Perception does not always match reality. We suspected this may be the case when it comes to the widely held belief that Bitcoin is considerably more volatile than other asset classes.

We tested our theory by revisiting Mieszko Mazur’s 2022 paper, “Misperceptions of Bitcoin Volatility.” In this blog post, we will discuss Mazur’s methodology, refresh his data, and illustrate why it’s best to approach the topic of Bitcoin volatility analytically and with an open mind.

The Beginning

Bitcoin began its journey as an esoteric whitepaper published in the hinterlands of the World Wide Web in 2008. As of mid-2024, however, its market capitalization sits at an impressive ~$1.3 trillion, and it is now the “poster child” of digital assets. “Valuation of Cryptoassets: A Guide for Investment Professionals,” from the CFA Institute Research and Policy Center, reviews the tools available to value cryptoassets including Bitcoin.

The specter of Bitcoin’s volatility from its early days looms large and is omnipresent in any discussion about its status as a currency or its intrinsic value. Vanguard CEO Tim Buckley recently dismissed the potential for including the cryptoasset in long-term portfolios, saying that Bitcoin is too volatile. Does his perception match reality?

Mazur’s Findings

Mazur’s study focused on the months preceding, during, and after the March 2020 stock market crash triggered by the COVID-19 crisis (e.g., the market crash period). His key aim was to discern Bitcoin’s comparative resilience and price behavior surrounding a market crash period. He focused on three indicators: relative ranking of daily realized volatility, daily realized volatility, and range-based realized volatility.

Here’s what he found:

Relative Ranking of Daily Realized Volatility

- Bitcoin’s return fluctuations were lower than roughly 900 stocks in the S&P 1500 and 190 stocks in the S&P 500 during the months preceding, during, and after the March 2020 stock market crash.

- During the market crash period, Bitcoin was less volatile than assets like oil, EU carbon credits, and select bonds.

Daily Realized Volatility

- Over the past decade, there has been a significant decline in Bitcoin’s daily realized volatility.

Range-Based Realized Volatility

- Bitcoin’s range-based realized volatility of Bitcoin was significantly higher than the standard measure, using daily returns.

- Its range-based realized volatility was lower than a long list of S&P 1500 constituents during the market crash period.

Do these conclusions carry over to the present day?

Our Methodology

We analyzed data from late 2020 to early 2024. For practical reasons, our data sources for certain assets diverged from those used in the original study and we chose to emphasize standardized percentile rankings for ease of interpretation. We examined the same three indicators, however: relative ranking of daily realized volatility1, daily realized volatility2, and range-based realized volatility3. In addition, for carbon credits, we used an ETF proxy (KRBN) instead of the EU carbon credits Mazur used in his study. BTC/USD was the currency pair analyzed.

Relative Daily Realized Volatility: An Updated View

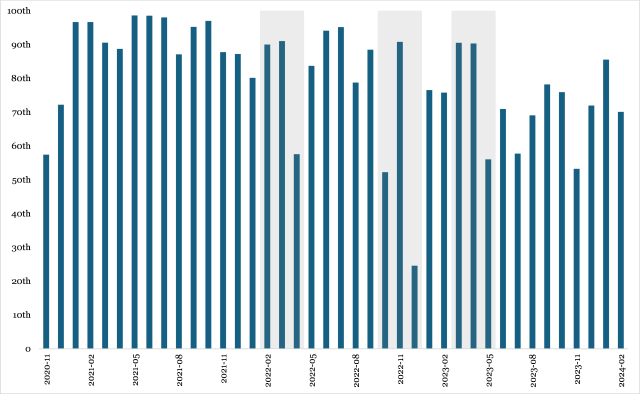

In Exhibit 1, higher percentiles denote greater volatility with respect to the constituents of the S&P 1500. From November 2020 to February 2024, Bitcoin’s daily realized volatility rank equated to the ~80th percentile relative to the S&P 1500 on average.

Exhibit 1. Bitcoin’s Daily Realized Volatility Percentile Rank vs. S&P 1500

Sources and Notes: EODHD; gray areas represent Market Shocks and higher percentile = higher volatility.

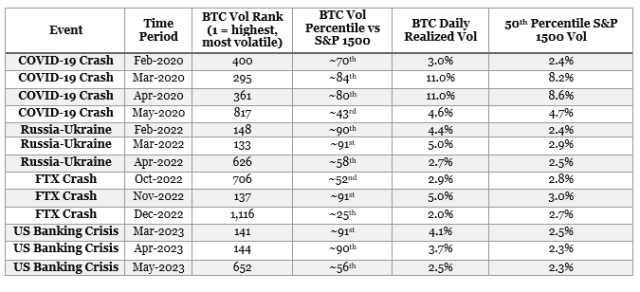

For subsequent market crises, Bitcoin’s relative volatility rankings had higher peaks compared to the crash triggered by COVID-19 but similar ranges for the most part. Notably, as depicted in Exhibit 2, in May 2020 and December 2022 Bitcoin was less volatile than the median S&P 1500 stock.

Exhibit 2. Bitcoin’s Daily Realized Volatility Across Market Shocks

Sources & Notes: Mazur (2022) and EODHD; the COVID-19 Crash ranks and daily realized volatility are derived directly from the original study. Rank of 1 = highest volatility value; percentiles are inverted such that higher percentiles = higher volatility value.

Exhibit 3. Bitcoin’s Daily Realized Volatility vs. Other Assets Across Market Shocks

Sources and Notes: EODHD, FRED, S&P Global, Tullet Prebon, and Yahoo! Finance; numbers are the maximum daily realized volatilities for the indicated time period.

