With my clubbing days long behind me – unless incipient membership of Saga counts – I get my weekend kicks these days by studying the yields on long-term gilts (UK government bonds).

And for the past couple of weeks I’ve been entranced by a low-coupon gilt maturing in 2061.

This bond is known to wonks as ‘UKT 0.5 2061’ – or just ‘TG61’ – on account of it being:

- a UK government bond/gilt (‘UKT’)

- with a 0.5% coupon

- that matures in 2061

Now, those numbers may not seem exciting to you.

But for the past couple of years they’ve made TG61 the most popular bond since Sean Connery.

Bond jargon explainer: if you’re confused (or you’re about to be confused) by the terms in this article, please refer to our bond lingo lexicon. I won’t make this post even longer by explaining what duration is for the umpteenth time. Our guide makes everything clear.

The appeal of TG61 isn’t completely new to me. I even owned some for a short while last year.

But every time I look at it I’m flabbergasted anew.

One of these bonds is not like the others

What’s so weird about TG61?

Mostly that its yield-to-maturity is meaningfully lower than the similarly long duration gilts sitting either side of it on the curve.

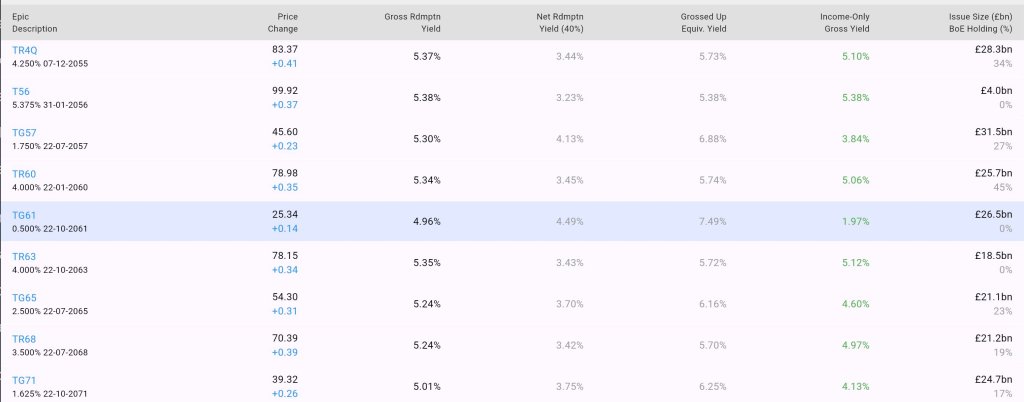

Check out this industrial-strength bond data from Tradeweb:

Source: Tradeweb

Okay, that’s a lot of numbers. But the key and wacky thing to note is the yield column.

Compared to the bonds maturing either side of it, TG61 sports a yield that’s nearly 40 basis points (i.e. 0.4%) lower than its brethren.

So is there something special happening in the year 2061?

Or does TG61 come with a special maturity bonus, like those promotional saving accounts that nab a spot in the Best Buy tables with a last-minute kicker?

No – or at least not exactly.

The lowdown on low coupons

You see, there is something sort of special – though hardly unique – about TG61. Which is that in common with a few others issued in the near-zero interest rate era, it boasts a very low coupon rate.

This low coupon means that while the yield you can expect from TG61 – if you hold to maturity – is 5% (or 4.985% to be precise) only a small proportion of your return comes from income.

Mostly you’ll get a capital gain.

- You can see TG61 currently costs just over £25. But it will mature in 2061 with a face value of £100.

- The uplift from £25 to £100 – known as the ‘pull to par’ – delivers the bulk of its 5% yield.

That pull to par works out as a 300% capital gain. The 0.5% coupon is just the cherry on top.

In fact for private investors that little income cherry is more sour than sweet. That’s because as we’ve previously covered, gilt income is taxed but capital gains on gilts are not.

Which means that wealthy folk facing a lot of taxable interest on savings held outside of ISAs and SIPPs can buy TG61 instead, and look forward to a much higher realised return than the equivalent from cash.

Betting on interest rates with Treasury 2061

Well, I say look forward to. But even with my healthy diet and a fairly active lifestyle, let’s just say me seeing 2061 is a stretch goal.

Indeed holding TG61 to maturity might be ambitious for many of the richer folk who own it.

That matters, because TG61’s low coupon and distant maturity date make it a very long duration bond indeed.

Which in turn makes its price very volatile – because it’s very vulnerable to shifting expectations for interest rates and inflation between now and 2061.

