Key Points

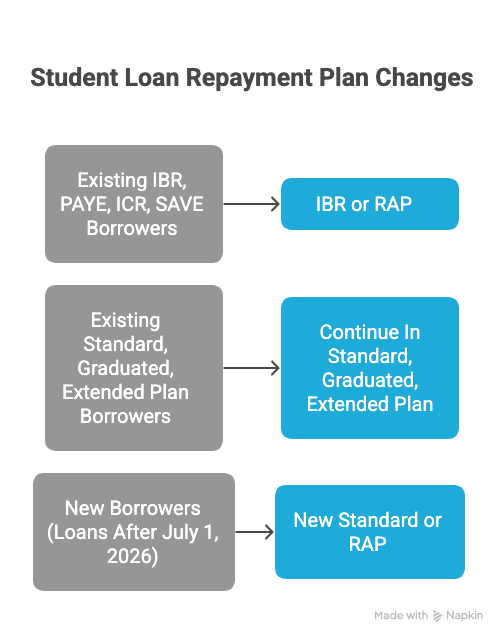

- All borrowers on SAVE, PAYE, and ICR will be moved to a version of IBR between 2026 and 2028.

- The new Repayment Assistance Plan (RAP) begins in July 2026 as an optional plan for income-based repayment.

- Existing Standard, Graduated, and Extended repayment plans will remain, while new borrowers will have a tiered Standard Repayment structure with terms based on loan balance.

Federal student loan repayment plans are about to be overhauled. Following the passage of the One Big Beautiful Bill, borrowers on existing income-driven repayment plans like SAVE, PAYE, and ICR will be automatically moved to IBR between 2026 and 2028.

Meanwhile, a new plan called the Repayment Assistance Plan (RAP) will launch in July 2026. These changes will affect tens of millions of borrowers and consolidate nearly all current repayment options into just a few alternatives.

While the Department of Education has not yet finalized the exact timing of each transition, the direction is clear. And for many borrowers, understanding what comes next may influence whether they change repayment plans now or wait.

Would you like to save this?

