Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

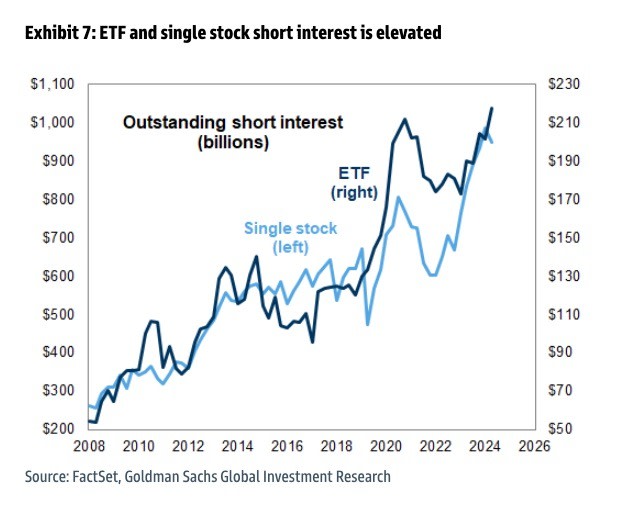

Earlier this year, we flagged a rebound in US stock market short interest. Sure, it was still a drag on performance and still way below the historical average, but the increase was sharp and undeniably intriguing.

It’s probably fine to now call it a comeback, with the median S&P 500 company short interest jumping back to pre-Covid and pre-GameStonk levels and above the long-term average.

The chart is from Goldman Sachs’ latest hedge fund positioning report, which parses through the 13F filings of 684 hedge funds with $3.1tn of equity positions, $2tn of which are longs and $1.1tn are shorts.

Those long positions are still outperforming the short ones, but hedge funds have nonetheless jacked up negative bets both through index-level ETFs and on individual companies.

The ETF shorts indicate that hedge funds are increasingly bearish on consumer staples, small-caps, Taiwanese stocks and semiconductors, but above all regional banks and biotech stocks.

The short interest in $KRE, State Street’s regional banking ETF, has more than doubled since February to 96 per cent of its float, and the short interest in the $XBI biotechnology ETF has climbed by 27 percentage points over the same period to 111 per cent of the float.

Of the most popular individual shorts, Lucid (natch), Birkenstock, Choice Hotels, Moderna have the highest level of negative bets relative to their free float.

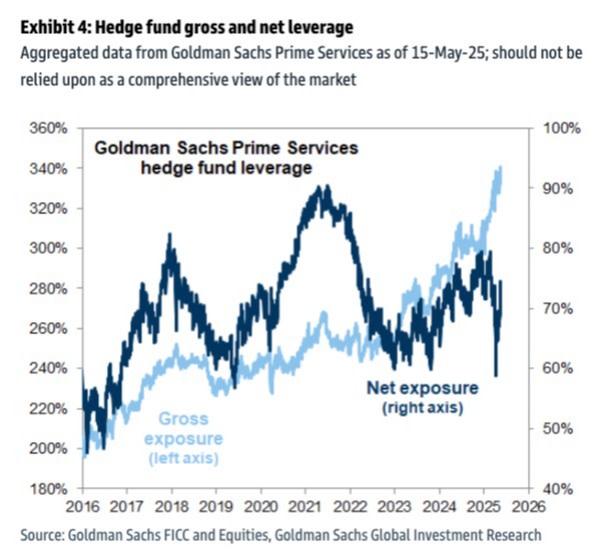

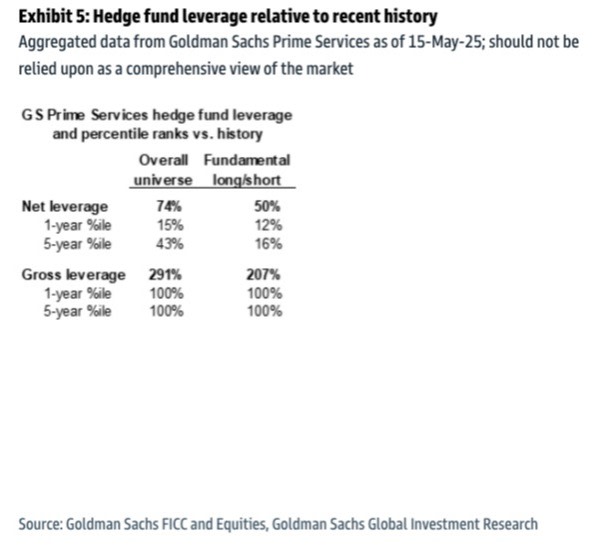

Net leverage remains muted, but the return of shorting has now lifted gross leverage to the 100th percentile, Goldman’s analysts note.

It makes sense that short selling is staging a comeback, given the whole golden era of fraud/tariff shenanigans. But Alphaville suspects that being a dedicated, standalone short seller is still an extremely difficult business model. Probably, the future is to be simply just another pod inside a bigger multi-manager hedge fund.

A good example is Steve Schurr. After a stint as the FT’s hedge fund correspondent, he worked for Jim Chanos’s Kynikos Associates, but eventually ended up at Point72 and then Balyasny.

Last month, Millennium poached Schurr with a $100mn compensation package. Nice. But far more importantly, he is the Namer of FT Alphaville, surely the greatest achievement of his career.