- Just a 1% move in interest rates could see the price of TG61 move by c.30%!

On the other hand, if you can stomach the volatility then this is another reason why you might own TG61.

As I say, thanks to its low coupon and long duration, TG61 is especially responsive to changing interest rates.

Hence if you want to bet on lower rates, you get a lot of bang for your buck here.

An L-shaped graph

None of this is news. Savvy active investors have been hunting for opportunities in long-term gilts since the crash of 2022.

The only snag is that interest rates have stayed higher for longer than many expected.

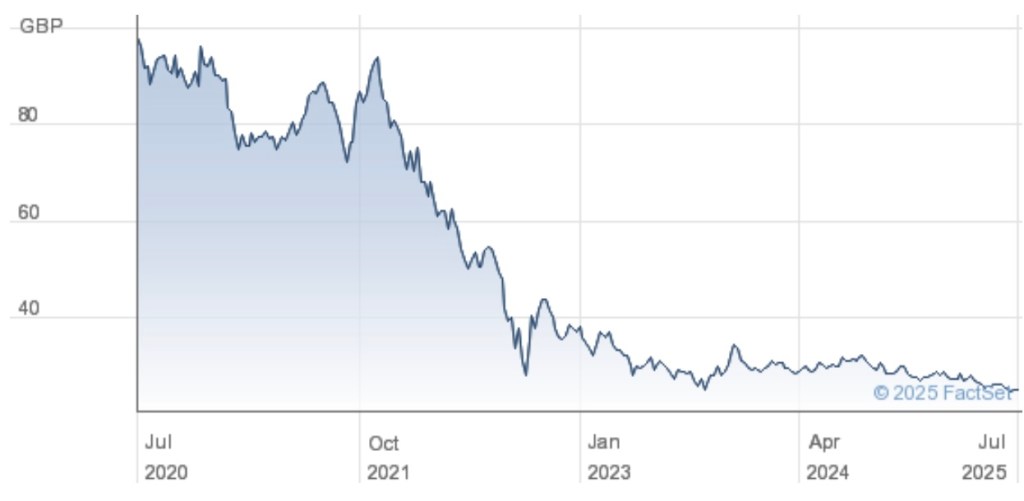

So even if you grabbed your TG61 after the price falls from the post-Covid bond rout, you’ve had to be pretty nimble with the buy/sell button to bank a profit:

Source: Hargreaves Lansdown

Zoom in on that grim flatlining since 2023 and it’s a story of small rallies followed by lower lows.

Anyone buying and holding TG61 hasn’t got much to show for it yet.

So who would buy a bond like Treasury 61?

Perhaps you’re wondering who would own such a racy gilt, even with its tax advantages?

I mean, they haven’t outlawed bungee jumping and downhill skiing. There are plenty of other ways to get your thrills.

On which note: when I mentioned the long-term, low-coupon gilt trade to my co-blogger The Accumulator, he almost had a SWR-boosting cardiac event at the thought of buying a gilt that doesn’t mature for 36 years.

(He later calmed down with reflection and a hot cocoa).

However kicking things about in text chat, Monevator contributor Finumus pointed me to a recent [paywalled] Bloomberg article claiming the TG61 trade is super-popular in the City.

It’s hip in the Square

Describing the ‘most talked about bond’ as a ‘losing bet’, Bloomberg noted that:

As far back as 2022, a UK bond maturing in 2061 was one of the most popular plays, with City bankers buying them for their own personal accounts and brokers reporting a surge in trading volumes from wealthy clients.

Instead, they’re turning out to be a losing bet. The notes have plunged, wiping out more than half their value since 2022, in a selloff across longer-dated notes that’s been fueled by concerns over government spending. At a time when “buying the dip” is paying off for stock traders, the UK’s 2061s stand as a reminder that it can also be a treacherous game.

“People are still holding onto the position hoping that it will work,” said Megum Muhic, an interest rate strategist at RBC Capital Markets, calling it “the most talked about bond” in the City.

“It’s quite strange. It’s almost turned into a religion or something.”

I knew TG61 had fans. But I didn’t appreciate it was the new lap-dancing for London’s traders and bankers.

A cheap insurance policy

As it happens, I know one of these supposed cultists. It’s the same chap I’ve mentioned before as a recent-ish convert to the long-term gilt game.

My friend is also a Mogul-level Monevator member. So he kindly agreed to share his motivations, as follows:

Let’s start with some caveats.

