Key Points

- The “Student Loan Tax Bomb” is a term that refers to the taxes owed on forgiven student loan debt in some circumstances.

- The tax bomb is set to return for many borrowers in 2026.

- Programs like PSLF are always tax-free federally, but others, like IDR-based loan forgiveness may face tax consequences.

Taxes on many student loan forgiveness programs are set to return in 2026. The American Rescue Plan Act (ARPA) made student loan forgiveness, regardless of the reason, tax-free federally from 2021 to December 31, 2025. However, the Big Beautiful Bill did not renew most of those provisions. Instead, it only allows death and disability discharge to remain tax-free permanently.

While Public Service Loan Forgiveness remains tax-free federally by statute, other programs, such as income driven repayment plan-based loan forgiveness and borrower defense to repayment will be taxable starting in 2026.

While there are ways to avoid the tax bomb, it's still a real issue that student loan borrowers may have to plan for. And while there are a lot of variables to this calculation, we wanted to create a simple tool that will allow you to estimate your future tax liability.

Would you like to save this?

Student Loan Tax Bomb Calculator

Here is the student loan tax bomb estimator:

Student Loan Tax Bomb Calculator

Single

Married Filing Jointly

Head of Household

What You Need To Know To Use The Tax Bomb Calculator

When you are trying to figure out what the potential tax bomb might be, there are a few things to consider. You need to know your future income and tax filing status (to figure out what federal tax bracket you'll be in), and you need to know your total assets and liabilities, to know if you're going to be insolvent or not.

Here's what to include in each box. This should be your estimate based on the day in the future your student loans are forgiven. So, if you think your student loans will be forgiven in May 2030, then all of this information should be your estimate as of May 2030.

Total Assets

In the total asset box, the IRS looks at the total amount of all assets you own. This includes the basics like checking, savings, and investment accounts. But it also includes the value of your retirement accounts, real estate, any business ownership, and the value of your possessions.

Total Liabilities

In the total liabilities box, you want to include everything you owe, including credit card debt, car loans, and any mortgage debt. You also want to include the amount of your student loans being forgiven.

Amount Of Student Loan Debt Forgiven

In this box, only include the amount of student loan debt being forgiven.

Estimated Adjusted Gross Income And Tax Filing Status

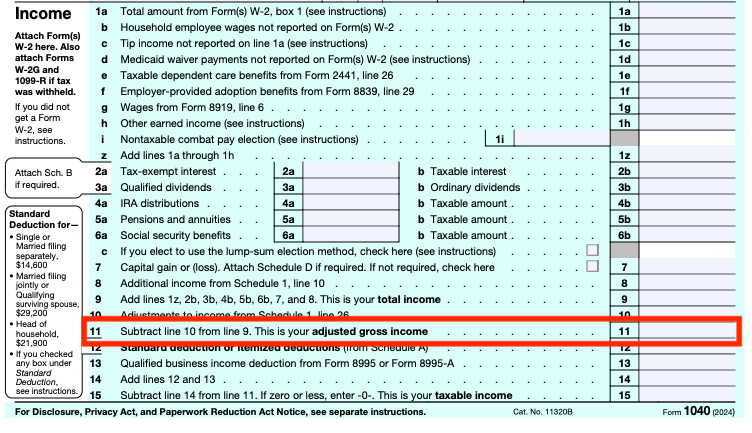

Finally, you need to include an estimate of your adjusted gross income (AGI) WITHOUT the debt being forgiven. So, if you pull up your prior year tax return, look on Line 11.

Of course, this should be the AGI for the year you get the loans forgiven. So, if you expect to be earning more, enter that amount.

Also, you need to select your martial status – again, for the year the loans are forgiven.

Additional Considerations About Student Loan Forgiveness And Taxes

There are a lot of things to consider about student loan forgiveness and taxes, and it honestly shouldn't be a huge priority. Your goal should always be thinking about what you can afford today, and whether you have a plan for your student loans – forgiveness and taxes, or not.

With that said, it's important to remember that PSLF and disability discharge are always tax free federally. Also, employer student loan repayment assistance is also tax-free (up to the $5,250 limit per year).

It's also important to realize that there may be state taxes on your student loan forgiveness as well. State taxes are a really mixed bag of rules. Even PSLF is taxable in Mississippi.

For real long term planning, it can make sense to save up a little money to pay the tax bomb, but you can also setup a payment plan with the IRS if it's something you can't afford. At the end of the day, the tax liability of your loan forgiveness will always be significantly less than your student loan balance.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Student Loan Tax Bomb Calculator And Estimator appeared first on The College Investor.