This event has a knack for prophesying outsize returns for Wall Street's benchmark stock index.

For more than a century, the stock market has been a stomping ground of wealth creation. While real estate, bonds, and commodities have also helped investors grow their wealth, no other asset class has come close to matching the long-term annualized return of stocks.

But there's a caveat to the above statement: Getting from Point A to B will, on occasion, tug at investors' heartstrings. Stock market corrections, bear markets, and even crashes are normal and inevitable aspects of the investing cycle, as we witnessed earlier this year from the benchmark S&P 500 (^GSPC 0.59%), iconic Dow Jones Industrial Average (^DJI 0.65%), and growth-focused Nasdaq Composite (^IXIC 0.44%).

Shortly after President Donald Trump unveiled his “Liberation Day” tariff and trade policy on April 2, all three major stock indexes navigated their way through a mini-crash that lasted just shy of a week. The S&P 500 endured its fifth-steepest two-day percentage decline in 75 years, while the Nasdaq Composite briefly dipped into a bear market.

Image source: Getty Images.

However, all three indexes have been off to the races since the closing bell on April 8, which is when President Trump instated a 90-day pause on higher “reciprocal tariffs.” In roughly 5.5 months, the Dow, S&P 500, and Nasdaq Composite have rallied 23%, 33%, and 47%, respectively, as of the closing bell on Sept. 24.

When Wall Street's benchmark index puts together month after month of gains, it historically points to outsize future returns for stocks.

The broad-based S&P 500 is on the verge of making history for the 32nd time in 75 years

To preface this discussion, there isn't a one-size-fits-all metric or correlative event when it comes to predicting directional moves in the S&P 500 or individual stocks. If there were a guaranteed way to predict what stocks will do next, you can rest assured that everyone on Wall Street would be leaning on such an indicator.

There are, however, specific events and/or metrics with an exceptionally high rate of correlation throughout history. It's one of these events that should put a smile on the faces of bull market enthusiasts.

Since 1950, Wall Street's broad-based S&P 500 has logged 31 winning streaks that lasted at least five consecutive months, the latest of which occurred from May 1, 2024 through Sept. 30, 2024. Though this works out to a five-month (or greater) winning streak occurring, on average, every 2.41 years since 1950, most of these extended bullish periods have taken place since the dawn of the internet in the mid-1990s. Since 1995, five-month or longer winning streaks have occurred, on average, every 1.58 years.

However, an increased occurrence of five-month or longer winning streaks isn't nearly as impressive as how the benchmark S&P 500 performed in the year following these winning streaks.

Want to make your favorite perma-bear mad? 🐻

The S&P 500 is about to be up five months in a row.

A year after 5 month win streaks? Higher 28 out of 30 times and up 12.6% on avg. 🐂 pic.twitter.com/9cNt0nYQWN

— Ryan Detrick, CMT (@RyanDetrick) September 24, 2025

According to a post on X from Carson Group's Chief Market Strategist Ryan Detrick, S&P 500 returns are overwhelmingly bullish in the 12 months following the conclusion of at least a five-month win streak.

All told, there have been 31 separate five- to 11-month win streaks for the broad-based index since 1950. Although last year's streak has yet to hit the 12-month mark (it will on Sept. 30, 2025), the S&P 500 was higher 12 months later following 28 of the previous 30 occurrences — a 93.3% success rate of forecasting future stock moves. On average, Wall Street's most encompassing index was higher by 12.6% one year after logging at least a five-month winning streak.

If (as of this writing on Sept. 24) the S&P 500 manages to close the month of September above 6,460.26, it would mark the fifth consecutive month of gains and the 32nd such winning streak in 75 years. At the moment, the index is nearly 178 points above its closing mark for August.

The prospect of lower interest rates, which can spur borrowing, corporate hiring, and merger and acquisition activity, coupled with investors' insatiable desire for anything having to do with artificial intelligence, suggests Wall Street's seemingly long-in-the-tooth bull market may still have legs.

Image source: Getty Images.

Buyer beware: History is a pendulum that swings in both directions

Over multidecade periods, the stock market has consistently been a moneymaker. Based on an analysis from Crestmont Research, which examined 106 separate rolling 20-year periods for the S&P dating back to the start of the 20th century, there hasn't been a 20-year period where, including dividends, the index has declined in value.

But history is a pendulum that swings in both directions, which means additional short-term upside isn't guaranteed.

Just as Detrick pointed out that five-month or longer winning streaks for the S&P 500 have a knack for delivering outsize returns one year later, a separate valuation-based tool has an immaculate track record of eventually forecasting significant downside in the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite.

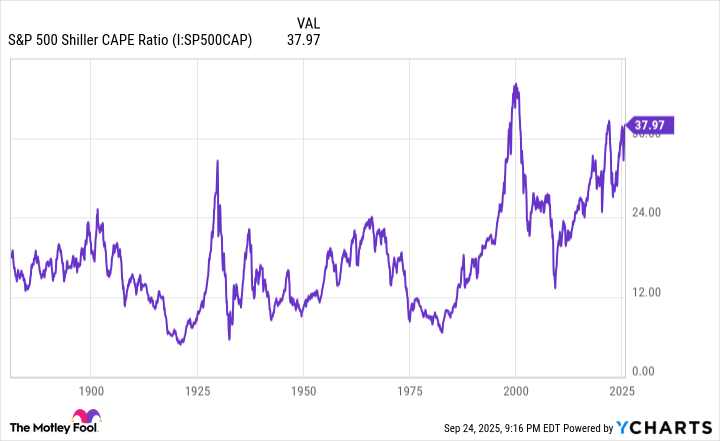

The S&P 500's Shiller price-to-earnings (P/E) ratio, which is also commonly referred to as the cyclically adjusted P/E ratio (CAPE ratio), is in rarified territory. The Shiller P/E has averaged a multiple of close to 17.3 when back-tested to January 1871.

S&P 500 Shiller CAPE Ratio data by YCharts.

On Monday, Sept. 22, the S&P 500's Shiller P/E came within a few hundredths of a multiple of 40, which is a figure that's only been reached two previous times during a continuous bull market spanning 154 years. The Shiller P/E surpassed 40 by a few hundredths during the first week of January 2022, and peaked at its all-time high of 44.19 in December 1999.

Following these two previous instances, the S&P 500 lost a quarter of its value during the 2022 bear market, and was nearly halved during the bursting of the dot-com bubble, which began in March 2000. It was an even steeper decline for the Nasdaq Composite, which shed 78% of its value on a peak-to-trough basis from 2000 to 2002.

Historical precedent tells us that anytime the S&P 500's Shiller P/E spends at least two months above a multiple of 30, one or more of Wall Street's major stock indexes will lose at least 20% of its value, if not considerably more. With the stock market bordering on its second-priciest valuation in more than 150 years of history, it's not a stretch to expect significant downside at some point in the presumed not-too-distant future.

Though long-term-minded investors continue to be set up for success, the bull-versus-bear narrative is more complicated than you might realize over the short run.