Despite shared language, overlapping demographics, and ambitious development agendas, the Middle East and North Africa (MENA) remains one of the least financially integrated regions globally. Investors seeking exposure to MENA face disjointed regulatory systems, currency regimes, and unresolved political divides.

The economic logic for integration is sound: scaling markets, lowering transaction costs, and improving price discovery. So why do MENA’s capital markets remain so fragmented? And what would meaningful integration mean for risk pricing, portfolio strategy, and regional growth?

This article examines the structural, regulatory, and political barriers to that integration, outlines practical steps toward a more connected regional market, and explores how investors can position themselves in the meantime.

The Promise vs. Reality

Integration is not a new idea. The Arab Monetary Fund, the Gulf Cooperation Council (GCC) coordination platforms, and pan-regional economic summits have all attempted to promote capital connectivity. But on-the-ground realities tell a different story:

- FX friction: Hard pegs, managed floats, and parallel markets complicate currency settlement and hedging.

- Restricted listings: Cross-exchange activity is rare. Large firms in Egypt, the United Arab Emirates (UAE), and Saudi Arabia operate mostly within domestic boundaries.

- Capital controls: Foreign ownership limits, repatriation hurdles, and disclosure gaps deter fund structures that span multiple MENA markets.

- Indexing deficits: No credible regional equity benchmark captures diversified sector exposure across the Maghreb, Levant, Gulf, and now, Israel.

Even well-capitalized and regionally headquartered sovereign wealth funds choose to allocate internationally rather than within MENA itself.

Structural Barriers

Three layers of fragmentation hinder integration:

- Capital account rigidity: Countries like Algeria and Tunisia maintain tight controls. Even liberalizing markets impose licensing thresholds for foreign investors.

- Divergent regulations: Listing standards, audit requirements, and governance frameworks vary widely. An offering cleared in Abu Dhabi may stall in Casablanca.

- Currency exposure without instruments: Derivatives markets are thin or nonexistent, leaving investors exposed to FX volatility without tools to hedge.

These obstacles force asset managers to build exposure country-by-country, each with different legal structures, tax codes, and macro risk profiles.

Integration in Name, Isolation in Practice

- GCC sovereign funds (e.g., PIF, Mubadala) manage more than $4 trillion. Yet most investments target Asia, Europe, and North America, not neighboring MENA markets.

- North Africa’s privatization progress is uneven. Egypt attracts global interest, but Algeria’s closed regime and Tunisia’s inconsistent reform path deter regional capital flows.

- Pan-MENA investment vehicles (REITs, ETFs) remain aspirational. Liquidity constraints and inconsistent regulations limit cross-border scale.

Israel: A regional Anchor with Asymmetric Connectivity

Historically excluded from MENA frameworks, Israel now maintains formal economic ties with the UAE, Bahrain, and Morocco under the Abraham Accords. Its financial ecosystem adds a new dimension:

- Market maturity: The Tel Aviv Stock Exchange offers deep liquidity, transparent governance, and robust investor protections.

- Capital corridor growth: Israeli VCs and Gulf sovereign funds are forging co-investment channels in infrastructure, fintech, and defense tech.

- Regulatory compatibility: While not harmonized, Israel’s standards align closely with global benchmarks, making cross-border partnerships feasible.

Recent developments like the Abraham Accords have opened new economic corridors between Israel and Arab economies, yet full financial integration remains uneven across the region.

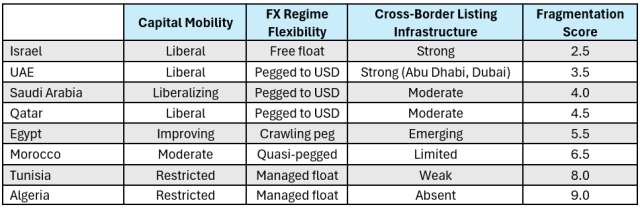

The comparative table below summarizes fragmentation across key MENA markets, capturing differences in capital mobility, currency regimes, and listing infrastructure including Israel’s evolving position.

Table 1: MENA Market Fragmentation Index

Source: Author’s analysis based on publicly available regulatory and market data as of 2025. Fragmentation Score is a qualitative composite derived from assessments of capital mobility, FX regime flexibility, and cross-border listing infrastructure. Data references include IMF Article IV reports, World Bank Financial Sector Assessments, central bank publications, and regional stock exchange disclosures. Note: This index is author-constructed for illustrative purposes and does not represent a formal benchmark or investment recommendation.

Investor Implications

- Fragmentation elevates risk premiums, even in stable economies, due to regional contagion and disjointed legal frameworks.

- Diversification is harder: Without true cross-border instruments, investors must manually construct region-wide exposure, a costly and inefficient process.

- Capital lacks scalability: Infrastructure, fintech, and logistics are growing in pockets, but lack of integration curtails cross-market scale.

Outlook: Signals of Progress, Not Cohesion

MENA’s financial integration remains uneven. Yet bilateral corridors, particularly post-Abraham Accords, suggest a pragmatic path forward:

- Harmonize disclosures and listing norms across exchanges.

- Build FX and clearing infrastructure to facilitate multi-currency transactions.

- Mobilize sovereign funds for joint ventures and regional ETFs.

- Engage supranational institutions to standardize frameworks and mitigate geopolitical friction.

For investors, that means building strategies that reflect the region’s structural segmentation while staying alert to emerging corridors of progress that could redefine the opportunity set.

Until then, investors must treat MENA not as a unified market, but as a strategic mosaic — rich with opportunity, but segmented by design.

So What?

The road ahead will require deliberate collaboration between regional leaders, regulators, and institutional investors. The prize is clear: lower costs, deeper liquidity, and scalable growth. The steps are known: align rules, build infrastructure, and deploy capital with a regional lens. Until that alignment happens, success in MENA will come to those who can navigate its many borders with precision and patience.

The PNC Financial Services Group, Inc. (“PNC”) provides investment consulting and wealth management, fiduciary services, FDIC-insured banking products and services, and lending of funds to individual clients through PNC Bank, National Association (“PNC Bank”), which is a Member FDIC, and provides specific fiduciary and agency services to individual clients through PNC Delaware Trust Company or PNC Ohio Trust Company. PNC provides various discretionary and non- discretionary investment, trustee, custody, consulting, and related services to institutional clients through PNC Bank, and investment management services through PNC Capital Advisors, LLC, a wholly-owned subsidiary of PNC Bank. PNC does not provide legal, tax, or accounting advice unless, with respect to tax advice, PNC Bank has entered into a written tax services agreement. PNC Bank is not registered as a municipal advisor under the Dodd- Frank Wall Street Reform and Consumer Protection Act.

“PNC” is a registered mark of The PNC Financial Services Group, Inc.

Investments: Not FDIC Insured. No Bank Guarantee. May Lose Value.

©2025 The PNC Financial Services Group, Inc. All rights reserved.