Absolute Daily Realized Volatility: An Updated View

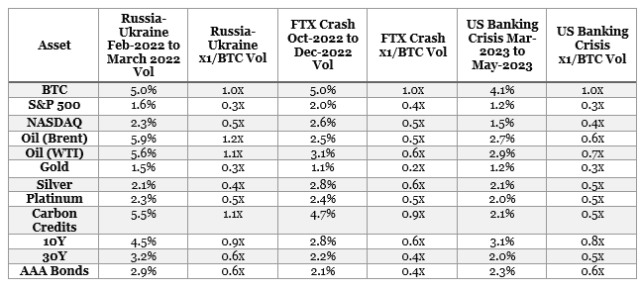

True to Mazur’s findings, Bitcoin’s volatility continued to trend downward and experienced progressively lower peaks. Between 2017 and 2020, there were several episodes of spikes that surpassed annualized volatility of 100%. Data from 2021 onward painted a different picture.

- 2021 peak: 6.1% (97.3% annualized) in May.

- 2022 peak: 5.5% (87.9% annualized) in June.

- 2023 peak: 4.1% (65.7% annualized) in March.

Exhibit 4. Daily Realized Volatility over Time

Source: EODHD.

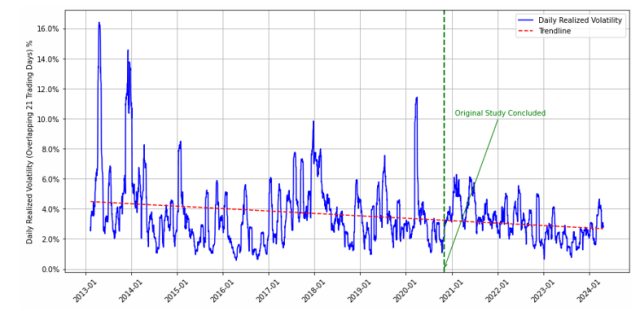

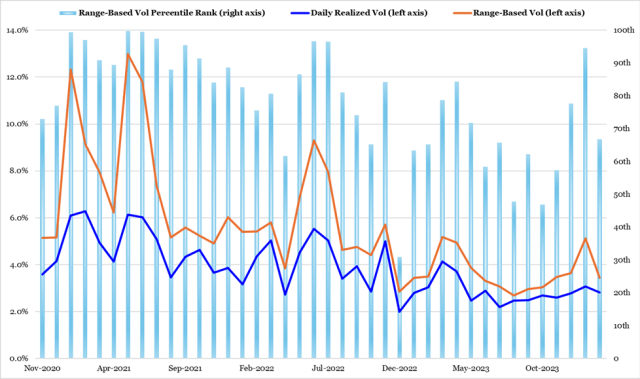

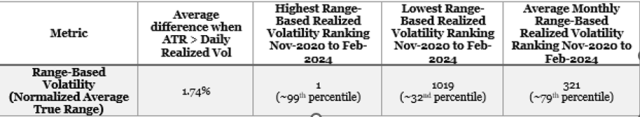

Range-Based Realized Volatility: An Updated View

Consistent with Mazur’s findings, range-based realized volatility was 1.74% higher than daily realized volatility, though this was not entirely surprising given our chosen calculation. Bitcoin’s range-based realized volatility was in the ~79th percentile relative to the S&P 1500 on average.

What is interesting, however, is that range-based realized volatility has not experienced a proportionate reduction in extreme peaks over recent years. The notably higher levels of range-based compared to daily close-over-close realized volatility, combined with media coverage that emphasizes inter-day movements over longer time horizons, suggest that this discrepancy is a primary factor contributing to the perception that Bitcoin is highly volatile.

Exhibit 5. Range-Based Realized Volatility over Time and Percentile Ranking Relative to S&P 1500

Source: EODHD. Note: Rank of 1 = highest volatility value; percentiles are inverted such that higher percentiles = higher volatility value.

Findings

Of all of Mazur’s conclusions, the finding pertaining to Bitcoin’s relative daily realized volatility did not hold up in our analysis, because its performance relative to other asset classes during market shocks degraded. Conversely, most of Mazur’s findings, including daily- and range-based realized volatility of Bitcoin, still hold true.

Relative Ranking of Volatility: Diminished in Strength

- With respect to the market shocks that followed the COVID-19 crash analyzed in the study, Bitcoin’s daily realized volatility percentile rankings were comparable to the S&P 1500.

- However, Bitcoin’s daily realized volatility was greater than almost all selected asset classes and showed the highest daily volatility during market shocks, except for oil and carbon credits during the Russia-Ukraine war.

Daily Realized Volatility Over Time: Reinforced

- Consistent with Mazur’s findings, we found that a longer time horizon helps us reduce “cherry picking.” As such, Bitcoin’s daily realized volatility has shown a gradual yet clear decline over time, with lower peaks observed over the past few years.

Range-Based Realized Volatility: Reinforced

- On average, monthly range-based realized volatility has been 1.74% higher than daily realized volatility since November 2020.

- Bitcoin’s range-based realized volatility was still lower than a few hundred names from the S&P 1500 on an average monthly basis.

Key Takeaways

Our update of Mazur’s study found that Bitcoin is not as volatile as perceived. This was evidenced by its percentile rankings compared to the constituents of the S&P 1500, the disparity between its daily realized and range-based realized volatility, and the gradual decline of its daily realized volatility over time.

With mainstream adoption of Bitcoin increasing alongside further regulations, the perception of its volatility will continue to evolve. This review of Mazur’s research underscores the importance of approaching this topic analytically and with an open mind. Perceptions do not always match reality.