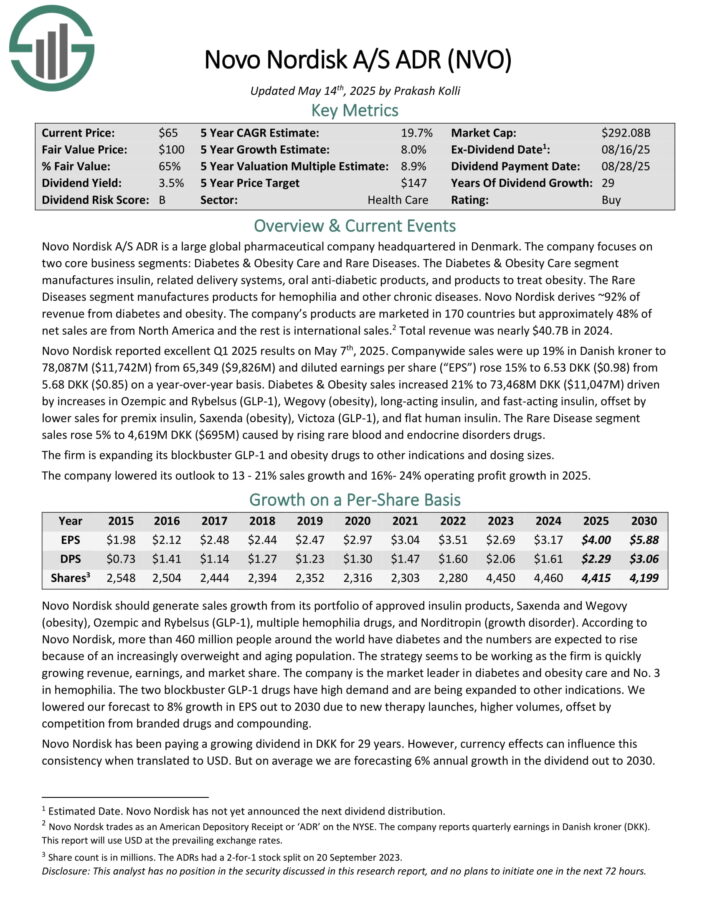

International Dividend Stock #1: Novo Nordisk (NVO)

- Annual Expected Returns: 18.4%

Novo Nordisk A/S ADR is a large global pharmaceutical company headquartered in Denmark. The company focuses on two core business segments: Diabetes & Obesity Care and Rare Diseases.

The Diabetes & Obesity Care segment manufactures insulin, related delivery systems, oral anti-diabetic products, and products to treat obesity. The Rare Diseases segment manufactures products for hemophilia and other chronic diseases. Novo Nordisk derives ~92% of revenue from diabetes and obesity.

Novo Nordisk reported excellent Q1 2025 results on May 7th, 2025. Company-wide sales were up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year basis.

Diabetes & Obesity sales increased 21% driven by increases in Ozempic and Rybelsus (GLP-1), Wegovy (obesity), long-acting insulin, and fast-acting insulin, offset by lower sales for premix insulin, Saxenda (obesity), Victoza (GLP-1), and flat human insulin.

The Rare Disease segment sales rose 5% caused by rising rare blood and endocrine disorders drugs. The firm is expanding its blockbuster GLP-1 and obesity drugs to other indications and dosing sizes.

The company lowered its outlook to 13 – 21% sales growth and 16%- 24% operating profit growth in 2025.

Click here to download our most recent Sure Analysis report on NVO (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.