Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It’s a weird feeling for a journalist to look for the most benign interpretation of apparent financial malfeasance, but SEBI’s report on Jane Street is so damning that doing so seems like the most interesting tack to take now.

After all, the overwhelming feeling even among many of Jane Street’s rivals is largely one of disbelief.

That one of the world’s biggest and smartest trading firms — one that until now enjoyed a strong reputation for avoiding even vaguely shady stuff — would engage in something that looks like a pretty unsophisticated pump-and-dump has staggered a lot of people. Even former Jane Streeters:

🧵

A thread of thoughts on the current Jane Street situation. In the words of another JS alum:1) What

— Agustin Lebron (@AgustinLebron3) July 7, 2025

We gather Jane Street is still working on a detailed point-by-point rebuttal of SEBI’s report on the alleged manipulation, but from a leaked internal memo we have the contours of the trading firm’s main argument.

What looked to SEBI like overt market manipulation — taking advantage of the huge and liquid options market and the weirdly smaller, less liquid and thus easy-to-move equity market — was actually just “basic index arbitrage trading”.

From Jane Street’s memo:

For example, the Order says “it is particularly instructive” to consider the first eight minutes of trading on January 17, 2024 in order to understand the “intent and design” of our options strategy, which it calls “Intra-day Index Manipulation.” Those eight minutes illustrate basic index arbitrage trading, which many of you will know as a core and commonplace mechanism of financial markets that keeps the prices of related instruments in line. One can easily observe that there was a large divergence between the price of the BANKNIFTY index (NSEBANK Index on Bloomberg) reflected in options markets and the price implied by the stock levels. Jane Street (presumably alongside other market participants) traded in a direction consistent with closing that gap and bringing the two markets more in line with one another:

We believe the trading activity shown here, which has the effect of better aligning the prices of index options and their underlying constituents, is unambiguously good for the health of financial markets: in the absence of participants like Jane Street, there would be no economic link between the Indian derivatives market and the underlying economy. The claim in the SEBI Order that this activity is “prima facie manipulative” disregards the role of liquidity providers and arbitrageurs in markets. The Order further utilizes a metric for market impact and trading aggressiveness which seems disconnected from actual market dynamics.

The Order uses similarly inflammatory language (“Extended Marking the Close Strategy”) to describe our trading in underlying stocks during the Indian market closing period. The nature of the Indian market, where market participants disproportionately transact in cash-settled index options, means that those participants who provide liquidity (us and others) accumulate stock price exposure which ceases to exist at the point of options expiration. Replacing expiring deltas with non-expiring deltas is a standard and well-understood practice in markets throughout the world.

As you’d expect, Matt Levine has by far the best benign interpretation of this that we’ve seen so far. Annoyingly, we’d started on something similar, but since we can’t do anything better we’ll try to provide a more succinct defence.

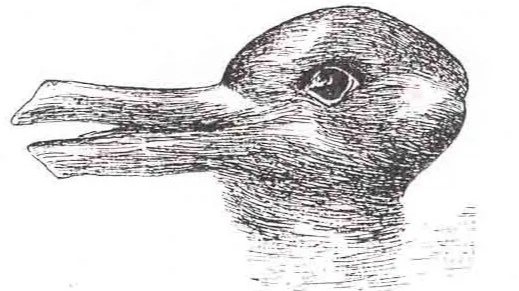

A lot of stuff in markets is actually a bit like the proverbial duck-rabbit. What might look like market manipulation could in fact just be arbitrage, and what might look like arbitrage can in fact be market manipulation. The old “Dr Evil” trade — Citigroup’s 2004 sale and repurchase strategy that exploited a weakness in the MTS electronic bond market — is a good example of the latter, and the Indian situation could be the former.

Or as Levine puts it:

I suppose the main point here is that, in many cases, “legitimately doing an arbitrage trade” and “trading in one market to manipulate prices in another market” look pretty similar. Either way, you are trading the opposite way, buying stock in the stock market and selling it in the options market or vice versa. The difference can be subtle, and I often joke that the difference between legitimate trading and manipulation is whether you send your colleagues an email saying “lol I sure manipulated that market.”

Still, there are a lot of unanswered questions. For example, index arbitrage doesn’t quite explain the full size of the massive directional options position, which probably accounted for the vast majority of the estimated $86mn Jane Street made on the day highlighted by SEBI for extra scrutiny. The timings of the different trades also don’t seem to match up for a standard index arbitrage.

We are now entering spitball territory, but the central issue could simply be the tangled reality of the business model of most large successful proprietary trading firms today.

Companies like Jane Street often portray themselves as humble, geeky market-makers, simply matching buyers and sellers of financial securities and making markets more efficient in the process.

In reality, many of them also make directional bets when they feel they have an edge, looking more like conventional hedge funds in the process. In fact, this is a large reason why many have become so wildly profitable in recent years. As a result, the delineation between market-making and prop trading is simply not as clear cut as one might think and its conceivable that separate strategies can bleed into each other or become mutually helpful.

In India, what could have started out as perfectly normal arbitrage in a massive and inefficient options market morphed into large de facto prop bets against Indian retail traders who overwhelmingly lose money. And the index arb conveniently happened to help that bet, while also helping Indian market pricing converge.

Aaaanyway, priors are powerful force so we don’t think anyone’s minds are going to be changed here. This is unquestionably a bad look for Jane Street, so its defence — which we assume they’ll have to make public, given all the attention — will be a fascinating read.