Income-Driven Repayment Will Consolidate

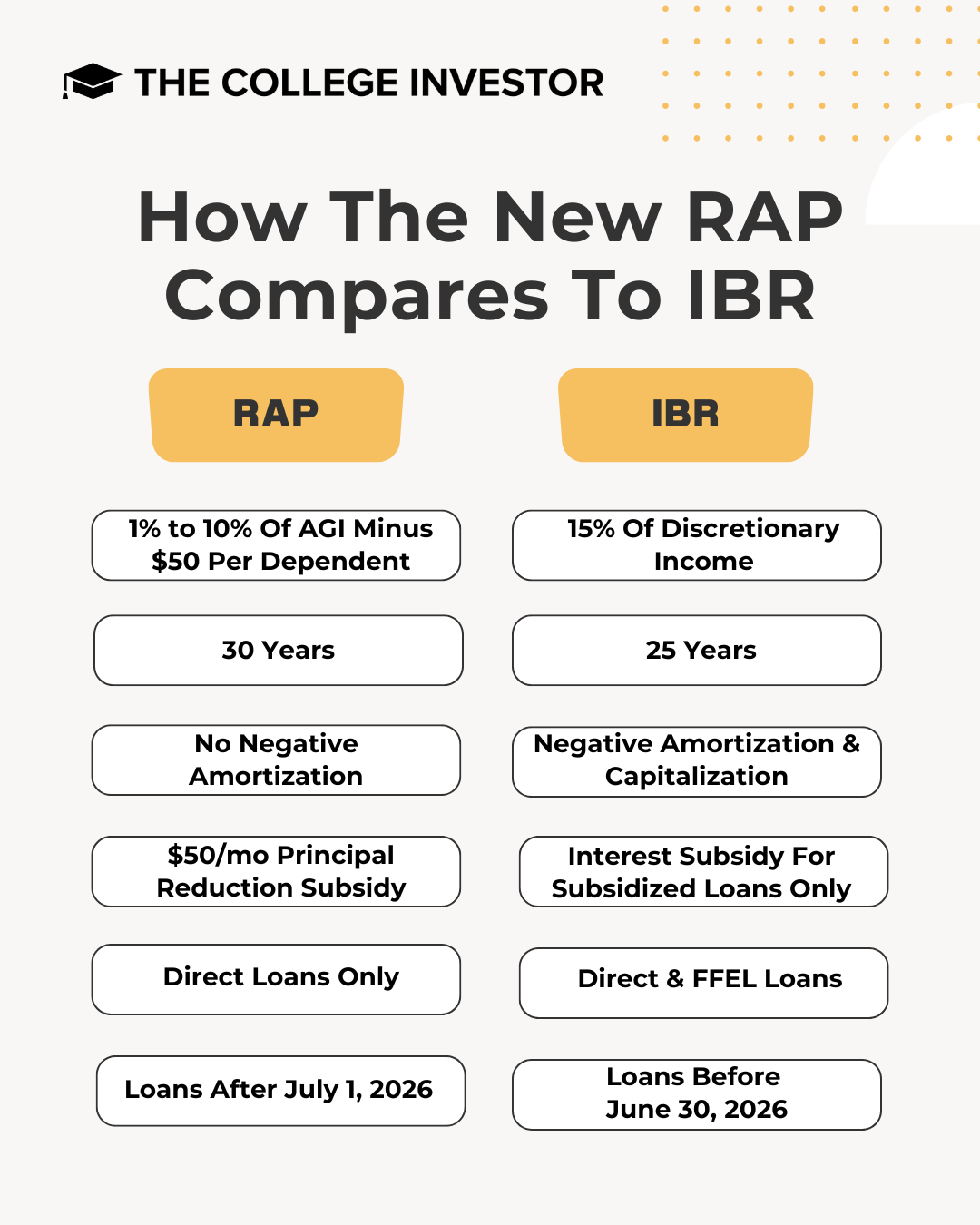

Borrowers enrolled in SAVE, PAYE, or ICR will be moved into a new version of Income-Based Repayment (IBR) depending on when they took out their loans. If the loans were disbursed before July 1, 2014, borrowers will shift into the original IBR, where payments are 15% of discretionary income. For loans made after that date, borrowers will move into the newer IBR version with 10% payments.

The only real change to IBR is the removal of the partial financial hardship requirement.

Both plans will maintain forgiveness after 20 or 25 years, depending on the loan and enrollment date. Borrowers will also have the option to leave IBR and join the new RAP plan starting July 1, 2026.

The Department of Education will finalize a timeline for this migration, but it is expected to occur in waves between July 2026 and June 2028.

According to Scott Buchanan, Executive Director of the Student Loan Servicing Alliance, loan servicers will likely stop processing PAYE and ICR applications at some point well before July 1, 2028 from a practical processing concern.

RAP Will Be A New Income-Based Repayment Plan

The Repayment Assistance Plan (RAP) is a new income-driven plan that calculates payments based on a fixed percentage of adjusted gross income. Payments start at just $10 per month for incomes under $10,000 and gradually scale up to 10% of AGI for those earning over $100,000.

This plan will be the only income-driven repayment option from new loans taken out after July 1, 2026, but existing borrowers can opt in.

The full structure is:

- $0 to $10,000: $10/month flat

- $10,001 to $20,000: 1%

- $20,001 to $30,000: 2%

- $30,001 to $40,000: 3%

- $40,001 to $50,000: 4%

- $50,001 to $60,000: 5%

- $60,001 to $70,000: 6%

- $70,001 to $80,000: 7%

- $80,001 to $90,000: 8%

- $90,001 to $100,000: 9%

- Over $100,000: 10%

RAP also applies a $50/month reduction for each dependent listed on the borrower’s tax return, but never brings the monthly payment below $10. Remaining debt is forgiven after 30 years of repayment.

RAP payments can count toward Public Service Loan Forgiveness. However, Parent PLUS borrowers are excluded and must use the Standard plan.

Standard Repayment Plan Changes

The new legislation also reshapes the Standard Repayment structure for new borrowers. Existing borrowers can remain in their existing plans (Standard, Graduated, or Extended) assuming they don't borrow any new loans after June 2026.

While borrowers may remember 10-year and 25-year plans, the revised approach adds new tiers based on the total loan balance:

- Under $25,000: 10 years

- $25,000 to $50,000: 15 years

- $50,000 to $100,000: 20 years

- Over $100,000: 25 years

This model replaces the old Standard, Graduated, and Extended plans, and acts more like a hybrid of the Standard and Extended plans. You can check out our new Standard Repayment Plan calculator and see the impact.

Looking Ahead

While RAP promises more predictable payments for some, its 30-year term could lead to higher total costs compared to IBR. For most borrowers, the near-term decision is whether to remain on their current plan or prepare to switch in 2026. Processing times for plan changes remain slow, and with interest resuming, timing matters.

The Department of Education is expected to release further updates this fall. Until then, borrowers should watch for communications from their loan servicer.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Student Loan Repayment Plans Are Changing: What To Know appeared first on The College Investor.