On the campaign trail, President Donald Trump pledged to eliminate federal income taxes on Social Security benefits for seniors.

However, that promise went unfulfilled, largely due to legislative constraints. Social Security tax policy cannot be changed through budget reconciliation, and eliminating taxes on benefits would require stand-alone legislation – something Congress did not pass.

Related: Secretary Bessent hints Social Security income tax changes are coming

Taxes on Social Security benefits were first introduced under the Social Security Amendments of 1983, signed into law by President Ronald Reagan. The change took effect in 1984, making a portion of benefits subject to federal income tax.

With the original promise off the table, Republicans pursued an alternative: increasing the standard deduction for older taxpayers.

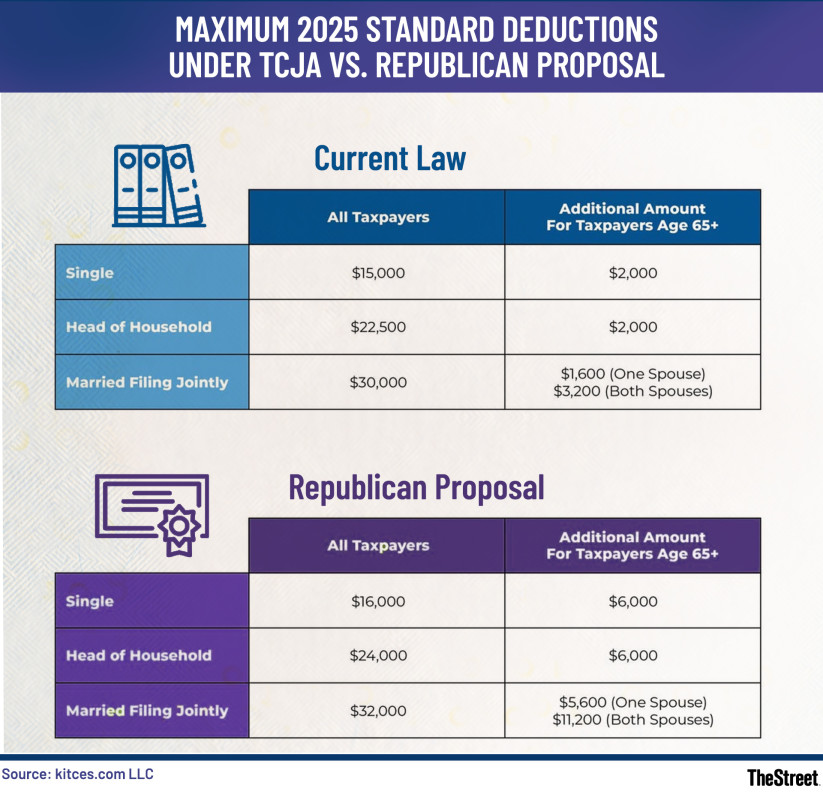

Under current law for 2025, married couples filing jointly receive a standard deduction of $30,000, plus an additional $3,200 for those age 65 and older.

💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰

This week, the House of Representatives passed the “One Big Beautiful” bill, which aims to fulfill Trump’s pledge in spirit, if not in substance.

The bill would raise the standard deduction for married couples aged 65 and older filing jointly to $35,200, with an additional $8,000 “senior bonus” deduction.

This expanded deduction is designed to provide financial relief to older taxpayers and would be available to those who take the standard deduction and those who itemize.

