Gold market bulls have been riding an intense wave since the 2022 lows, when prices began trending towards the $2,000 per ounce level and finally breaking out, and the momentum hasn't let up. By July 2025, gold had an all-time high of $3,509.9, based on the nearest futures contract charts. Trading up 117% from $1,618 in October 2022. Managed Money began aggressively buying during the October 2022 lows and continued until September 2024, when gold was trading near $2,730. Later, I will assess the current Commitment of Traders (COT) report.

Invest in Gold

Hedgers, like mining companies and central banks, have also benefited. Miners like Newmont (NEM) had revenue in Q1 2025 of $5.01 billion, representing a 24.5% increase from the $4.023 billion reported in Q1 2024. Higher year-over-year realized gold prices primarily drove this increase. In 2024, central banks accumulated significant gold as part of their reserve diversification strategy amidst global economic uncertainties and currency volatility. The amount of gold stockpiled was close to 1,045 metric tonnes, according to the World Gold Council. This marked the third consecutive year in which central bank gold purchases exceeded 1,000 tonnes, a trend according to AInvest driven by geopolitical tensions, inflation risks, and a strategic retreat from the U.S. dollar. This rally has rewarded both those chasing quick profits and those shielding against economic uncertainty.

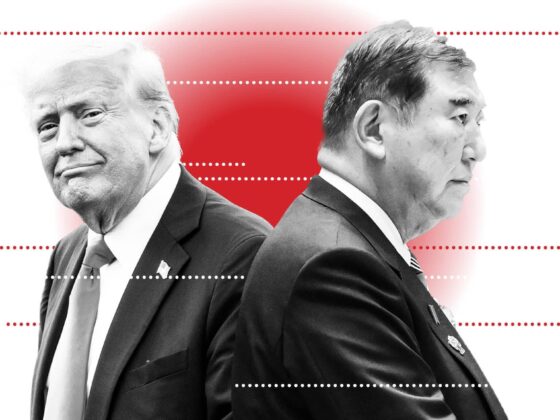

Two events point to potentially higher gold prices ahead. First, central bank purchases are set to continue, with the People's Bank of China continuing its 2024 buying spree. Reporting amounts of gold purchased by the PBOC is challenging to narrow down due to the underreporting of Chinese gold purchases, making it difficult to confirm the exact quantity definitively. Second, reports over the weekend that Federal Reserve Chair Jerome Powell will be resigning could result in much lower short-term interest rates if President Trump gets his wish of a more dovish Fed Chairman replacement. This would lead to a lower U.S. dollar and interest rates, which is bullish for gold prices.

However, one event could disappoint gold buyers: If Powell does resign and the new chairperson drastically cuts short-term interest rates, the markets may perceive this as highly inflationary due to the strength of the current economy and employment situation. Thereby raising yields on the long end of the yield curve (TLT), anticipating this uptick in inflation. This would be a headwind for gold investors/traders as gold usually underperforms in high-interest-rate environments. Speculators might face short-term losses, while hedgers could see reduced urgency for gold if U.S. dollar stability returns.