Digital asset investment firm SharpLink added another haul of Ether to its balance sheet, bringing its overall ETH holdings to almost $2 billion.

On Tuesday, the company said it bought 83,562 Ether (ETH) worth $264.5 million at an average price of $3,634. The purchases, made between July 28 and Aug. 3, brought the company’s total ETH holdings to 521,939 ETH, worth $1.91 billion at current market prices.

The company said that all of its ETH holdings are staked, allowing it to earn from Ethereum’s native proof-of-stake consensus mechanism. According to SharpLink, its cumulative staking rewards have reached 929 ETH, worth over $3.3 million.

The company measures the success of its ETH strategy through an ETH-per-share metric called ETH concentration. This shows how much ETH is backed per outstanding share. SharpLink’s ETH concentration is now 3.66, up 83% since it started buying Ether.

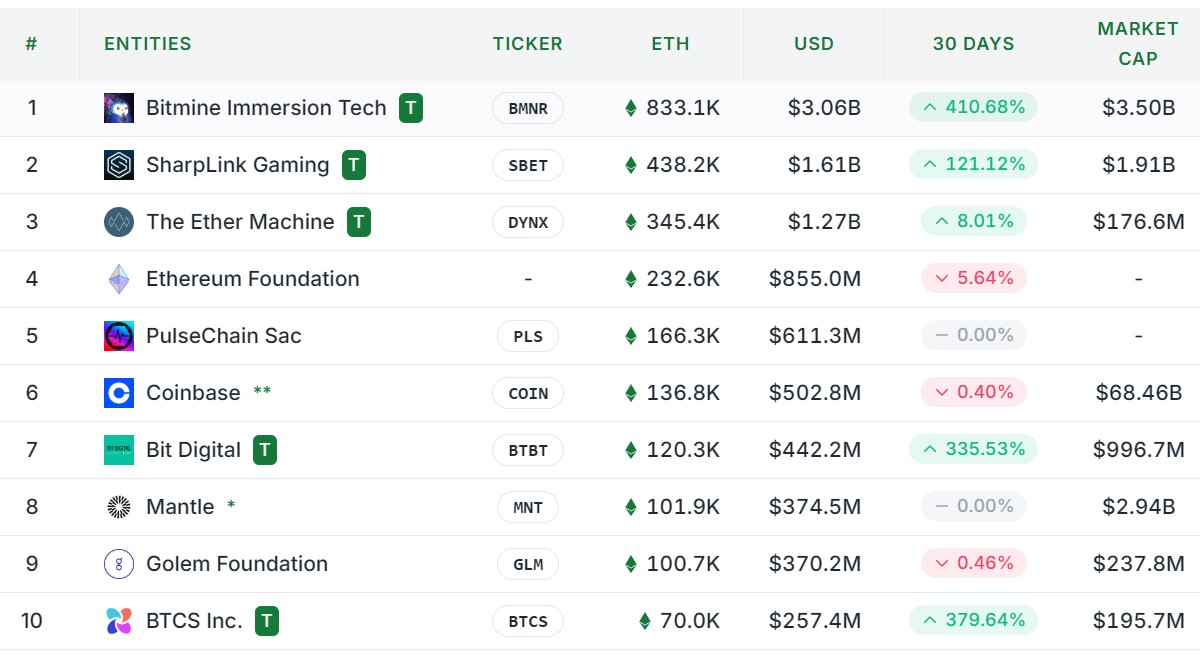

SharpLink ranks second in ETH treasury race

The move marks a continuation of the company’s aggressive ETH accumulation strategy, which began in June.

On June 13, the company announced its first purchase of $463 million in ETH, making it the largest public holder of Ether. It has since been overtaken by another Ether-stacking company called Bitmine.

BitMine Immersion Technologies added 208,137 ETH to its holdings on Monday, pushing its overall ETH stash to 833,137 ETH, worth over $3 billion.

As ETH hovered around $3,700, BitMine became the fourth-largest crypto treasury firm, trailing behind Strategy, MARA Holdings and Twenty One Capital.

According to the data tracker Strategic ETH Reserve, the Ether Machine ranks third in ETH holdings with 345,000 ETH ($1.27 billion).

The Ethereum Foundation ranks fourth with 232,600 ETH, valued at $855 million, while PulseChain ranks fifth with 166,300 ETH, worth over $611 million.

Related: Staked Ethereum hits all-time high as ETH tops $2.7K

Spot Ether ETFs record $465 million in outflows

SharpLink’s latest ETH purchase announcement follows record outflows from spot Ether exchange-traded funds (ETFs).

On Monday, data provider SoSoValue showed that Ethereum-based ETFs saw $465 million in net daily outflows, their highest recorded since launch.

BlackRock’s iShares Ethereum Trust (ETHA) took the biggest hit, seeing nearly $375 million in net outflows. The Fidelity Ethereum Fund (FETH) ranked second in daily outflows, recording $55.11 million.

Magazine: Ethereum’s roadmap to 10,000 TPS using ZK tech: Dummies’ guide