Taxes paid on Social Security benefits

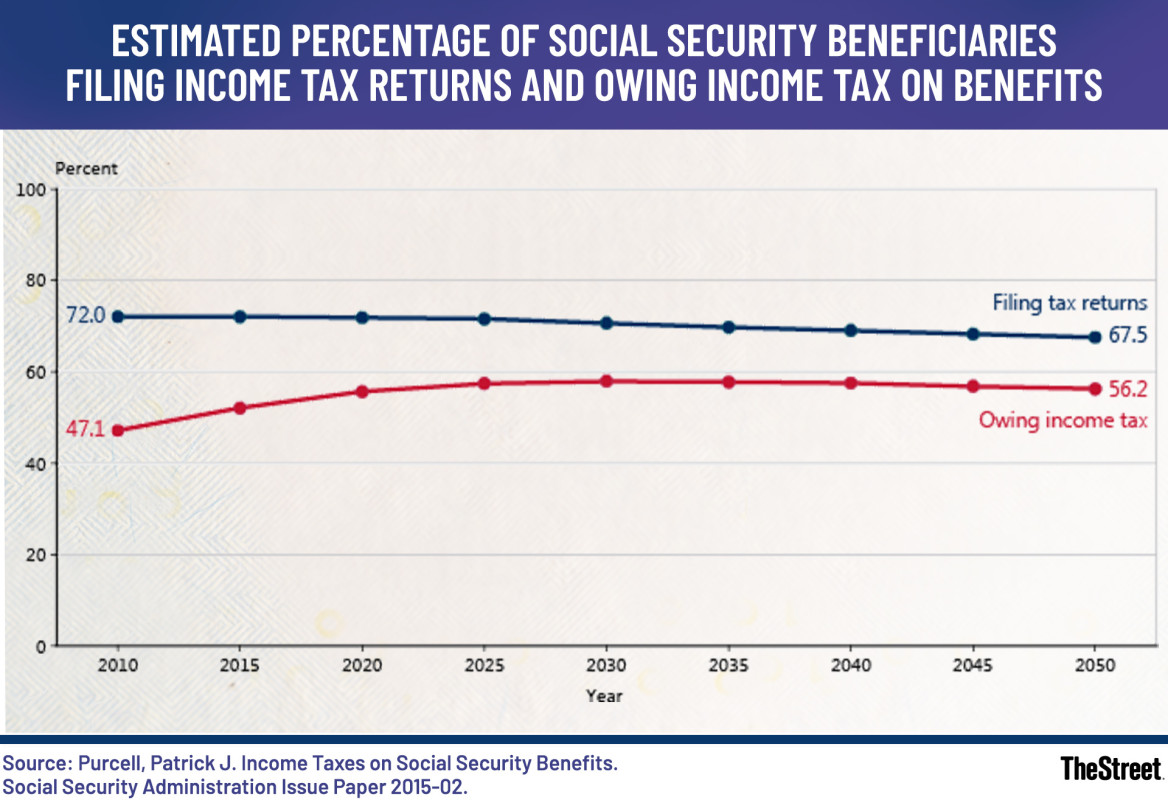

Under current law, a significant portion of Social Security beneficiaries – about 56% – pay federal income taxes on their benefits.

Whether benefits are taxed depends on your income level. If your income is below a certain threshold, none of your benefits are taxed. But once income exceeds those thresholds, up to 85% of benefits may become taxable.

Related: Social Security income tax cuts may include a huge new deduction for retirees

The key factor in determining tax liability on Social Security benefits is your provisional income, or what some call combined income, calculated as:

Provisional income = adjusted gross income (AGI) + nontaxable interest + 50% of Social Security benefits

Your AGI includes all taxable income – such as wages, pensions, dividends, capital gains, and withdrawals from traditional IRAs or 401(k)s.

2025 Federal Income Thresholds for Married Couples Filing Jointly:

- Below $32,000 in provisional income: No Social Security benefits are taxed.

- $32,000 to $44,000: Up to 50% of benefits may be taxable.

- Above $44,000: Up to 85% of benefits may be taxable.

Projections from the Social Security Administration (SSA) show that an average of 56% of beneficiary families will owe federal income taxes on their benefits each year from 2015 through 2050.

Among those families, the median portion of benefits subject to tax is expected to increase modestly – from about 11% in 2015 to 12% by 2025, and remain steady through mid-century.

Generally, higher-income households bear the brunt of these taxes, while lower-income retirees typically owe little or nothing on their benefits.

SSA

Will the standard deduction increase cut taxes on Social Security benefits?

For context, the estimated average monthly Social Security retirement benefit in January 2025 was $1,976, according to the SSA. The maximum monthly benefit for a worker retiring at full retirement age in 2024 is $3,822.

In total, 71.6 million Americans received Social Security benefits in 2023, with 5.8 million newly awarded benefits that year. Notably, 55% of adult beneficiaries were women.

Related: How the IRS taxes Social Security income in retirement

Offsetting income taxes on Social Security via an increased deduction appears to be the intention behind the recently passed House bill.

While the bill doesn’t repeal taxes on Social Security benefits—as President Trump once promised—it does aim to reduce the burden.

Currently, the standard deduction for married couples filing jointly in 2025 is $30,000, plus an additional $3,200 for those aged 65 and older, totaling $33,200.

Under the proposed legislation, that would rise to $32,000, plus $11,200 for seniors, for a new total of $43,200.

According to Alex Durante, senior economist at the Tax Foundation, that increase could significantly reduce – or eliminate – tax liability for many retirees.

He noted that joint filers with provisional income below $32,000 already pay no tax on their benefits, while those between $32,000 and $44,000 pay tax on up to 50%, and those above $44,000 pay tax on up to 85%.

Durante also pointed out that over the next four years, the standard deduction will increase by $6,000 for senior couples – $2,000 for all joint filers and an additional $4,000 for those aged 65 and older.

Seniors who itemize can also claim the additional deduction, potentially raising their total deductions even further.

Given that the median household income for seniors is about $50,000, this expanded deduction could substantially reduce or even eliminate federal tax liability on Social Security benefits for many.

kitces.com

A Social Security case study

To illustrate the potential impact of the proposed legislation, we turned to Roger Pine, CEO and co-founder of Holistiplan, for a detailed analysis.

He examined a hypothetical 65-year-old married couple filing jointly with $80,000 in gross income, including $40,000 in Social Security benefits.

Under current law, with a standard deduction of $33,200, their taxable income would be $26,400, resulting in a federal income tax bill of $2,691.

Under the proposed legislation, which would increase their standard deduction to $35,200 plus the $8,000 new senior bonus deduction, their taxable income would drop to $16,400, lowering their tax bill to $1,640.

According to Pine's calculations, the proposed $2,000 increase to the standard deduction would save this hypothetical couple $240 in taxes. Then the $8,000 enhanced senior deduction would save an additional $811 in taxes, a total of $1,051 in savings across the two new deductions.

In both scenarios, $19,600 of their Social Security benefits would be subject to tax, Pine found.

The takeaway: While taxation of Social Security benefits isn’t going away, raising the standard deduction could provide relief for retirees, particularly those hovering near the key income thresholds where benefits become taxable.

Related: These are the most tax-friendly states if you work in retirement