Wall Street has been undergoing a volatile environment since the start of April, mainly due to heightened trade tensions. Although President Donald Trump's push for reciprocal tariffs caused a bloodbath in markets in April, markets have stabilized following a temporary truce in U.S.-China trade tensions.

The Nasdaq has officially entered a new bull market, rocketing 24% from its early April lows. The S&P 500 isn’t far behind, up 17% over the same period. This sharp rebound caught many investors off guard (read: U.S. Stocks Rebound Sharply in May: Can the Rally Continue?).

Plenty of investors sat this rally out for a host of reasons—waiting for a clearer signal amid trade tensions, trying to time the exact market bottom, or even pull out of the market altogether as fear peaked.

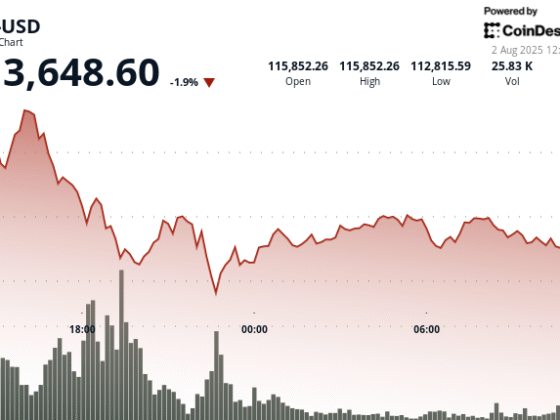

In such an improving scenario, Wall Street again faced a rough patch last week, with major indexes posting significant losses. The S&P 500 fell 2.6%, the Dow Jones Industrial Average retreated 2.5%, and the Nasdaq Composite also fell 2.5%.

The decline was driven largely by increasing investor anxiety over the United States' swelling fiscal deficit, which overshadowed the otherwise positive economic data. Note that U.S. macroeconomic indicators have offered some reassurance in the meantime. Business activity picked up in May, suggesting stronger demand and higher business confidence. Initial jobless claims declined, pointing to continued labor market strength.

Investor sentiment was rattled by Moody’s decision to strip the United States of its top-tier credit rating. This downgrade has added complexity to concerns surrounding President Donald Trump’s proposed tax legislation, which recently passed the House and now heads to the Senate. Many fear that the bill could exacerbate the fiscal imbalance and contribute to a larger national deficit.

According to data from the Congressional Budget Office, the level of outstanding U.S. Treasuries has surged from $4.5 trillion in 2007 to nearly $30 trillion today. Public debt as a percentage of GDP has also soared, jumping from 35% to 100% over the same period, fueling investor unease about long-term fiscal sustainability.

If these fears were not enough, in a move that further unsettled markets, President Trump proposed 50% tariffs on European Union imports starting June 1, citing stalled trade talks. He also threatened Apple AAPL with a minimum 25% tariff if the tech giant does not shift iPhone production to the United States.