For my sins, I’m one of those naughty ‘active investors’ that The Investor occasionally speaks of – the sort who owns individual stocks, some of which are obscure, illiquid, and occasionally interesting for the wrong reasons.

So I would say I’ve got a higher-than-average tolerance for volatility and esoterica in my portfolio. That’s important, because the very long-dated, low-coupon gilts I’ve been buying are definitely not for everyone.

As 2022 reminded investors rather forcefully, these instruments can be stomach-churningly volatile. You might wait decades for them to return to par – or even get close to it.

Passive purists, you may want to scroll down a bit (or at least look away politely) for the next few paragraphs.

I began building a position in these bonds in 2023. Now aged in my mid-30s, it felt like time to ease out of the 100% equity allocation I’ve held since my teenage years and start introducing some ballast into the portfolio as I get closer to potentially drawing it down.

Happily, gilts were having a moment – or rather, a markdown. After a generation of yields being miserly, suddenly we had discounts that would make TK Maxx blush.

Now long-dated gilts make up about 7% of my portfolio. I plan to keep adding opportunistically, for as long as yields look attractive to me.

Take that TG61 gilt maturing in 2061: based on Tradeweb data, it’s offering around 5% yield to maturity today.

Inflation could do anything between now and then, but a 5% government-backed return strikes me as a reasonable deal – especially since, all being well, I would be in my early 70s when it matures.

I’m willing to hold it for that long if prices and yields stay at these levels.

So I can’t claim this is a clever short-term trade, or that I’ve chosen to do it as part of an elaborate tax wheeze. It’s a basket of long-term holdings that nudges my portfolio closer to something suitable for eventual drawdown. So far, not so naughty.

But I did buy these gilts with one eye on the ‘option’ they provide.

Just as these long bonds got crushed when rates surged, the opposite could be true if rates fall. To me, it’s not outside the realms of possibility that – even within the next five to ten years – central banks could dust off the same playbook that ‘saved’ the global economy (and markets) during the last two major crises.

A return to quantitative easing might seem far-fetched today. Inflation still feels like an uninvited guest who won’t leave, and geopolitical tensions are bubbling away.

But in my experience, it’s always hard to see past the immediate mess – especially when markets have just taken a beating.

If that happens, these long gilts could soar – just when the rest of my (still equity-heavy) portfolio might be flagging.

In the meantime, I’m happy to have this option in my back pocket while holding onto my bonds, and if nothing else I’ll achieve the long-term yield on offer.

But I can’t help but feel that UK gilts will have their day again – at least at some point in the next 30-odd years. And I can’t shake the sense that the market will take these bonds off my hands in a time of crisis before then.

Who knows? With a bit of luck, I’ll be back here in 2061 to tell you how it all panned out.

Well there you have it, folks. They walk among us!

(Don’t tell The Accumulator…)

Won’t anybody think of the kinks?

My friend is unusual in that he’s buying a range of long-dated gilts. Also, since he’s mostly using tax shelters he’s not super-wedded to the tax advantages.

For most people though, I think you’d only buy TG61 rather than the higher-coupon gilts that flank it if your holding is subject to tax.

After all, you’re getting a much lower yield with TG61. That difference will really add up over the decades.

