Eric Conner, a prominent Ethereum figure who helped design the network’s landmark fee-market overhaul EIP-1559 and recently left the ecosystem to work in artificial intelligence, said late Thursday that the US Securities and Exchange Commission’s new policy direction amounts to a dramatic tailwind for Ether. “The SEC just lit a rocket under Ethereum,” Conner wrote on X on July 31, reacting to a policy address delivered hours earlier by SEC Chairman Paul S. Atkins in Washington. Conner characterized the remarks as a “full-blown regulatory pivot,” adding that Atkins “informally but unmistakably said Ethereum is not a security,” and that the agency had put ETH “in the spotlight as the foundation for the next era of US finance.”

Is Ethereum The Biggest Beneficiary Of ‘Project Crypto’?

Atkins’ prepared speech, titled “American Leadership in the Digital Finance Revolution,” unveiled a program he called Project Crypto—a Commission-wide effort to refit securities regulation for on-chain markets. “We are at the threshold of a new era … I am announcing the launch of ‘Project Crypto’—a Commission-wide initiative to modernize the securities rules and regulations to enable America’s financial markets to move on-chain,” he said, while stressing that his remarks reflected his views rather than the Commission’s as a whole. The chair tied the initiative to a recent White House-led policy push and said he had directed SEC staff to draft clear rules for crypto asset distributions, custody, and trading, and to consider interpretive and exemptive relief “in the coming months” to avoid stifling innovation.

The most consequential signal for digital-asset markets was Atkins’ stance on asset classification. “Despite what the SEC has said in the past, most crypto assets are not securities,” he said, promising “bright-line rules” to help market participants determine whether a token should be treated as a digital collectible, a digital commodity, or a stablecoin, and to craft purpose-fit disclosures, exemptions and safe harbors—including for ICOs, airdrops and network rewards. In parallel, he argued that classifying a token as a security “should not be a scarlet letter,” and outlined a path for crypto-securities to flourish within US markets.

Atkins also sketched an ambitious market-structure blueprint. He backed side-by-side trading of non-security crypto assets and crypto-asset securities on SEC-regulated venues, floated a “Reg Super-App” concept to let broker-dealers offer trading, staking and lending under a single license, and said he would seek to modernize custody rules so investment advisers and broker-dealers can hold crypto assets under updated standards. “It will be a priority of my chairmanship to carry out the [report’s] recommendation to modernize the SEC’s custody requirements,” he noted, while defending users’ right to self-custody and staking.

Crucially for tokenization, Atkins said the Commission would work with firms distributing tokenized securities in the US and provide relief where appropriate, pointing to pent-up demand “from household names on Wall Street to unicorn tech companies” and explicitly referencing compliance-enabled token standards such as ERC-3643. In a section on decentralized finance, he pledged to “create space” for both fully on-chain, non-intermediated systems and intermediated models, and said DeFi “will be part of our securities markets.”

Why Ethereum Takes Center Stage

While Atkins’ prepared remarks did not name Ethereum explicitly, they repeatedly referenced Ethereum-native concepts and standards, and outside the speech the chair has recently spoken more directly about ETH. In a July 21 appearance on CNBC’s Squawk Box, Atkins said the agency has “stated informally more than formally that Ether is not a security,” adding that whether corporates hold ETH in treasury “is up to companies to decide.”

Conner unpacked the same themes in an eight-part thread that ricocheted across Crypto-X. The former core dev argued that the speech “isn’t just lip service. It’s a full-blown regulatory pivot,” stressing that Atkins had “informally but unmistakably” removed the security overhang from Ether. “That’s the clarity institutions have been waiting for,” he wrote, predicting corporate-treasury allocations and a deep link-up between DeFi and Wall Street.

He hailed the endorsement of public-chain tokenization as still more consequential: “He said: let’s bring regulated markets on-chain… Ethereum is the obvious base layer for this.” And, in a swipe at legacy doctrine, Conner cheered the promise of purpose-built rules: “No more trying to jam crypto into 1940s laws.”

Whether that enthusiasm endures will depend on how quickly Project Crypto moves from rhetorical flourish to concrete rule-making—but, as Conner put it in his closing salvo, “ETH isn’t just a coin anymore. It’s the US government’s preferred settlement layer for modern finance. Regulatory uncertainty has been ETH’s biggest overhang, and now it’s being lifted. The SEC just put Ethereum in the spotlight as the foundation for the next era of US finance. This is bigger than an ETF. It’s regulatory alignment with ETH as the global digital asset backbone. Get ready.”

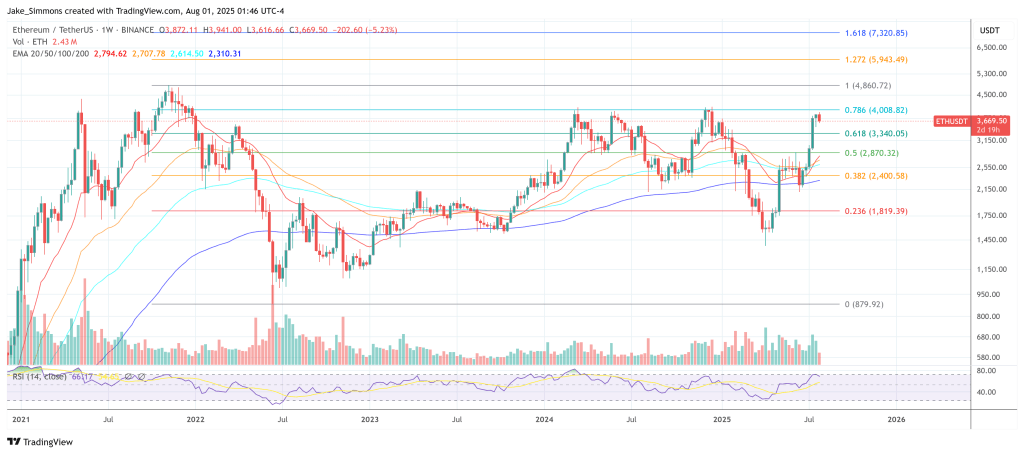

At press time, ETH traded at $3,669.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.