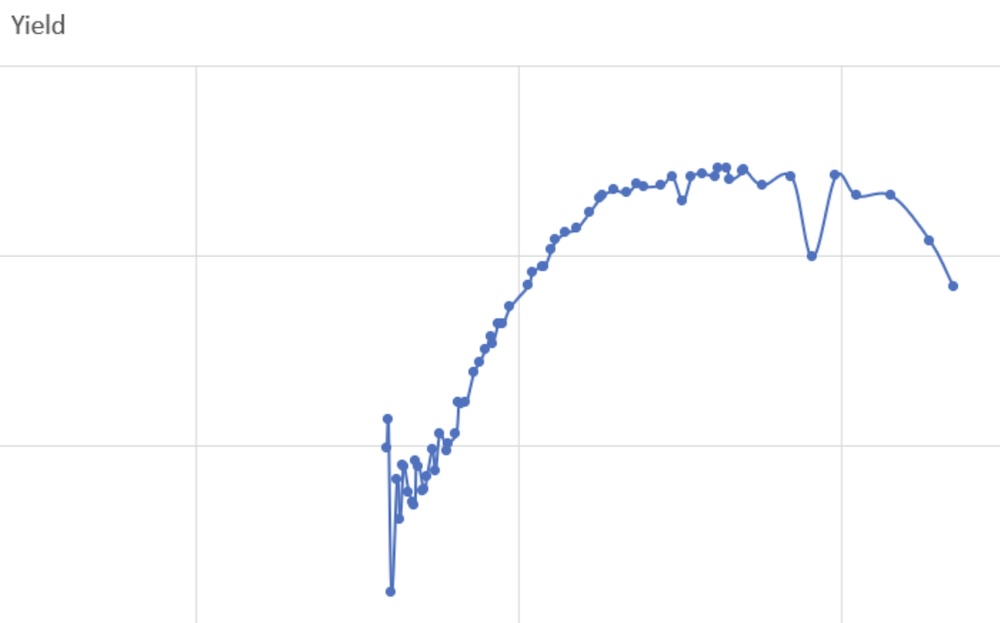

To illustrate this, Finumus bunged me a yield curve graph that shows what an outlier TG61 is:

As is his wont as a hard-charging captain of finance, Finumus hasn’t labelled the X-axis.

But what we’re looking at is how yields rise as you go out over the decades – before violently glitching down then spiking up again on the right-hand side of the graph.

That ‘woah’ moment? That’s the yield to redemption of Treasury 2061.

Remember my table at the start of this piece? We saw similar long-dated gilts offered yields of almost 5.4%.

The 5% on TG61 looks a very poor deal by comparison.

However you must calculate the after-tax yield – especially for higher or additional-rate tax payers – to truly grok the appeal of the Treasury 2061 gilt.

You can easily get this data from a service called YieldGimp:

Source: YieldGimp

Again, lots of numbers. But the columns to note are the ‘net redemption yield’ for a 40% taxpayer and the ‘equivalent grossed up yield’.

- The former shows us that a higher-rate taxpayer being taxed on their gilt income can expect a roughly 1% higher redemption yield from owning TG61 instead of TR60 or TR63.

- The latter calculates that as of today, TG61’s expected return is equivalent to a taxable cash account paying 7.49%.

In this light it’s pretty obvious why those cash-hoarding City boys love it.

Short(er) kings

Obvious… but I don’t think it’s quite a slam dunk though.

There are gilts maturing in 20 to 25 years’ time that offer similar redemption yields to TG61, without you having to go full Bryan Johnson to live long enough to see it mature.

Of course, the very high duration of TG61 – that also makes it such a great play on interest rate cuts – is providing some extra boost to its appeal.

Or maybe there’s some macho thing in the Square Mile about having the cojones to own such a volatile long-dated bond…

…though in that case we need to talk about Treasury 2073!

Or maybe not. The tax-adjusted yield on TR73 is much lower for private investors than on TG61 and others. It’s one for institutions where tax breaks aren’t a factor.

Treasury 2061: another market oddity

Talking of the institutions, it’s a bit of a mystery to me why the TG61 yield anomaly persists.

Shouldn’t the yield differentials be arbitraged away by the deep and liquid gilt market?

I guess the first thing to note is that the market isn’t quite as ‘deep and liquid’ as a bond tourist like me might imagine.

There’s only £26.5bn in TG61, for example, according to YieldGimp.

A big number for sure. But, you know, only 50,000 or so half-a-milly City nest eggs.

More seriously, doesn’t it seem odd that a hedge fund can’t step in and arb the differentials away?

Finumus muttered something about “weird basis risks” when I joked with him that we should set up a vehicle to do it ourselves.

What he means, I think, is that such a fund would use futures contracts and lots of leverage to actually express your view that the yield to maturity on TG61 ought to converge to be roughly the same as its compadres. And these structures would be imperfect enough – especially given the very long timeframes – to make the trade unviable.

Still, it’s interesting to think about, since in my opinion the lower yield on TG61 is really odd.

I’m no expert, but it’s not even obvious to me that the secondary very high duration as a means to get more interest rate risk oomph argument adds up.

Usually in investing you’d expect a higher expected return to compensate you for extra risk.

So it’s all about the income tax break I’d say.

A long and winding road

I do like my friend’s insurance policy angle for owning long-dated gilts though. And I suppose that is much the same as chasing Treasury 2061’s high duration.

Personally, I’ve already tried to tuck some very long gilts away for the same potential crash-protection properties that my pal alludes to.

But, as is my wont, I sold them for a small gain soon after.

Perhaps – unlike my friend, who despite being an investing fanatic can go a year between making trades – I’m just not cut out to own a gilt that matures around the same time I’ll be looking forward to a telegram from King George!